Methodology, Parameters, and Calculations

health economics methodology, clinical trial cost analysis, medical research ROI, cost-benefit analysis healthcare, sensitivity analysis, Monte Carlo simulation, DALY calculation, pragmatic clinical trials

Overview

This appendix documents all 214 parameters used in the analysis, organized by type:

- External sources (peer-reviewed): 88

- Calculated values: 97

- Core definitions: 29

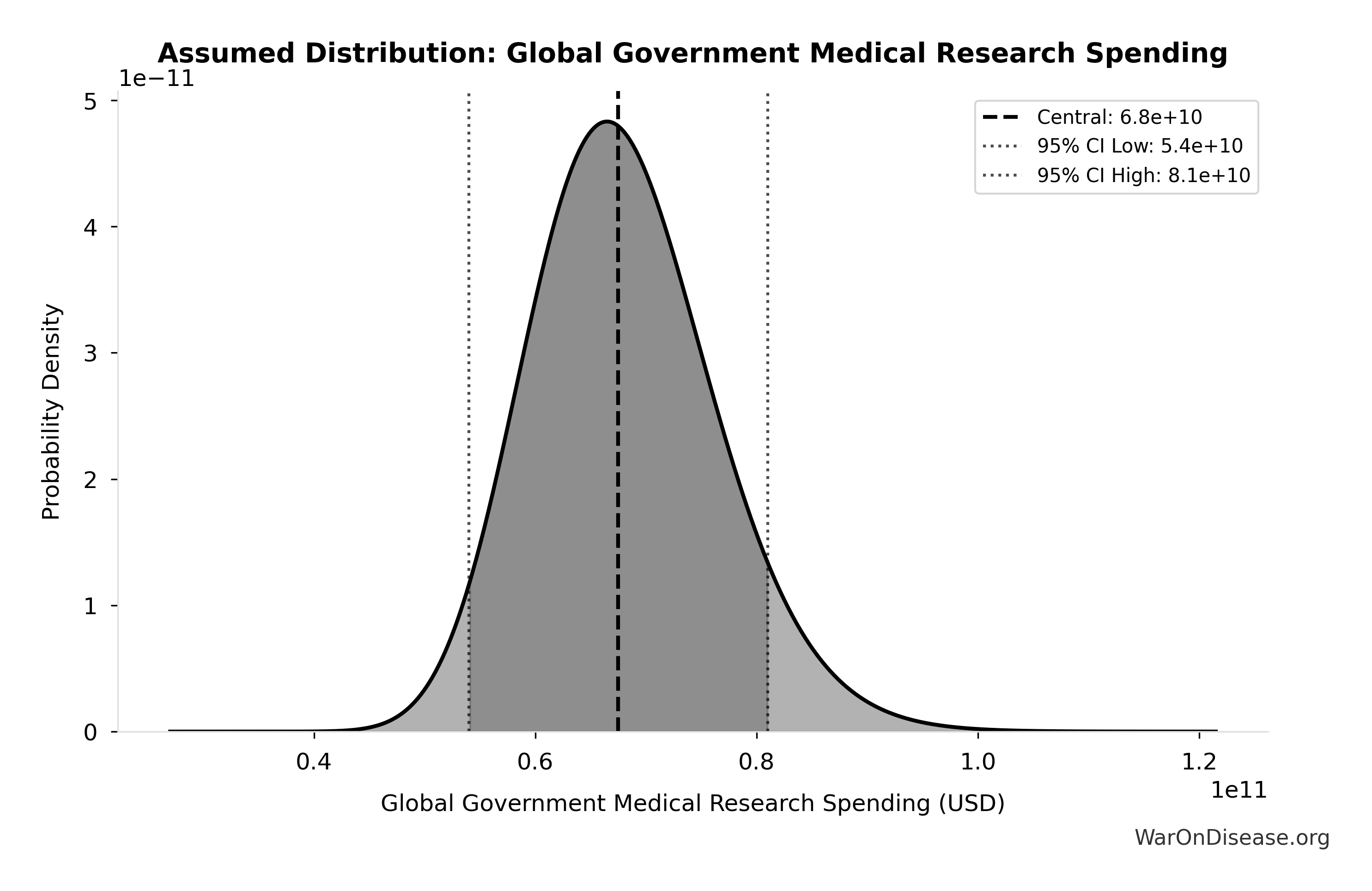

Calculated Values

Parameters derived from mathematical formulas and economic models.

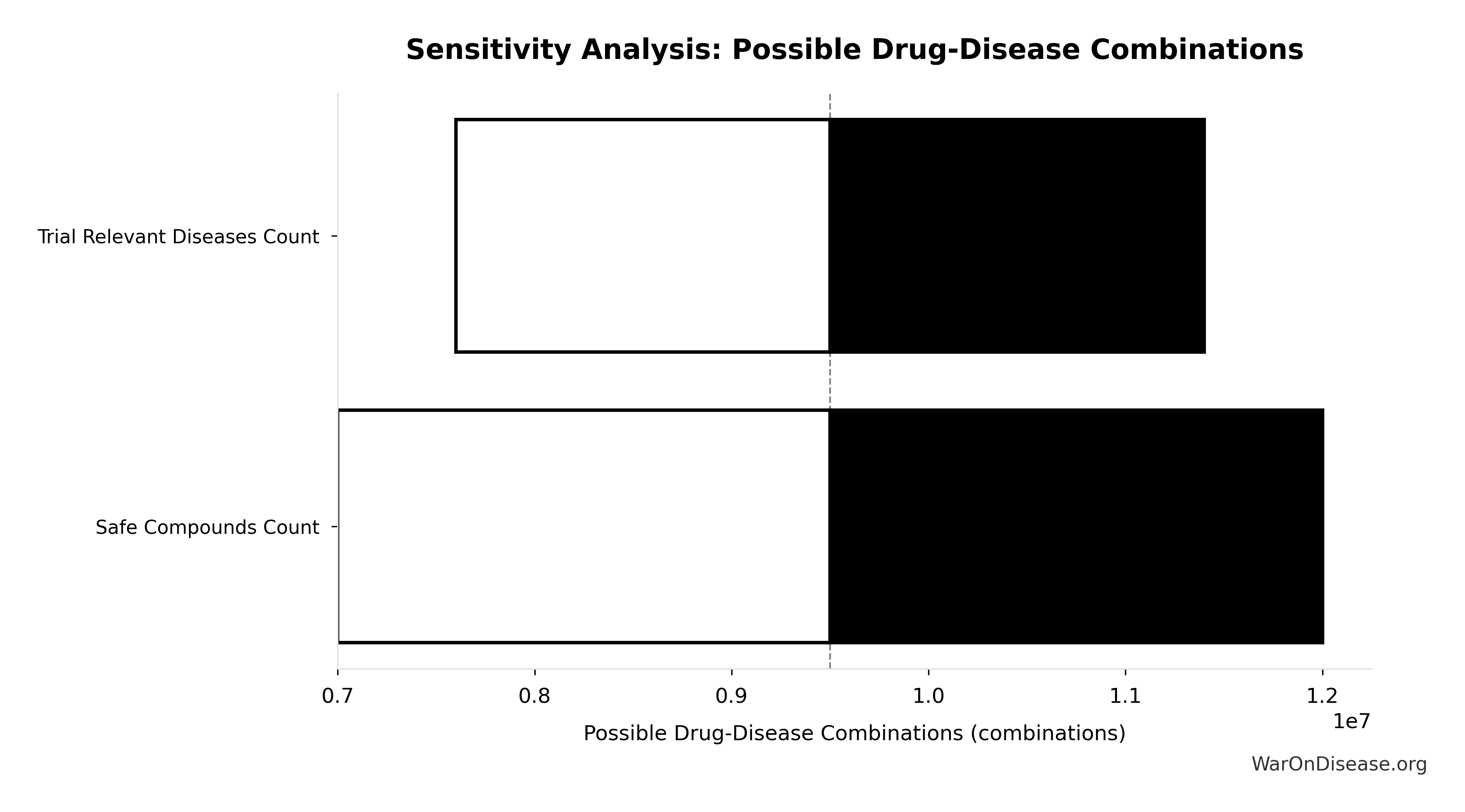

Combination Therapy Space: 45.1 billion combinations

Total combination therapy space (pairwise drug combinations × diseases). Standard in oncology, HIV, cardiology.

Inputs:

- Pairwise Drug Combinations 🔢: 45.1 million combinations

- Trial-Relevant Diseases: 1.00 thousand diseases (95% CI: 800 diseases - 1.20 thousand diseases)

\[ \begin{gathered} Space_{combo} \\ = N_{combo} \times N_{diseases,trial} \\ = 45.1M \times 1{,}000 \\ = 45.1B \end{gathered} \]

✓ High confidence

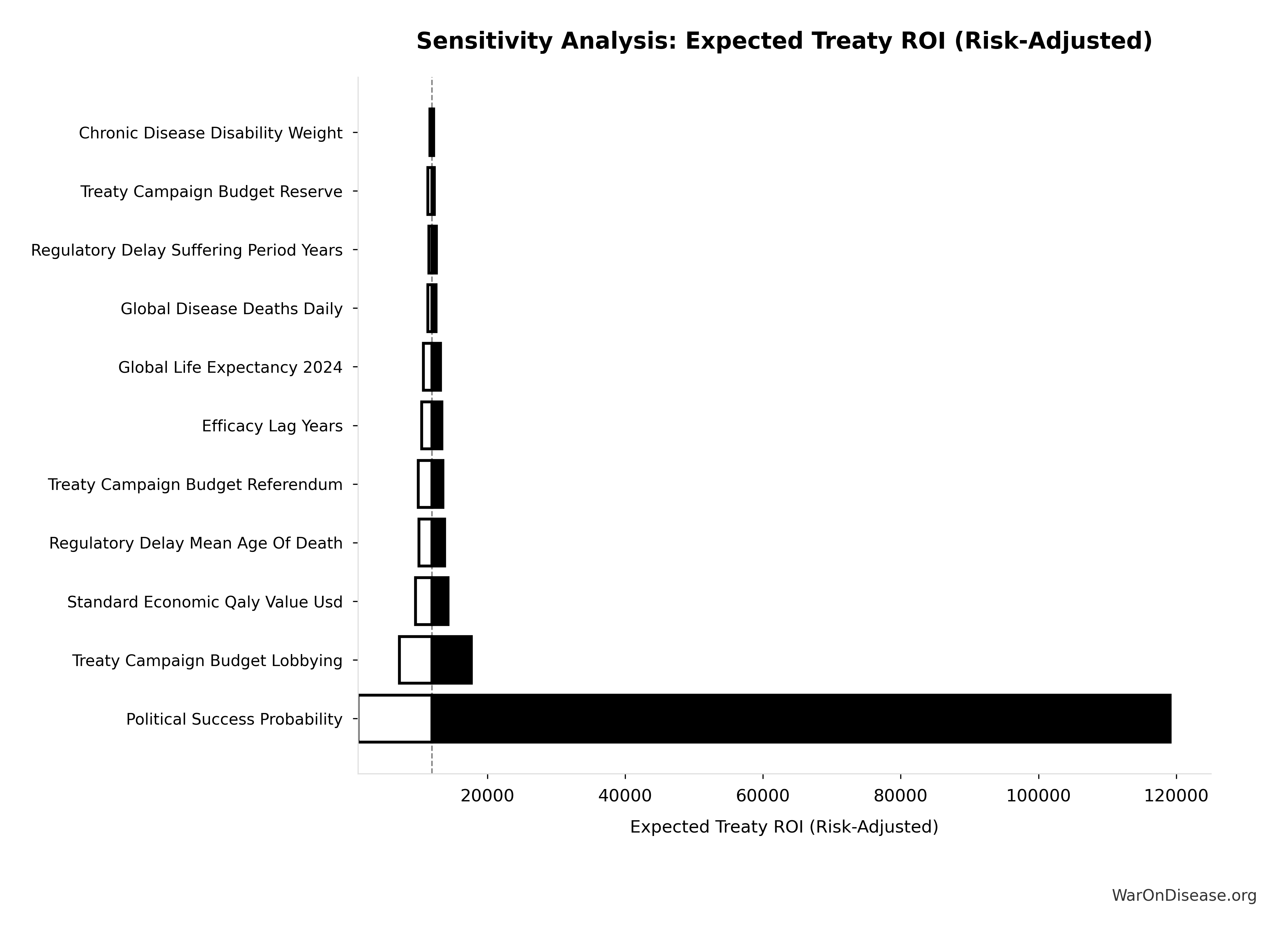

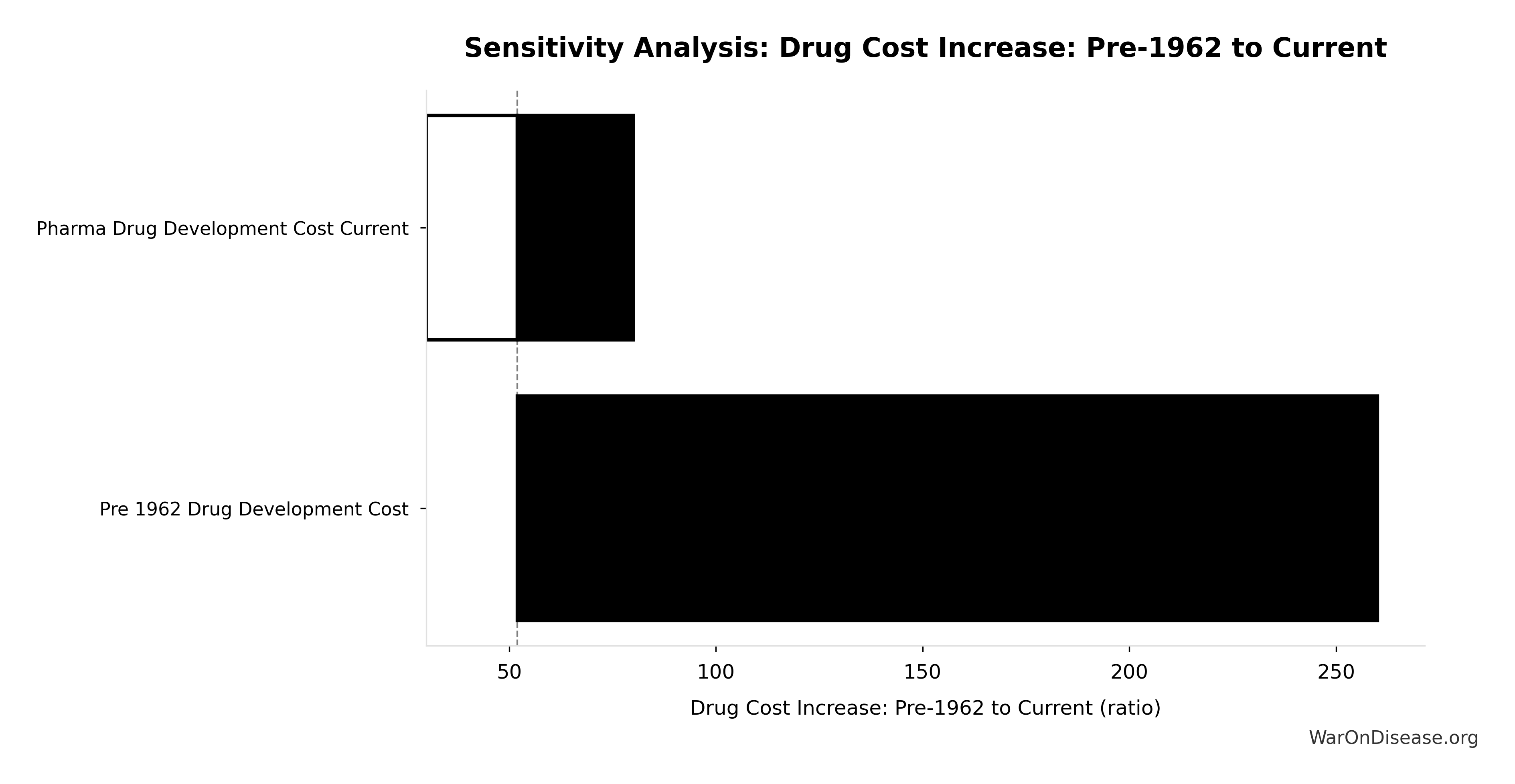

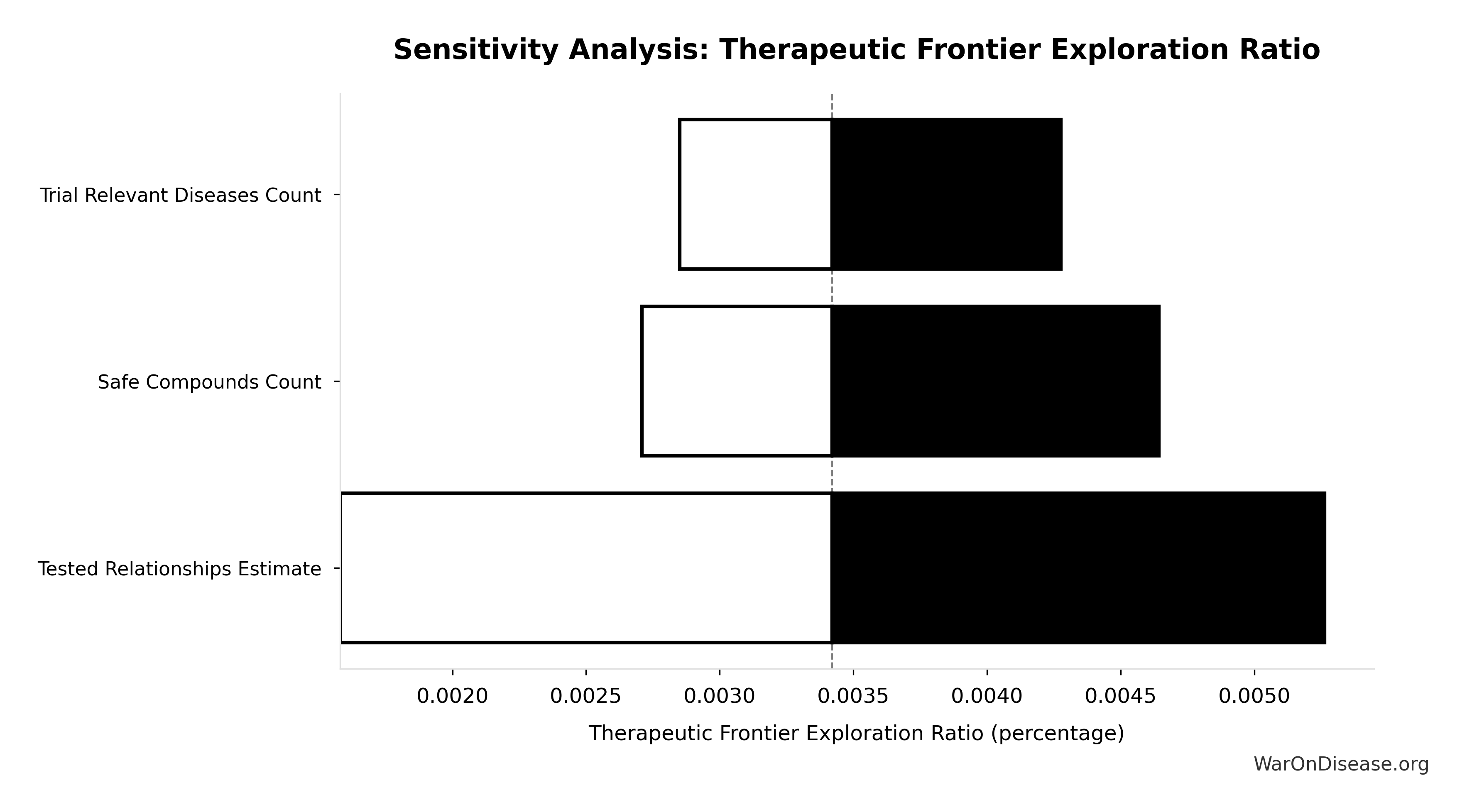

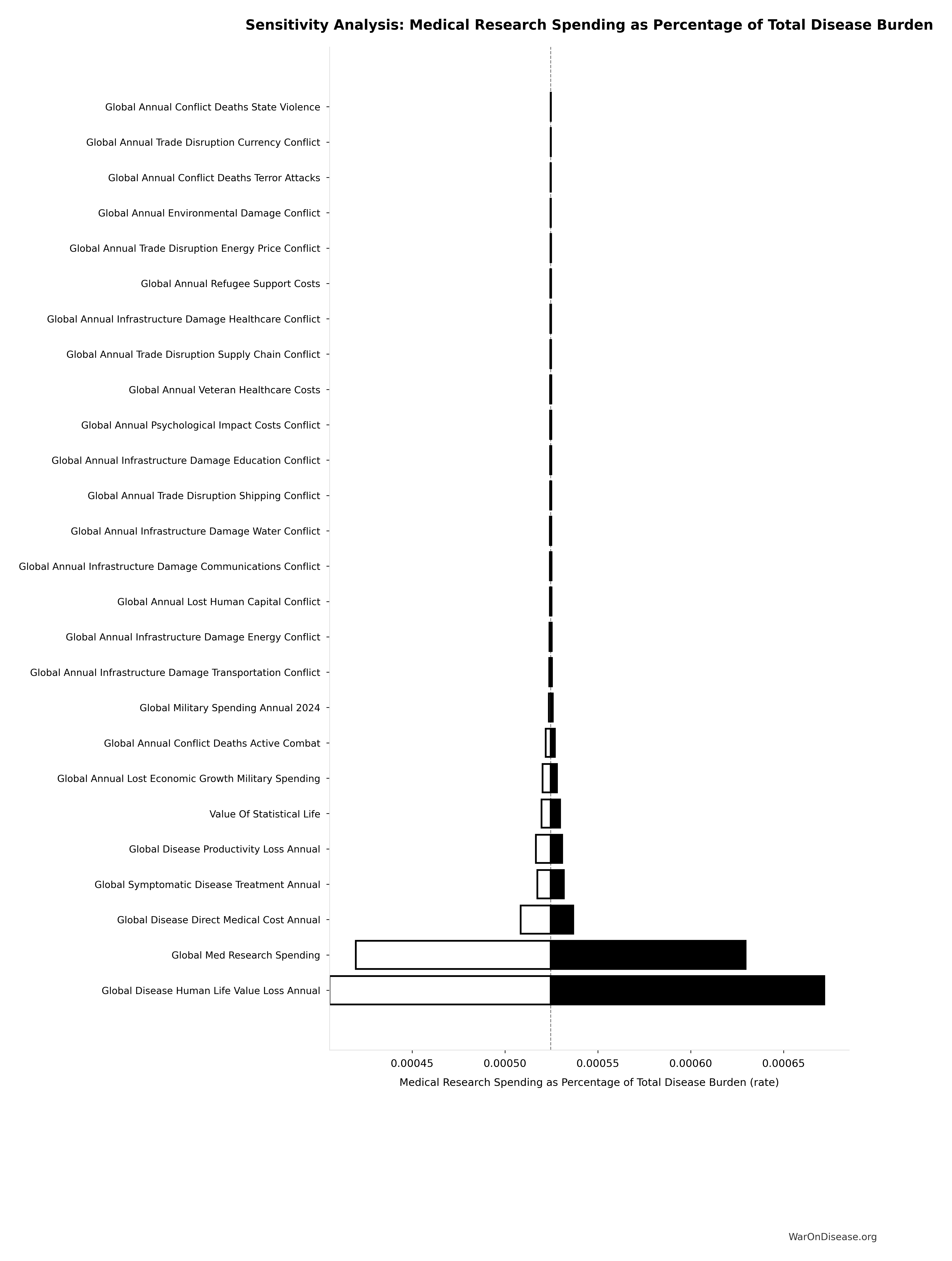

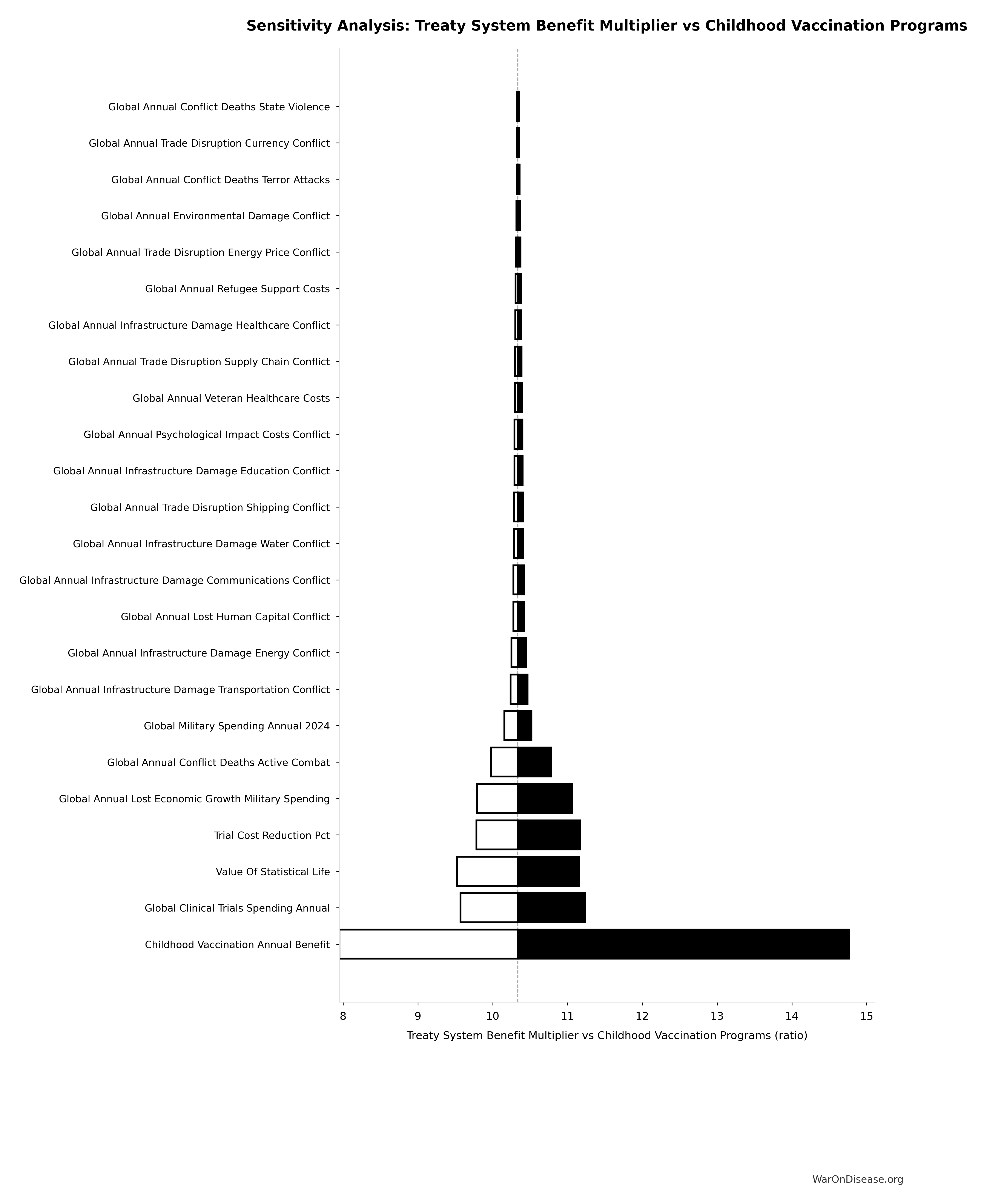

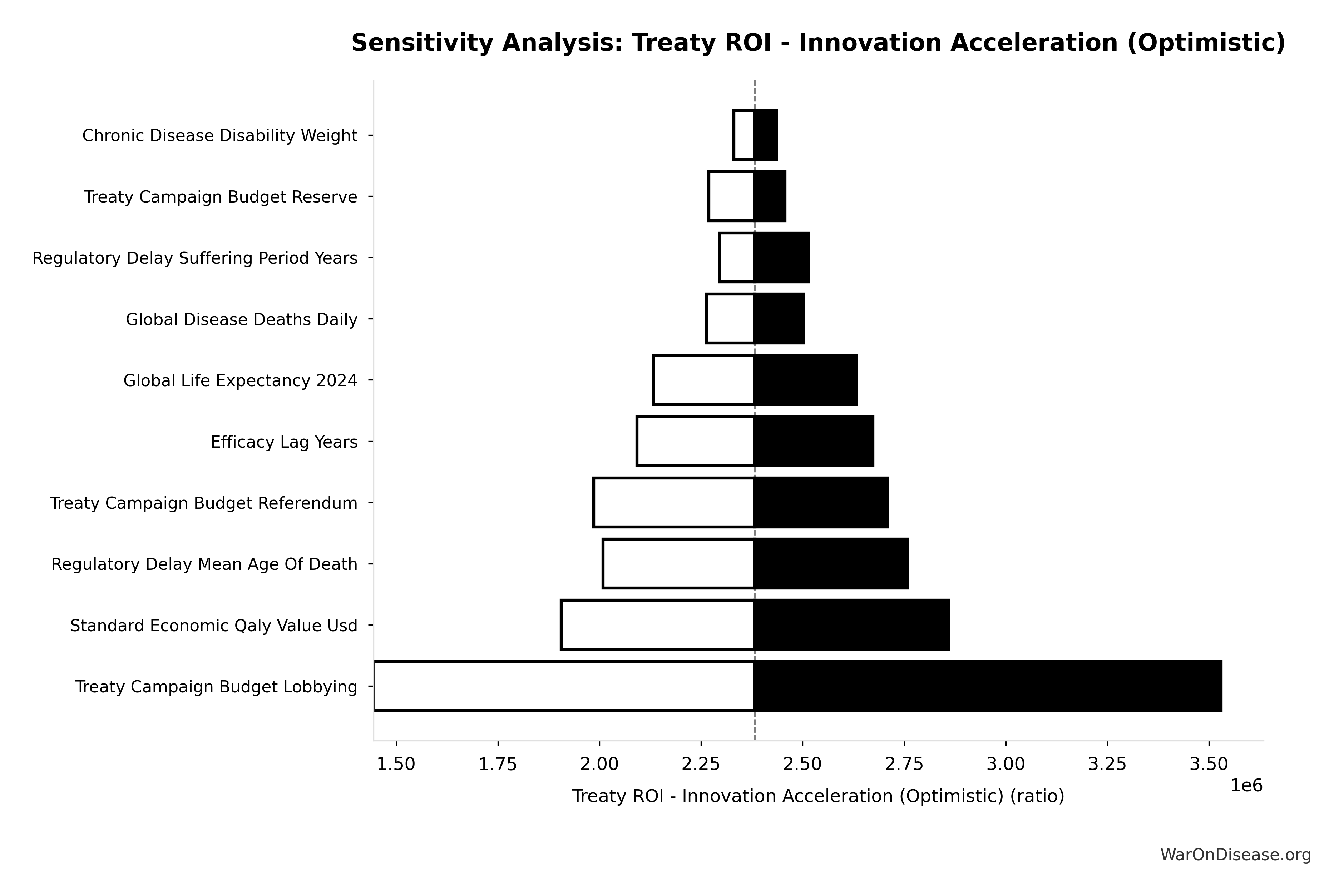

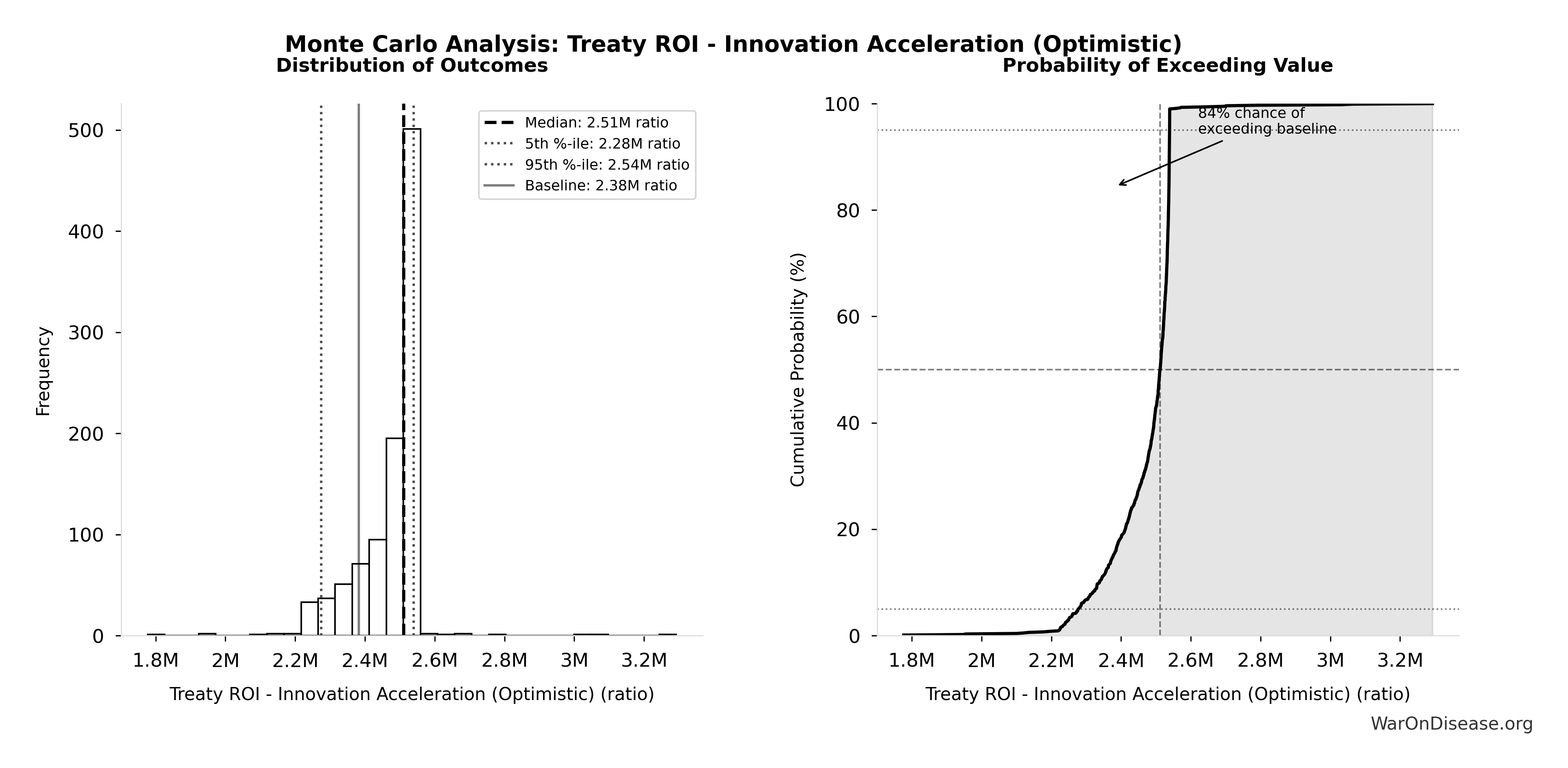

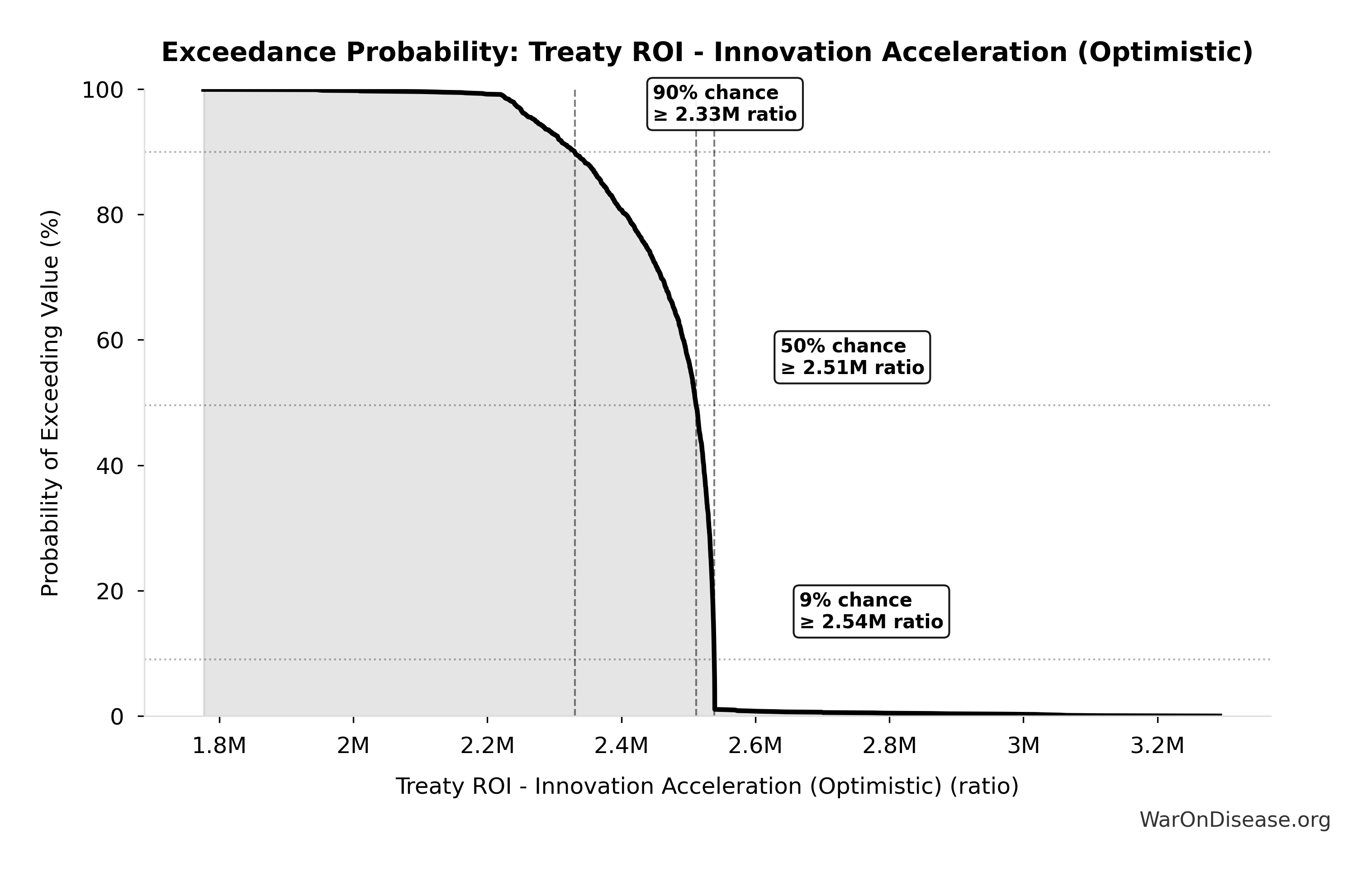

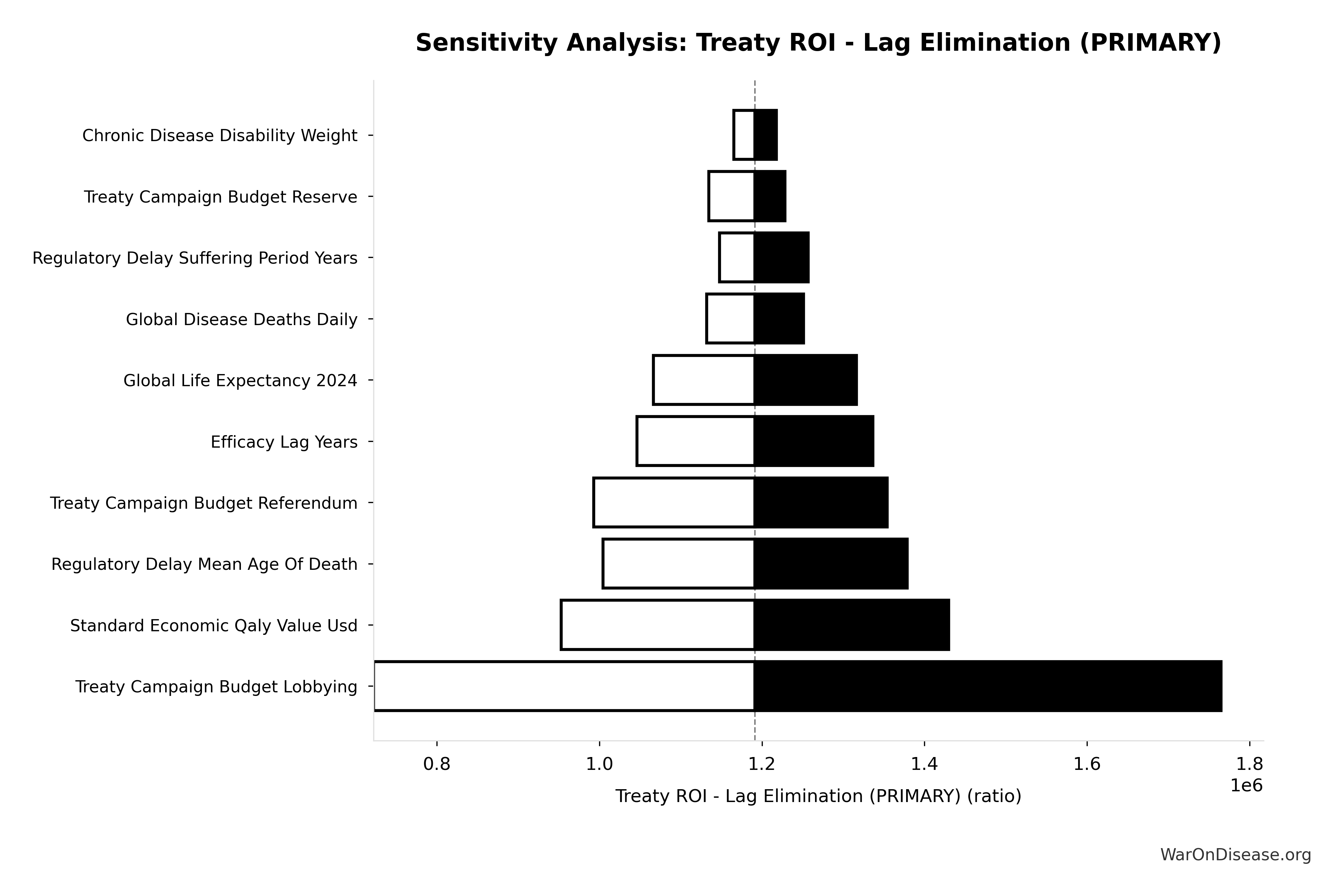

Sensitivity Analysis

Pairwise Drug Combinations: 45.1 million combinations

Unique pairwise drug combinations from known safe compounds (n choose 2)

Inputs:

- Safe Compounds Available for Testing: 9.50 thousand compounds (95% CI: 7.00 thousand compounds - 12.0 thousand compounds)

Formula: SAFE_COMPOUNDS × (SAFE_COMPOUNDS - 1) ÷ 2

✓ High confidence

Sensitivity Analysis

Combination Therapy Exploration Time (Current): 13.7 million years

Years to test all pairwise drug combinations at current trial capacity. Combination therapy is standard in oncology, HIV, cardiology.

Inputs:

- Combination Therapy Space 🔢: 45.1 billion combinations

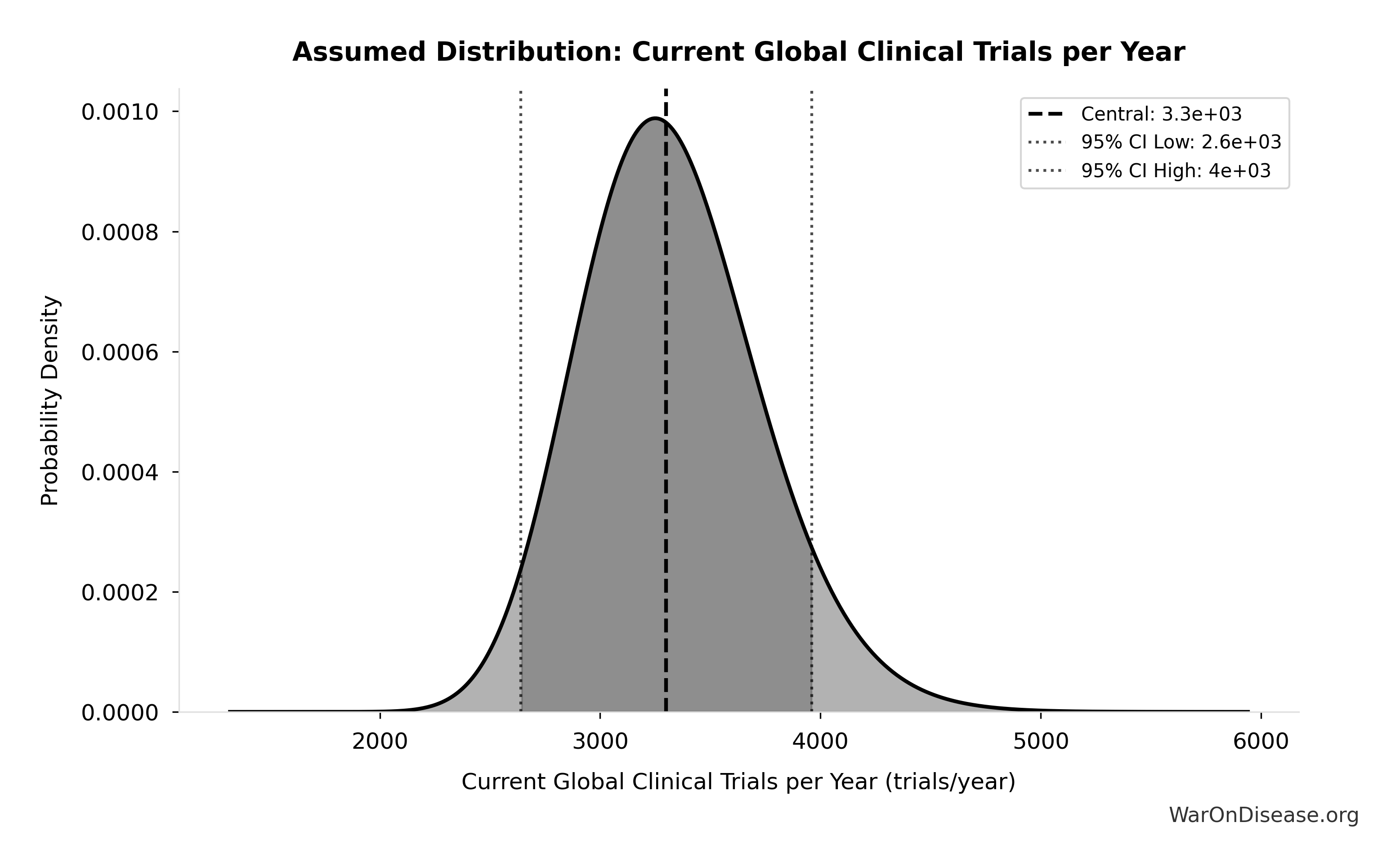

- Current Global Clinical Trials per Year 📊: 3.30 thousand trials/year (95% CI: 2.64 thousand trials/year - 3.96 thousand trials/year)

\[ \begin{gathered} T_{explore,combo} \\ = \frac{Space_{combo}}{Trials_{ann,curr}} \\ = \frac{45.1B}{3{,}300} \\ = 13.7M \\[0.5em] \text{where } Space_{combo} \\ = N_{combo} \times N_{diseases,trial} \\ = 45.1M \times 1{,}000 \\ = 45.1B \end{gathered} \]

✓ High confidence

Sensitivity Analysis

Sensitivity Indices for Combination Therapy Exploration Time (Current)

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| Current Trials Per Year | -0.9931 | Strong driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

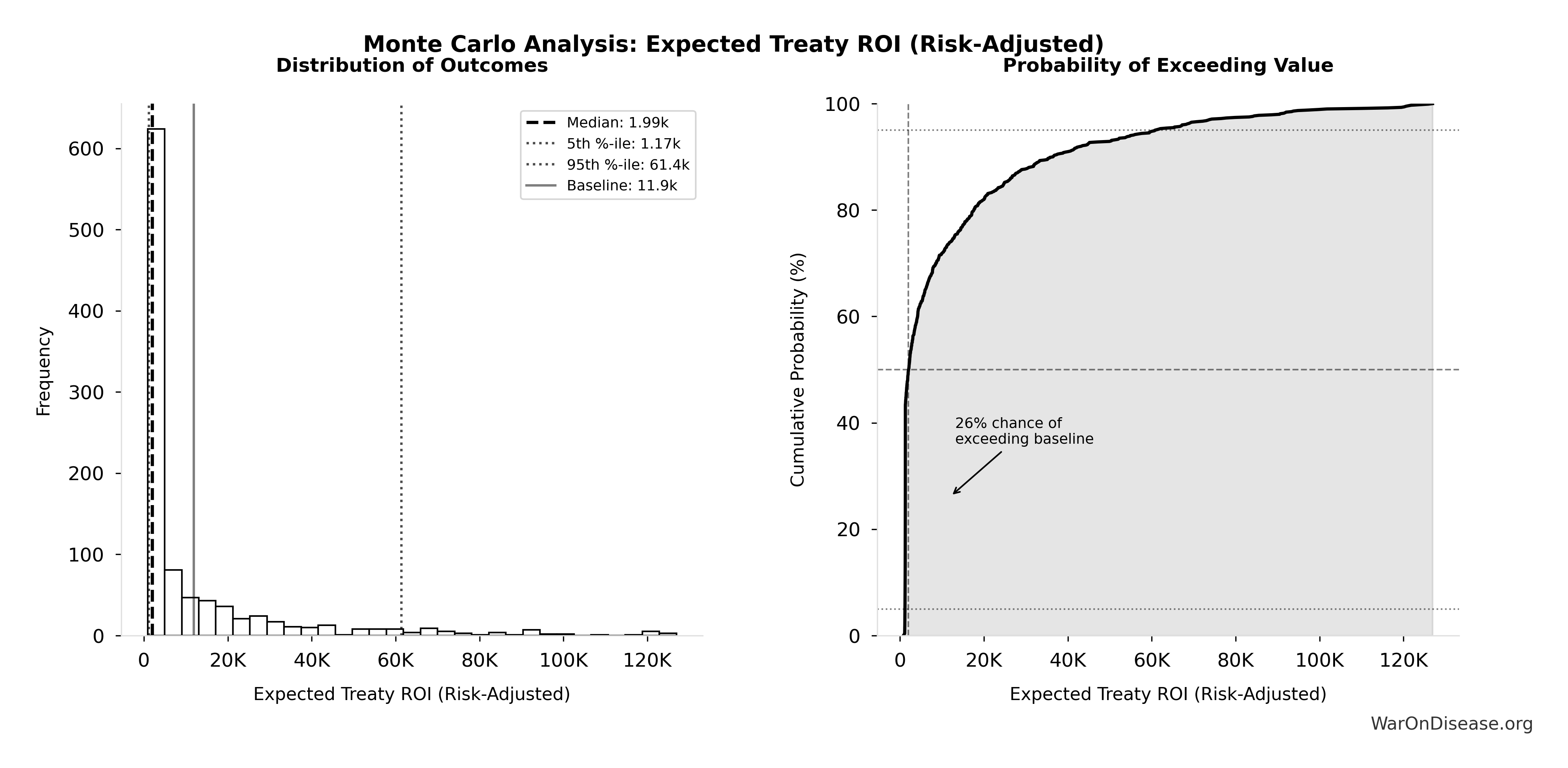

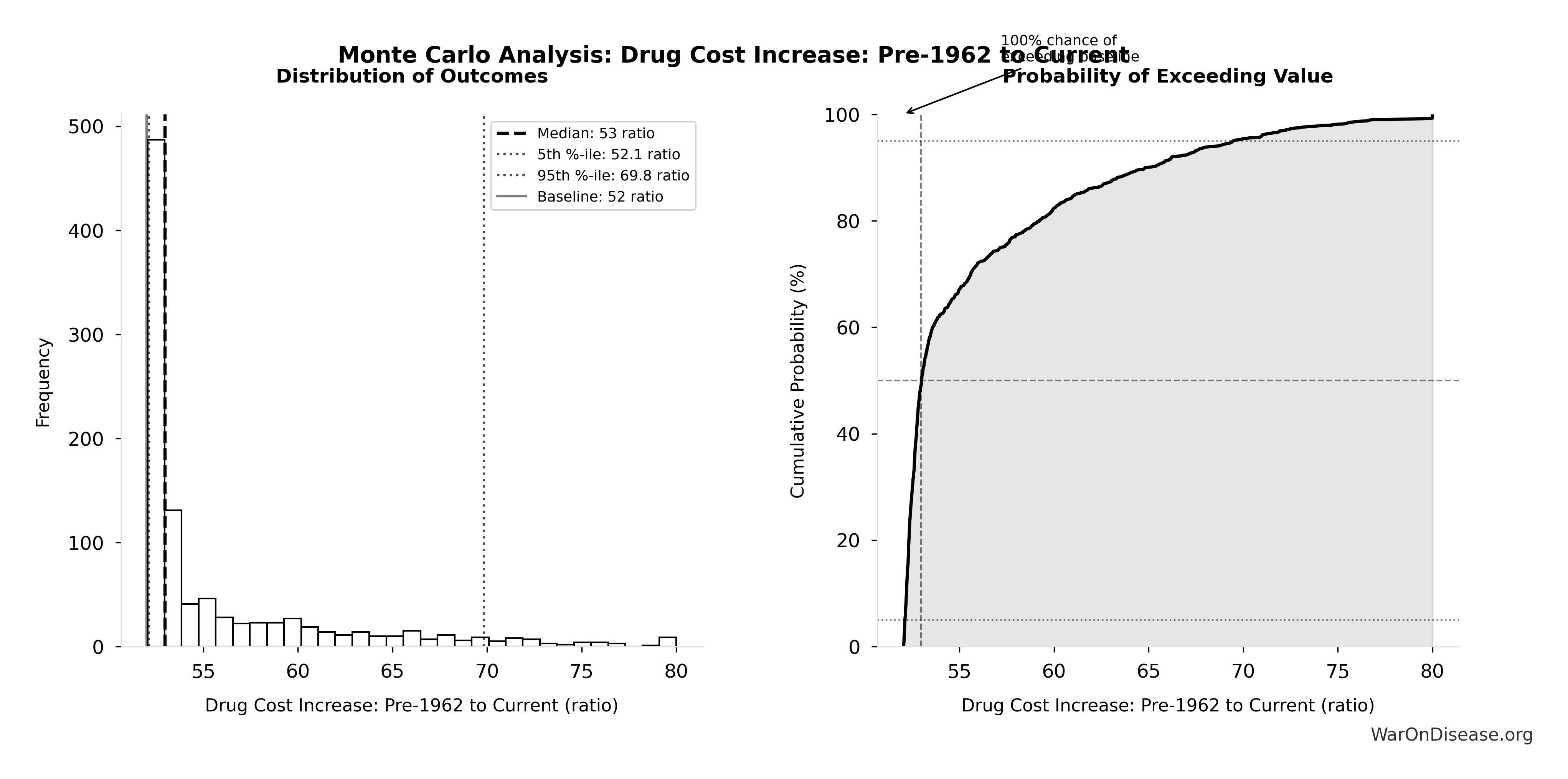

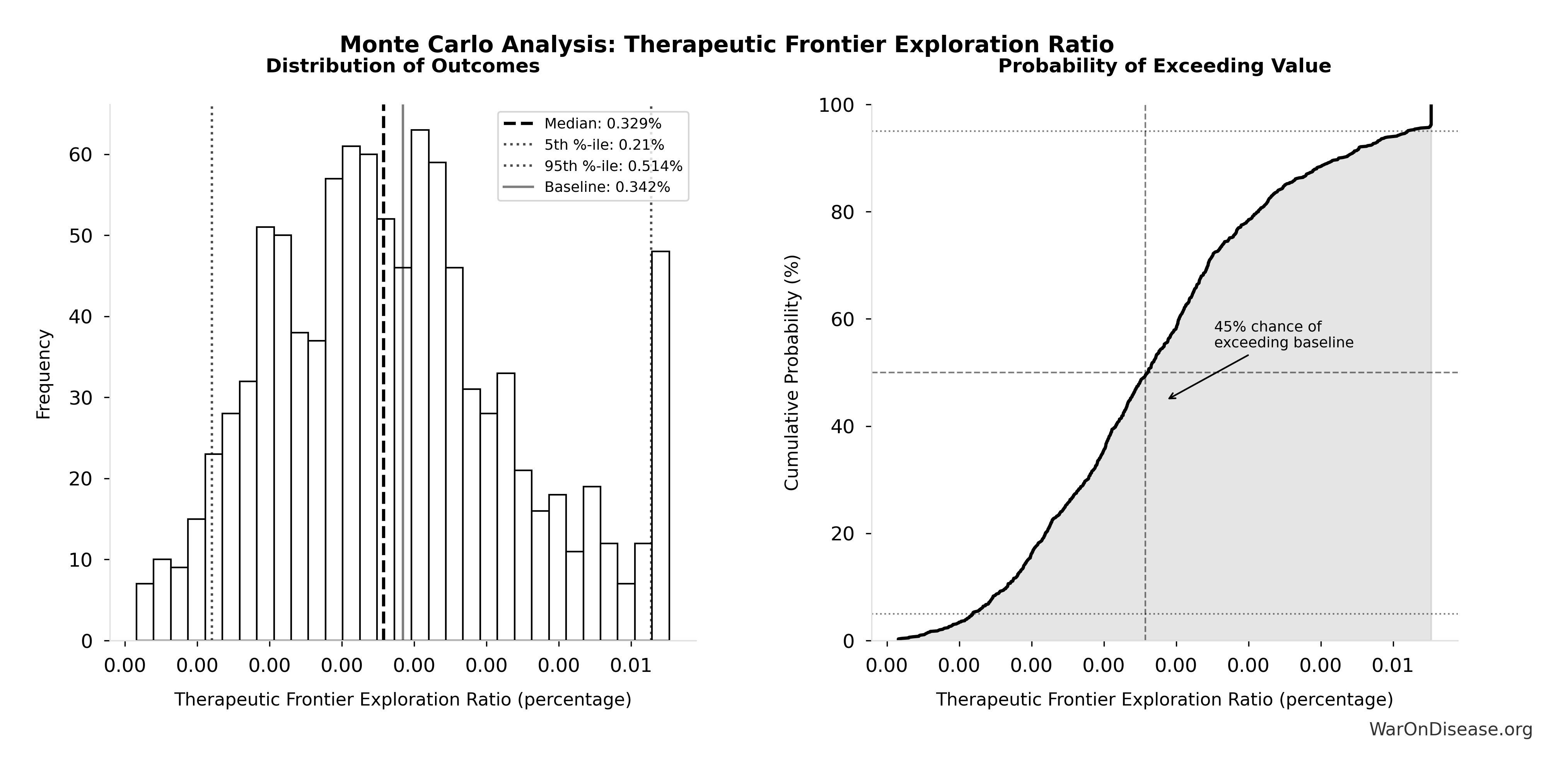

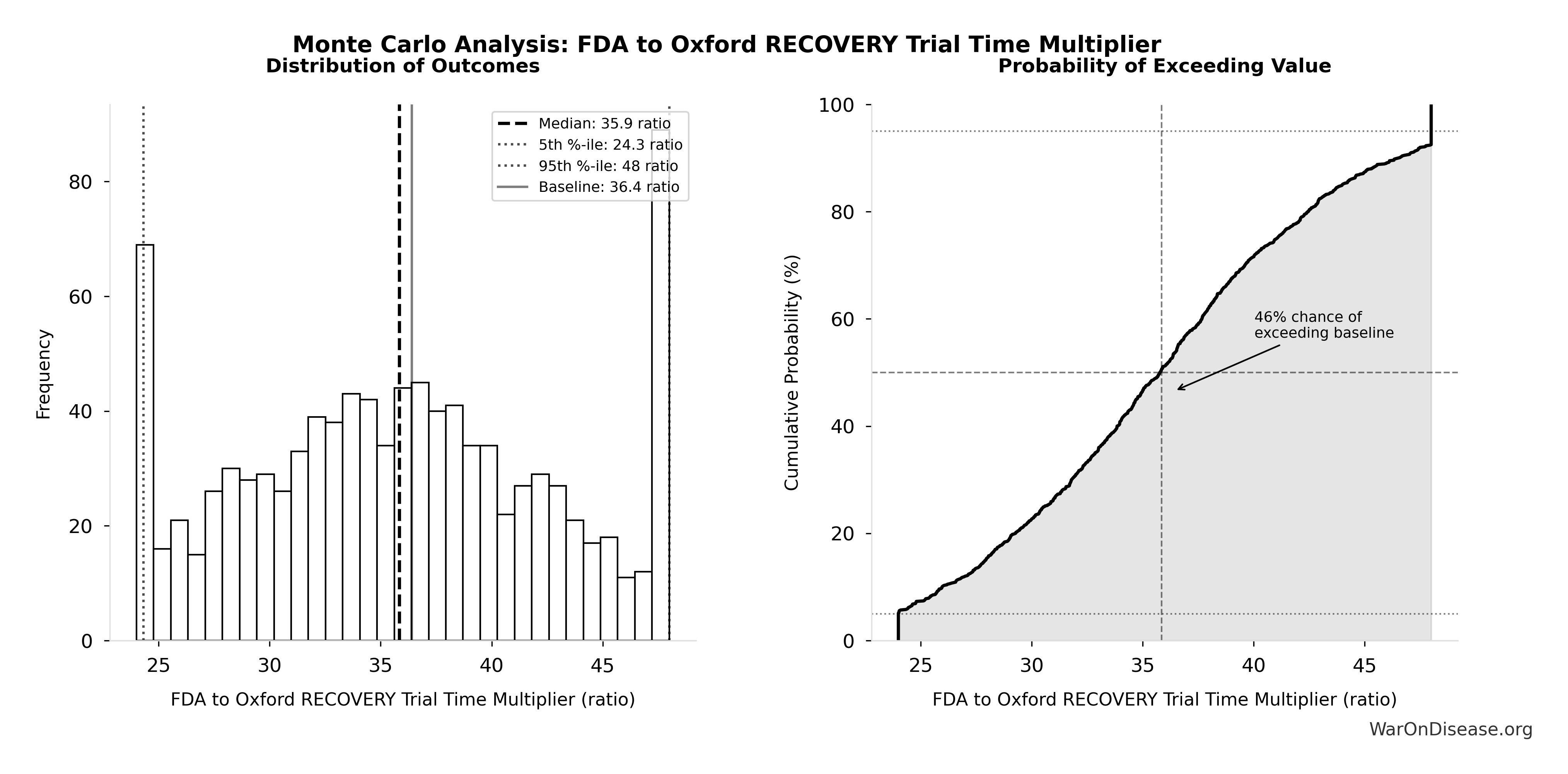

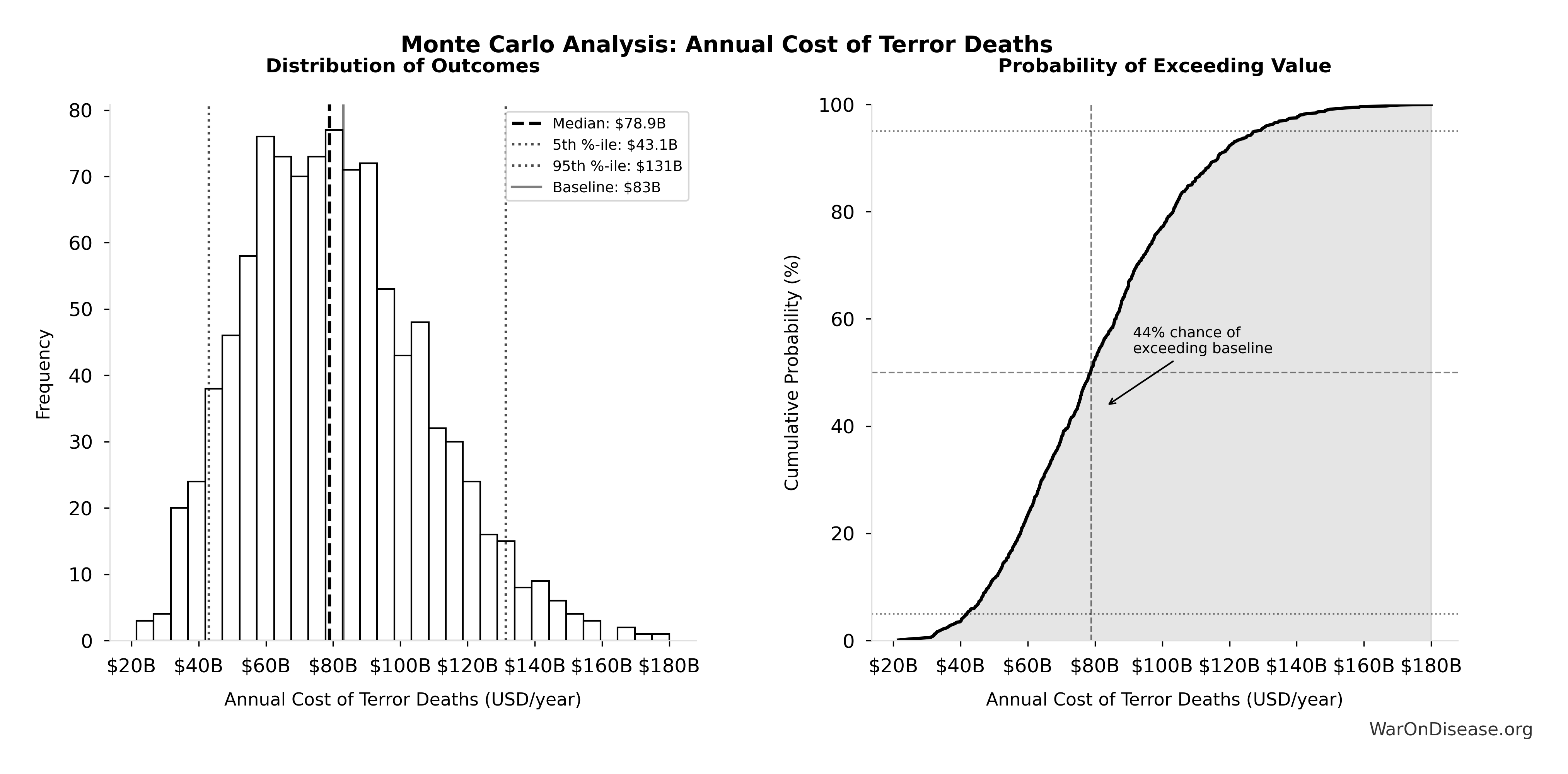

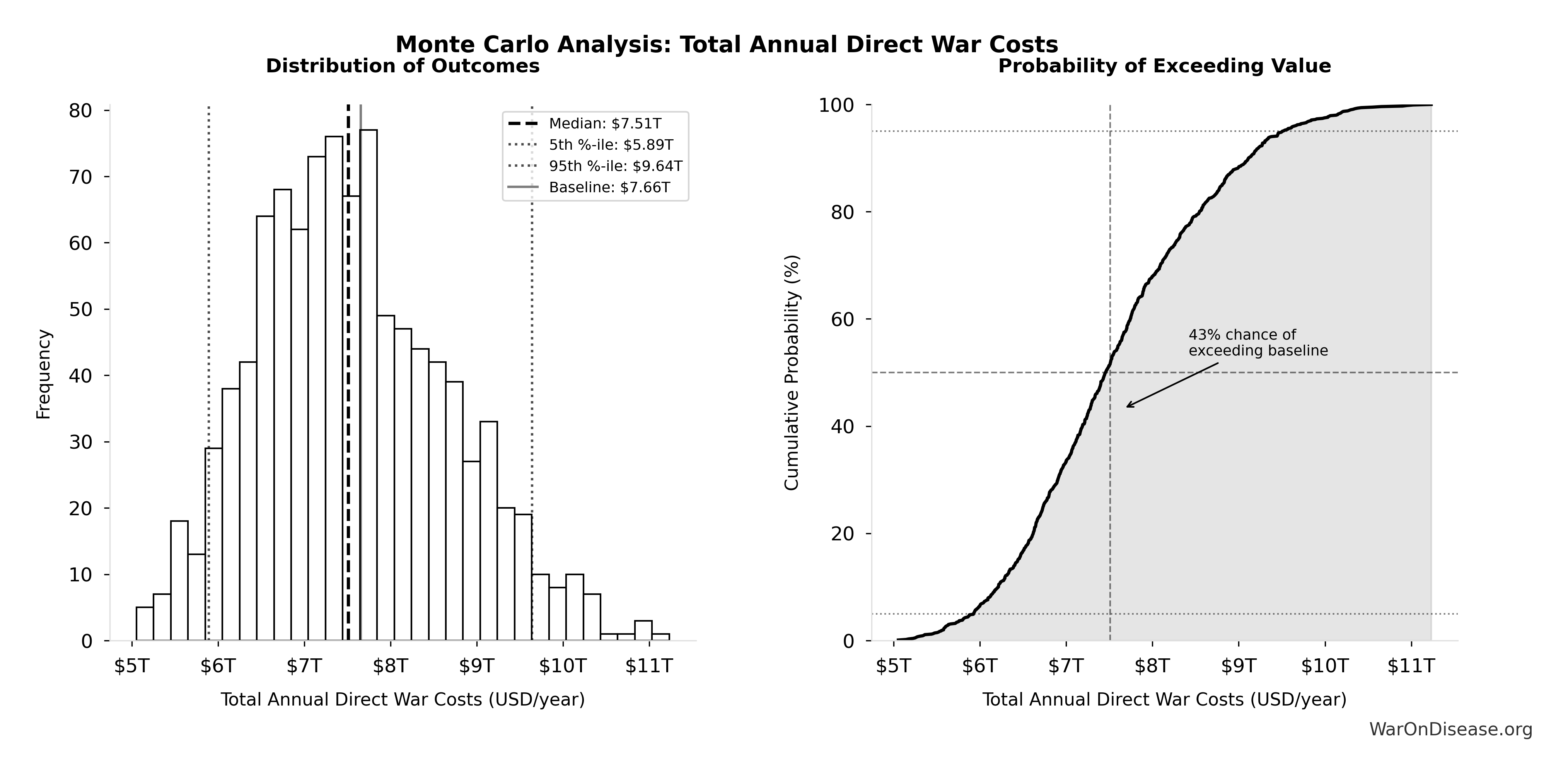

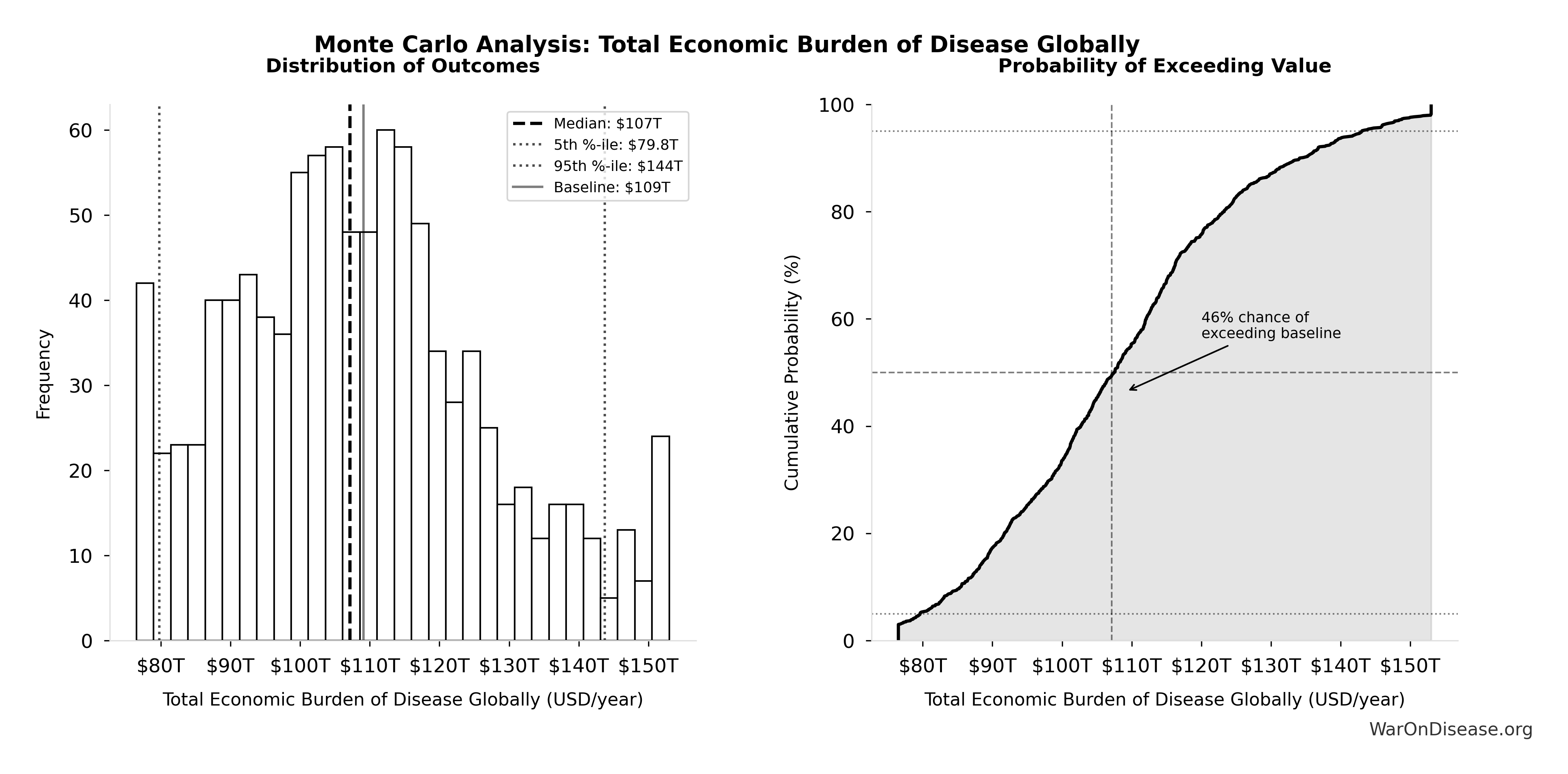

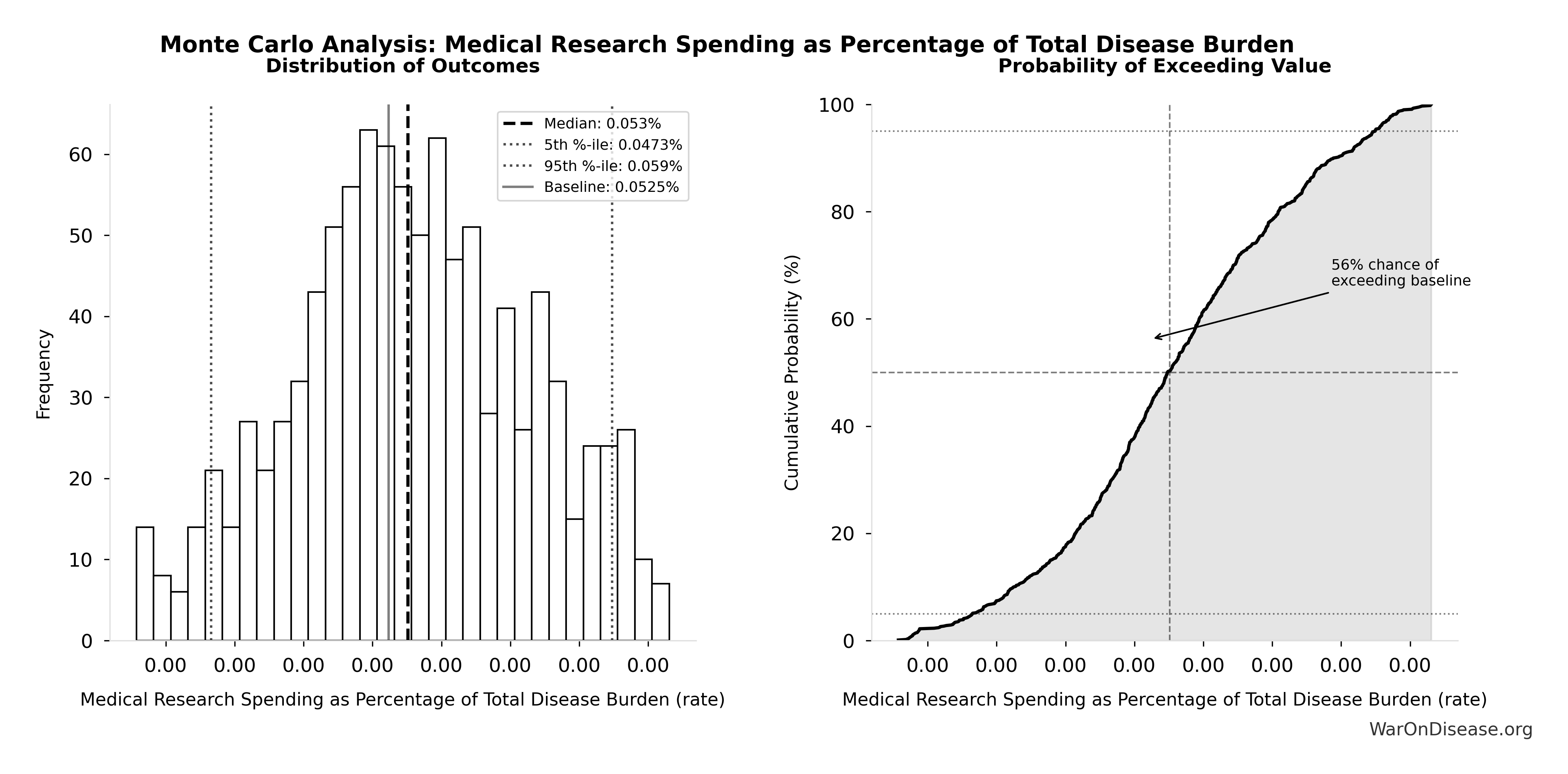

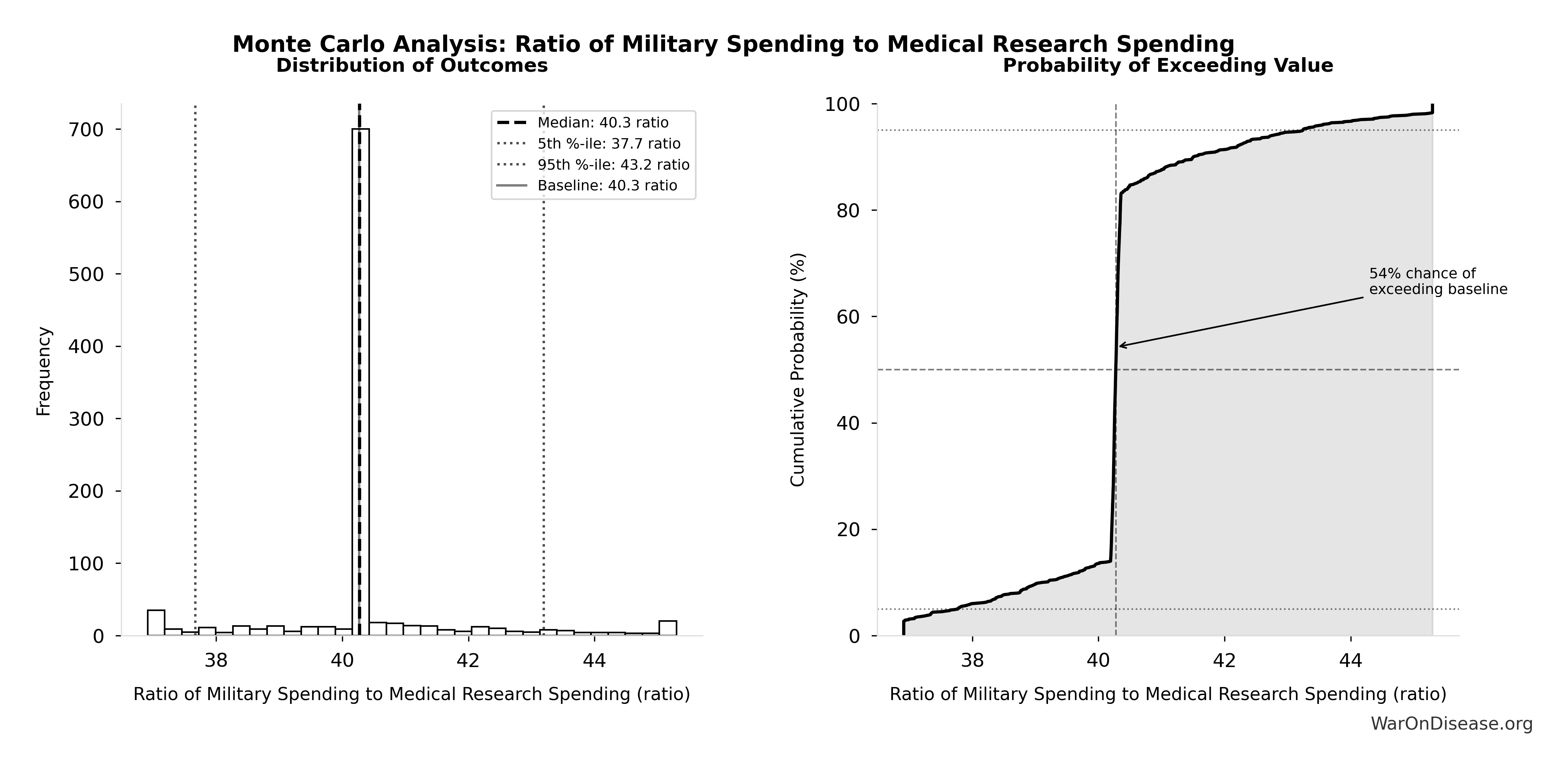

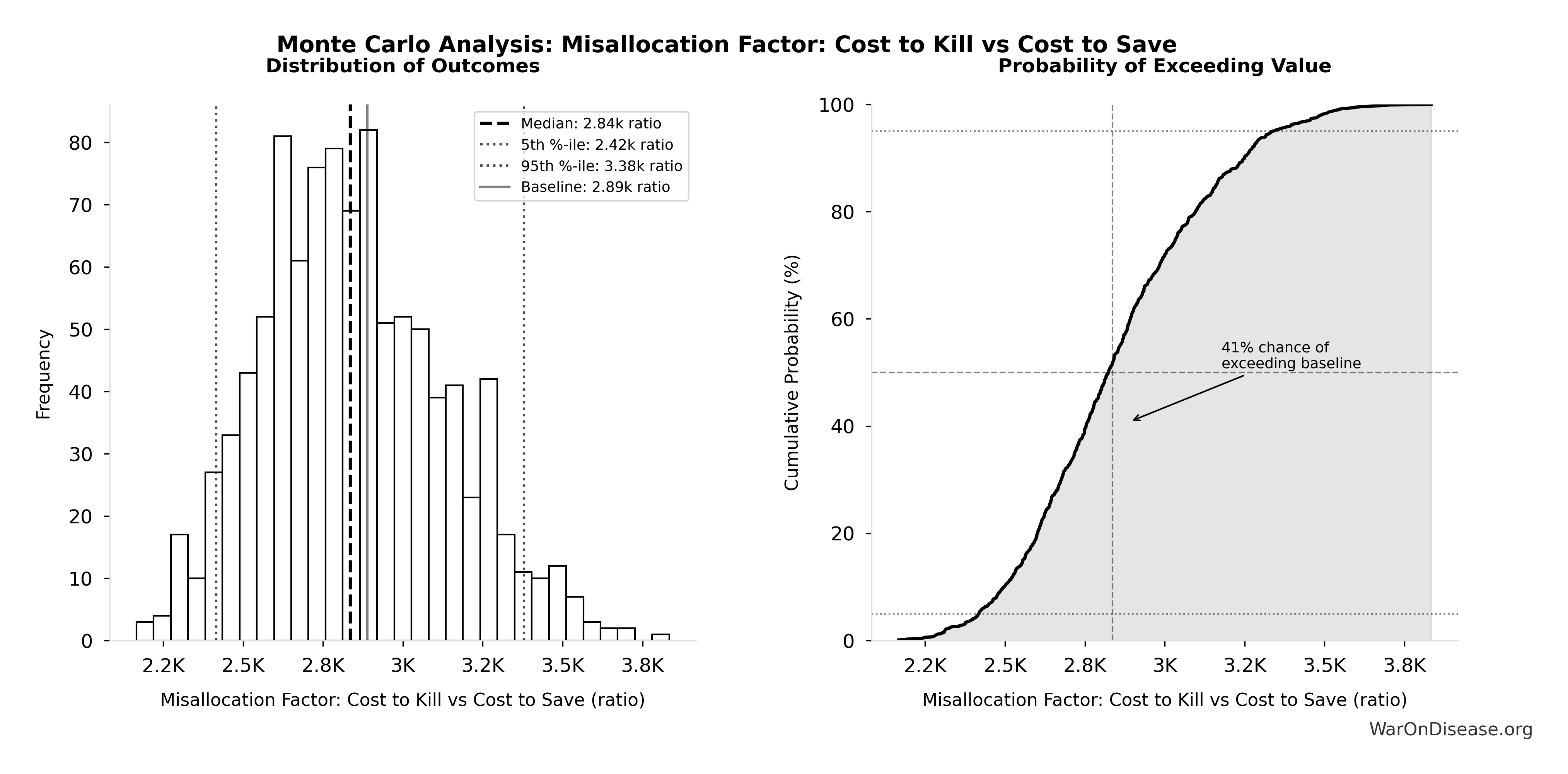

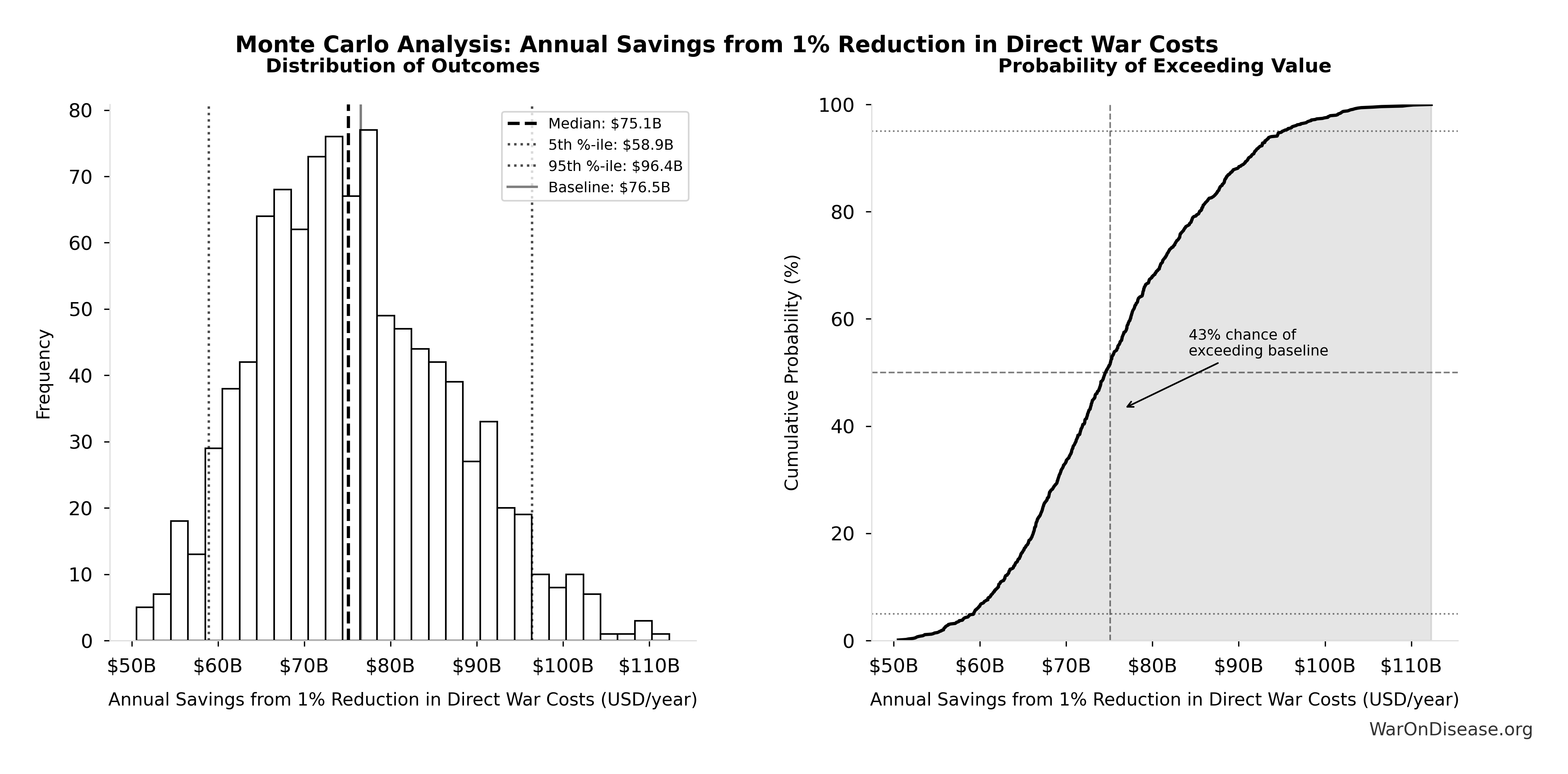

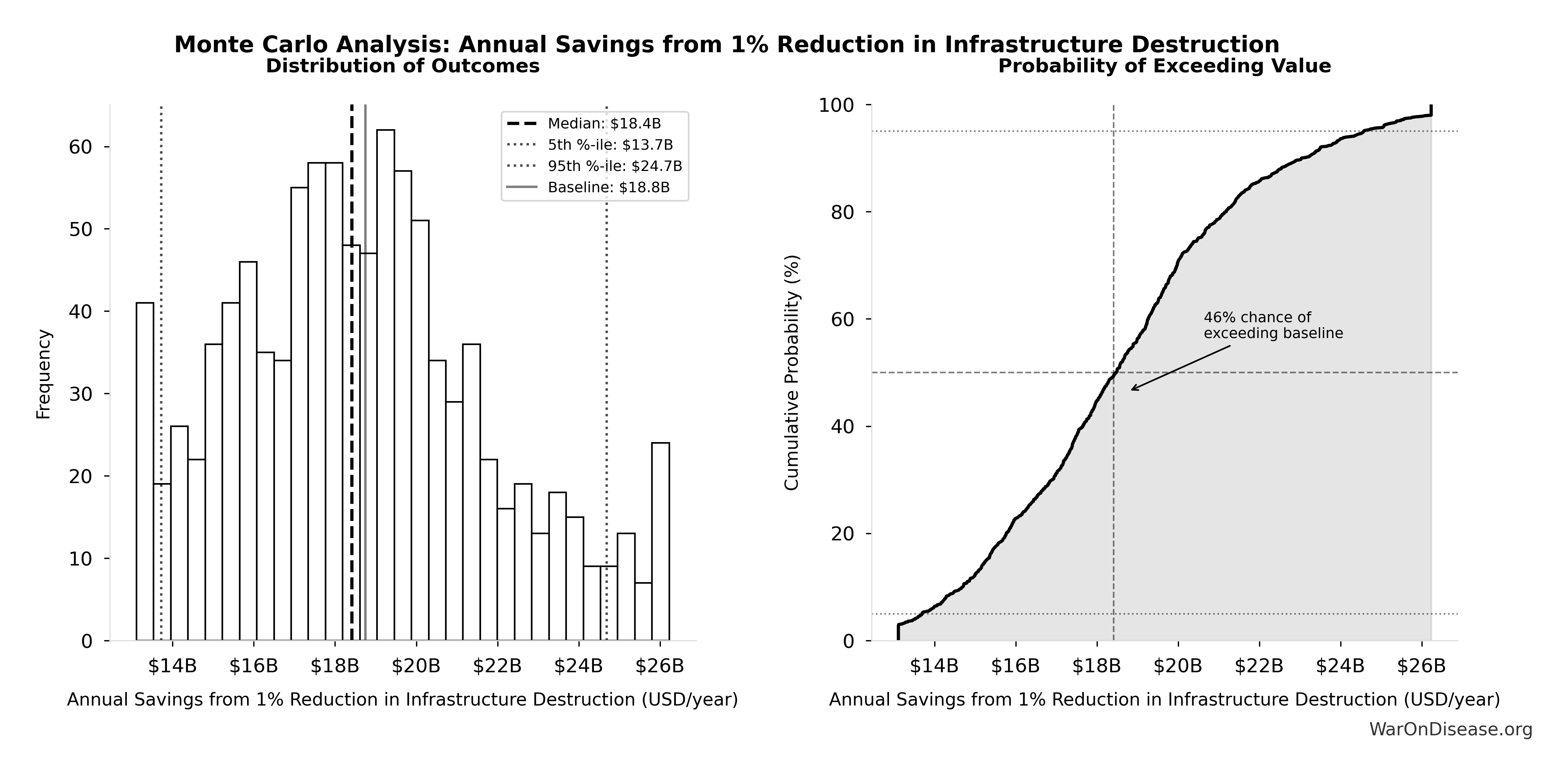

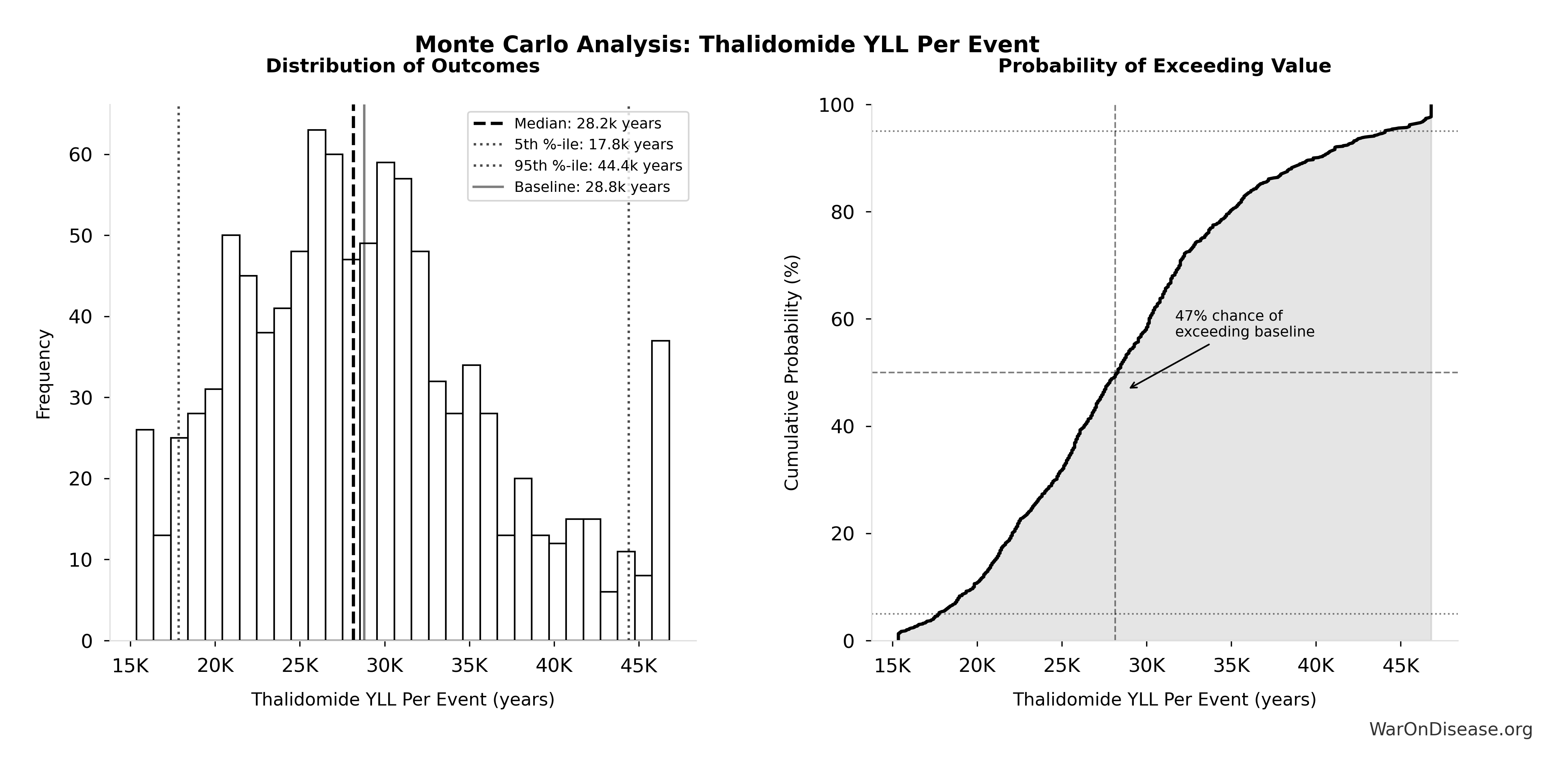

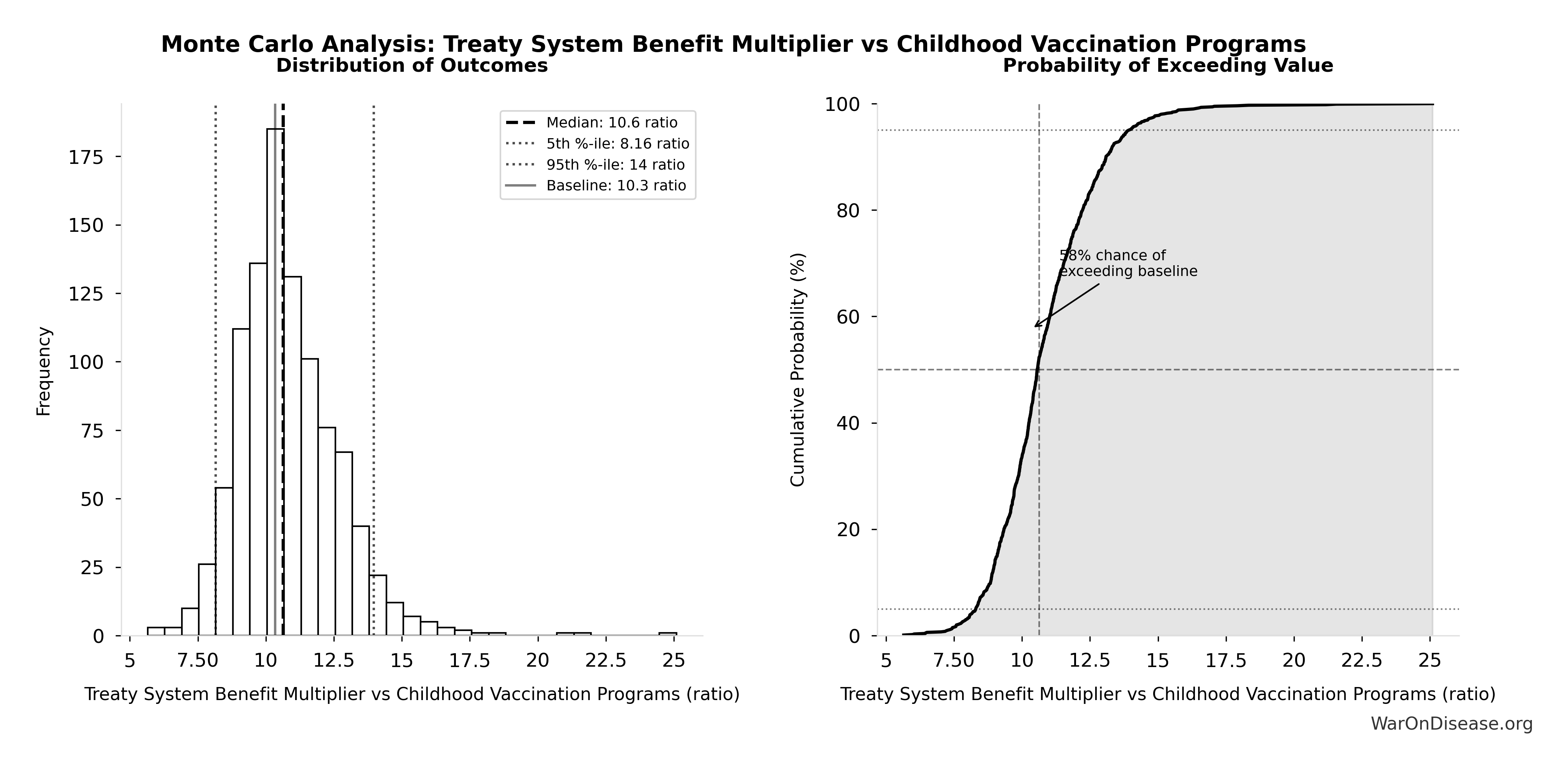

Monte Carlo Distribution

Simulation Results Summary: Combination Therapy Exploration Time (Current)

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 13.7 million |

| Mean (expected value) | 13.8 million |

| Median (50th percentile) | 13.8 million |

| Standard Deviation | 1.36 million |

| 90% Range (5th-95th percentile) | [11.6 million, 16.3 million] |

The histogram shows the distribution of Combination Therapy Exploration Time (Current) across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

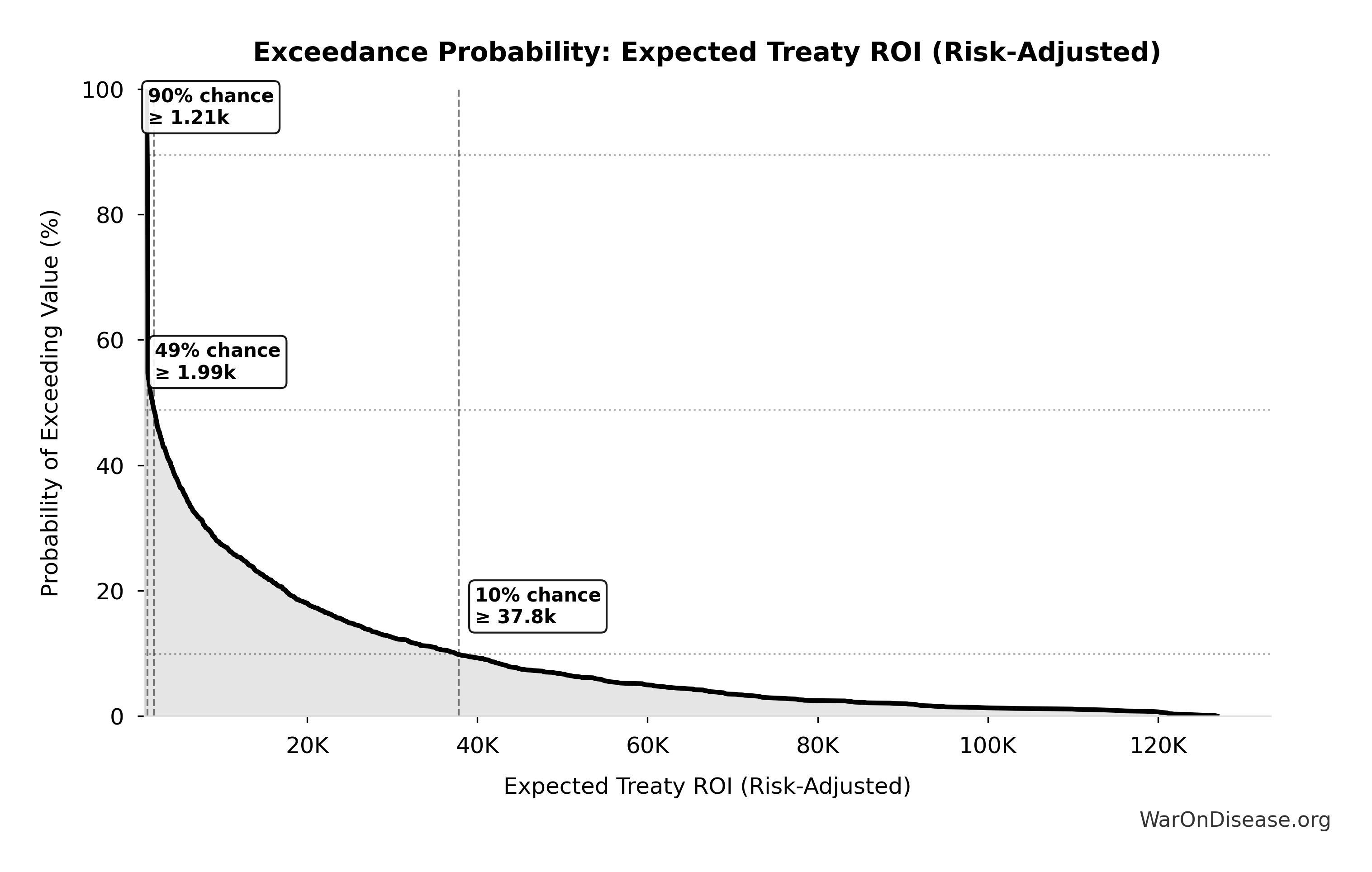

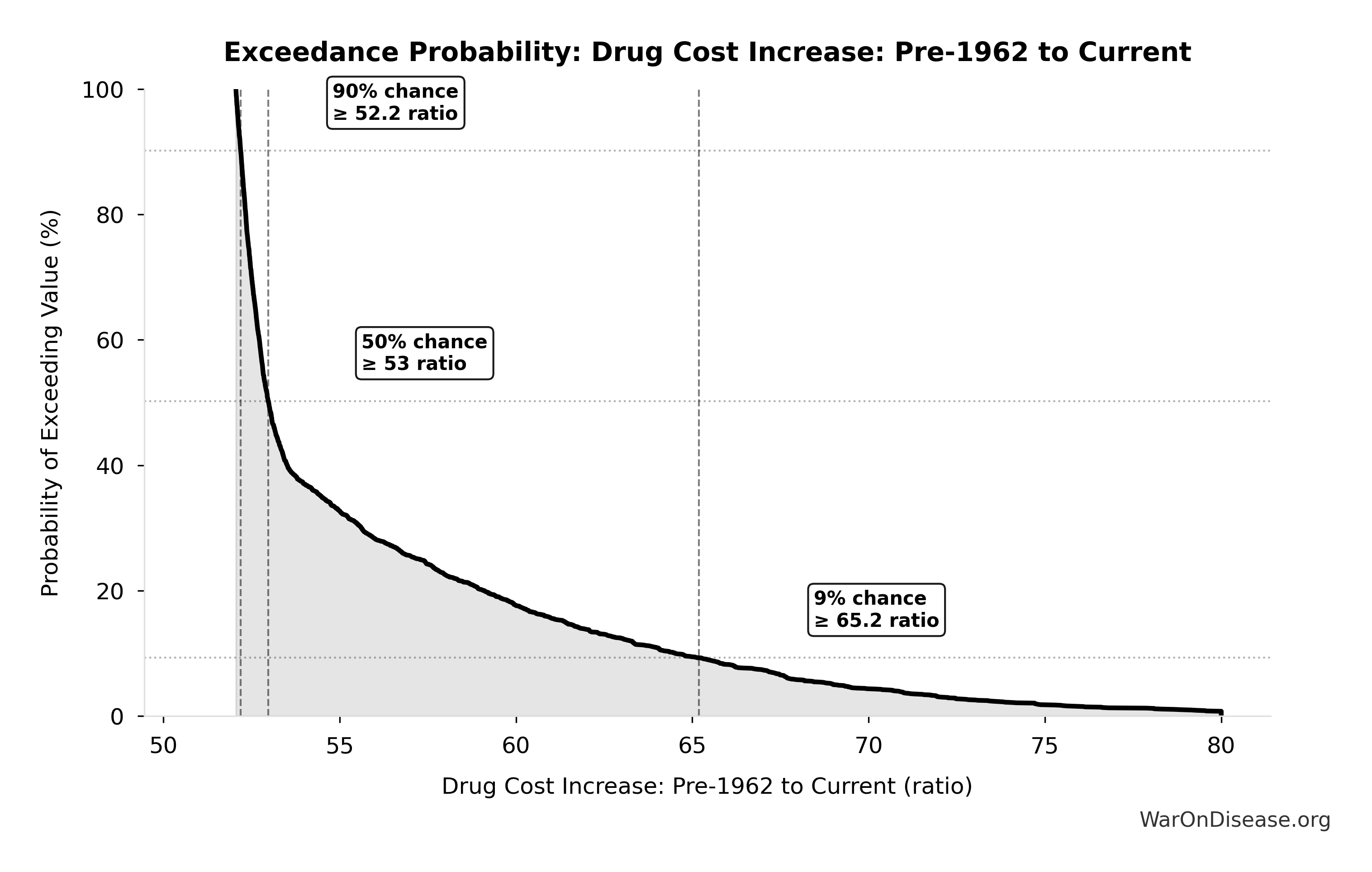

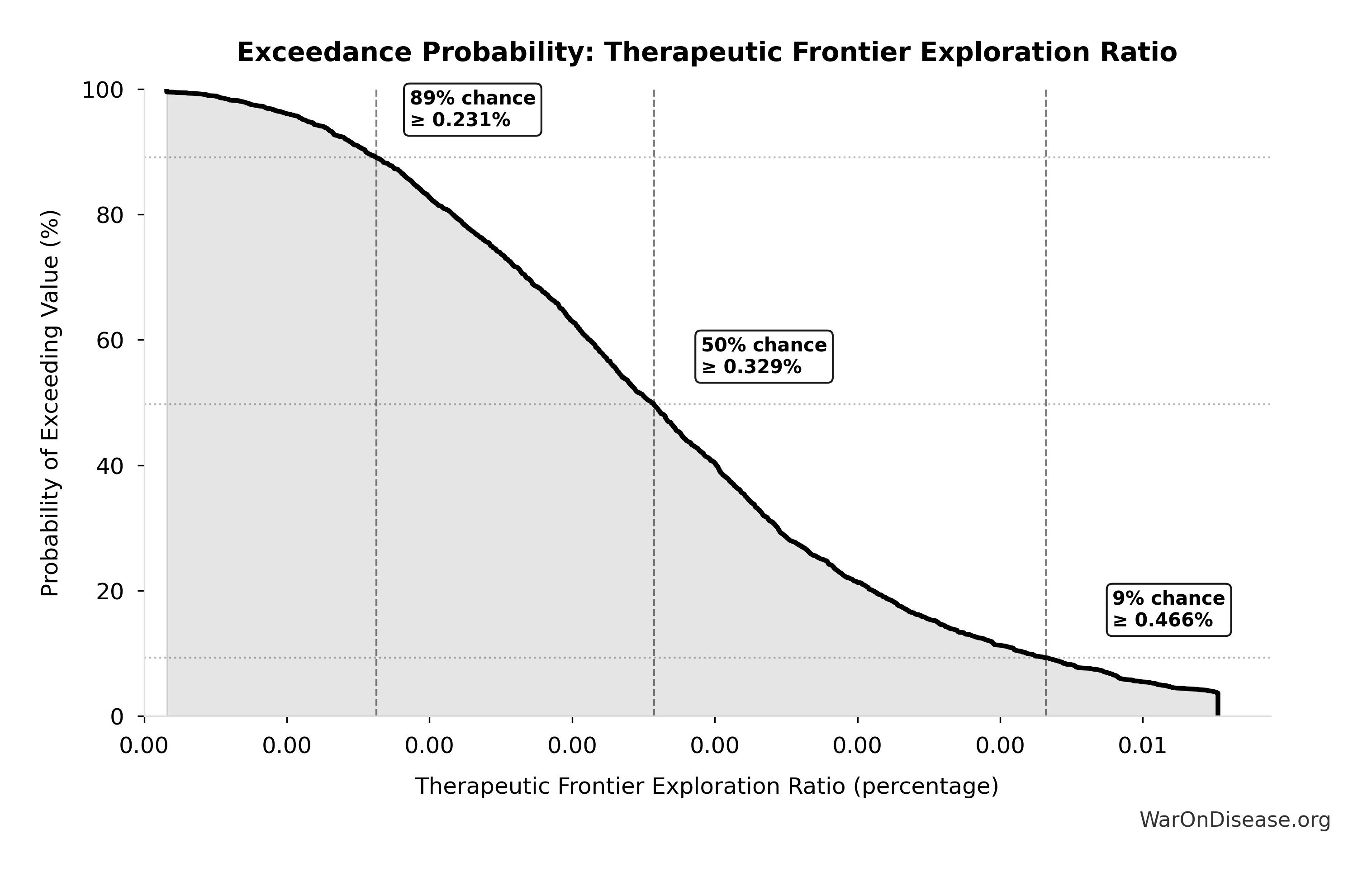

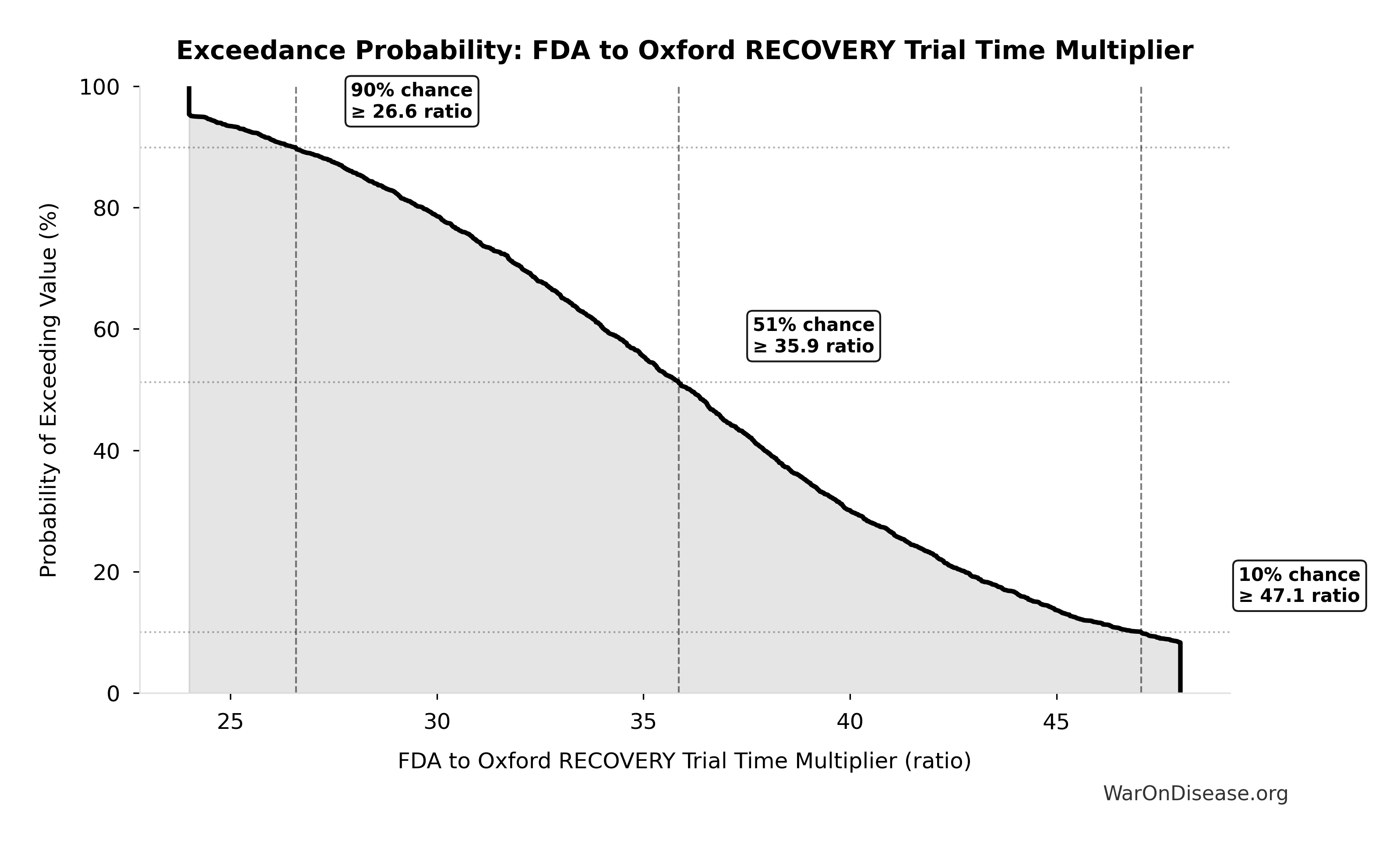

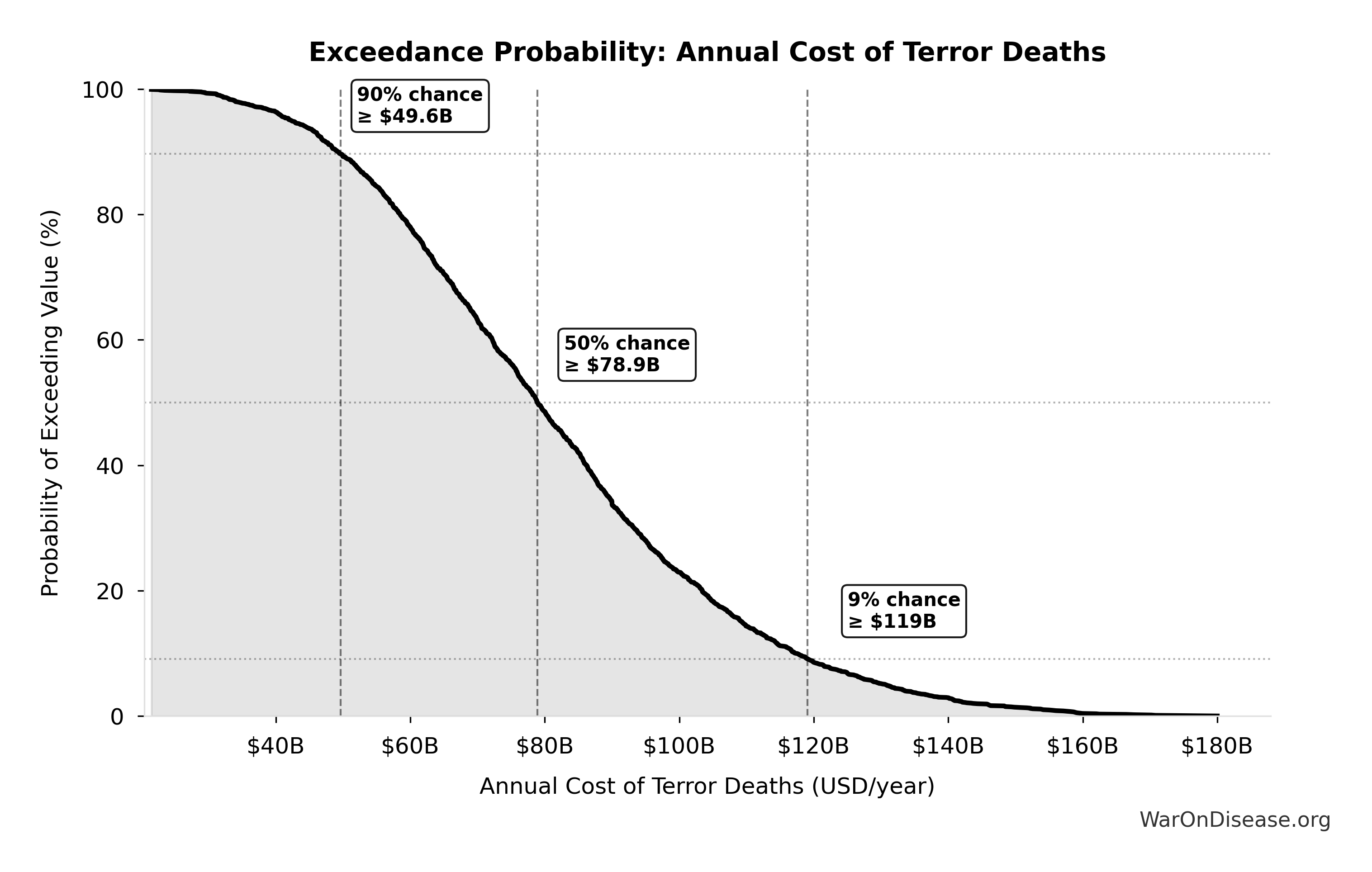

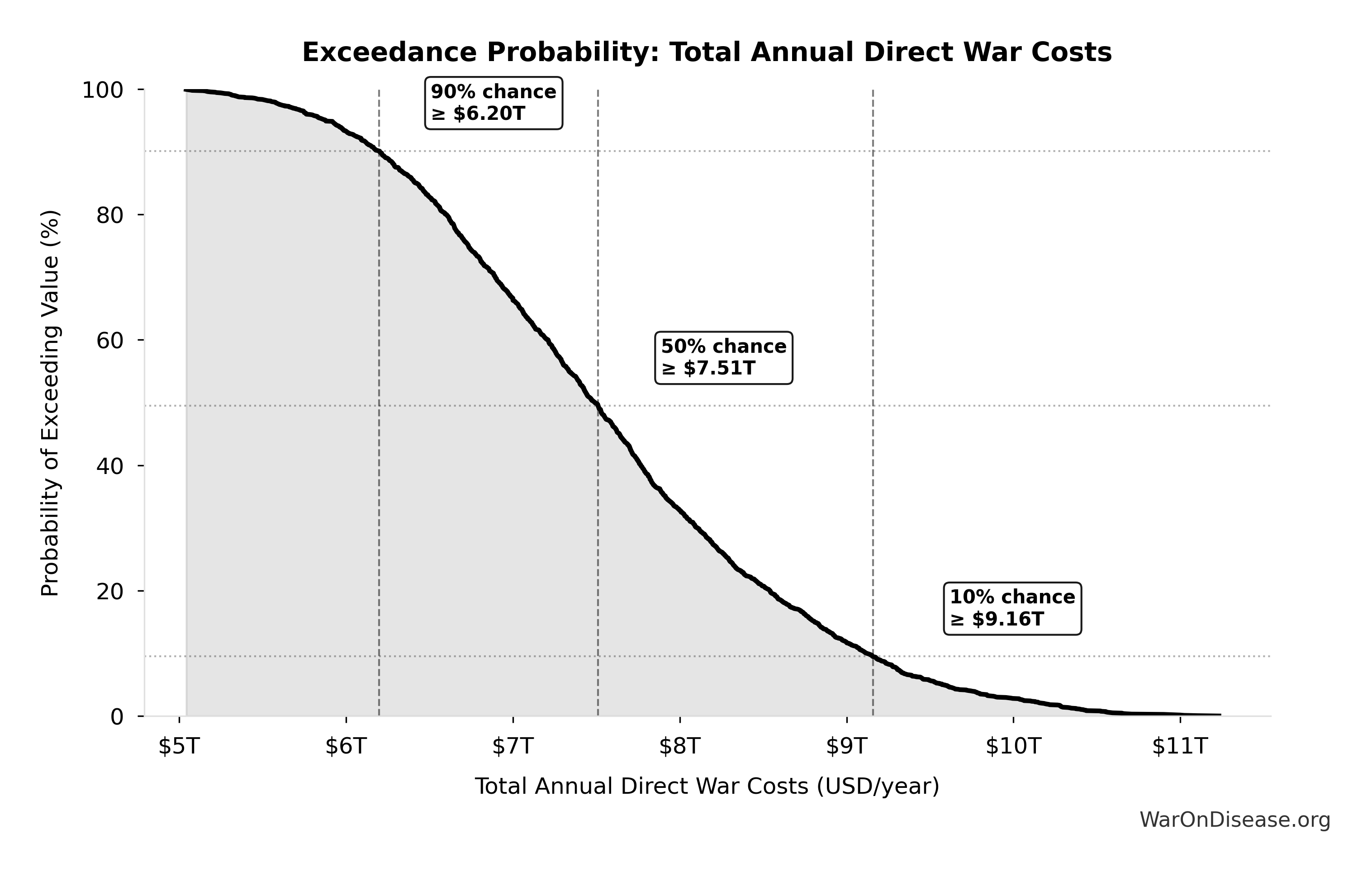

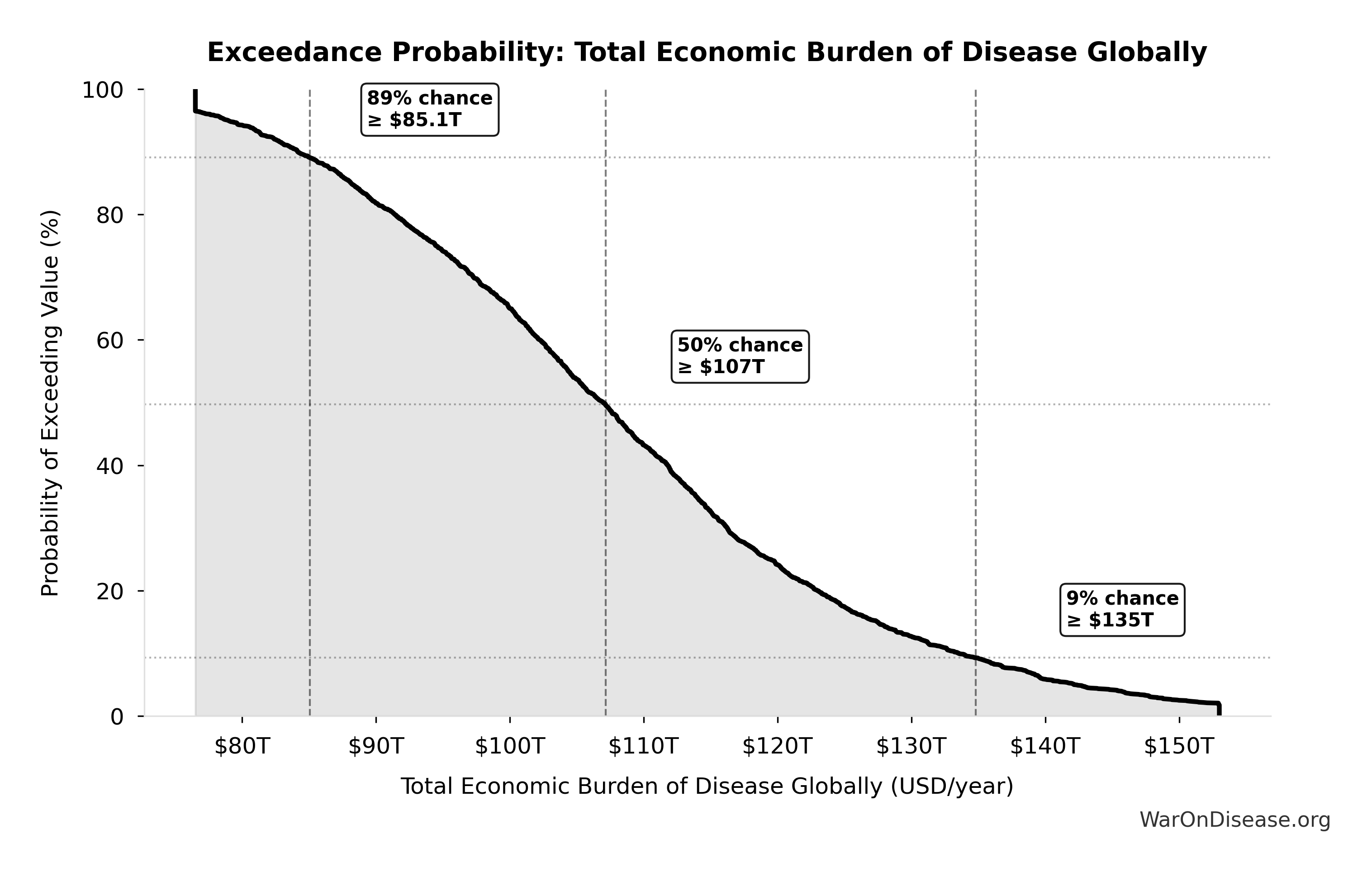

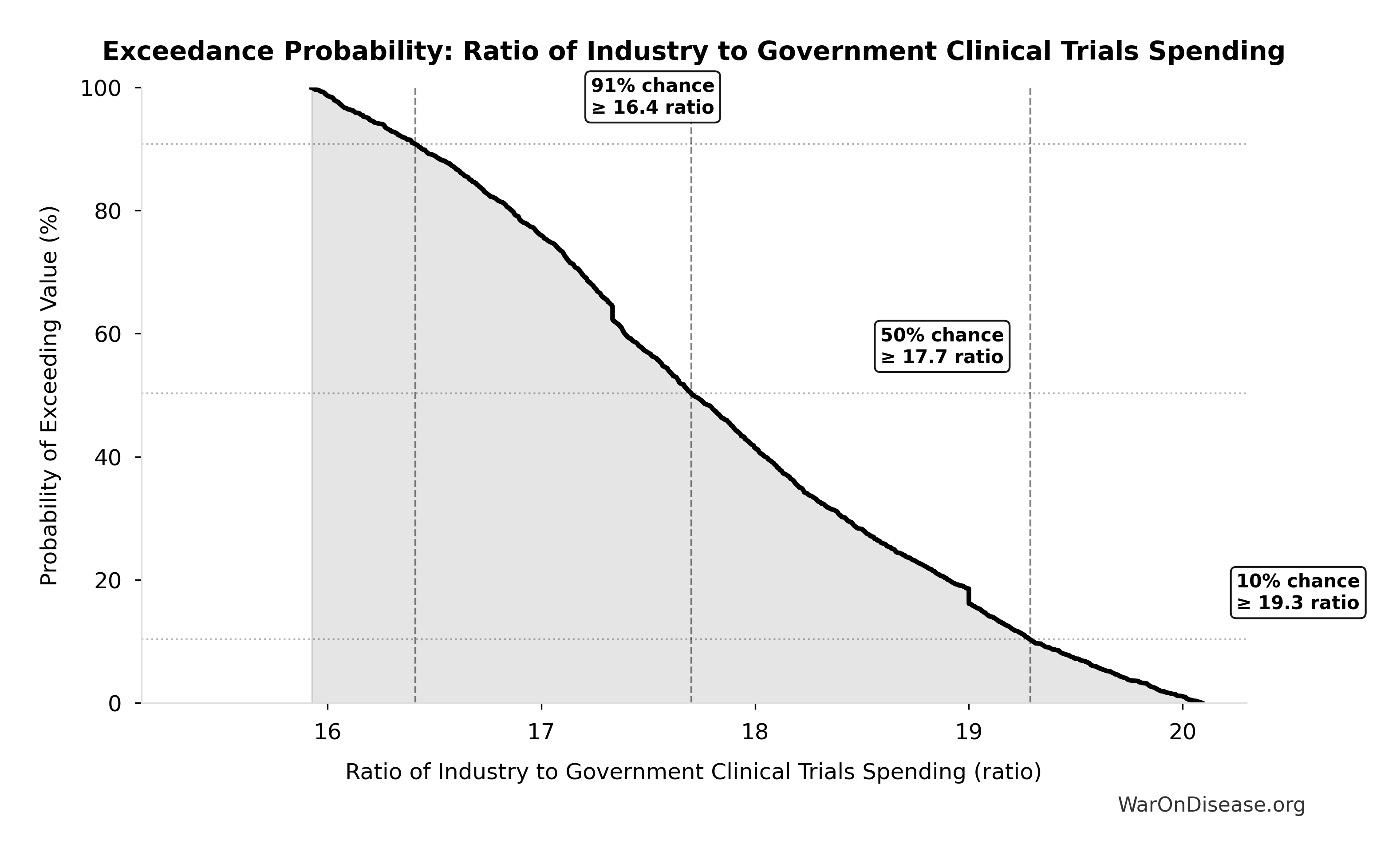

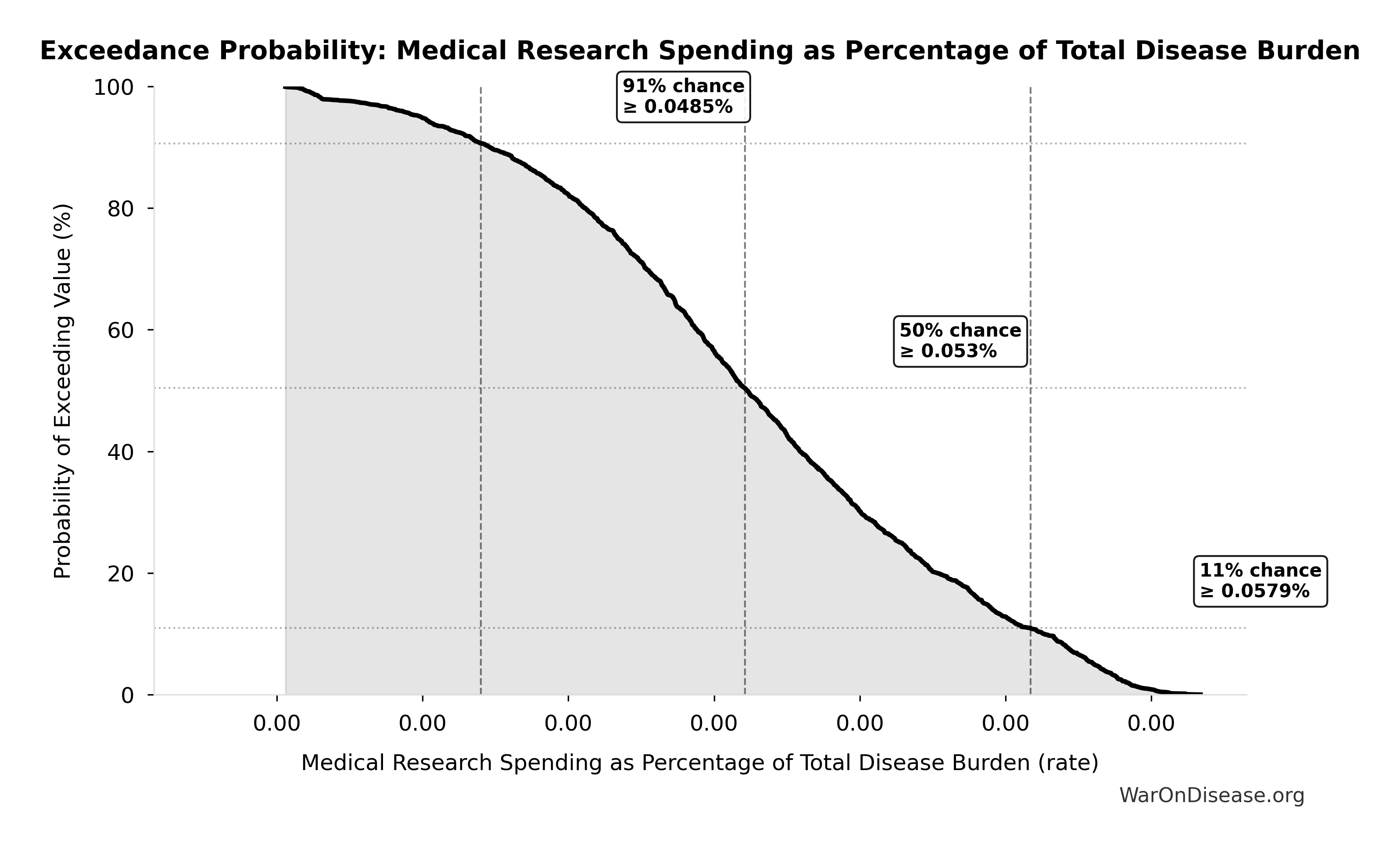

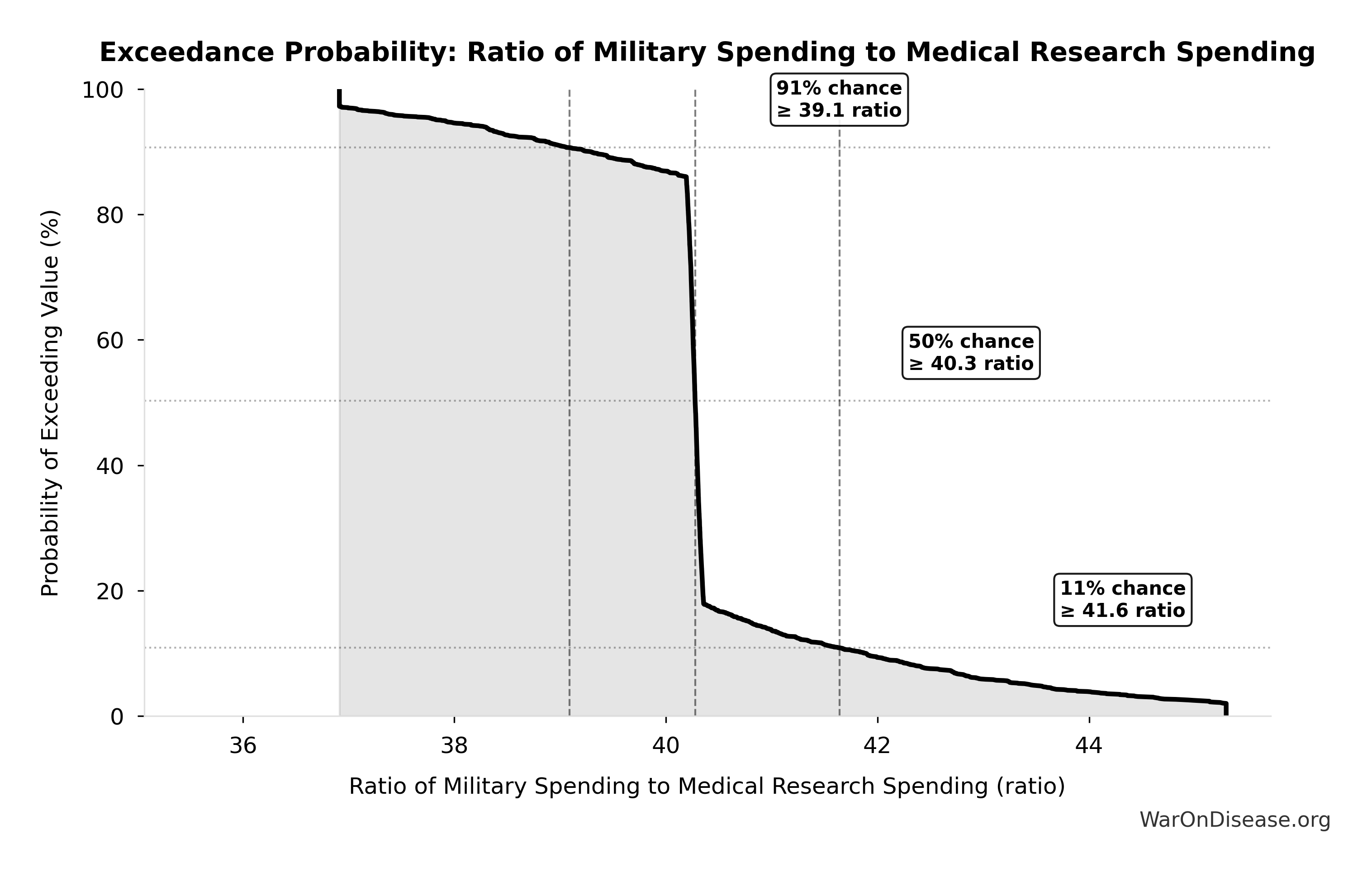

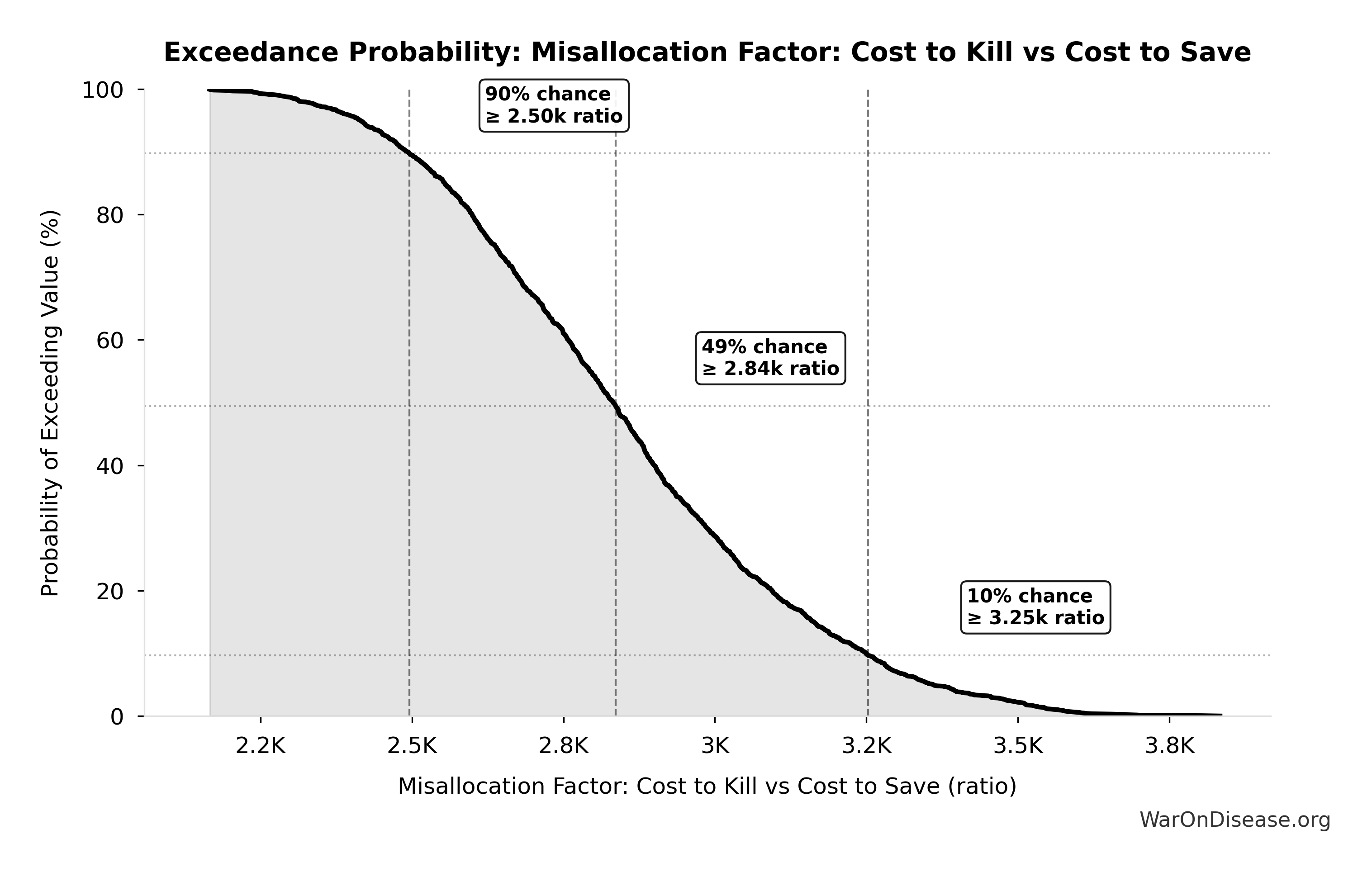

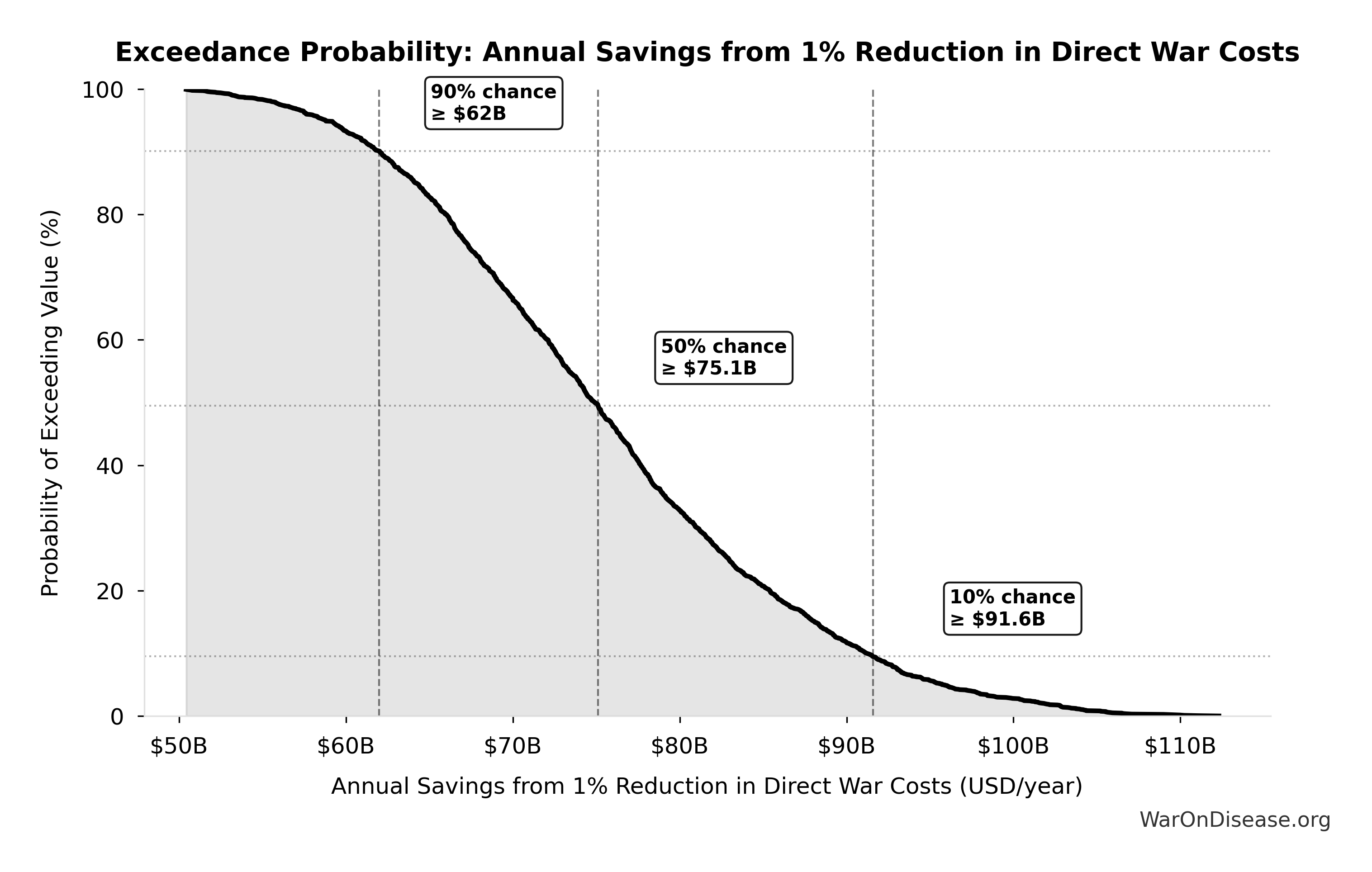

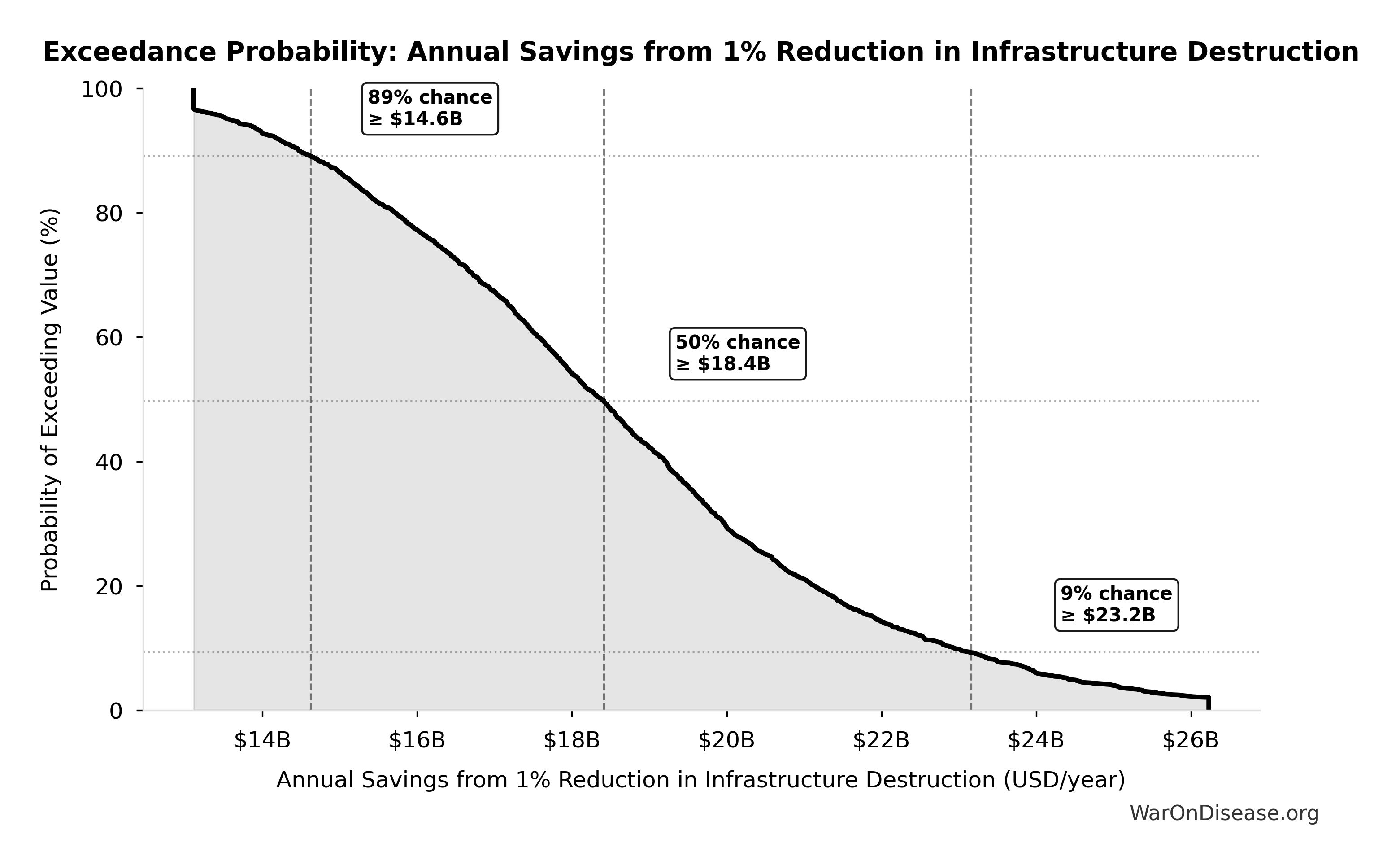

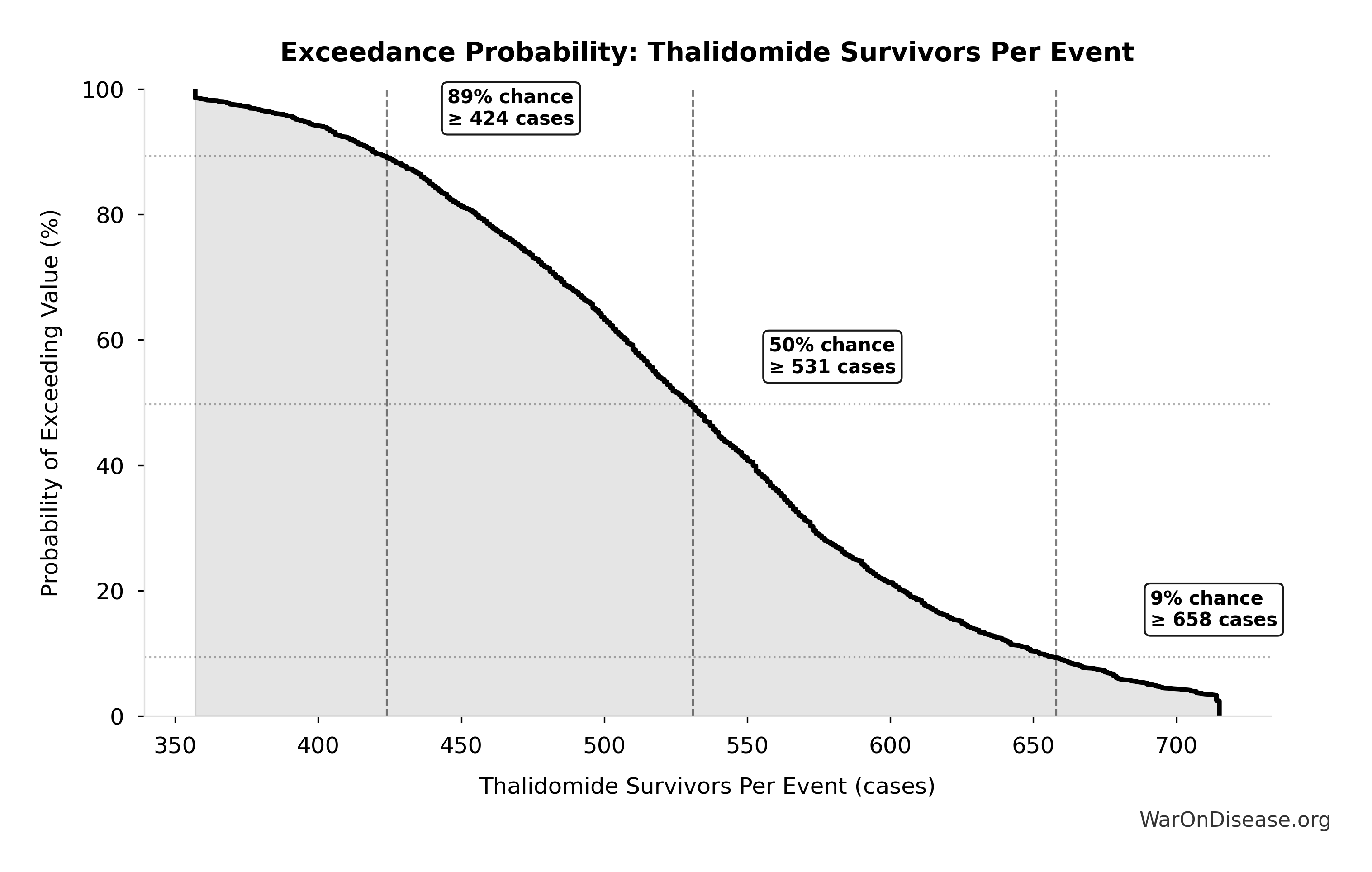

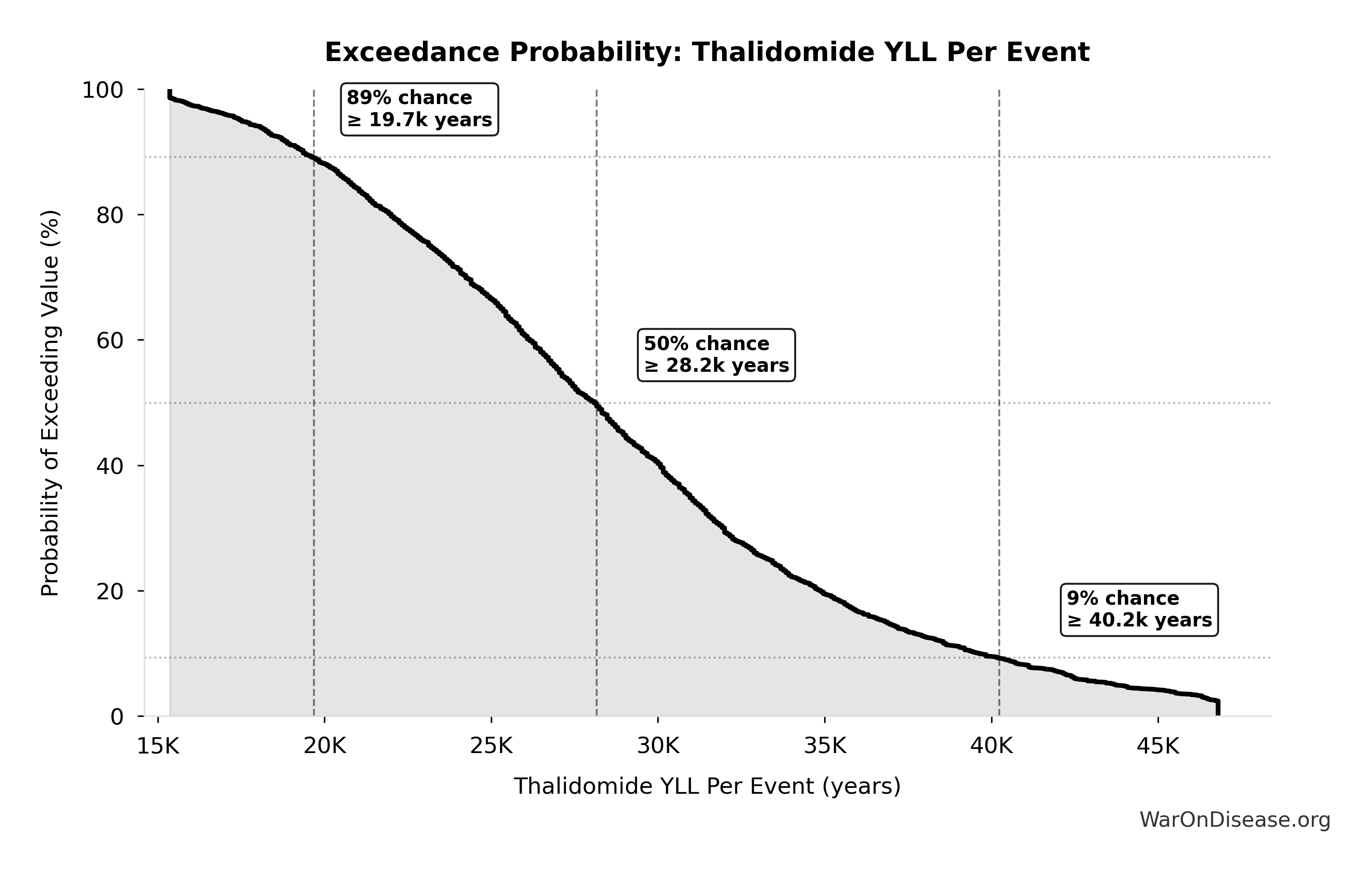

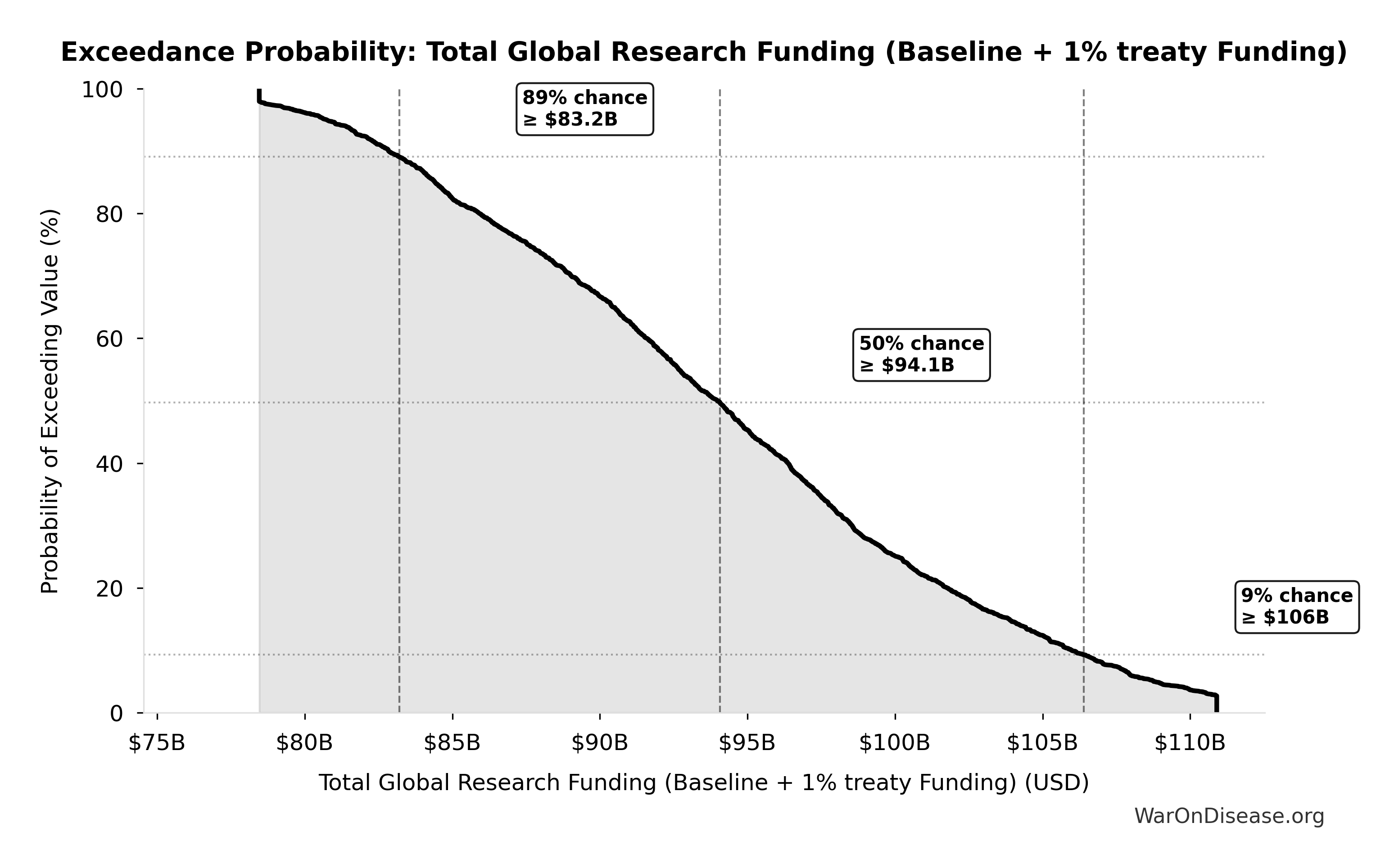

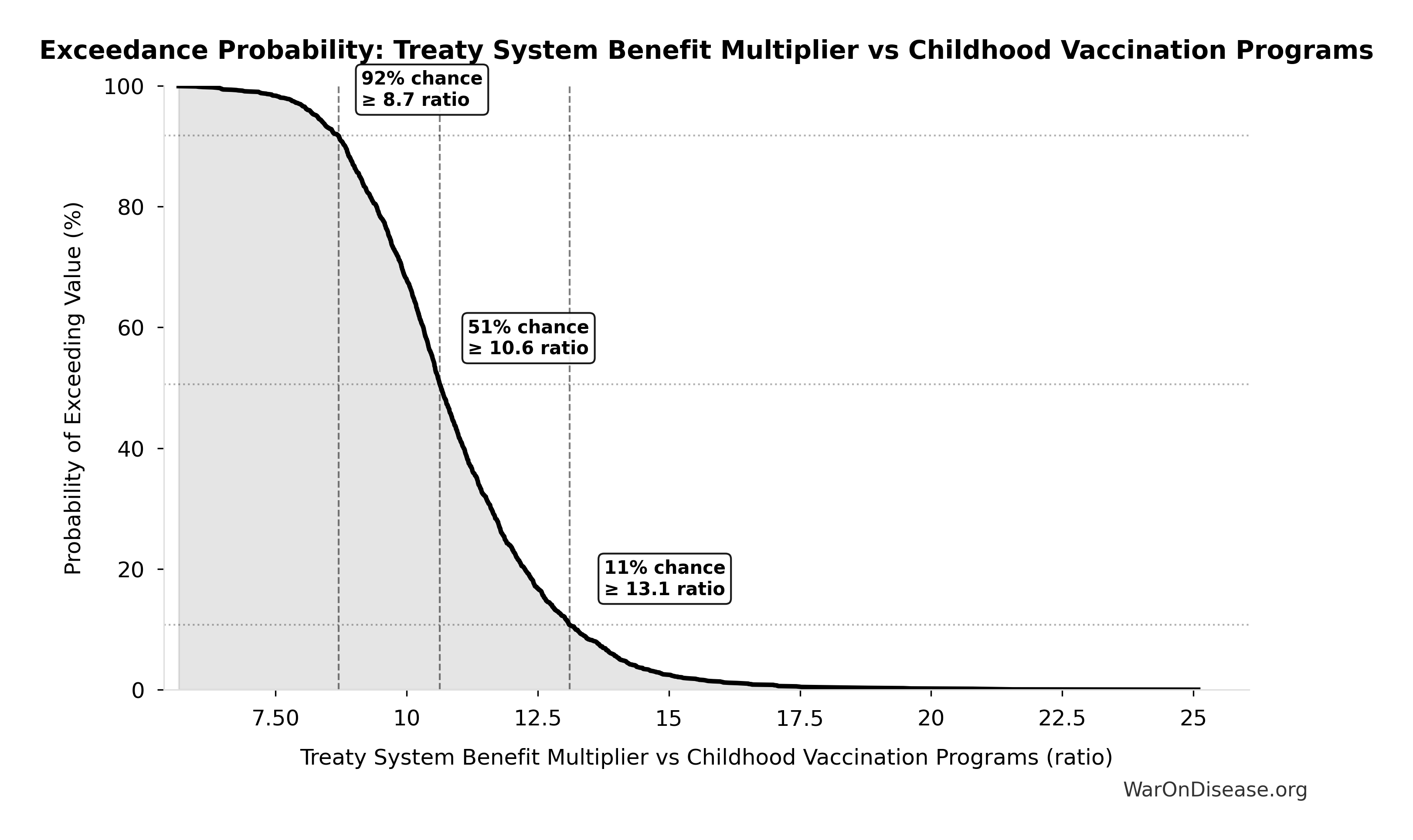

Exceedance Probability

This exceedance probability chart shows the likelihood that Combination Therapy Exploration Time (Current) will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

Known Safe Exploration Time (Current): 2.88 thousand years

Years to test all known safe drug-disease combinations at current global trial capacity

Inputs:

- Possible Drug-Disease Combinations 🔢: 9.50 million combinations

- Current Global Clinical Trials per Year 📊: 3.30 thousand trials/year (95% CI: 2.64 thousand trials/year - 3.96 thousand trials/year)

\[ \begin{gathered} T_{explore,safe} \\ = \frac{N_{combos}}{Trials_{ann,curr}} \\ = \frac{9.5M}{3{,}300} \\ = 2{,}880 \\[0.5em] \text{where } N_{combos} \\ = N_{safe} \times N_{diseases,trial} \\ = 9{,}500 \times 1{,}000 \\ = 9.5M \end{gathered} \]

✓ High confidence

Sensitivity Analysis

Sensitivity Indices for Known Safe Exploration Time (Current)

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| Current Trials Per Year | -0.9931 | Strong driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

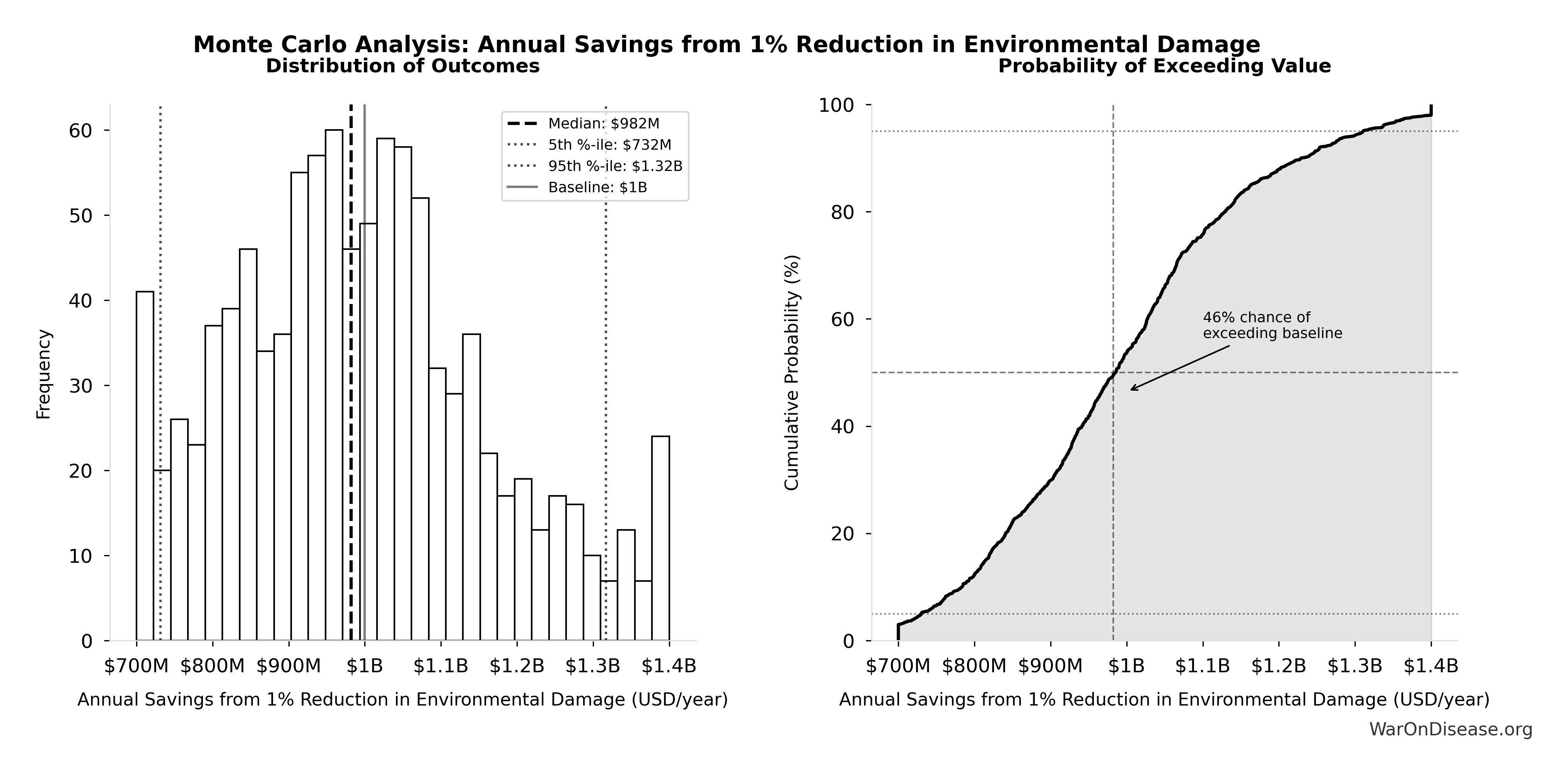

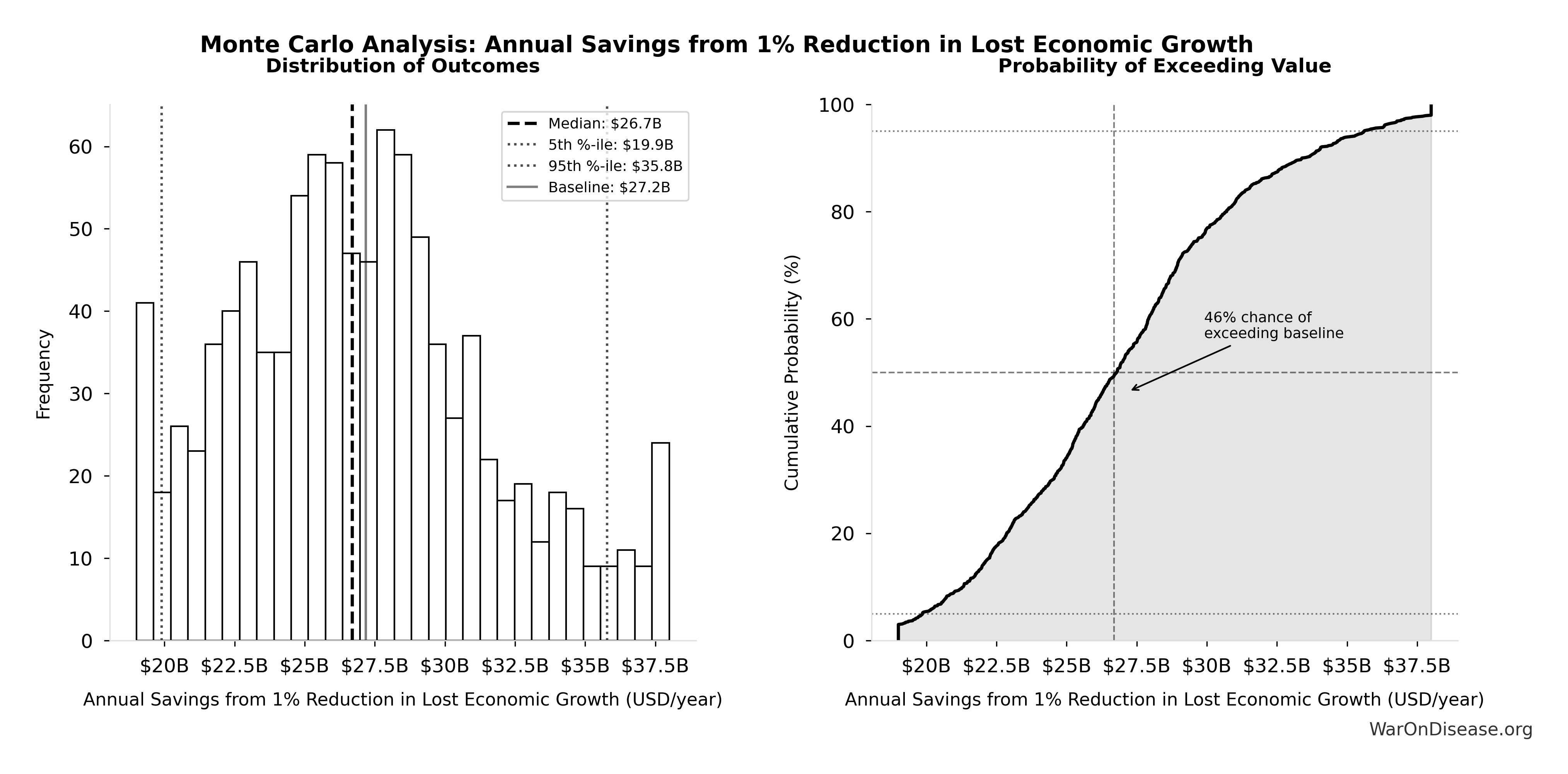

Monte Carlo Distribution

Simulation Results Summary: Known Safe Exploration Time (Current)

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 2.88 thousand |

| Mean (expected value) | 2.91 thousand |

| Median (50th percentile) | 2.90 thousand |

| Standard Deviation | 286 |

| 90% Range (5th-95th percentile) | [2.45 thousand, 3.43 thousand] |

The histogram shows the distribution of Known Safe Exploration Time (Current) across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

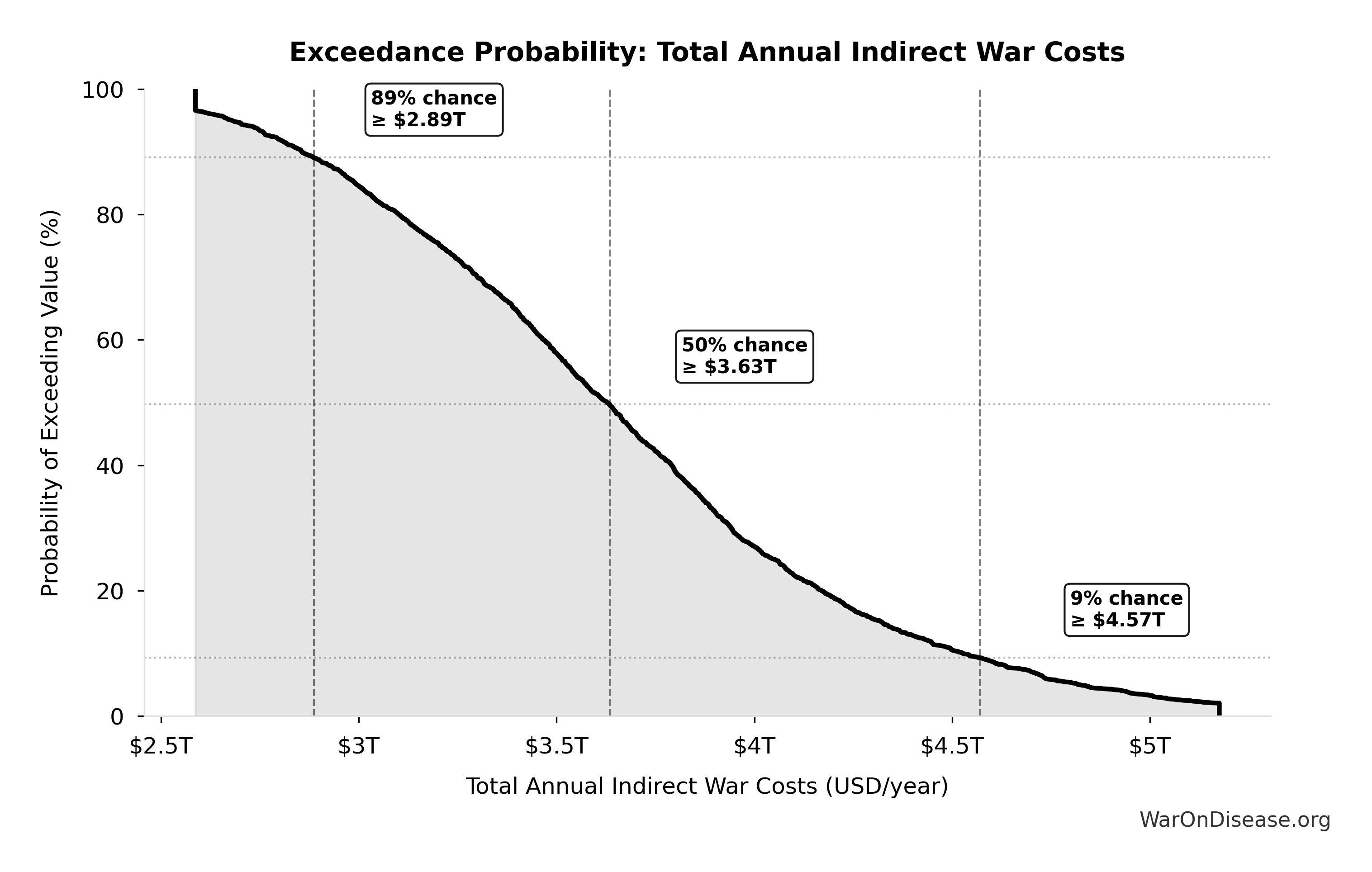

Exceedance Probability

This exceedance probability chart shows the likelihood that Known Safe Exploration Time (Current) will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

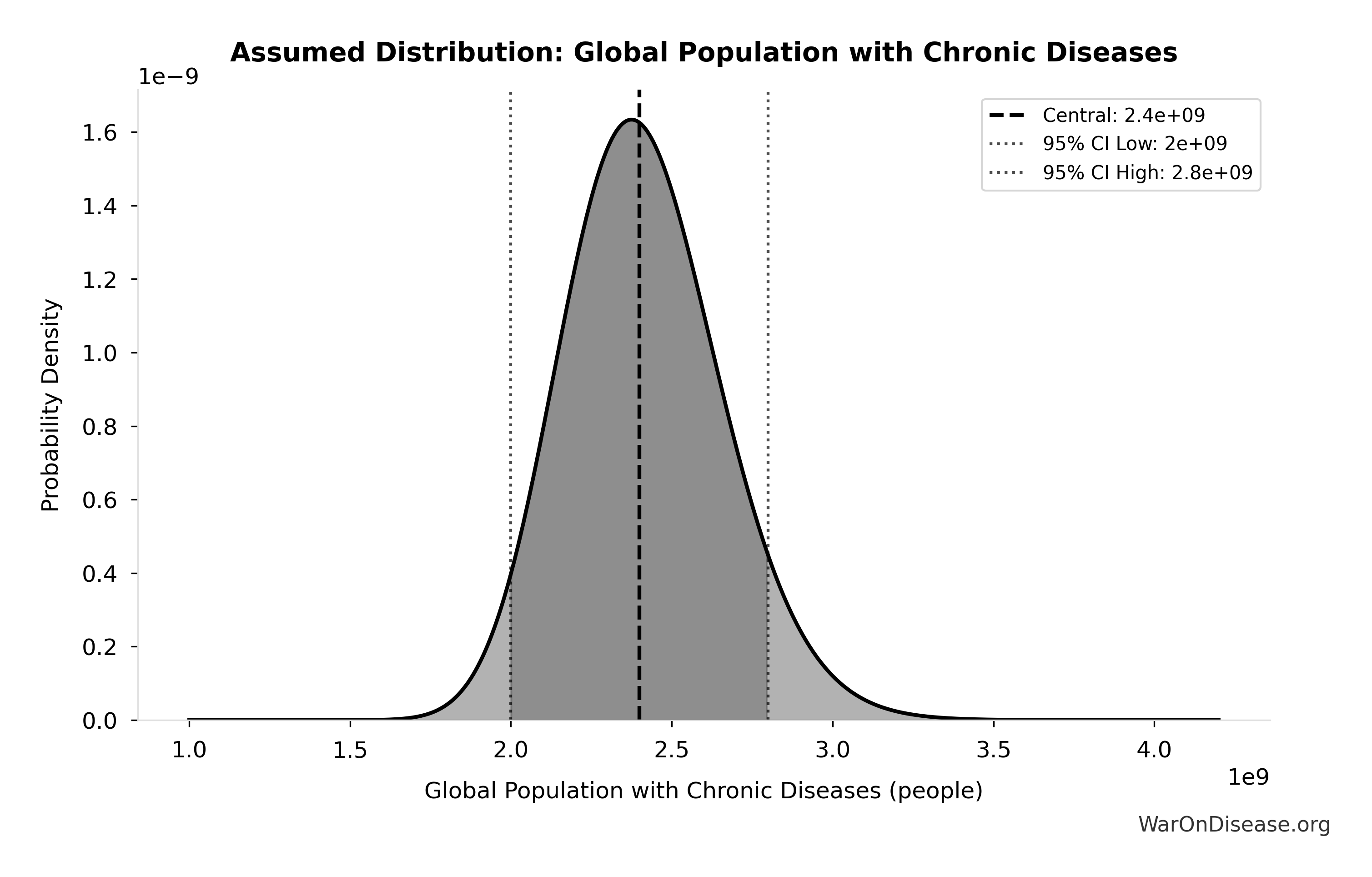

Current Patient Participation Rate in Clinical Trials: 0.0792%

Current patient participation rate in clinical trials (0.08% = 1.9M participants / 2.4B disease patients)

Inputs:

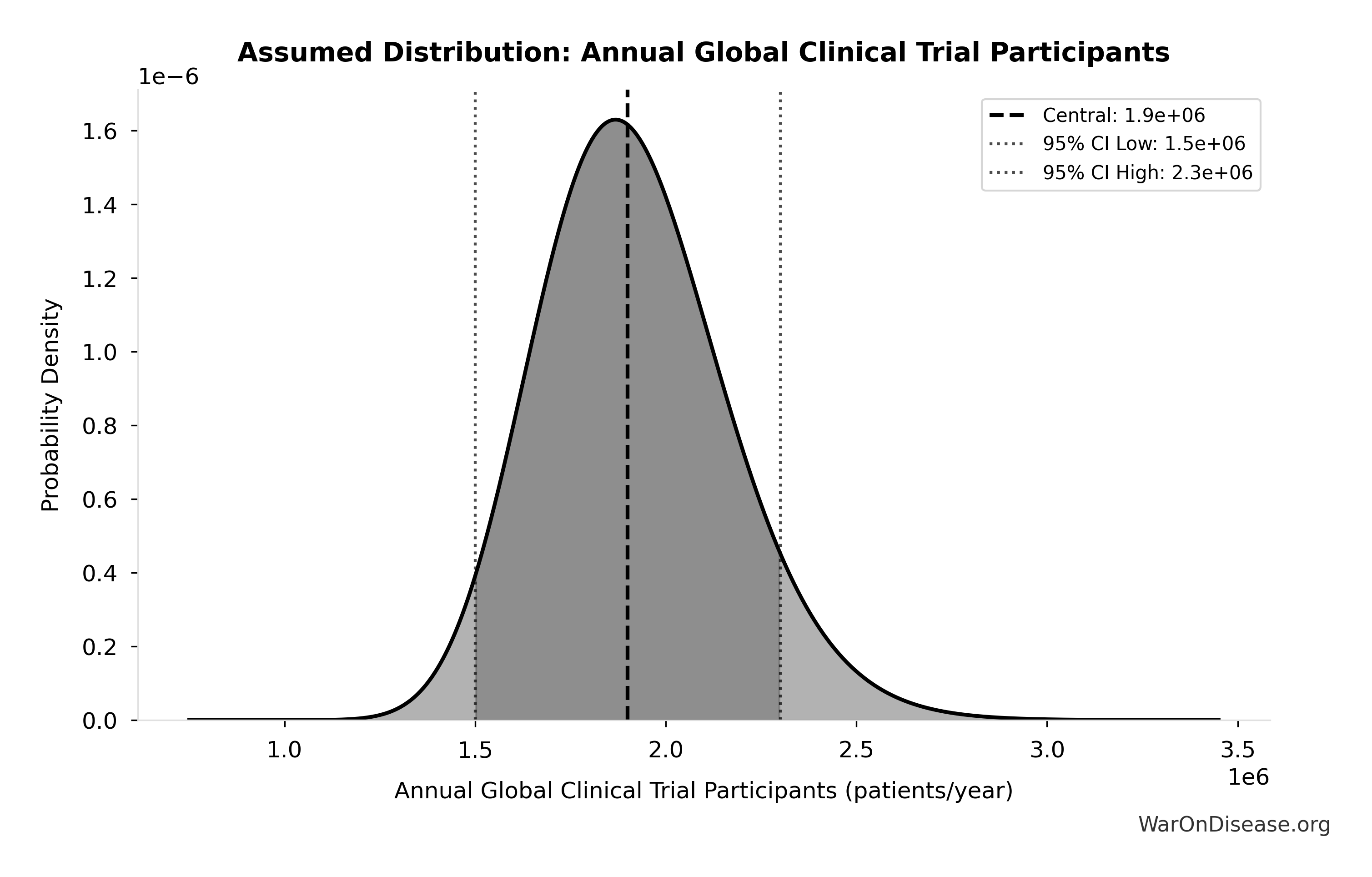

- Annual Global Clinical Trial Participants 📊: 1.90 million patients/year (95% CI: 1.50 million patients/year - 2.30 million patients/year)

- Global Population with Chronic Diseases 📊: 2.40 billion people (95% CI: 2.00 billion people - 2.80 billion people)

\[ \begin{gathered} Rate_{part} \\ = \frac{Slots_{curr}}{N_{patients}} \\ = \frac{1.9M}{2.4B} \\ = 0.0792\% \end{gathered} \]

Methodology:11

✓ High confidence

Sensitivity Analysis

Sensitivity Indices for Current Patient Participation Rate in Clinical Trials

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| Current Disease Patients Global | 4.1698 | Strong driver |

| Current Trial Slots Available | -3.1720 | Strong driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

Monte Carlo Distribution

Simulation Results Summary: Current Patient Participation Rate in Clinical Trials

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 0.0792% |

| Mean (expected value) | 0.079% |

| Median (50th percentile) | 0.079% |

| Standard Deviation | 0.00169% |

| 90% Range (5th-95th percentile) | [0.0761%, 0.0819%] |

The histogram shows the distribution of Current Patient Participation Rate in Clinical Trials across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

Exceedance Probability

This exceedance probability chart shows the likelihood that Current Patient Participation Rate in Clinical Trials will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

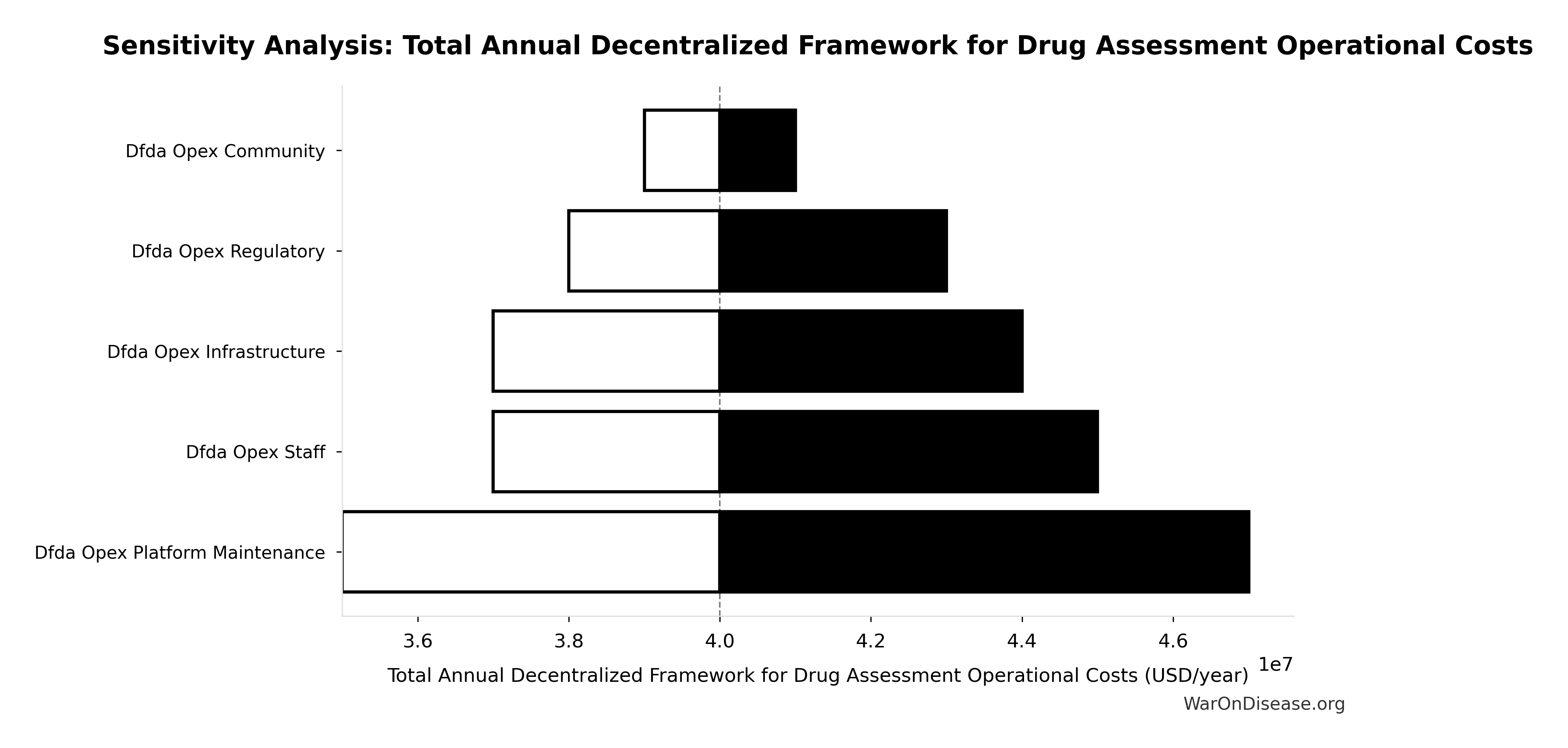

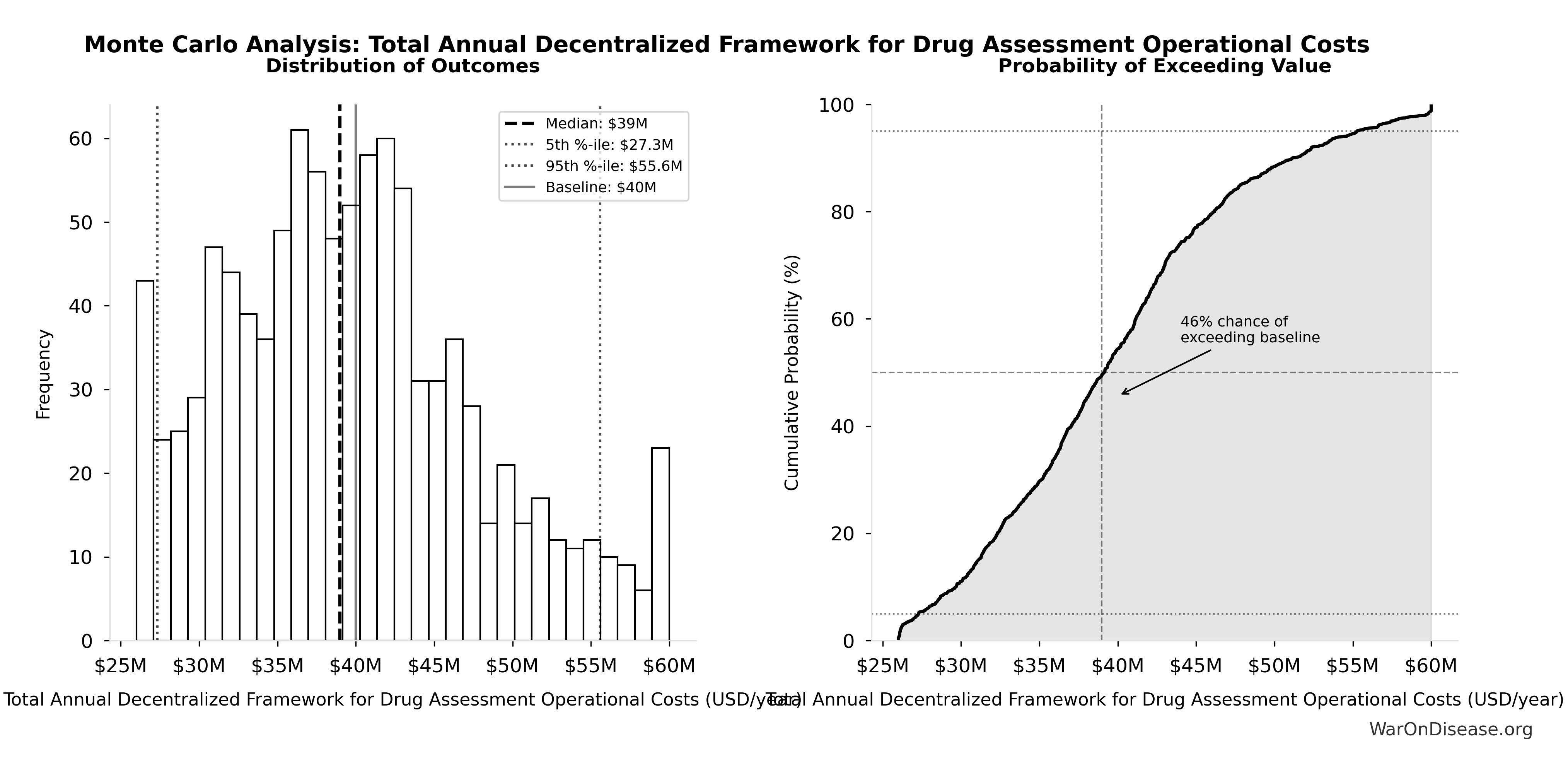

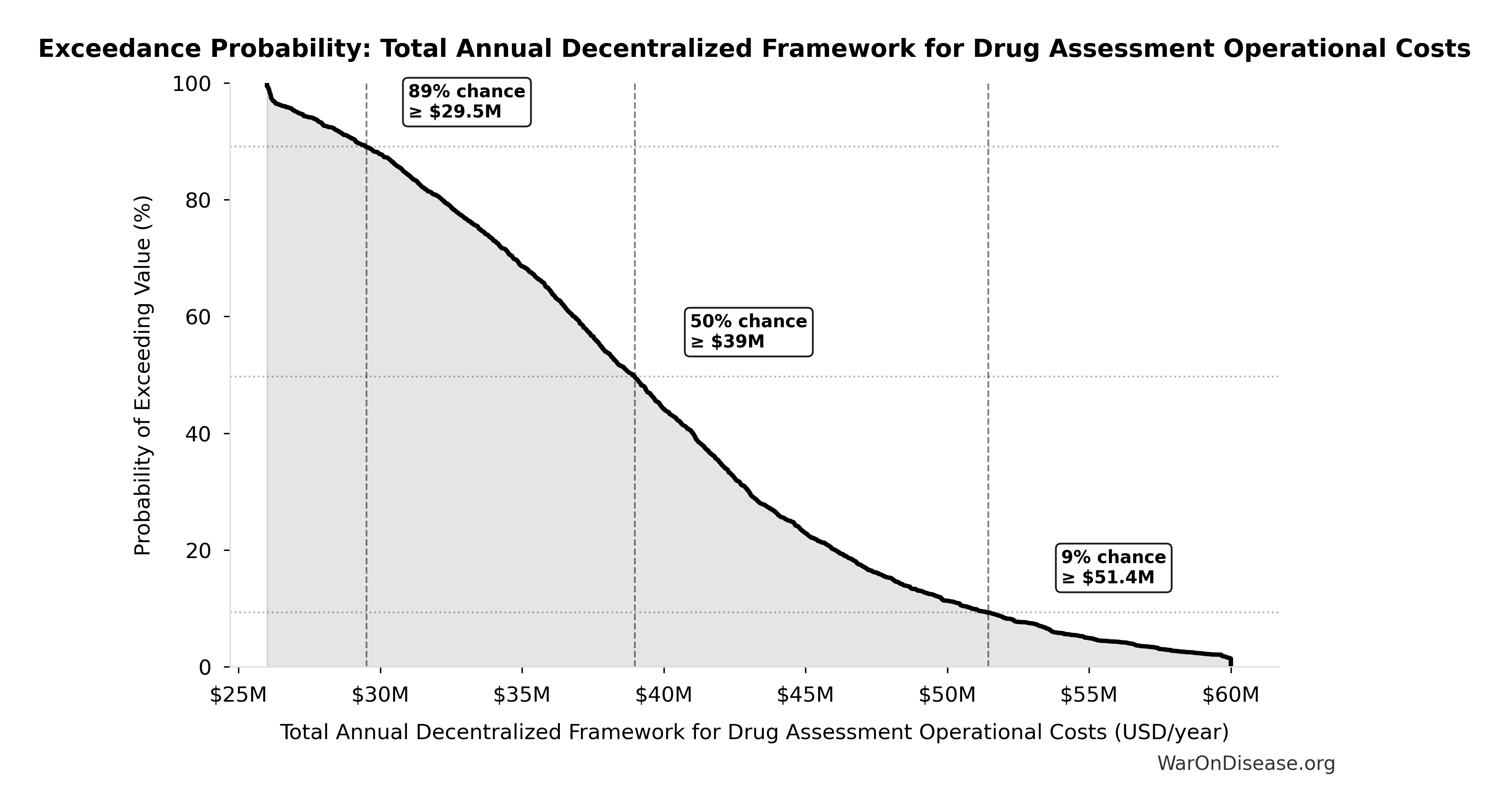

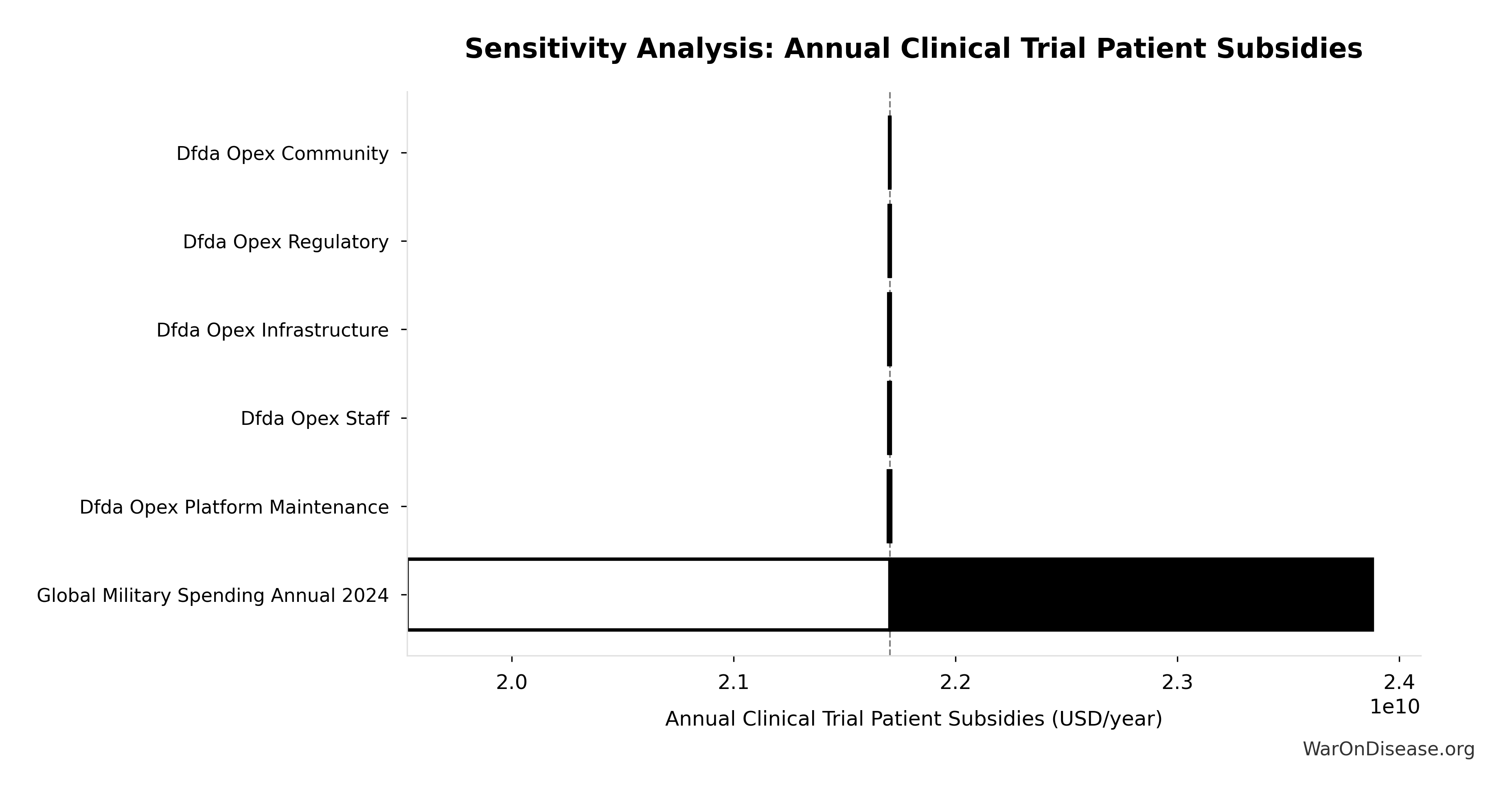

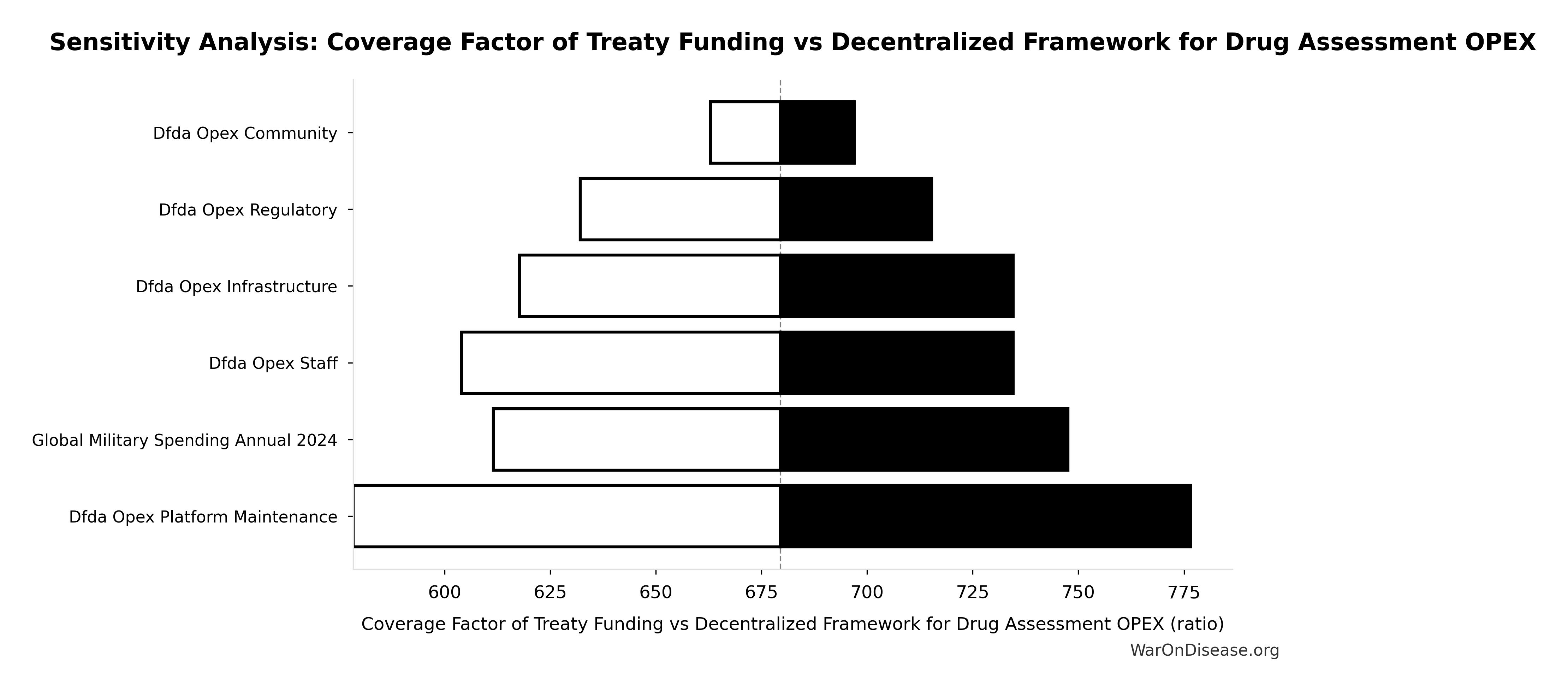

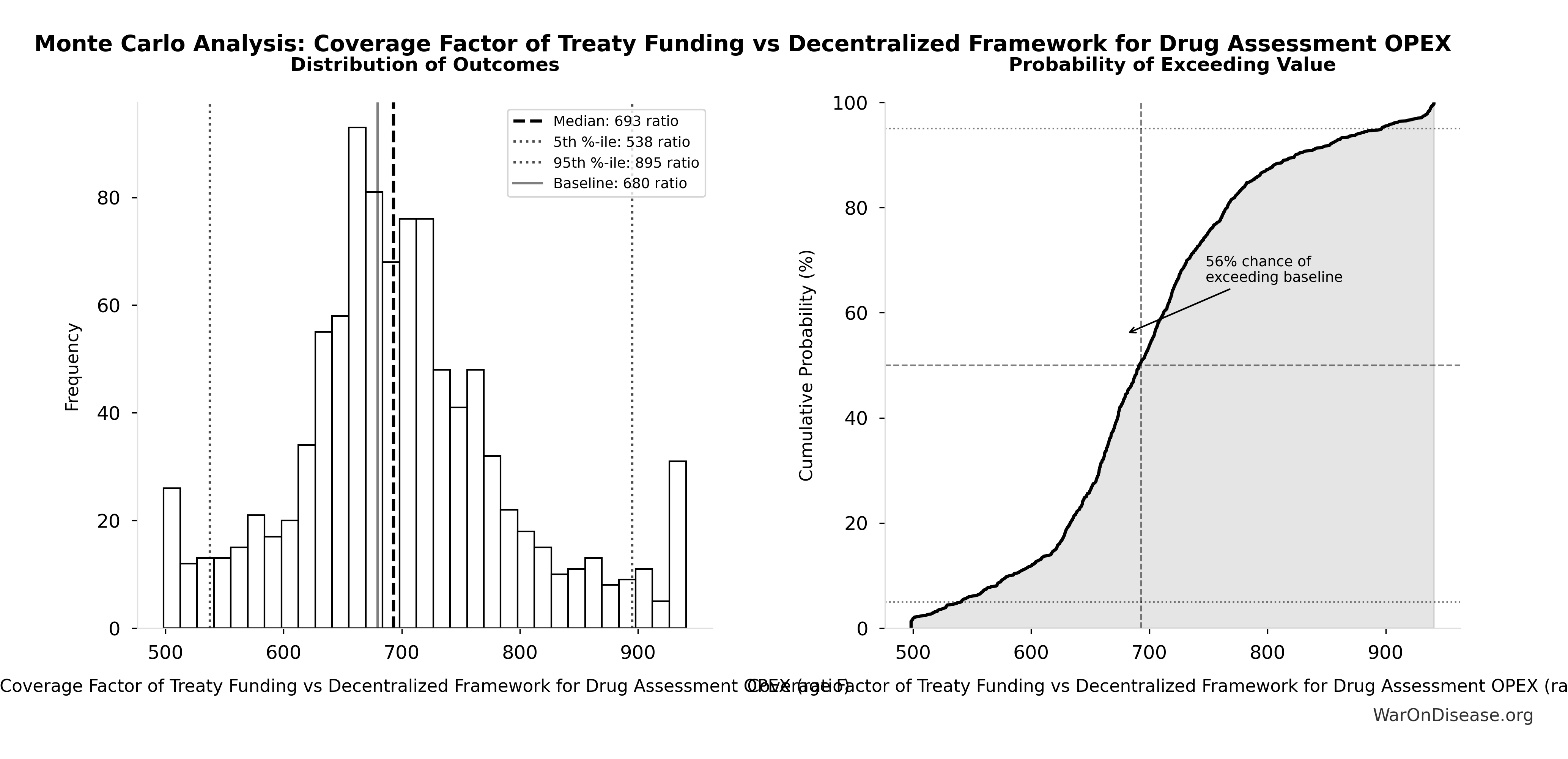

Total Annual Decentralized Framework for Drug Assessment Operational Costs: $40M

Total annual Decentralized Framework for Drug Assessment operational costs (sum of all components: $15M + $10M + $8M + $5M + $2M)

Inputs:

- Decentralized Framework for Drug Assessment Maintenance Costs: $15M (95% CI: $10M - $22M)

- Decentralized Framework for Drug Assessment Staff Costs: $10M (95% CI: $7M - $15M)

- Decentralized Framework for Drug Assessment Infrastructure Costs: $8M (95% CI: $5M - $12M)

- Decentralized Framework for Drug Assessment Regulatory Coordination Costs: $5M (95% CI: $3M - $8M)

- Decentralized Framework for Drug Assessment Community Support Costs: $2M (95% CI: $1M - $3M)

\[ \begin{gathered} OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \end{gathered} \]

✓ High confidence

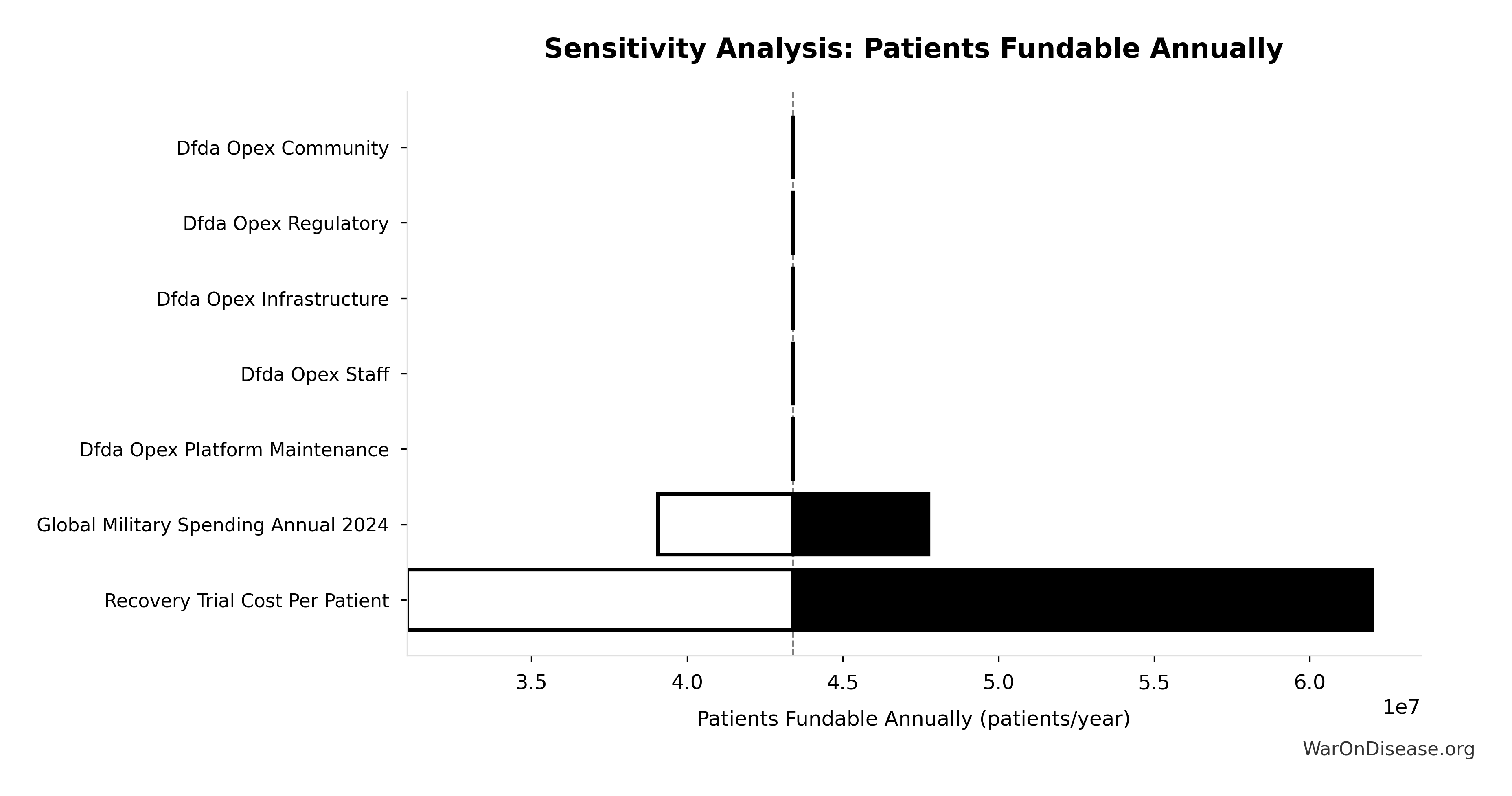

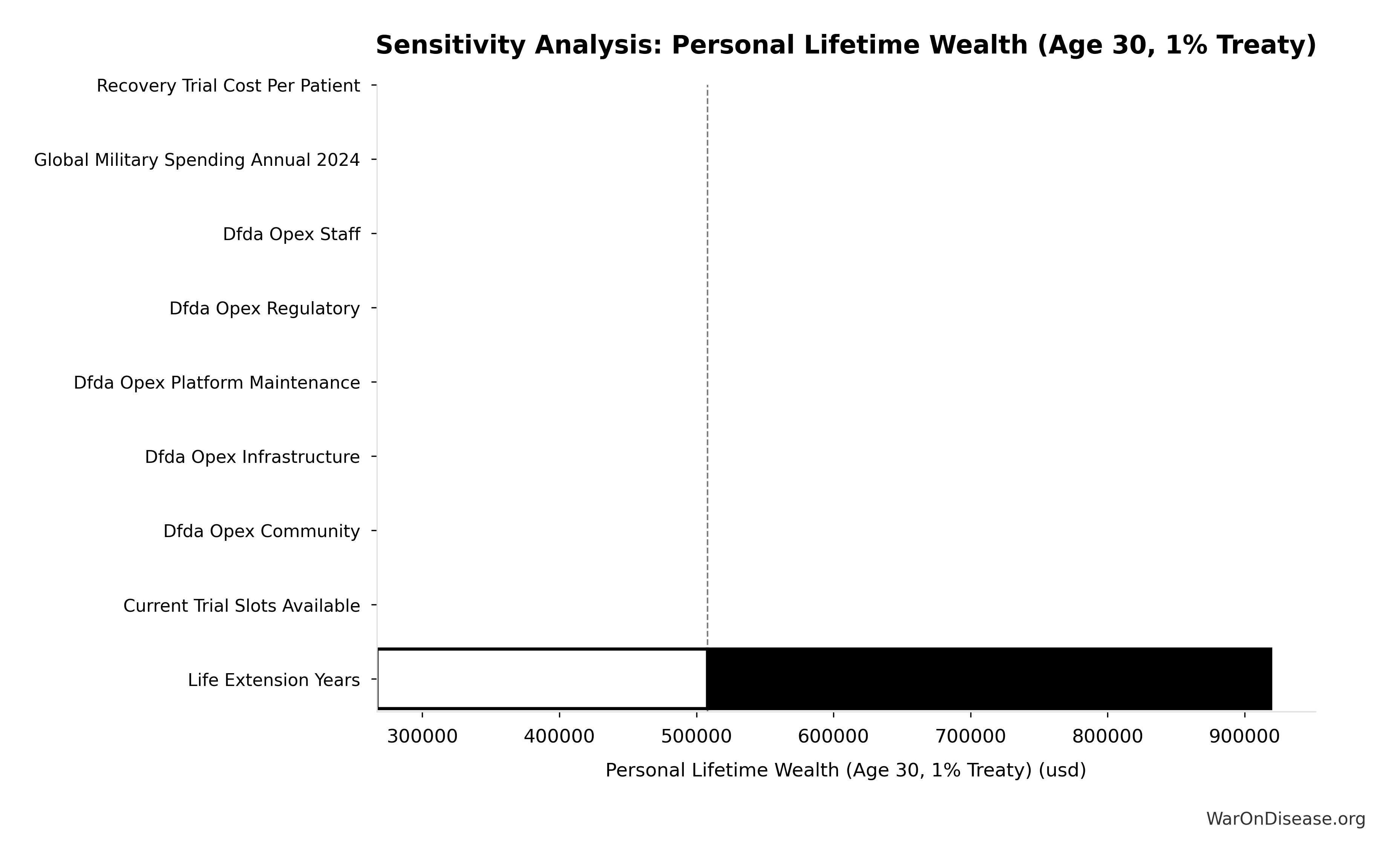

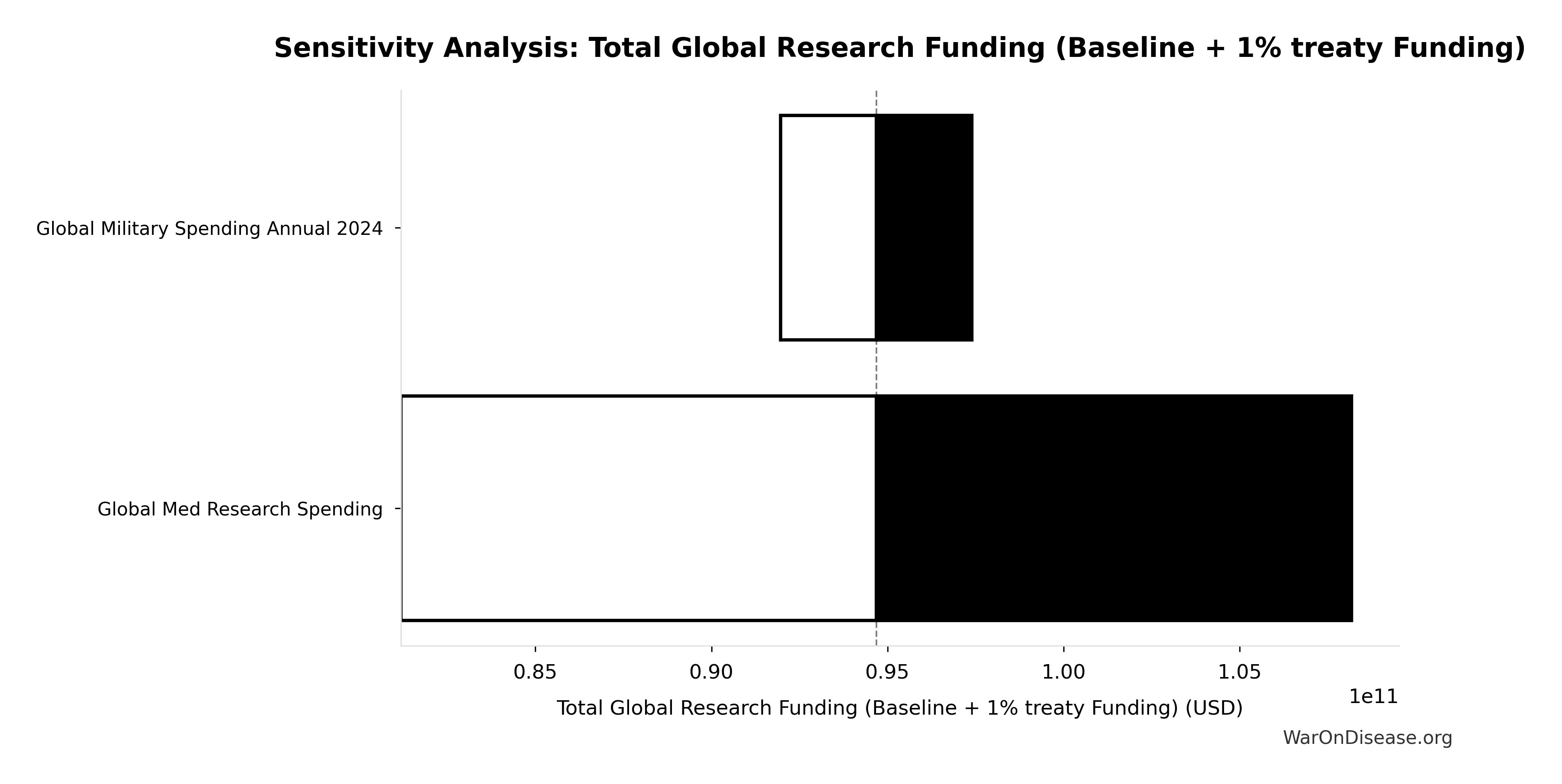

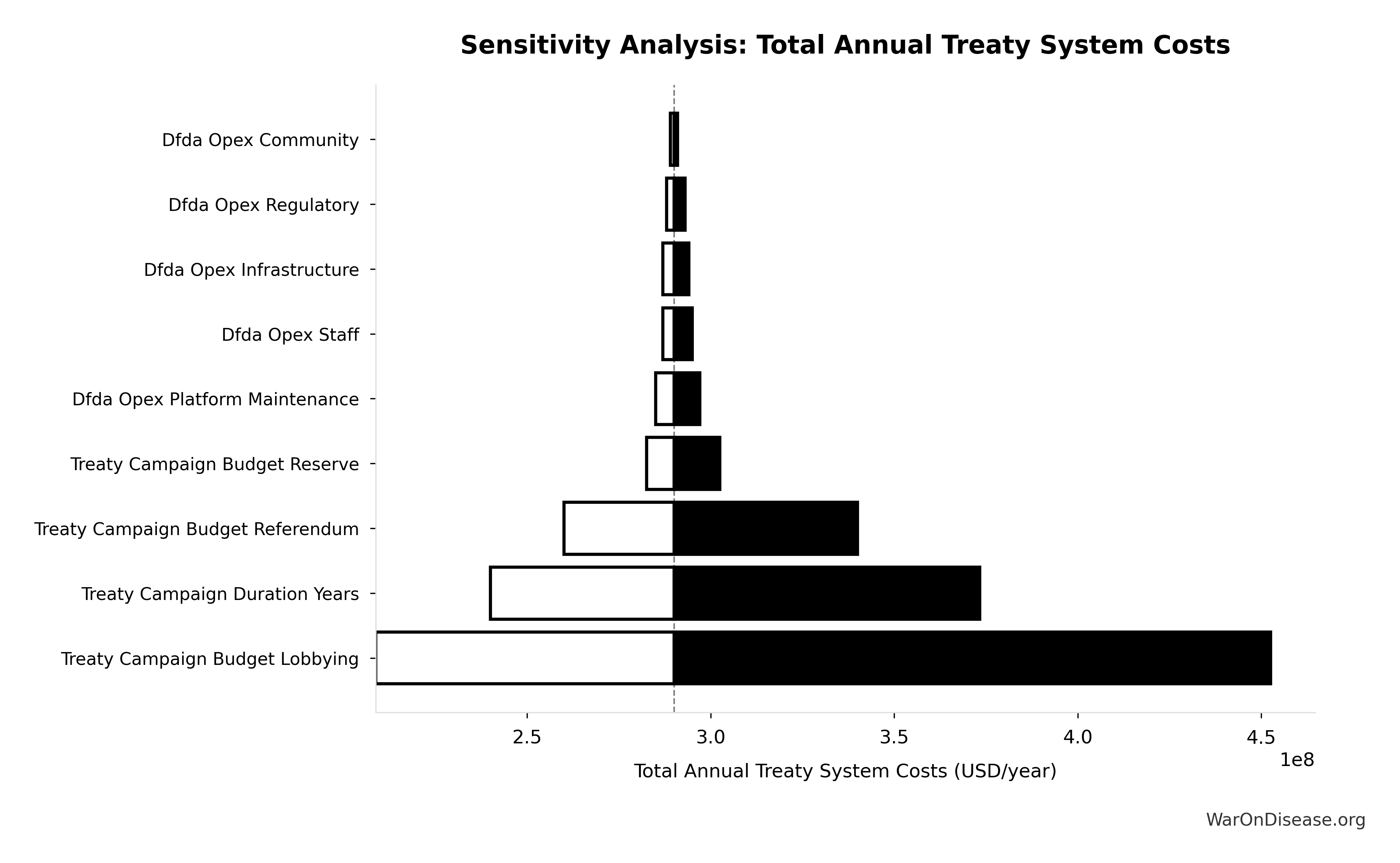

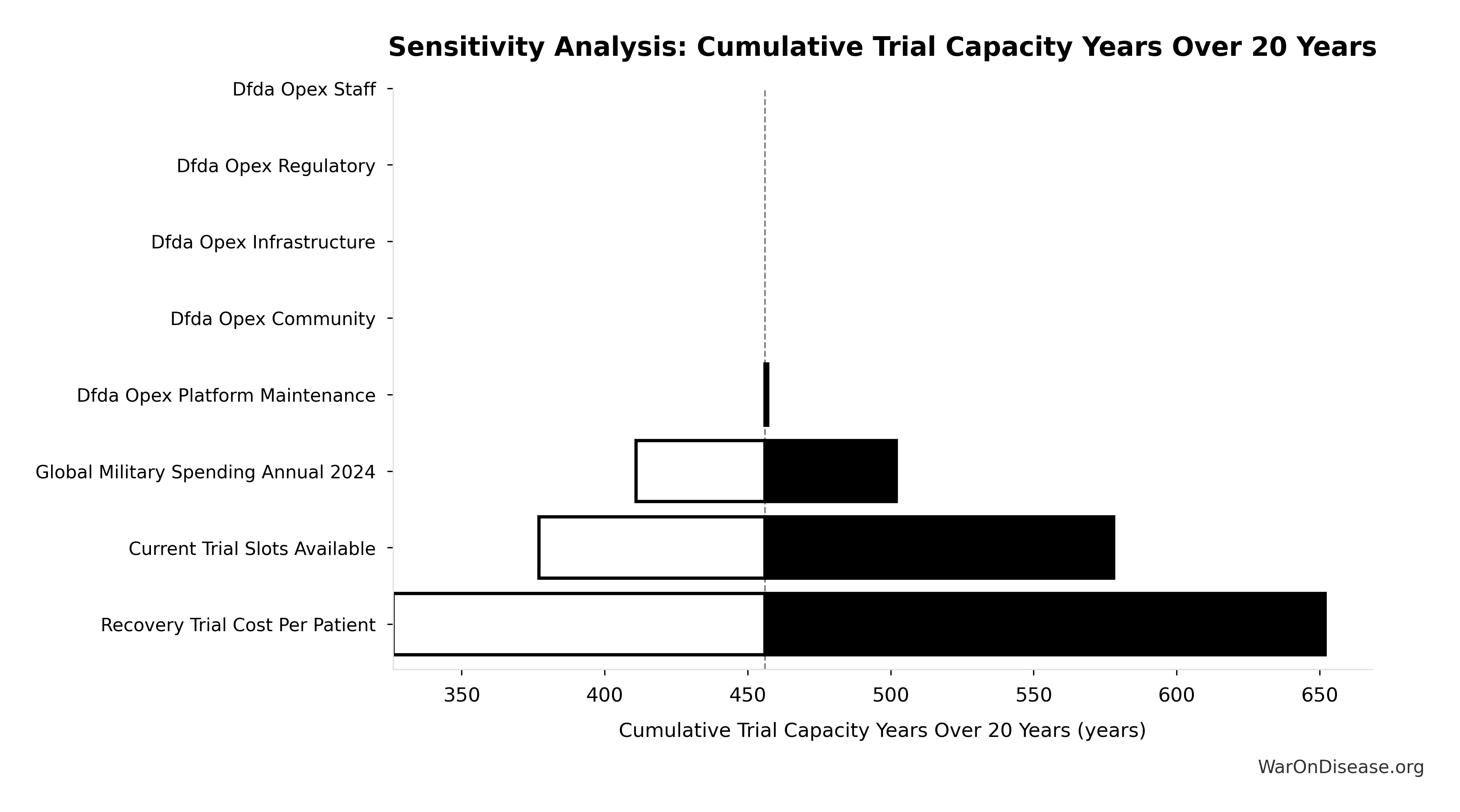

Sensitivity Analysis

Sensitivity Indices for Total Annual Decentralized Framework for Drug Assessment Operational Costs

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA OPEX Platform Maintenance | 0.3542 | Moderate driver |

| dFDA OPEX Staff | 0.2355 | Weak driver |

| dFDA OPEX Infrastructure | 0.2060 | Weak driver |

| dFDA OPEX Regulatory | 0.1469 | Weak driver |

| dFDA OPEX Community | 0.0576 | Minimal effect |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

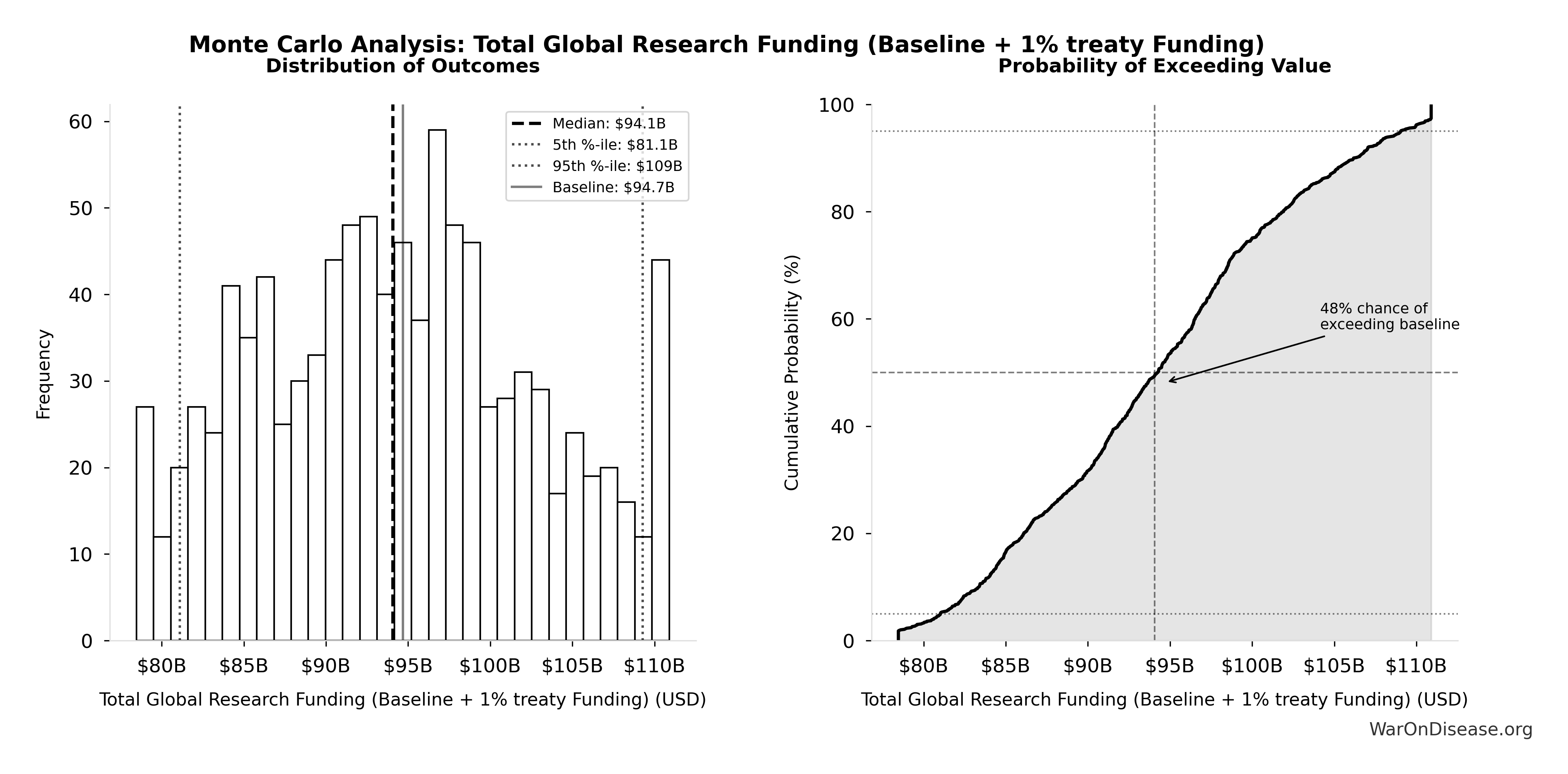

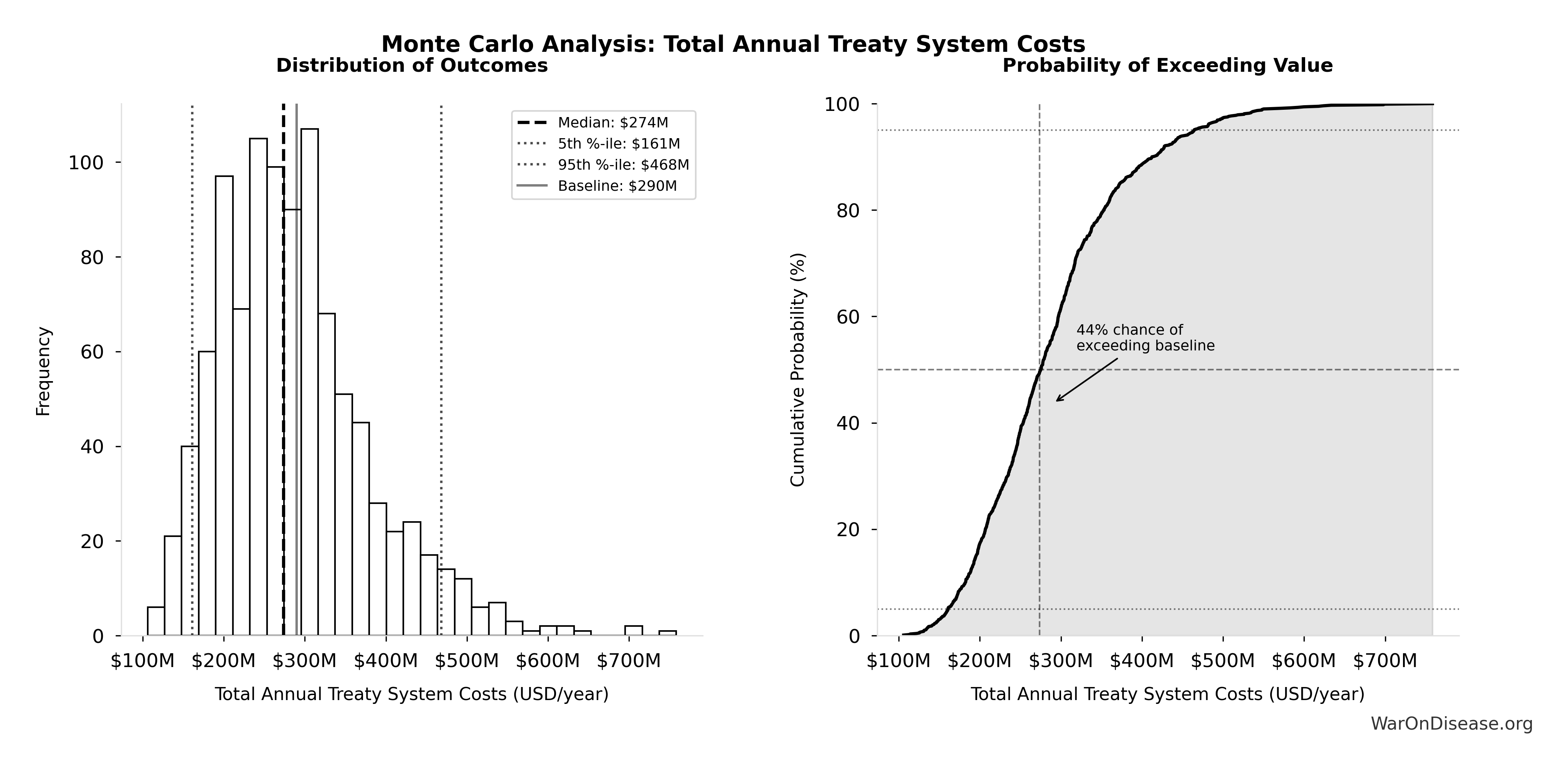

Monte Carlo Distribution

Simulation Results Summary: Total Annual Decentralized Framework for Drug Assessment Operational Costs

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $40M |

| Mean (expected value) | $39.9M |

| Median (50th percentile) | $39M |

| Standard Deviation | $8.21M |

| 90% Range (5th-95th percentile) | [$27.3M, $55.6M] |

The histogram shows the distribution of Total Annual Decentralized Framework for Drug Assessment Operational Costs across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

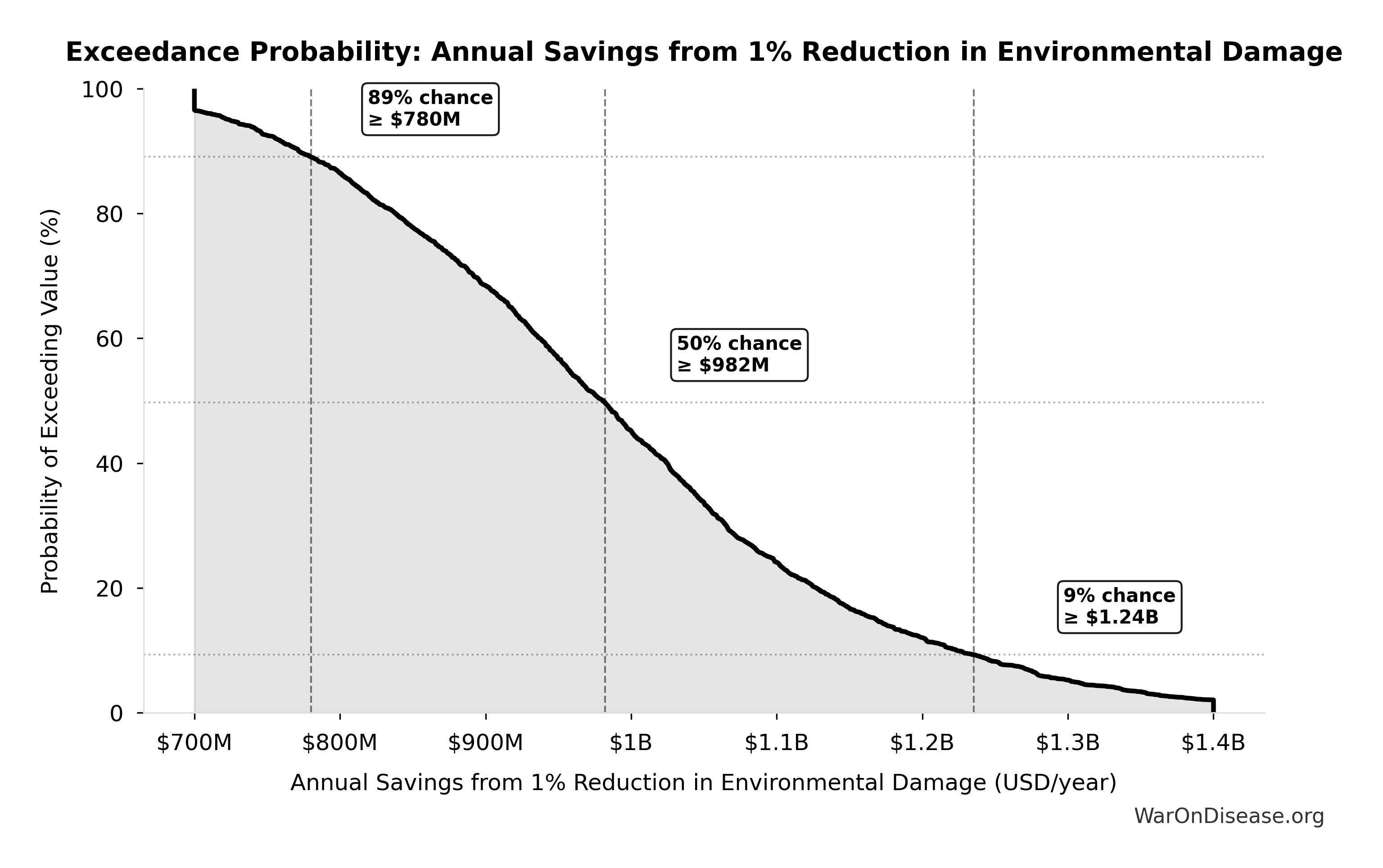

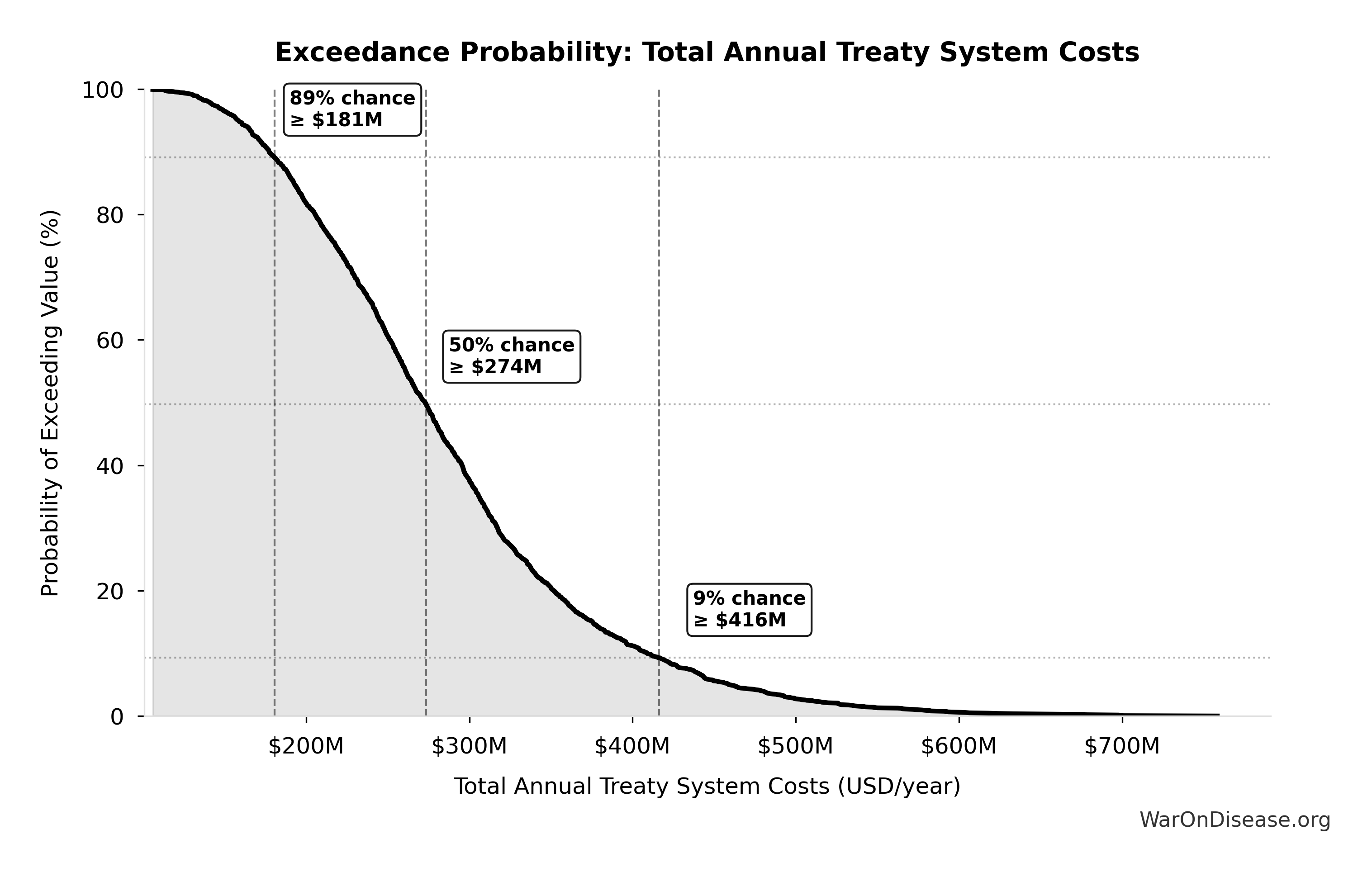

Exceedance Probability

This exceedance probability chart shows the likelihood that Total Annual Decentralized Framework for Drug Assessment Operational Costs will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

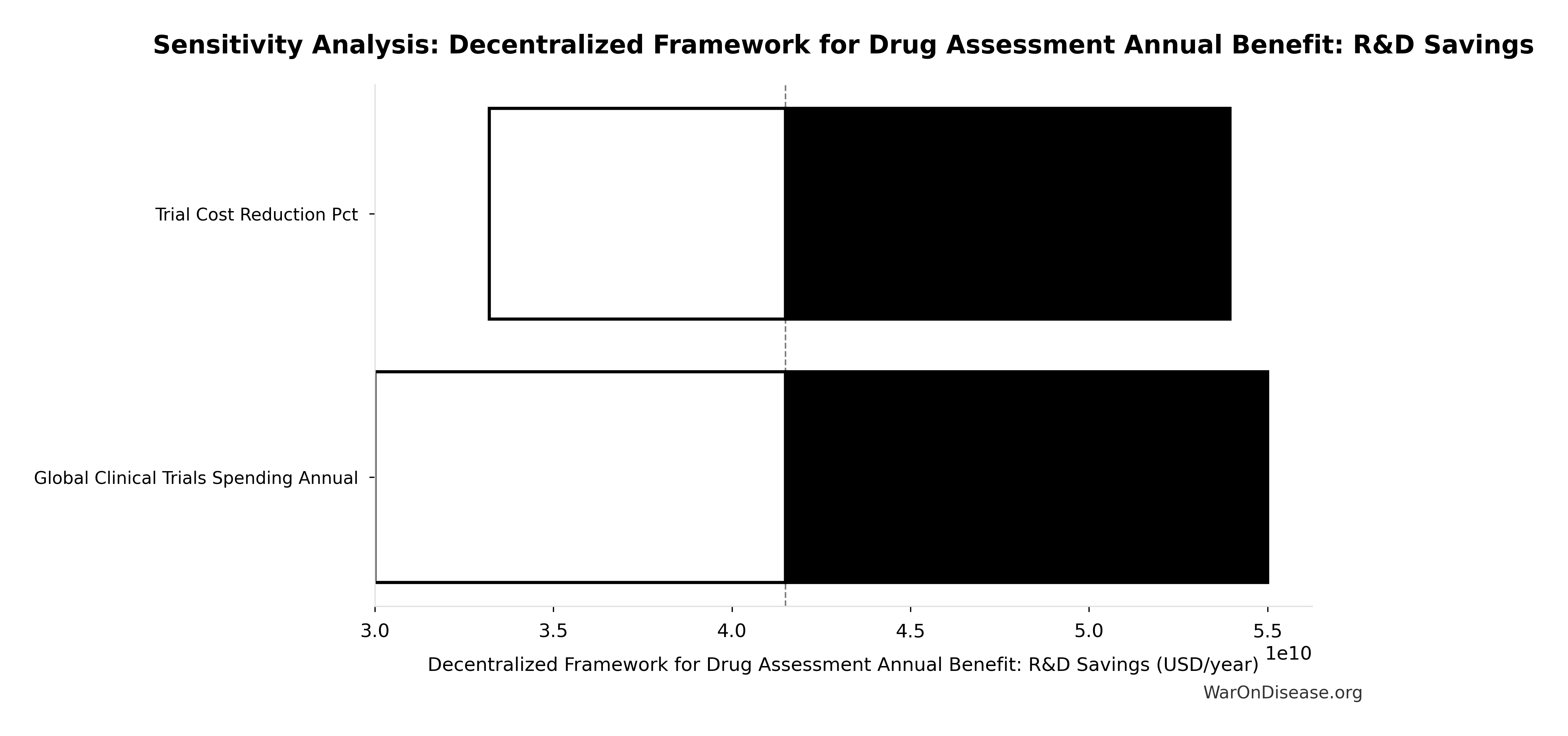

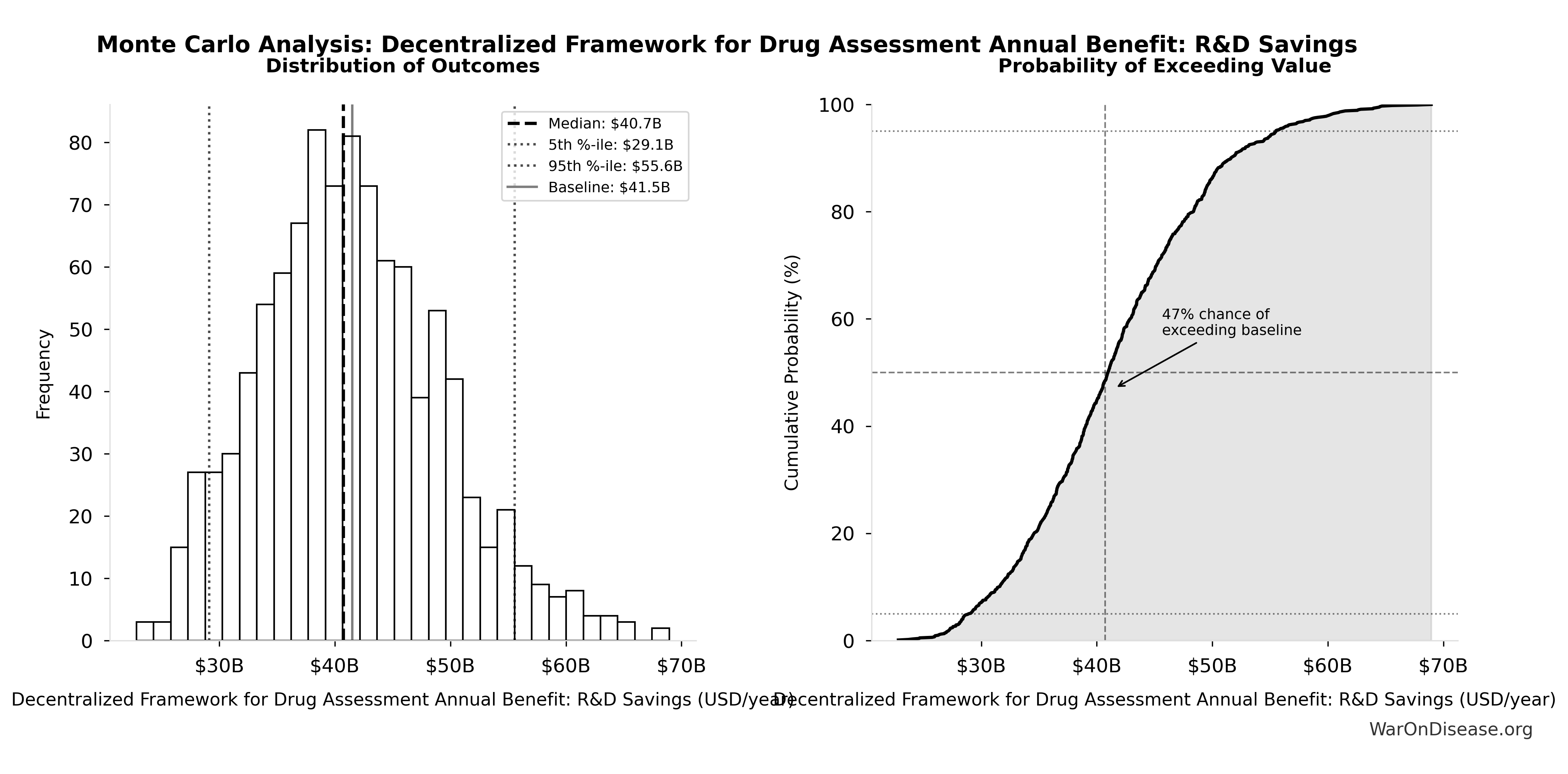

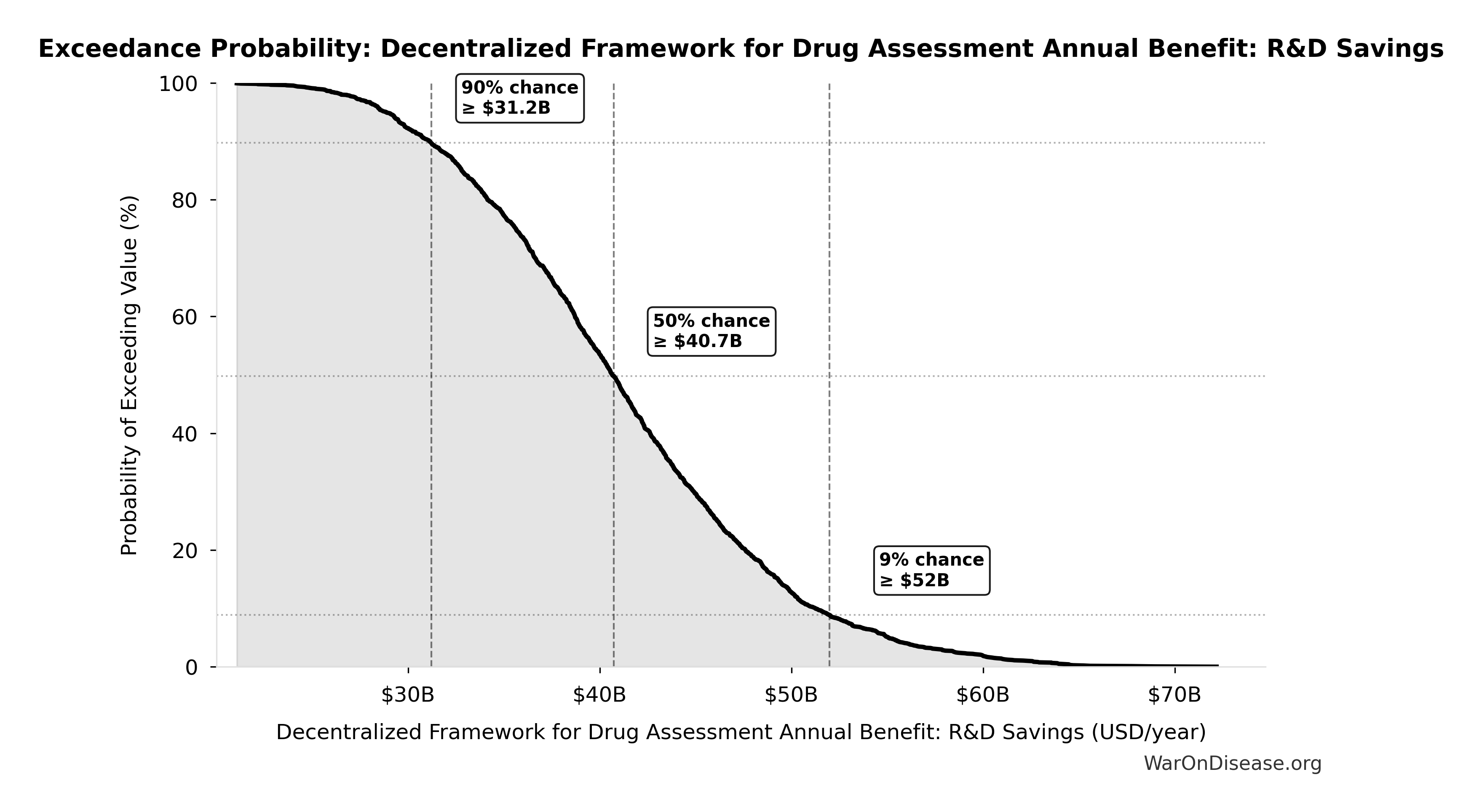

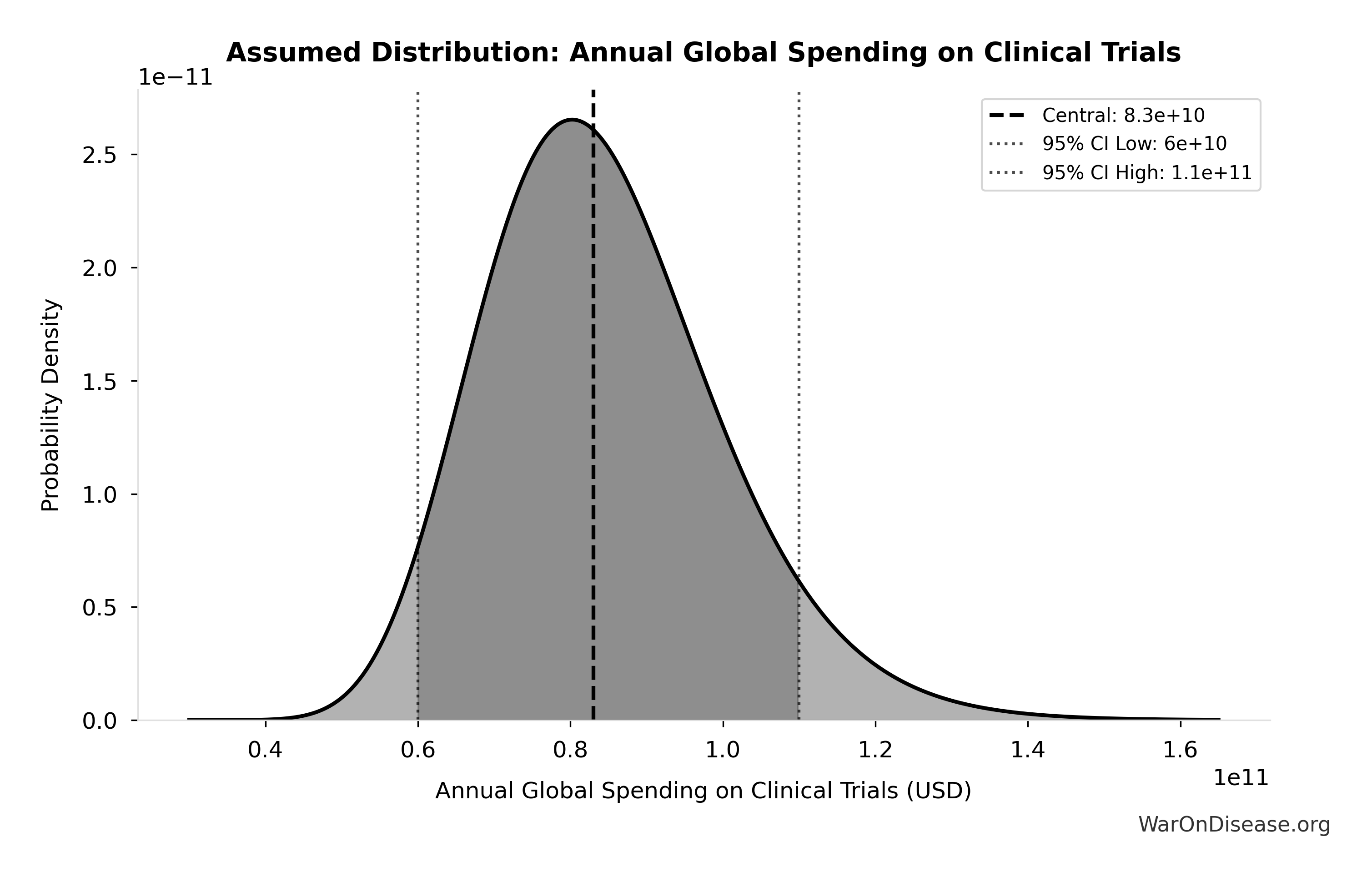

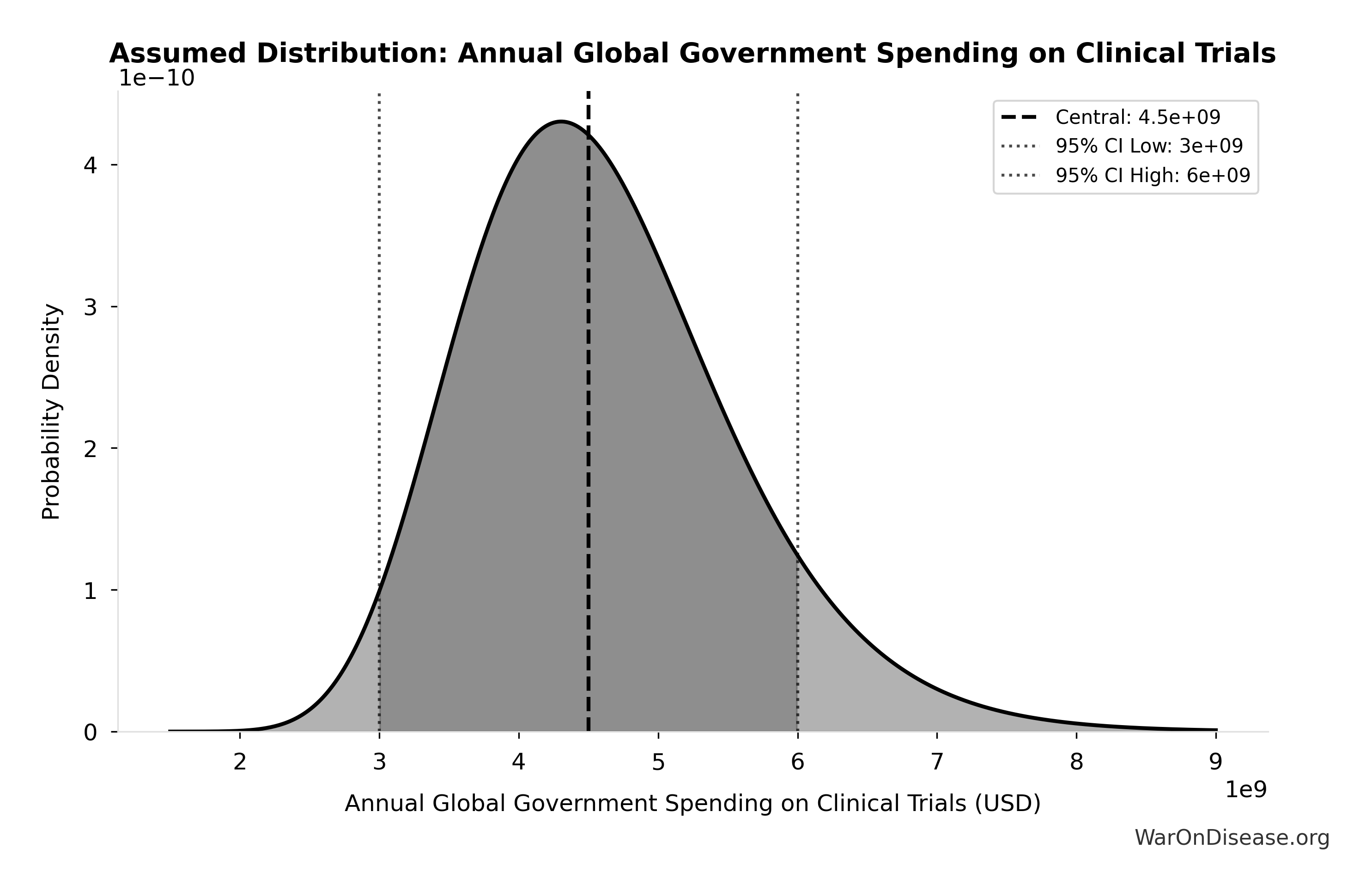

Decentralized Framework for Drug Assessment Annual Benefit: R&D Savings: $58.6B

Annual Decentralized Framework for Drug Assessment benefit from R&D savings (trial cost reduction, secondary component)

Inputs:

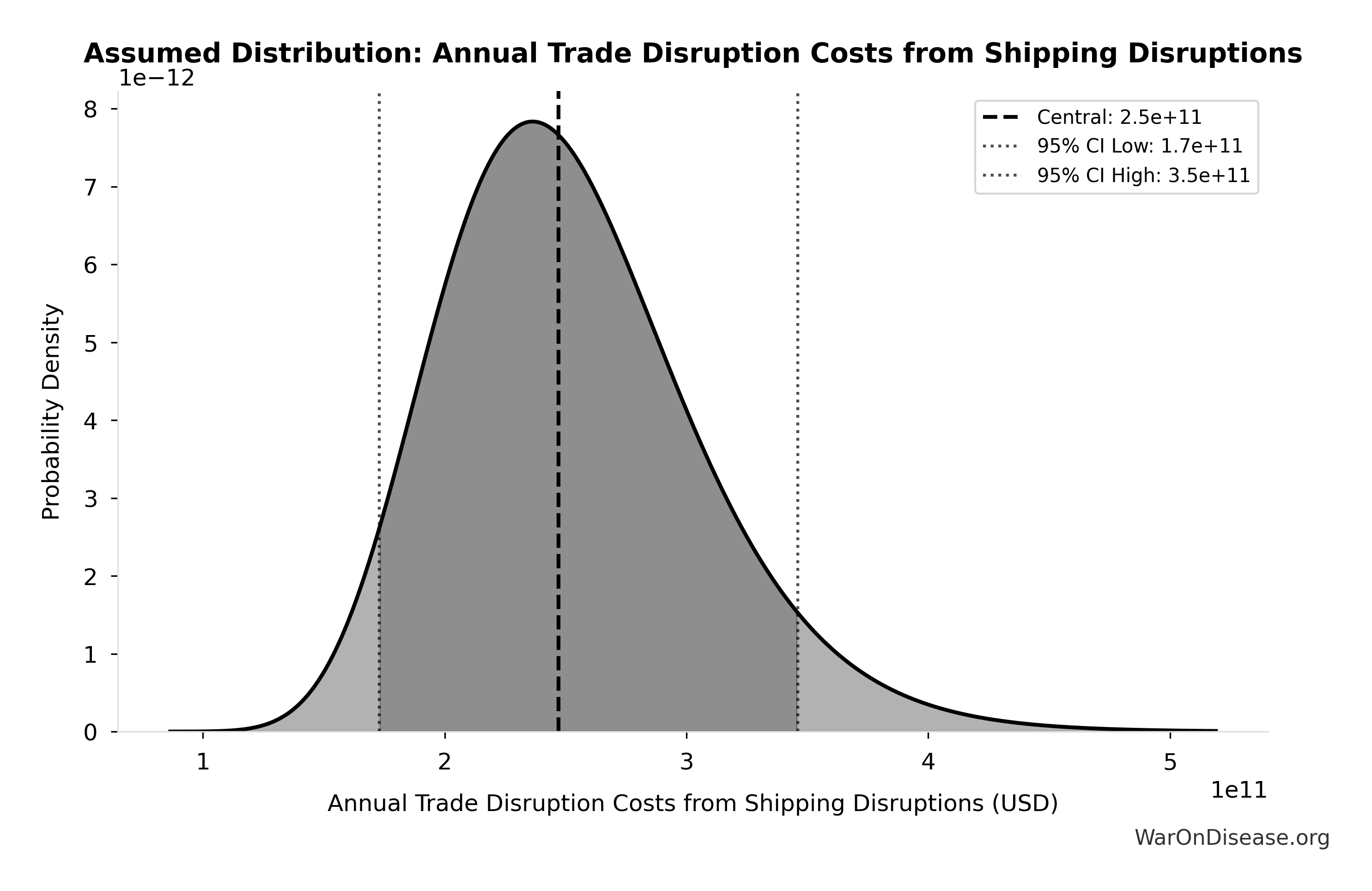

- Annual Global Spending on Clinical Trials 📊: $60B (95% CI: $50B - $75B)

- dFDA Trial Cost Reduction Percentage 🔢: 97.7%

\[ \begin{gathered} Benefit_{RD,ann} \\ = Spending_{trials} \times Reduce_{pct} \\ = \$60B \times 97.7\% \\ = \$58.6B \\[0.5em] \text{where } Reduce_{pct} \\ = 1 - \frac{Cost_{pragmatic,pt}}{Cost_{P3,pt}} \\ = 1 - \frac{\$929}{\$41K} \\ = 97.7\% \end{gathered} \]

✓ High confidence

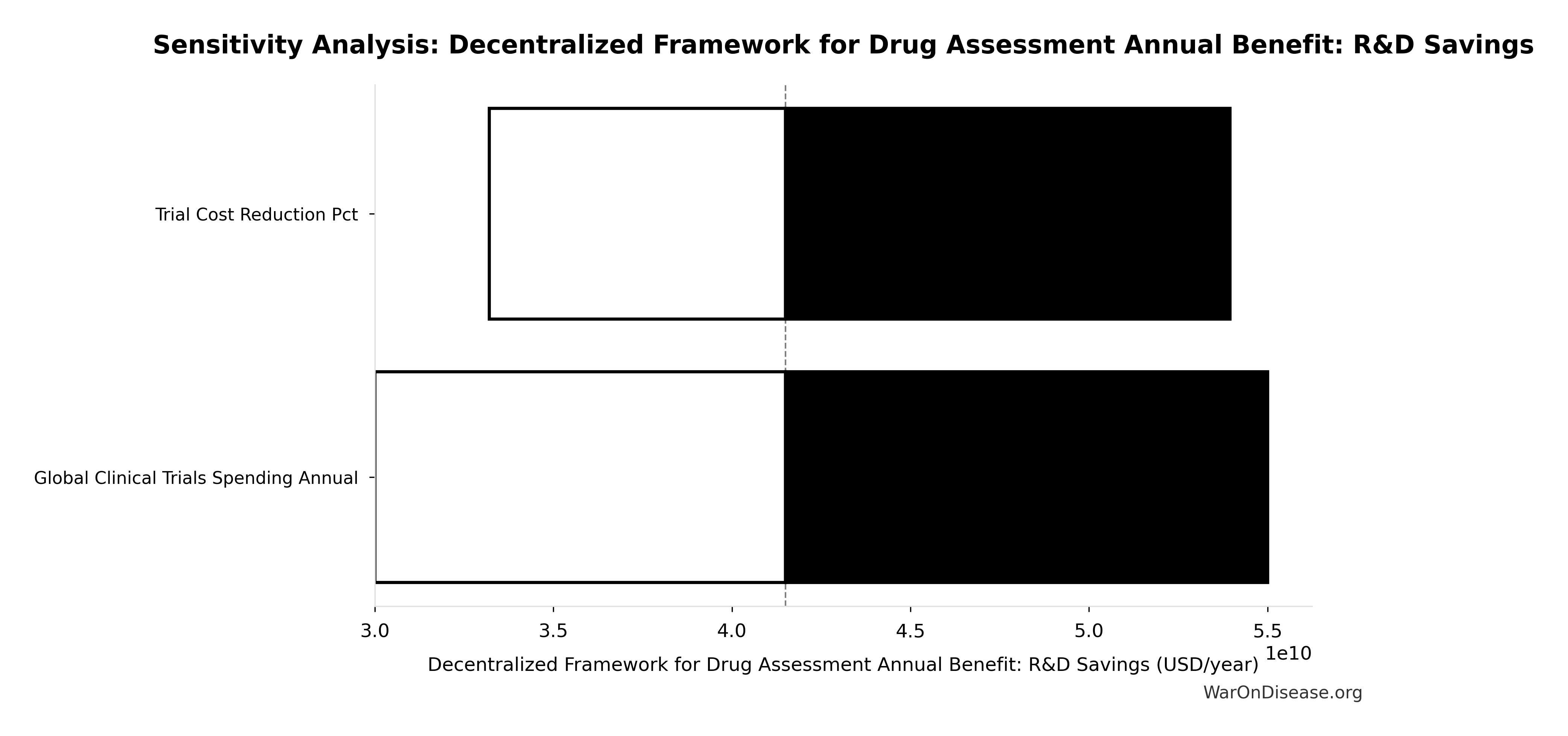

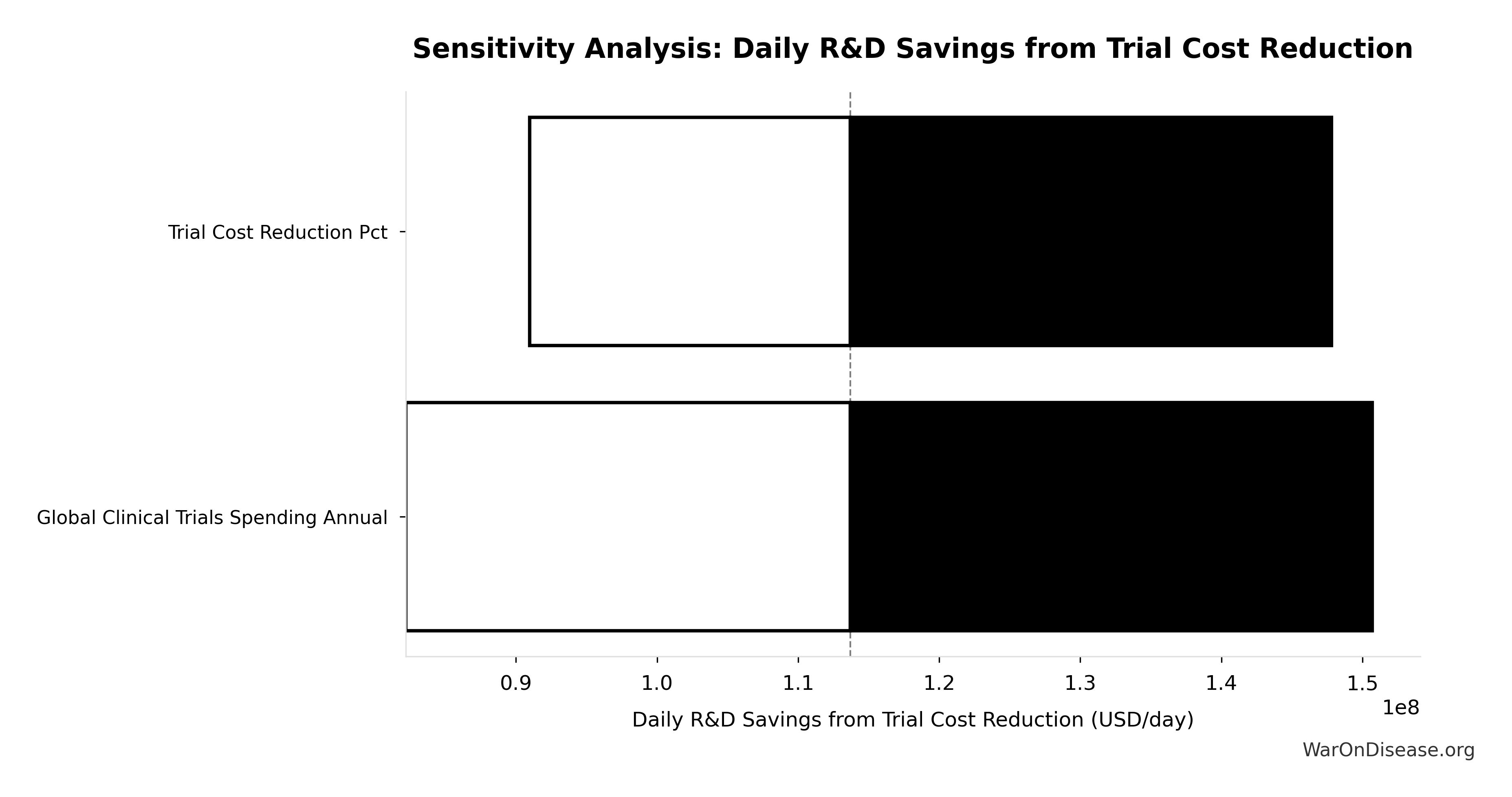

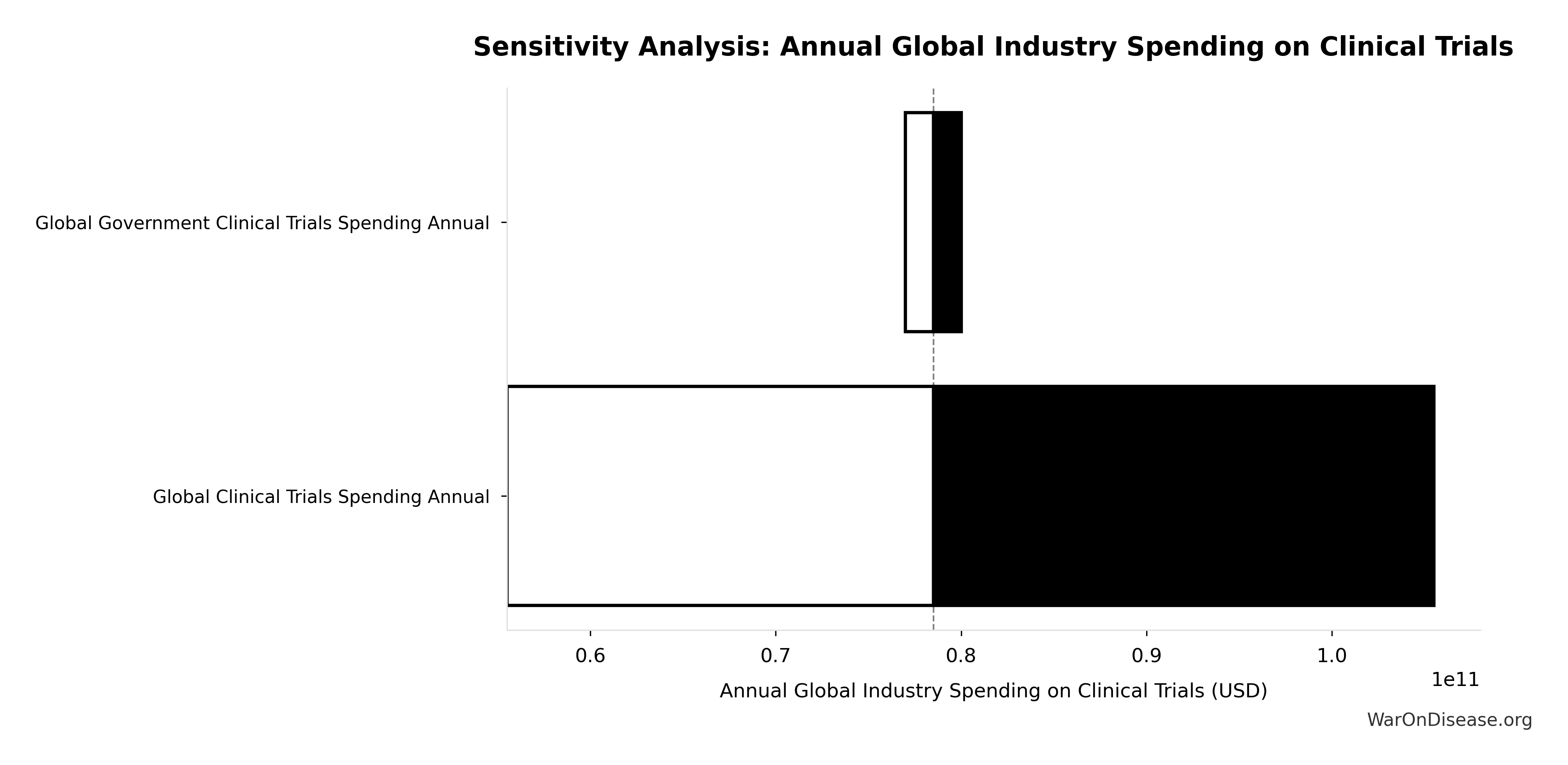

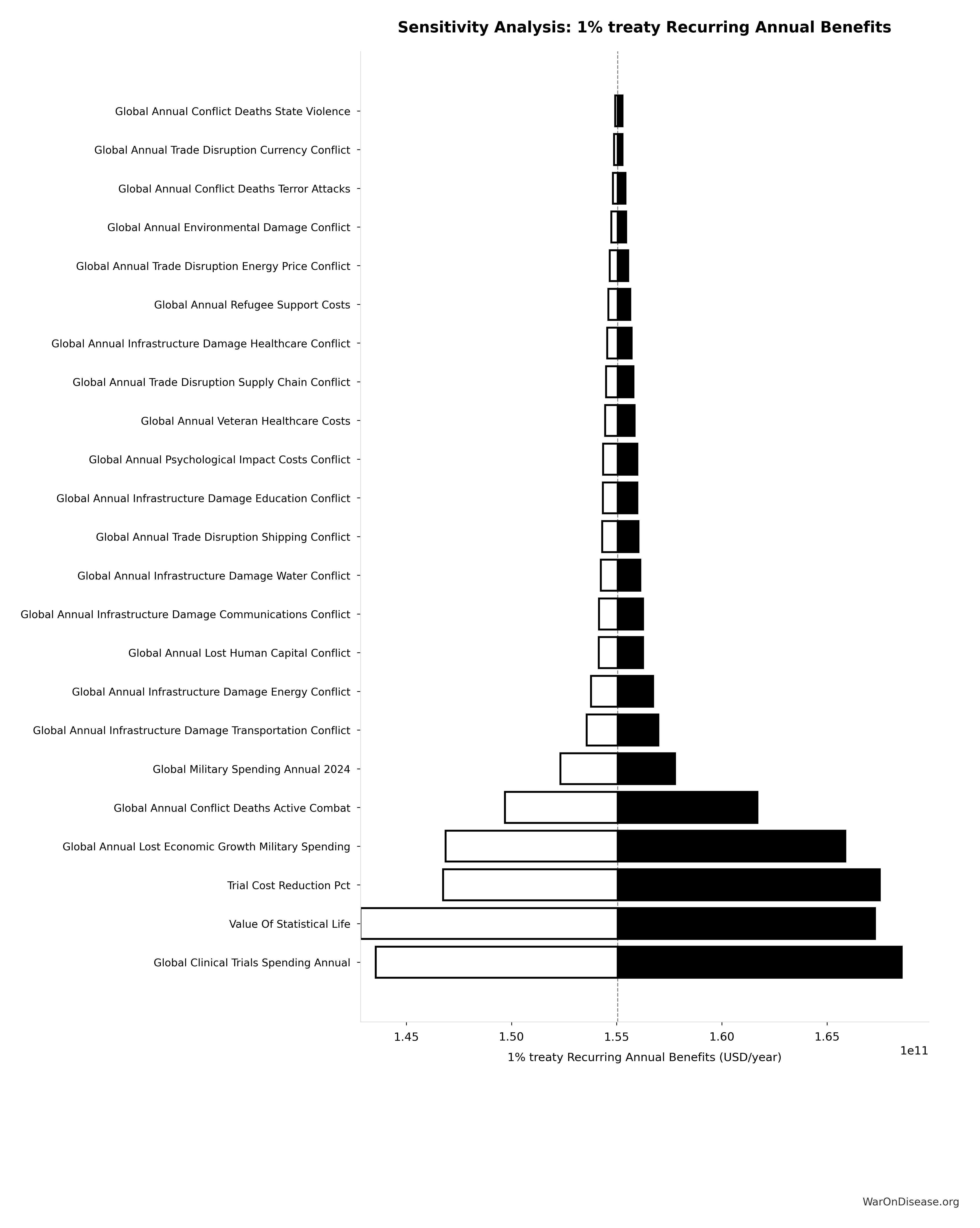

Sensitivity Analysis

Sensitivity Indices for Decentralized Framework for Drug Assessment Annual Benefit: R&D Savings

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| Global Clinical Trials Spending Annual | 1.0205 | Strong driver |

| dFDA Trial Cost Reduction % | 0.0244 | Minimal effect |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

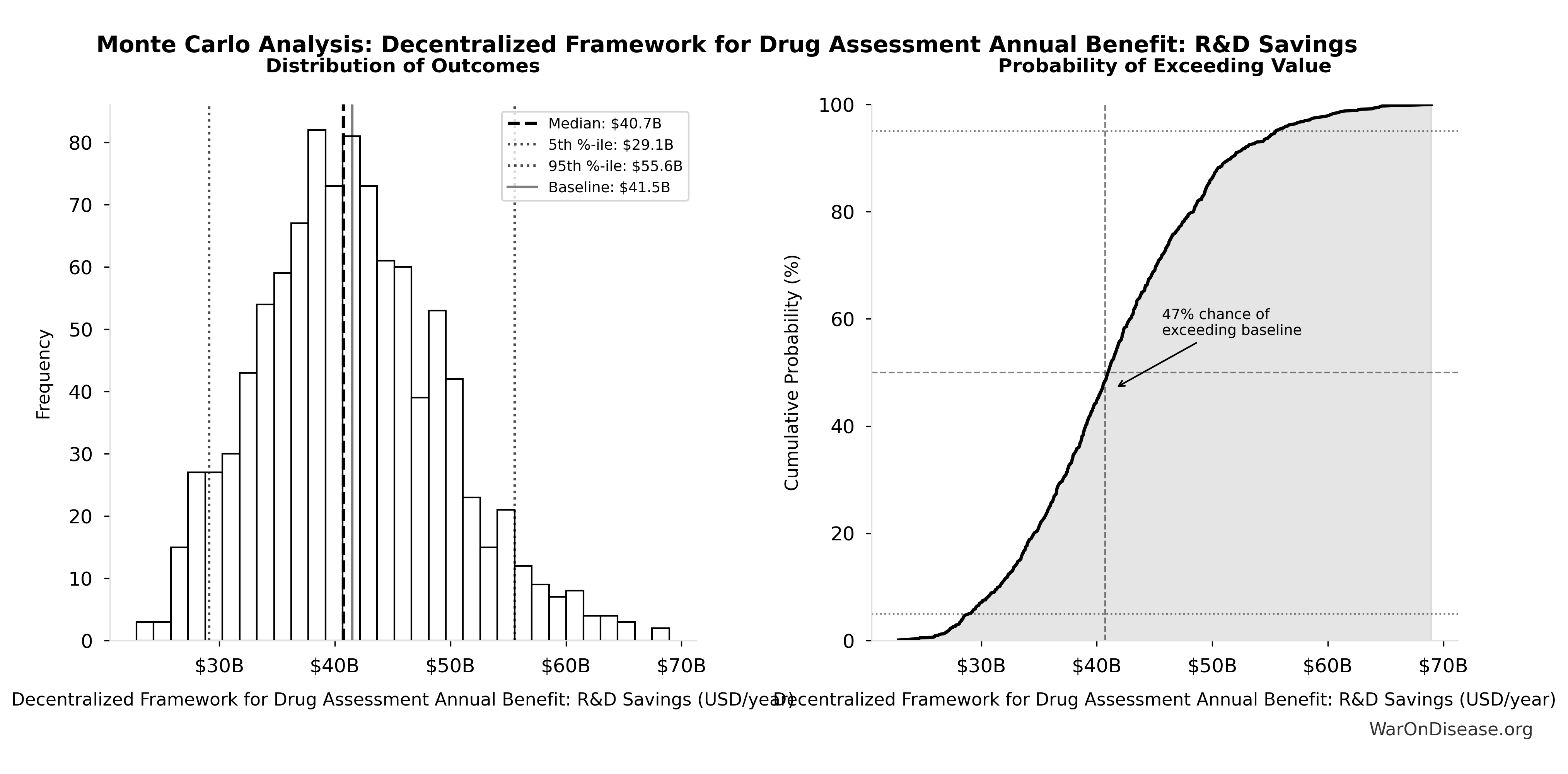

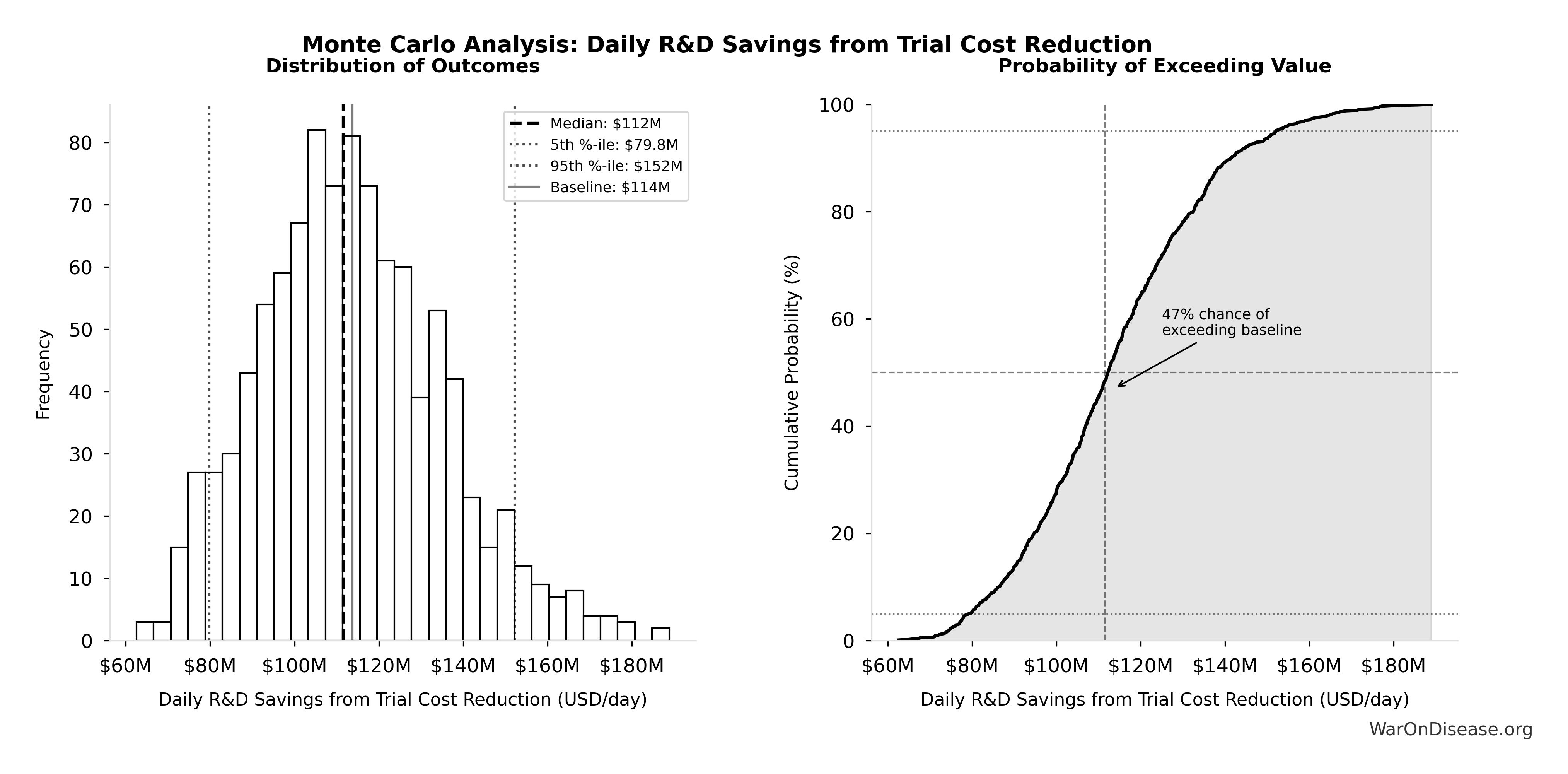

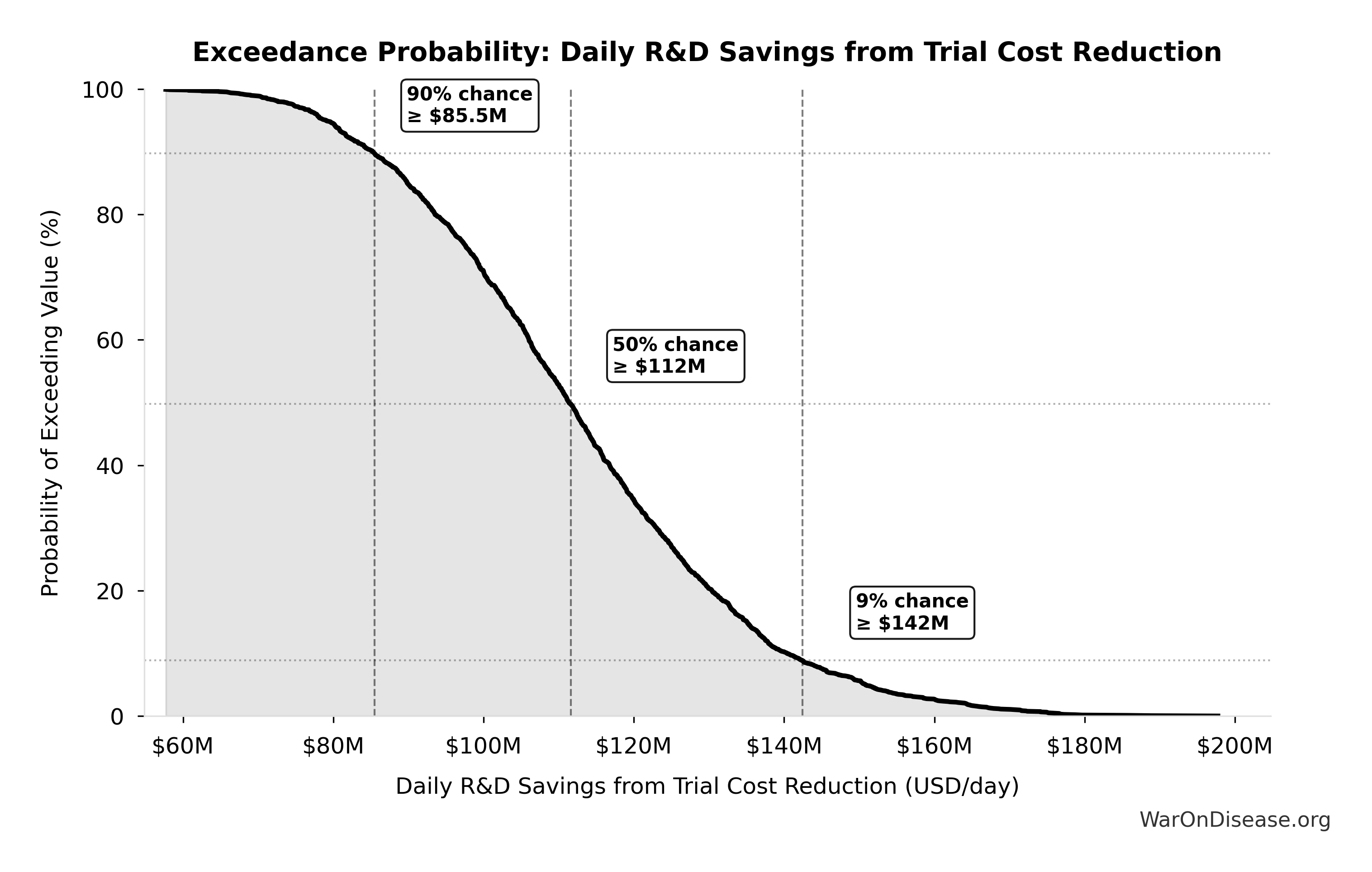

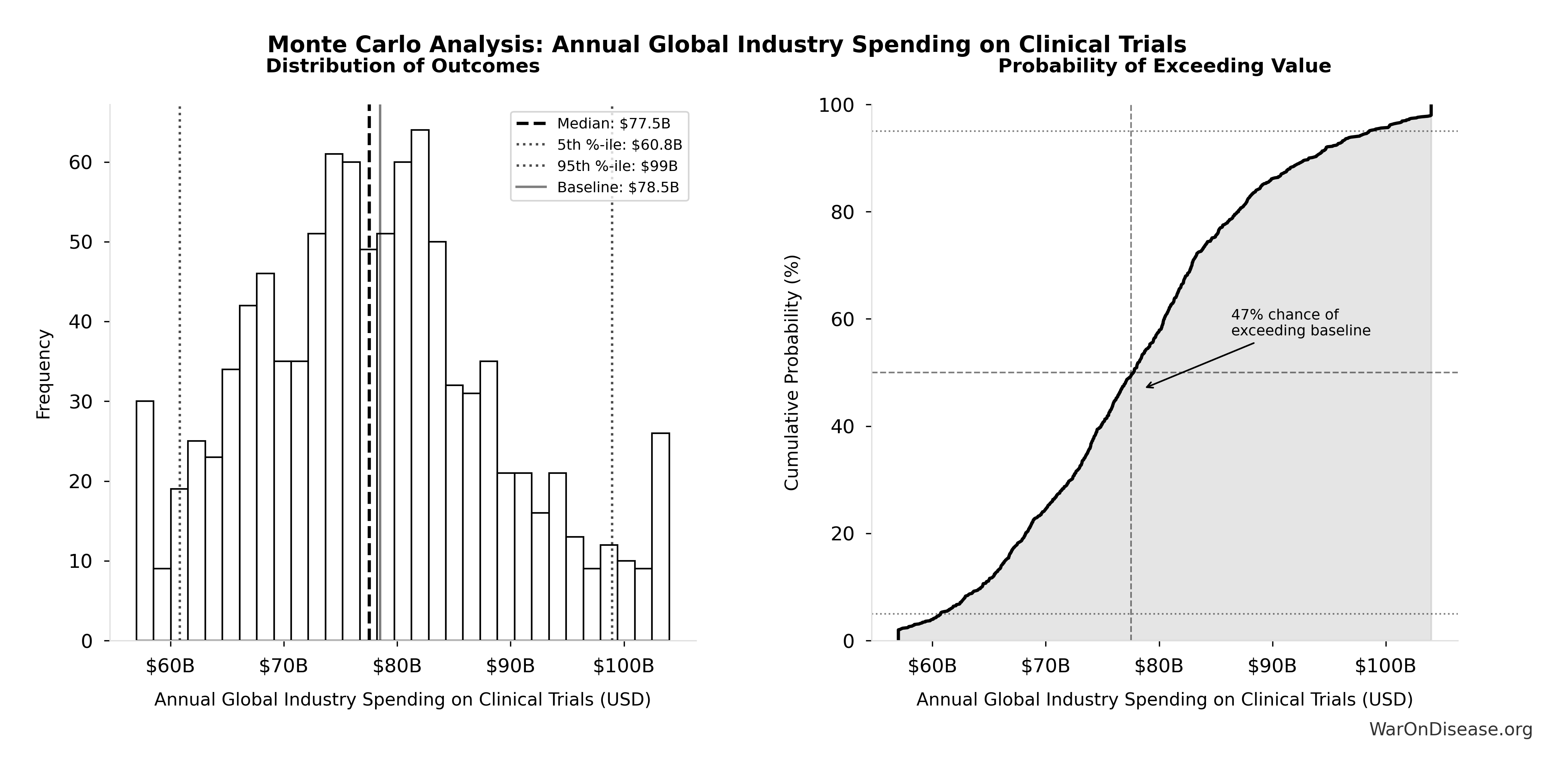

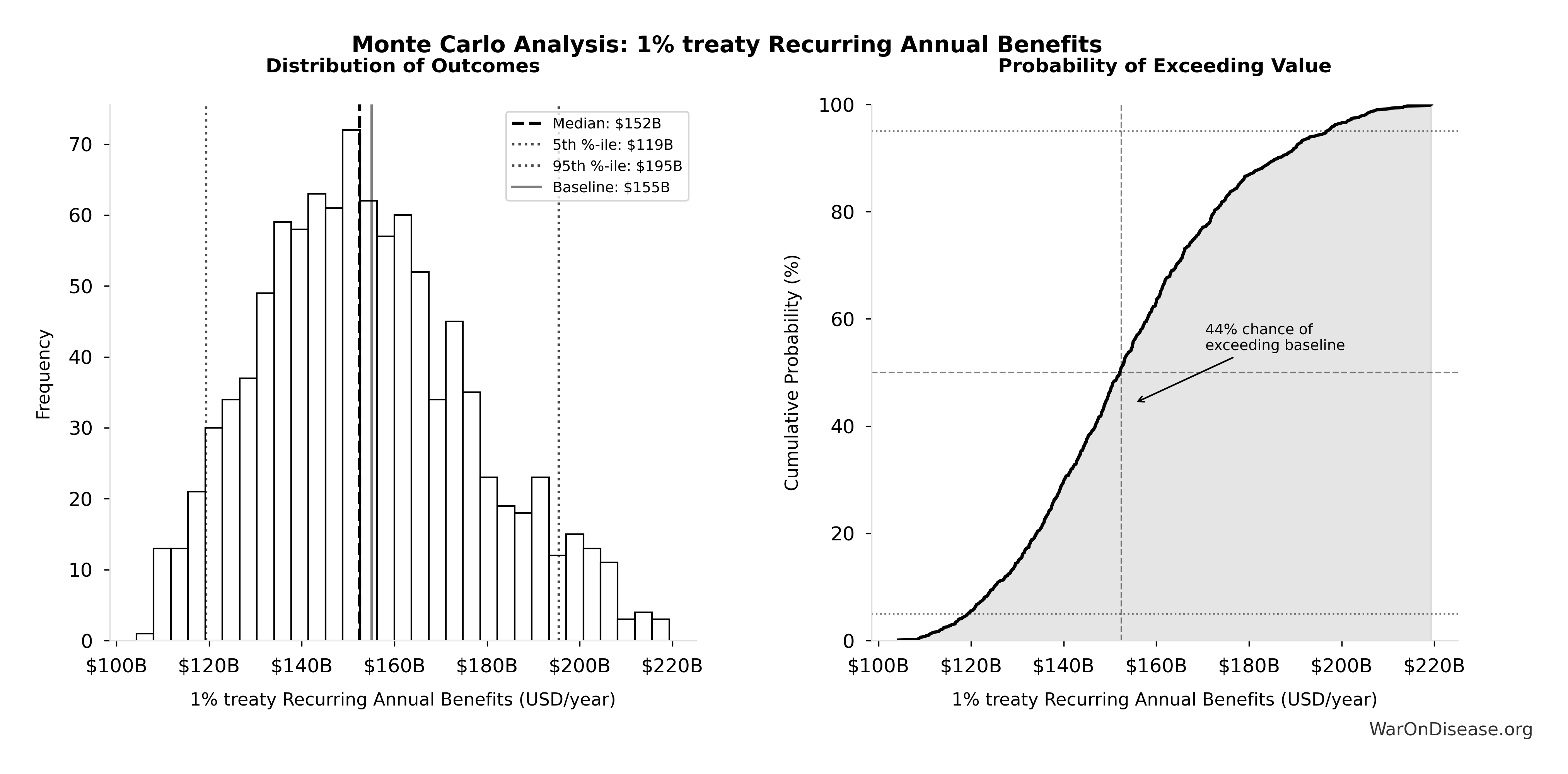

Monte Carlo Distribution

Simulation Results Summary: Decentralized Framework for Drug Assessment Annual Benefit: R&D Savings

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $58.6B |

| Mean (expected value) | $58.8B |

| Median (50th percentile) | $57.8B |

| Standard Deviation | $7.66B |

| 90% Range (5th-95th percentile) | [$49.2B, $73.1B] |

The histogram shows the distribution of Decentralized Framework for Drug Assessment Annual Benefit: R&D Savings across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

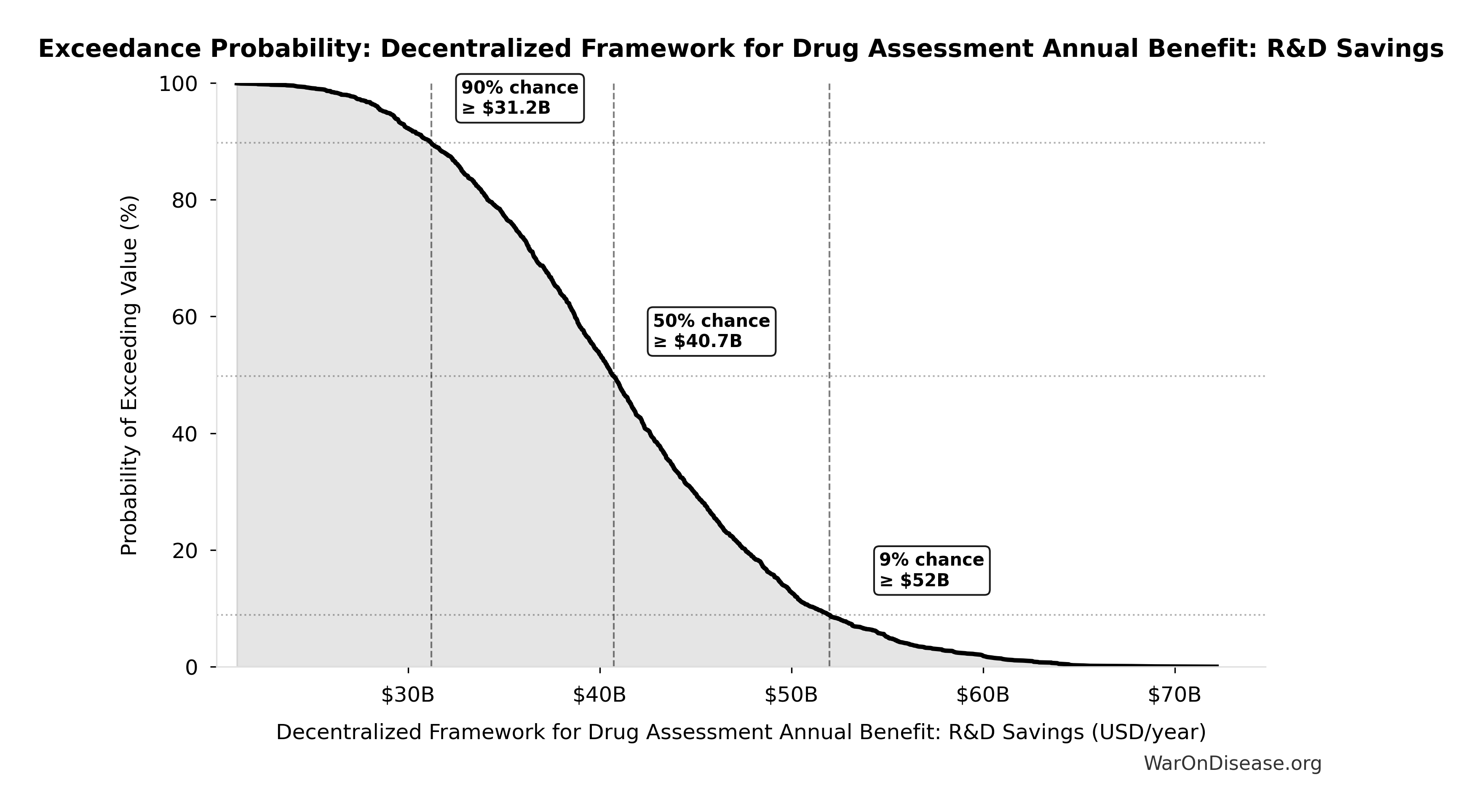

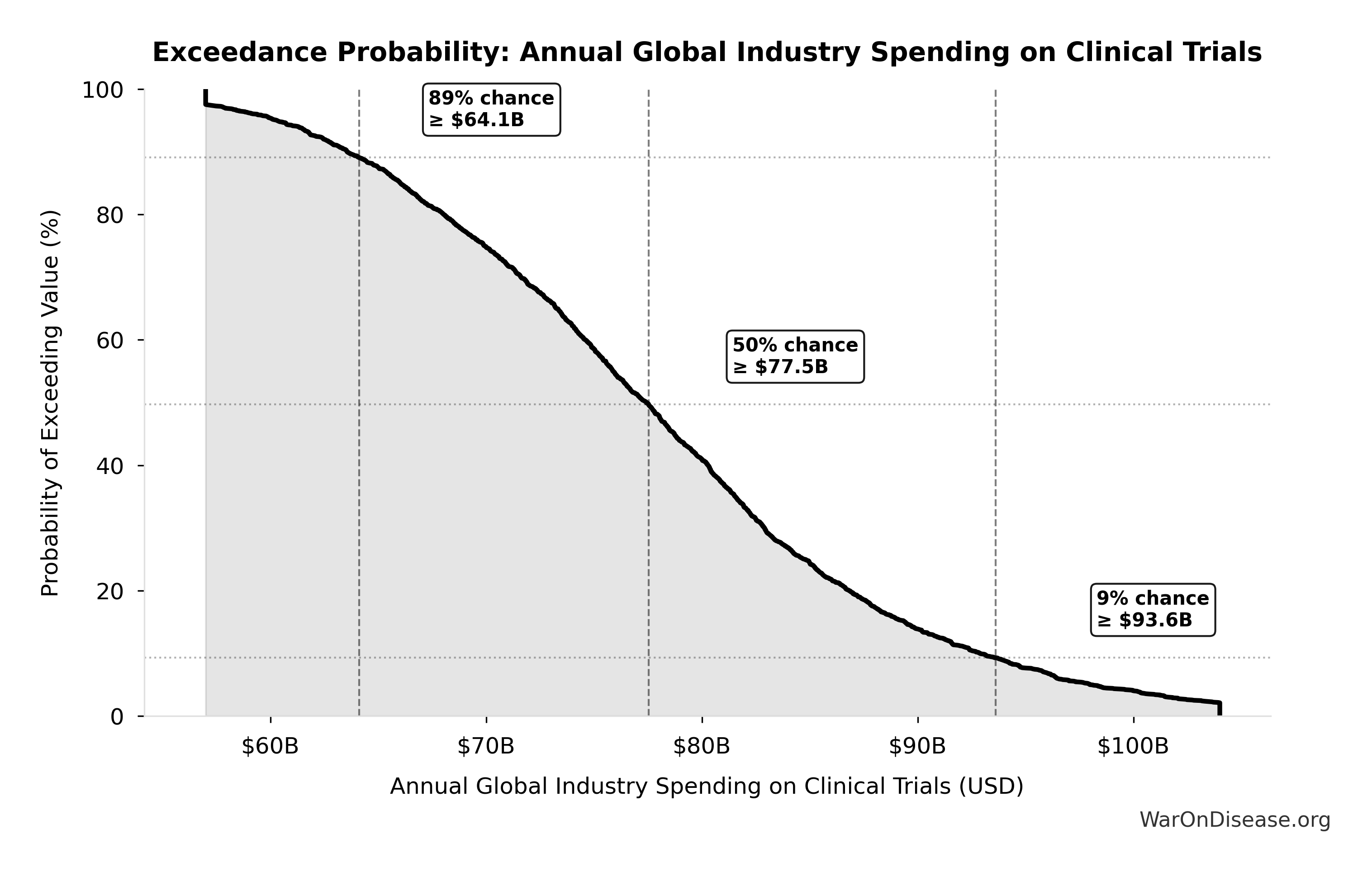

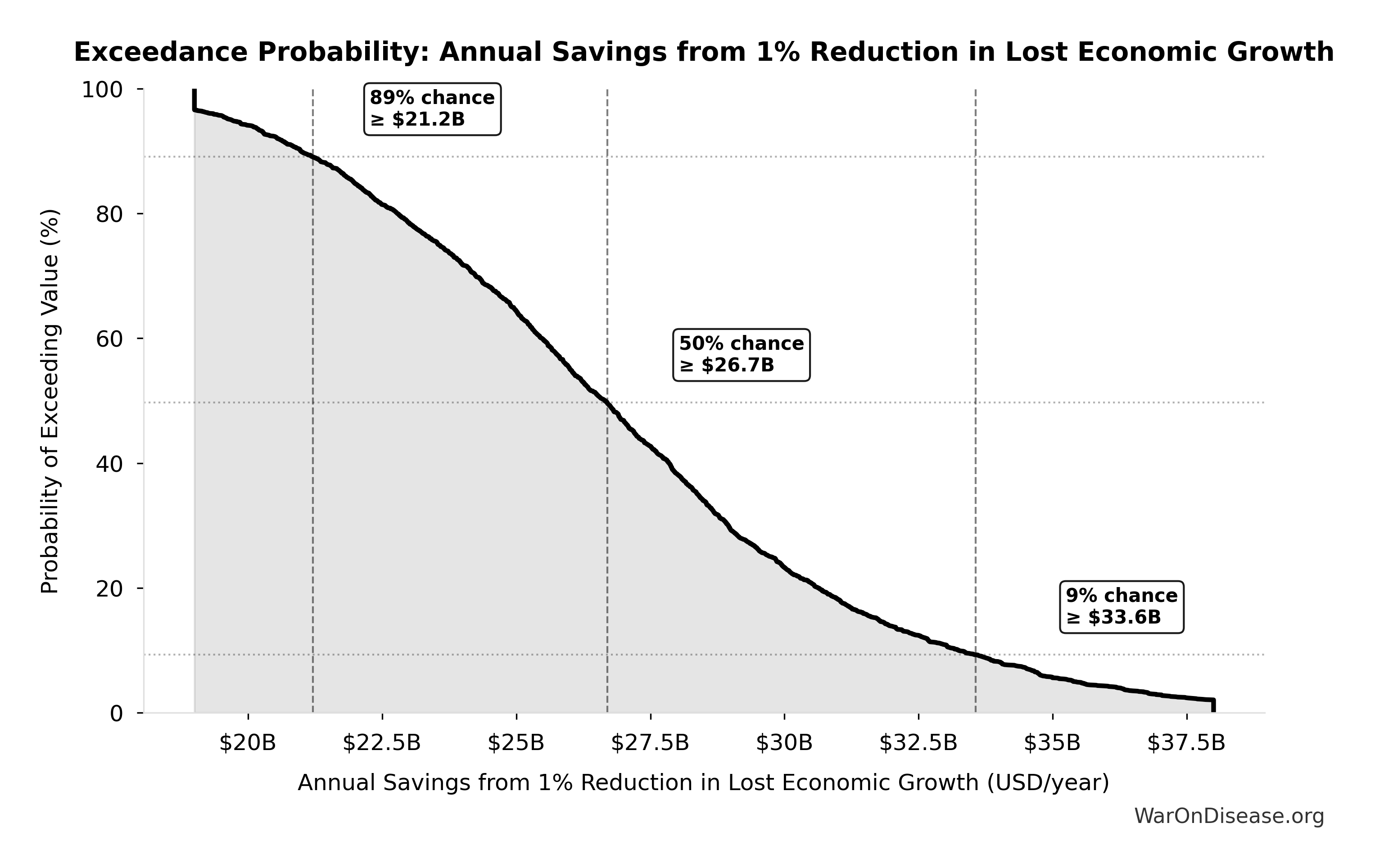

Exceedance Probability

This exceedance probability chart shows the likelihood that Decentralized Framework for Drug Assessment Annual Benefit: R&D Savings will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

dFDA Direct Funding Cost per DALY: $0.841

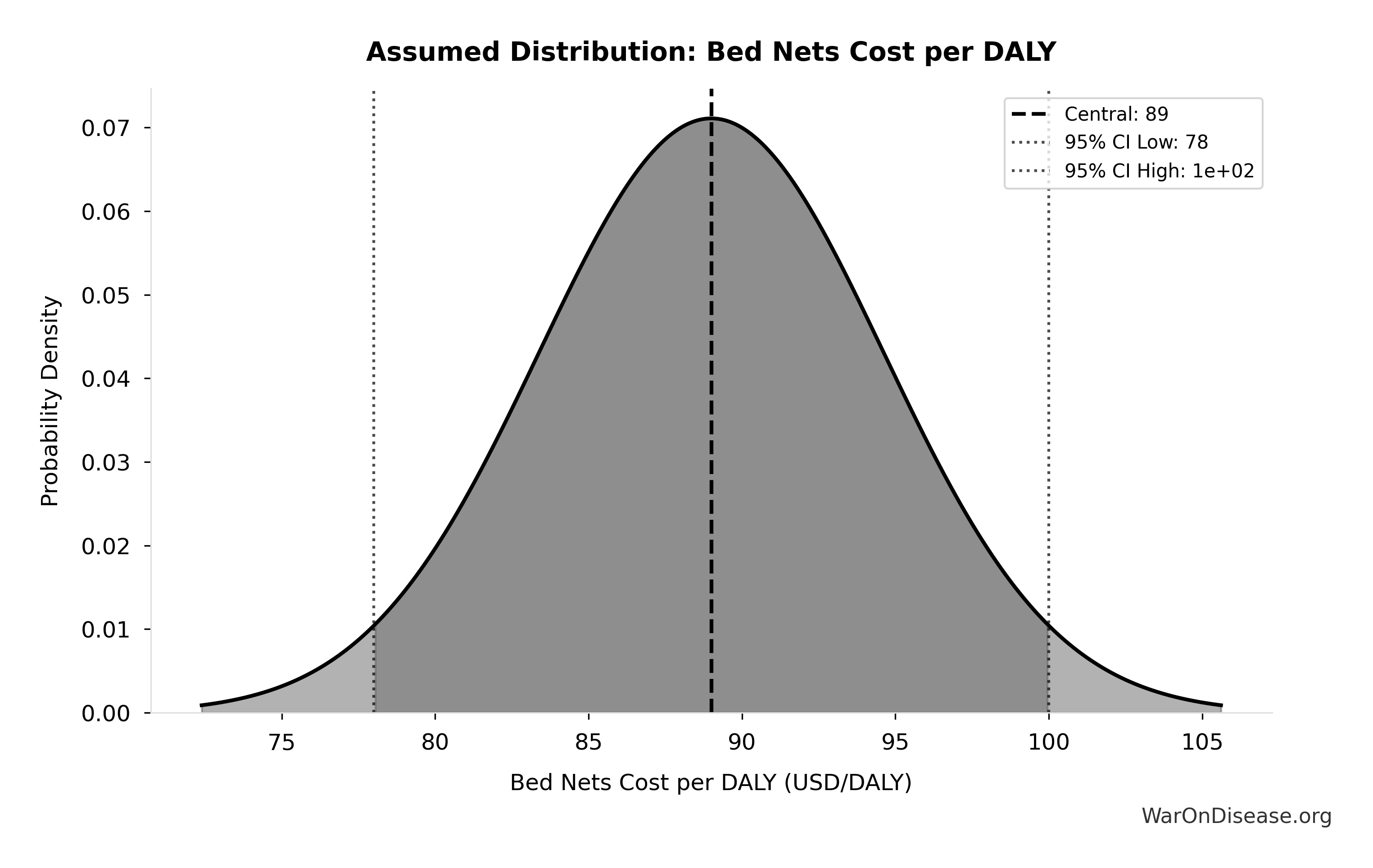

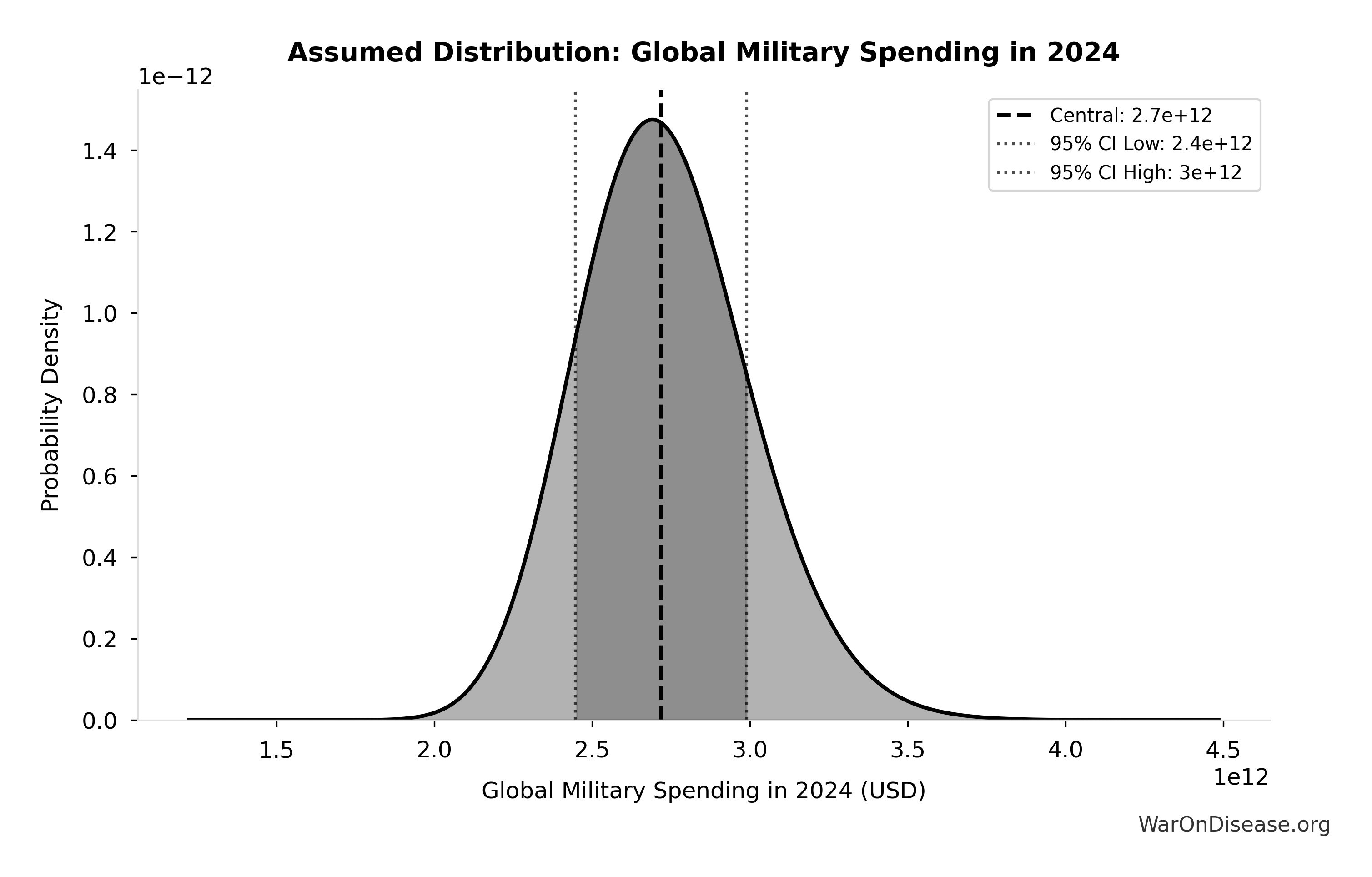

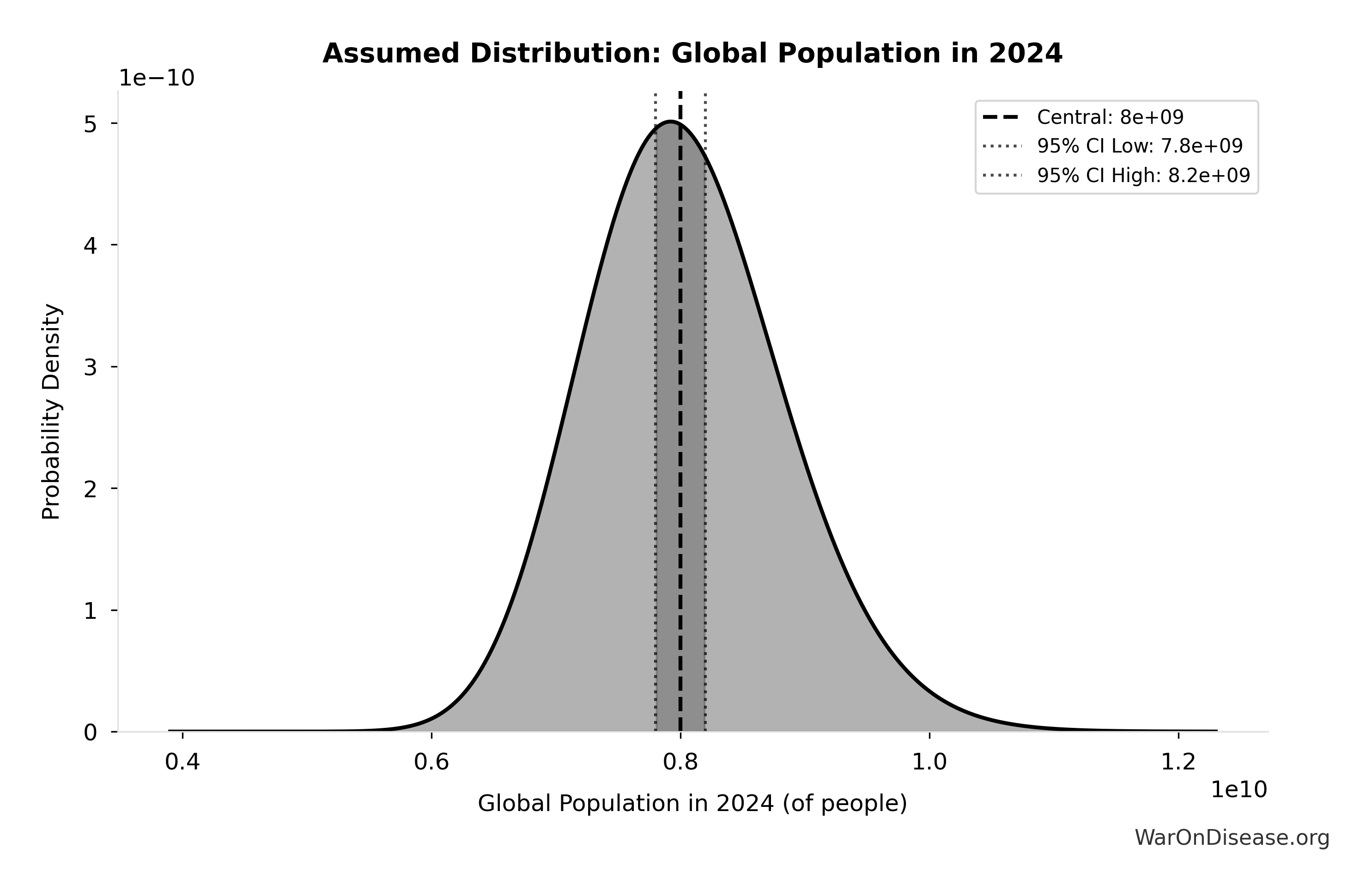

Cost per DALY if philanthropists/governments directly funded $21.76B/year for ~46.5 years (therapeutic space exploration period, NPV: ~$541.9B) instead of treaty campaign ($1B). Treaty achieves 542× leverage: $1B campaign unlocks government funding for 46.5 years (NPV: $541.9B), avoiding direct philanthropic commitment. Both achieve same 200B DALY timeline shift benefit. Still cost-effective vs bed nets ($89.0/DALY).

Inputs:

- dFDA Direct Funding NPV (Exploration Period) 🔢: $475B

- Total DALYs from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput 🔢: 565 billion DALYs

\[ \begin{gathered} Cost_{direct,DALY} = \frac{NPV_{direct}}{DALYs_{max}} = \frac{\$475B}{565B} = \$0.841 \\[0.5em] \text{where } NPV_{direct} = Funding_{ann} \times \frac{1 - (1+r)^{-T}}{r} \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } T_{queue,dFDA} = \frac{T_{queue,SQ}}{k_{capacity}} = \frac{443}{12.3} = 36 \\[0.5em] \text{where } T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } DALYs_{max} \\ = DALYs_{global,ann} \times Pct_{avoid,DALY} \times T_{accel,max} \\ = 2.88B \times 92.6\% \times 212 \\ = 565B \\[0.5em] \text{where } T_{accel,max} = T_{accel} + T_{lag} = 204 + 8.2 = 212 \\[0.5em] \text{where } T_{accel} \\ = T_{first,SQ} \times \left(1 - \frac{1}{k_{capacity}}\right) \\ = 222 \times \left(1 - \frac{1}{12.3}\right) \\ = 204 \\[0.5em] \text{where } T_{first,SQ} = T_{queue,SQ} \times 0.5 = 443 \times 0.5 = 222 \\[0.5em] \text{where } T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

~ Medium confidence

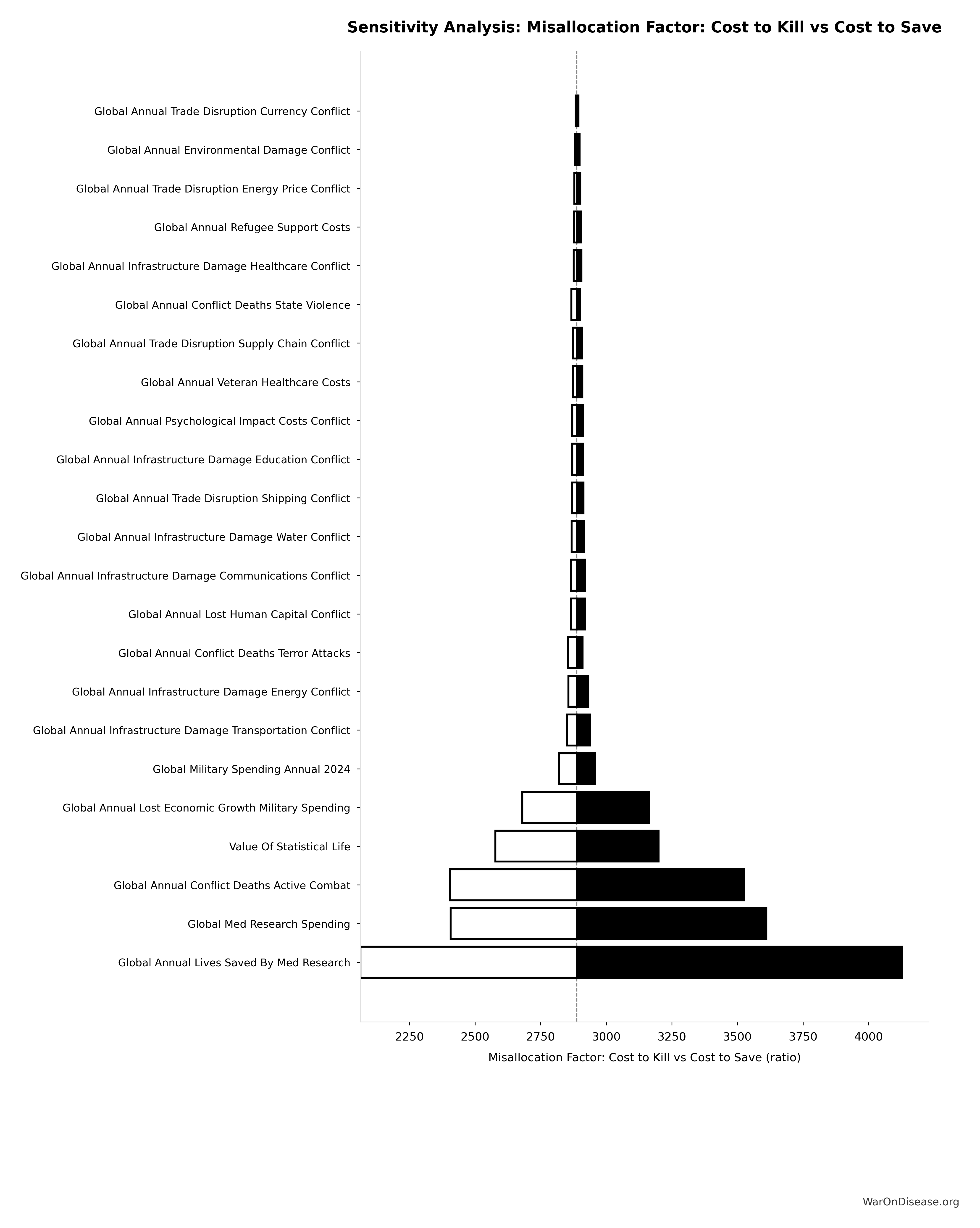

Sensitivity Analysis

Sensitivity Indices for dFDA Direct Funding Cost per DALY

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Trial Capacity Plus Efficacy Lag DALYs | -0.5182 | Strong driver |

| dFDA Direct Funding Queue Clearance NPV | 0.4583 | Moderate driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

Monte Carlo Distribution

Simulation Results Summary: dFDA Direct Funding Cost per DALY

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $0.841 |

| Mean (expected value) | $0.800 |

| Median (50th percentile) | $0.695 |

| Standard Deviation | $0.466 |

| 90% Range (5th-95th percentile) | [$0.242, $1.75] |

The histogram shows the distribution of dFDA Direct Funding Cost per DALY across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

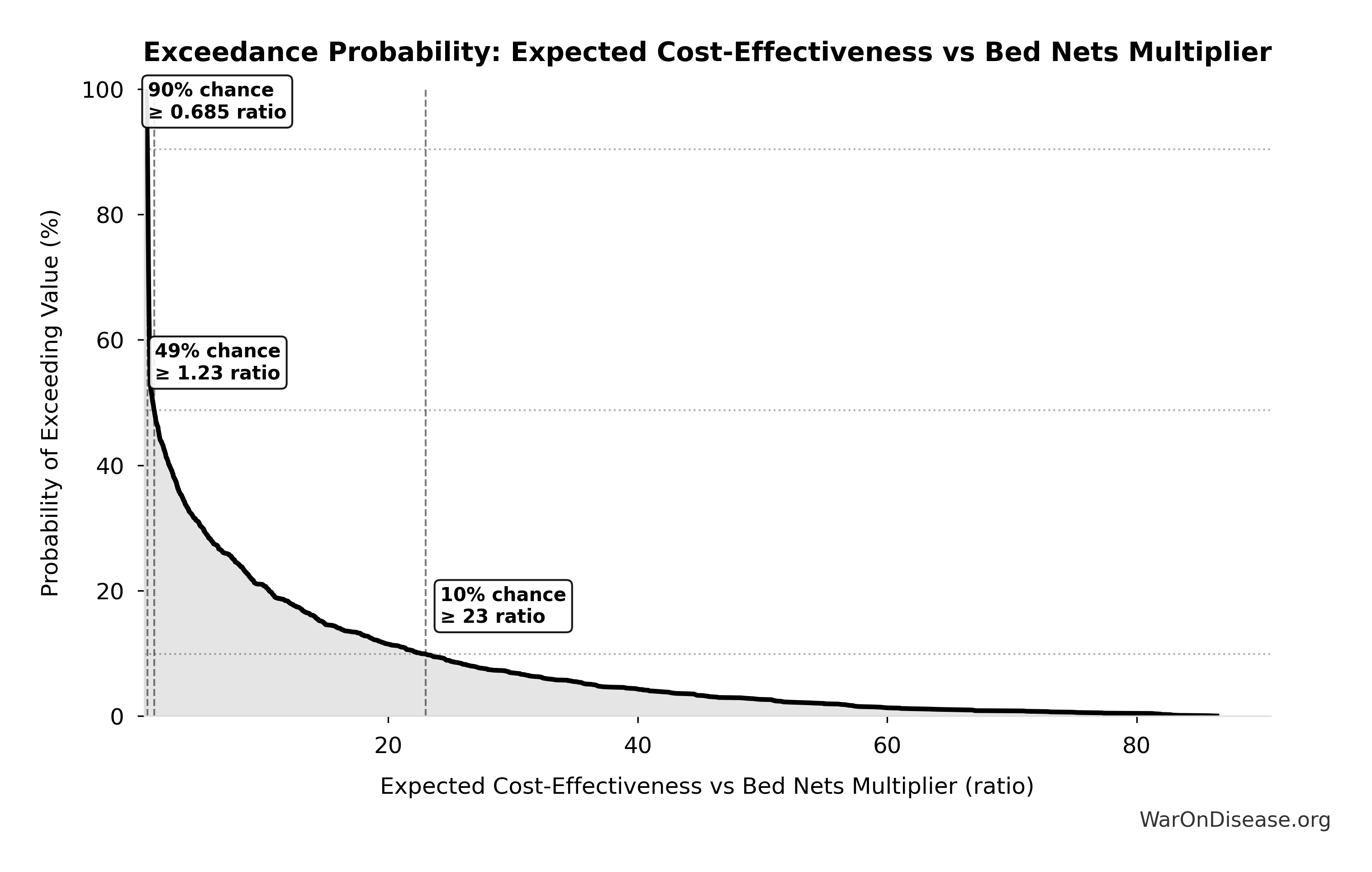

Exceedance Probability

This exceedance probability chart shows the likelihood that dFDA Direct Funding Cost per DALY will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

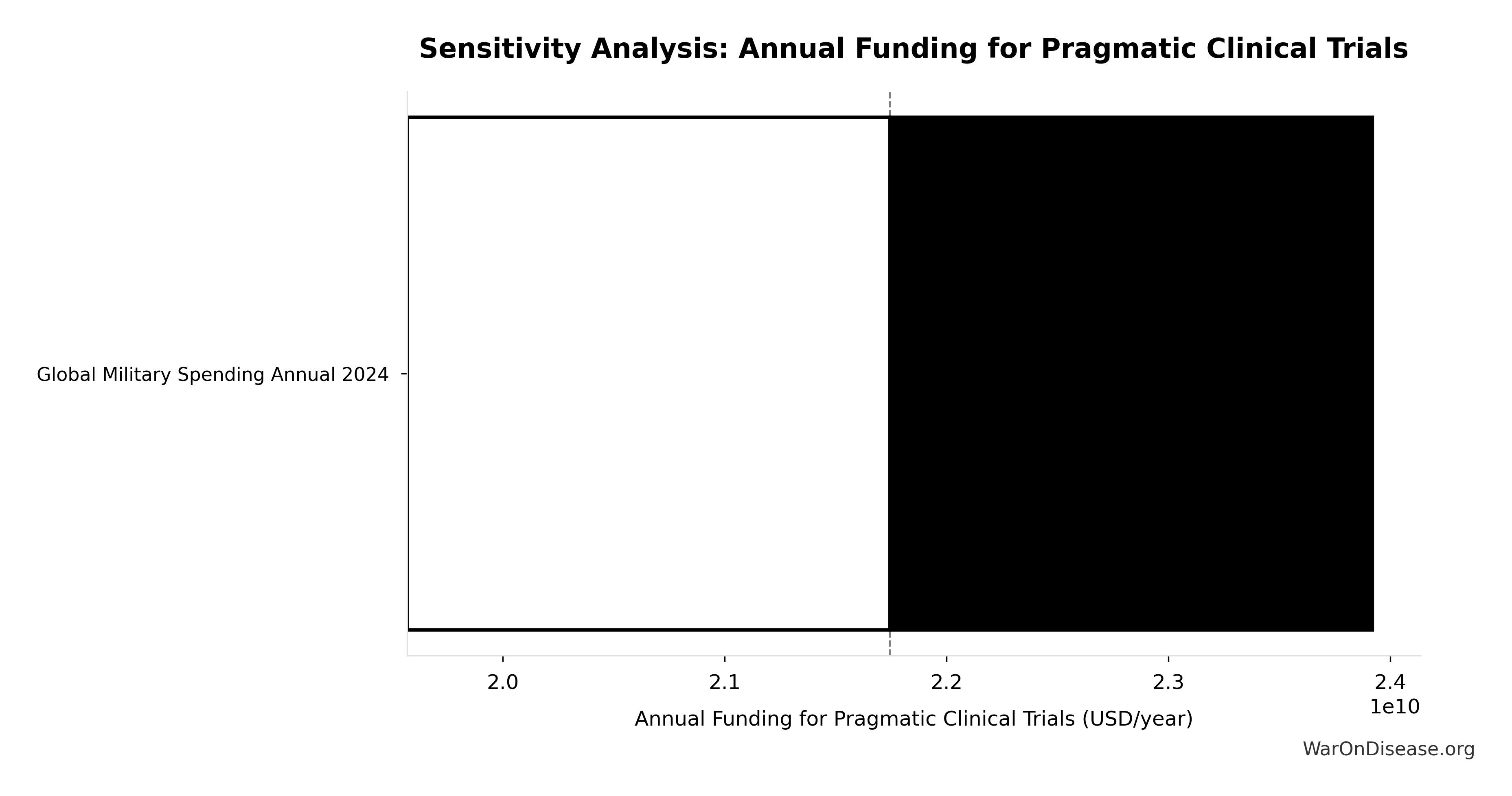

dFDA Direct Funding NPV (Exploration Period): $475B

NPV of direct funding ($21.76B/year for medical research after bond/IAB allocations) for the ~46.5-year therapeutic space exploration period. Alternative scenario: instead of $1B treaty campaign to unlock government funding, philanthropists/NIH directly fund clinical trials until the therapeutic space is fully explored. Funding period is exploration time (46.5 years with 9.5× trial capacity), not timeline shift amount (207 years). After exploration completes, the timeline shift benefit (200B DALYs) is fully realized.

Inputs:

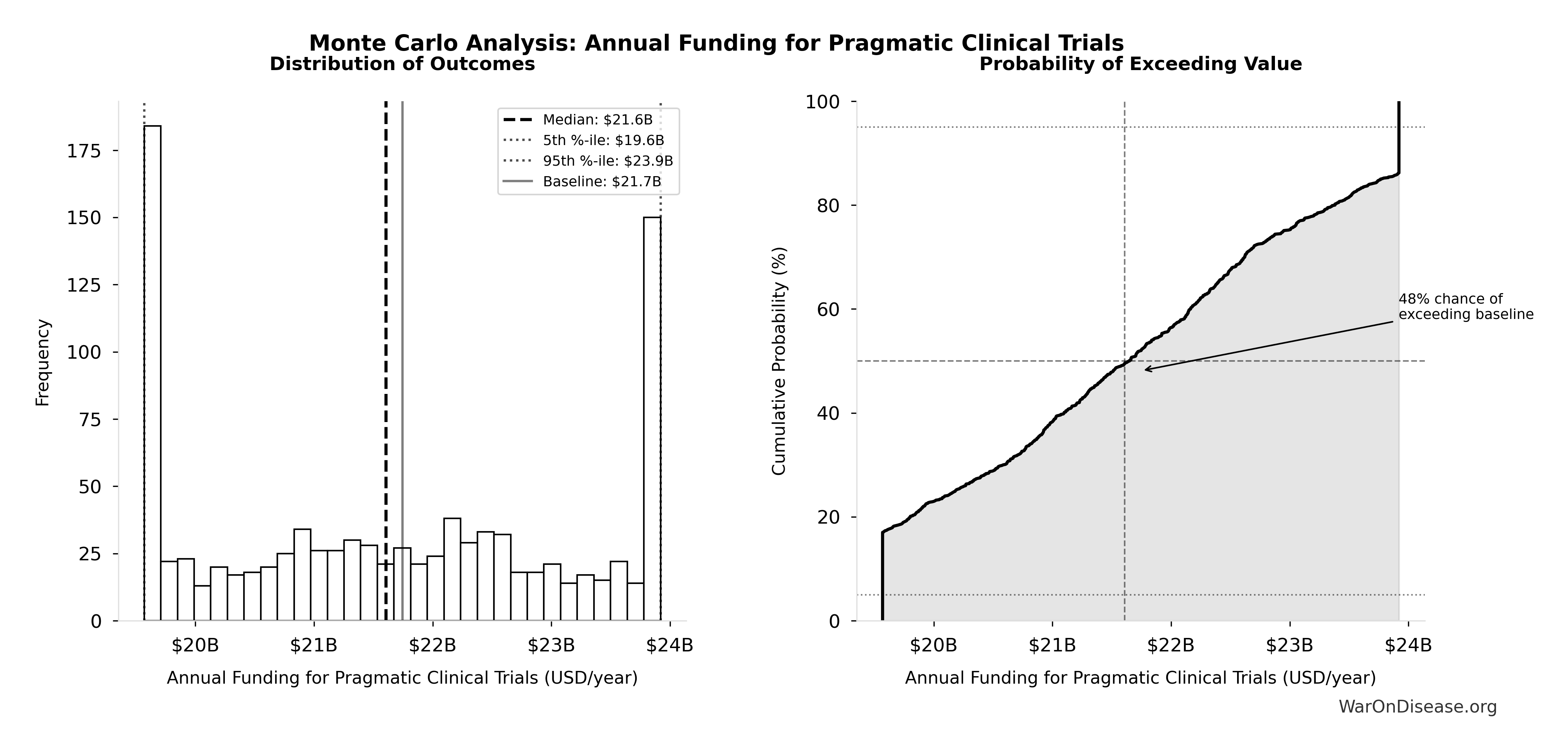

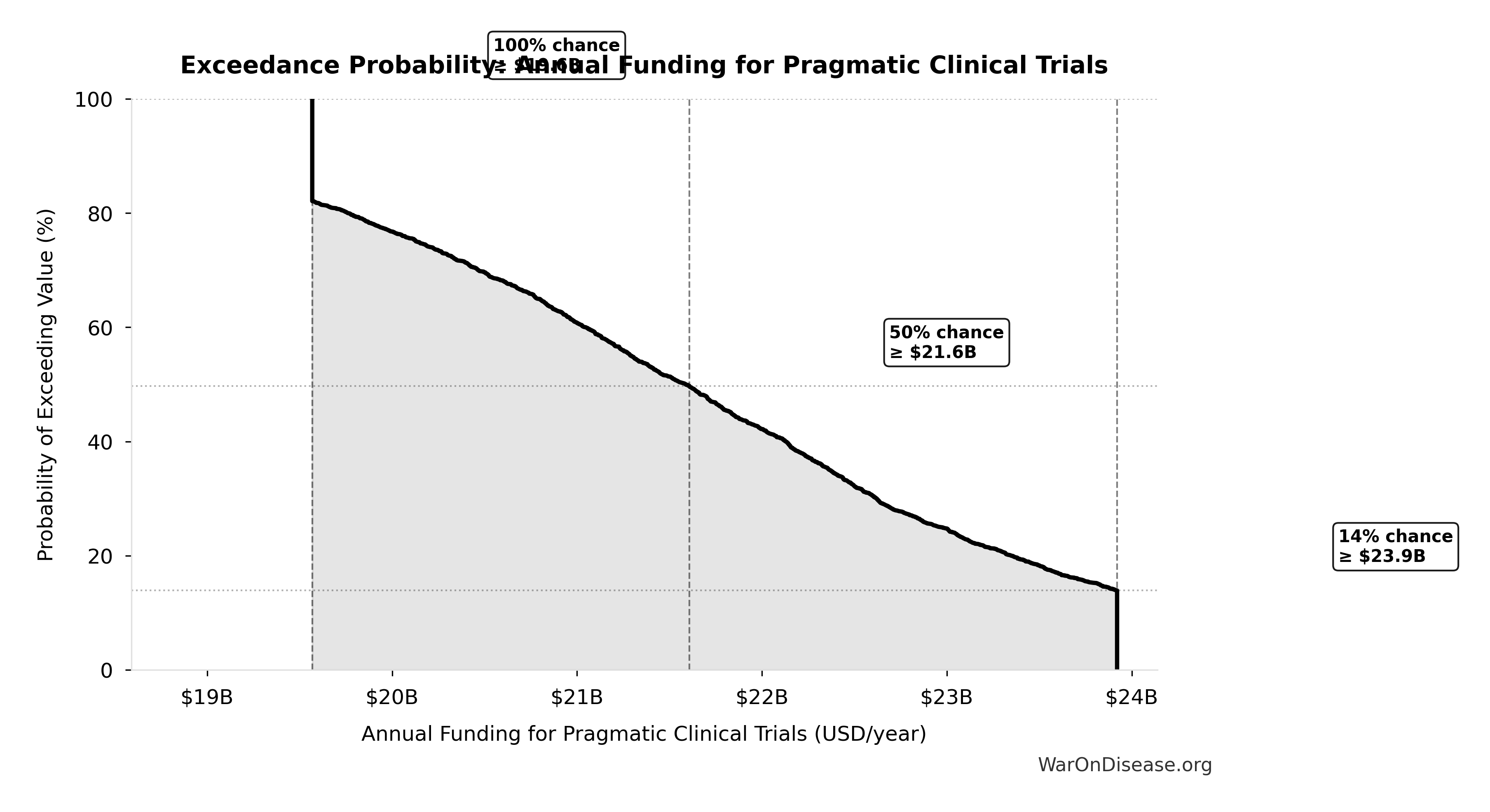

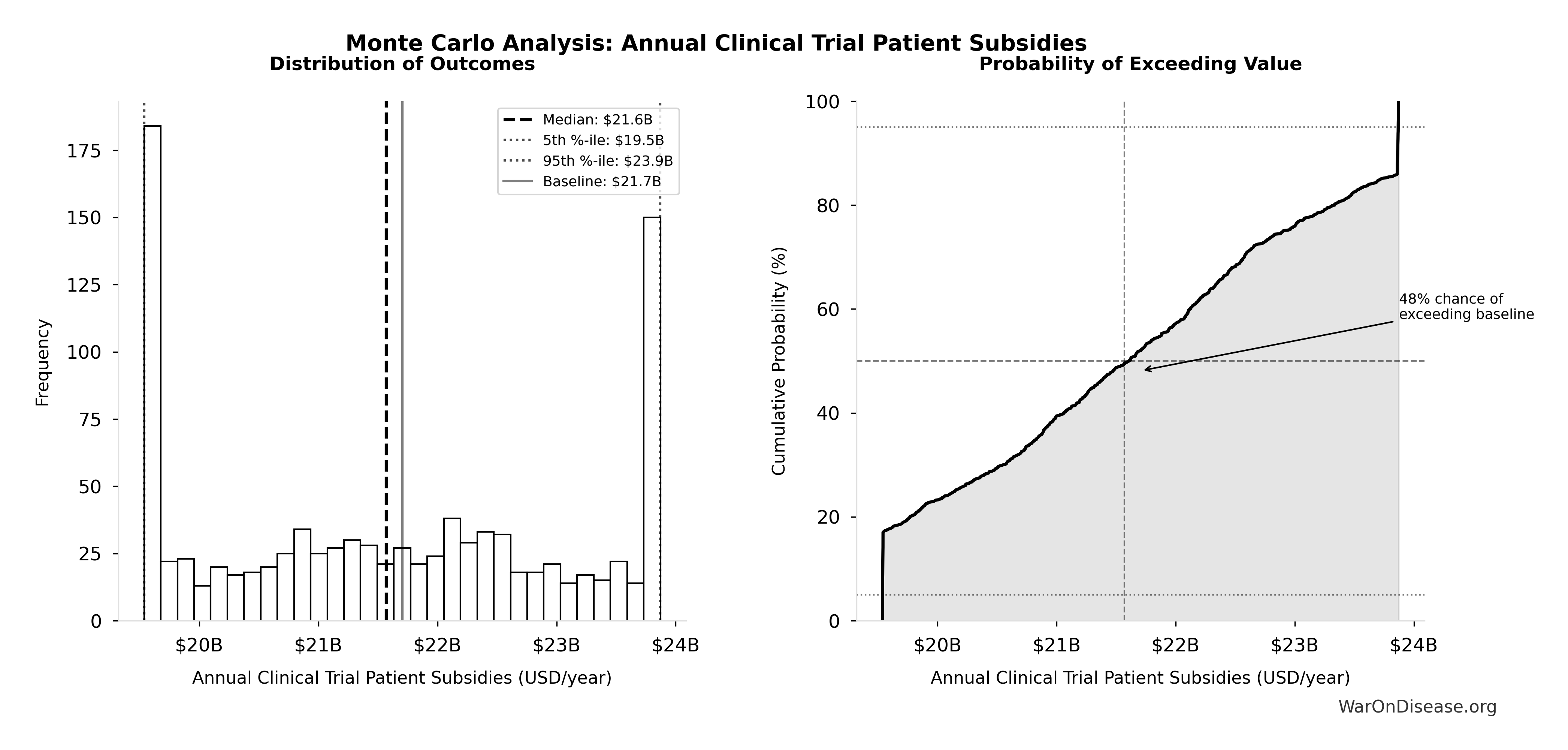

- Annual Funding for Pragmatic Clinical Trials 🔢: $21.8B

- Standard Discount Rate for NPV Analysis: 3%

- dFDA Therapeutic Space Exploration Time 🔢: 36 years

\[ NPV_{direct} = Funding_{ann} \times \frac{1 - (1+r)^{-T}}{r} \]

✓ High confidence

Sensitivity Analysis

Sensitivity Indices for dFDA Direct Funding NPV (Exploration Period)

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Queue Clearance Years | 0.9443 | Strong driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

Monte Carlo Distribution

Simulation Results Summary: dFDA Direct Funding NPV (Exploration Period)

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $475B |

| Mean (expected value) | $425B |

| Median (50th percentile) | $424B |

| Standard Deviation | $135B |

| 90% Range (5th-95th percentile) | [$211B, $651B] |

The histogram shows the distribution of dFDA Direct Funding NPV (Exploration Period) across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

Exceedance Probability

This exceedance probability chart shows the likelihood that dFDA Direct Funding NPV (Exploration Period) will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

Total DALYs Lost from Disease Eradication Delay: 7.94 billion DALYs

Total Disability-Adjusted Life Years lost from disease eradication delay (PRIMARY estimate)

Inputs:

- Years of Life Lost from Disease Eradication Delay 🔢: 7.07 billion years

- Years Lived with Disability During Disease Eradication Delay 🔢: 873 million years

\[ \begin{gathered} DALYs_{lag} = YLL_{lag} + YLD_{lag} = 7.07B + 873M = 7.94B \\[0.5em] \text{where } YLL_{lag} \\ = Deaths_{lag} \times (LE_{global} - Age_{death,delay}) \\ = 416M \times (79 - 62) \\ = 7.07B \\[0.5em] \text{where } Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \\[0.5em] \text{where } YLD_{lag} \\ = Deaths_{lag} \times T_{suffering} \times DW_{chronic} \\ = 416M \times 6 \times 0.35 \\ = 873M \\[0.5em] \text{where } Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \end{gathered} \]

~ Medium confidence

Sensitivity Analysis

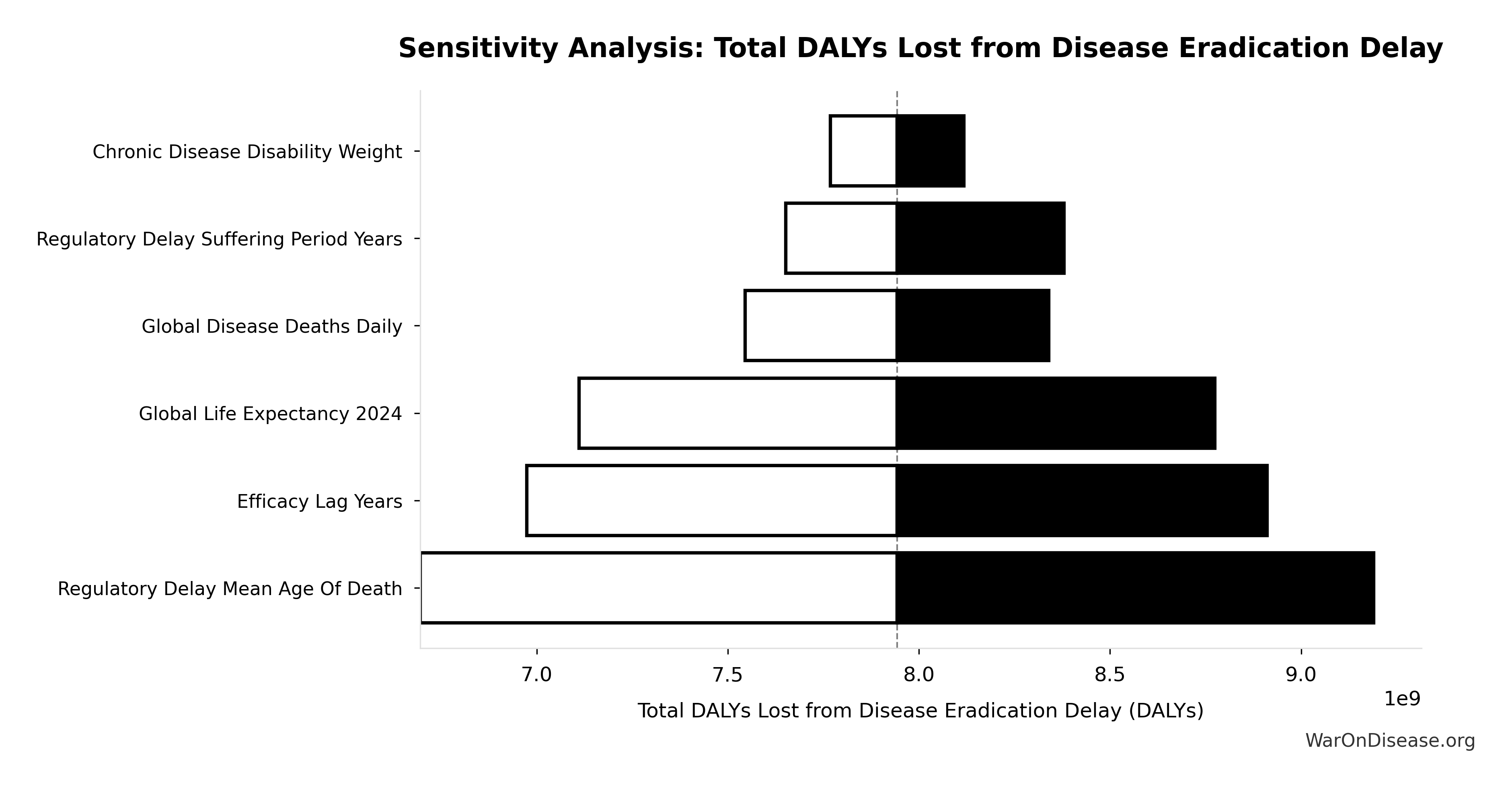

Sensitivity Indices for Total DALYs Lost from Disease Eradication Delay

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Efficacy Lag Elimination Yll | 0.7043 | Strong driver |

| dFDA Efficacy Lag Elimination Yld | 0.3107 | Moderate driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

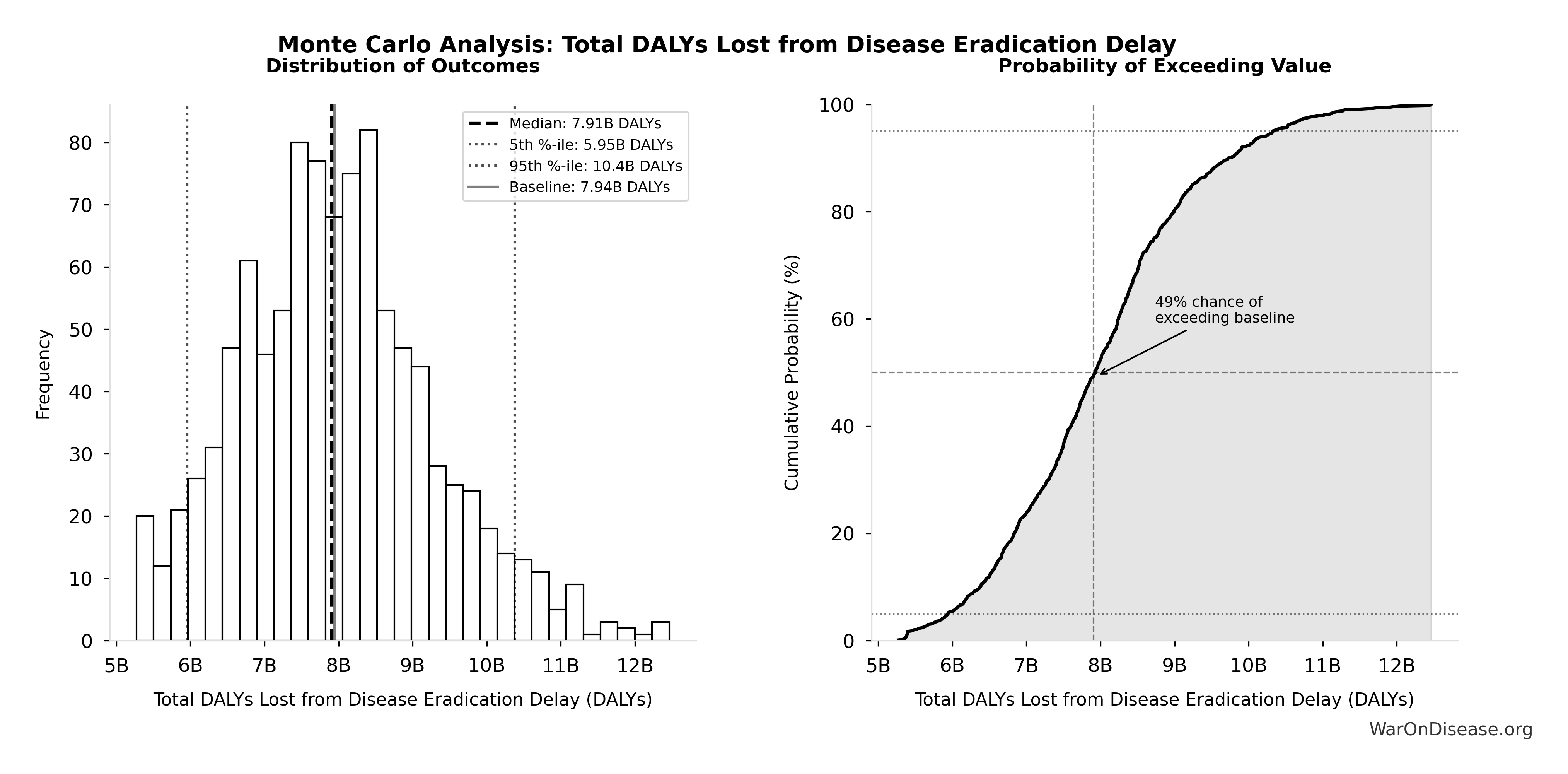

Monte Carlo Distribution

Simulation Results Summary: Total DALYs Lost from Disease Eradication Delay

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 7.94 billion |

| Mean (expected value) | 8.05 billion |

| Median (50th percentile) | 7.89 billion |

| Standard Deviation | 2.31 billion |

| 90% Range (5th-95th percentile) | [4.43 billion, 12.1 billion] |

The histogram shows the distribution of Total DALYs Lost from Disease Eradication Delay across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

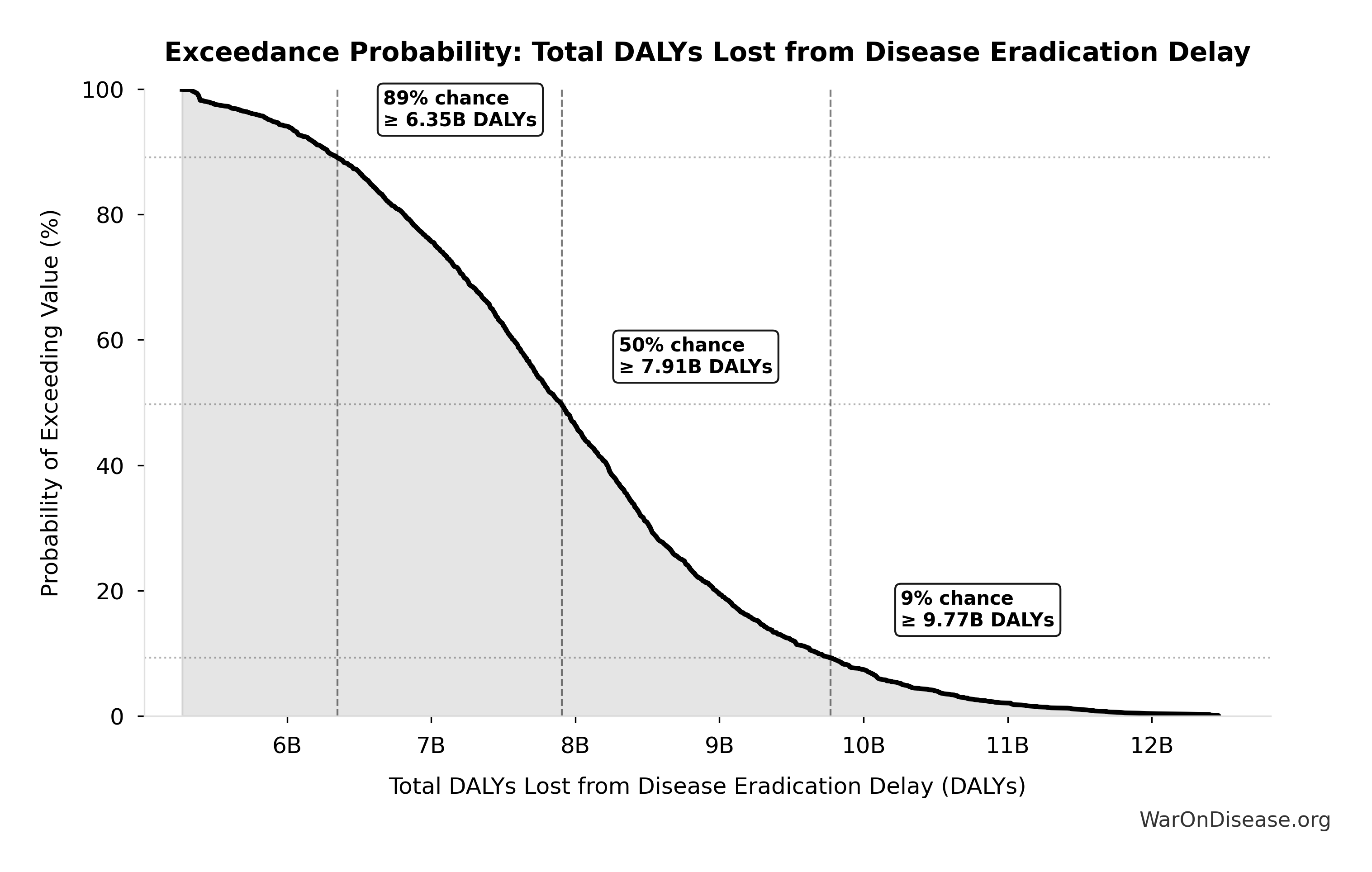

Exceedance Probability

This exceedance probability chart shows the likelihood that Total DALYs Lost from Disease Eradication Delay will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

Total Deaths from Disease Eradication Delay: 416 million deaths

Total eventually avoidable deaths from delaying disease eradication by 8.2 years (PRIMARY estimate, conservative). Excludes fundamentally unavoidable deaths (primarily accidents ~7.9%).

Inputs:

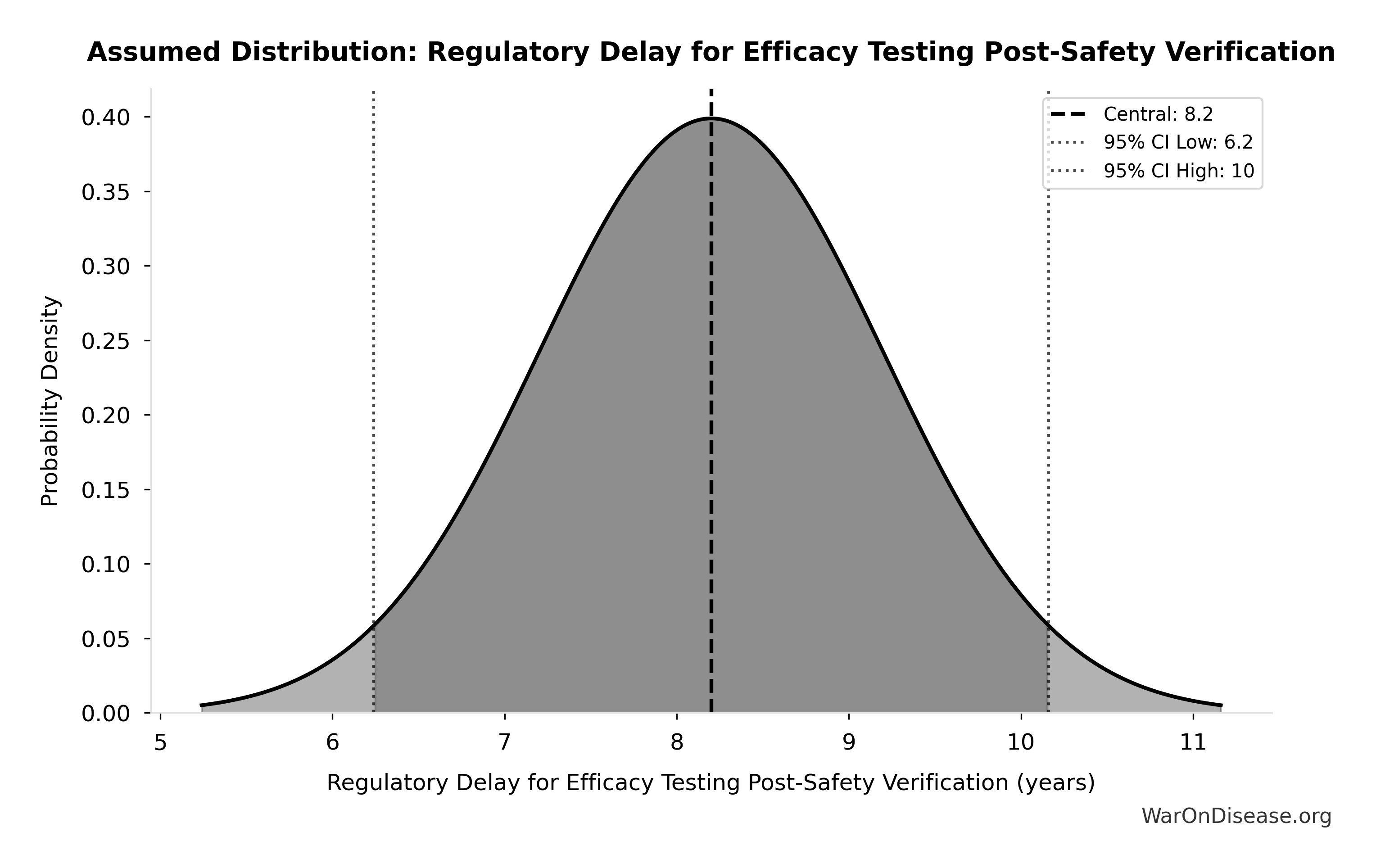

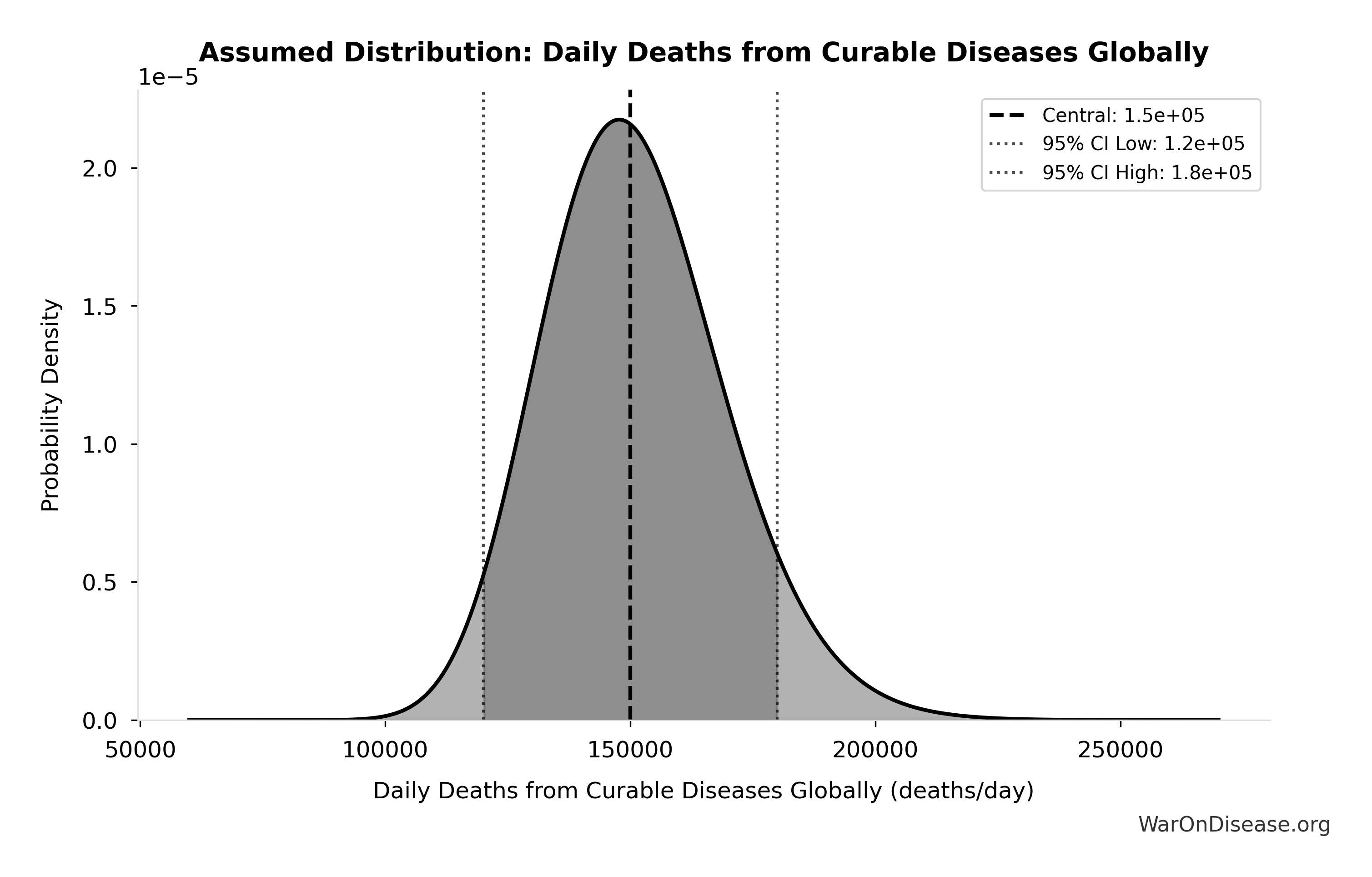

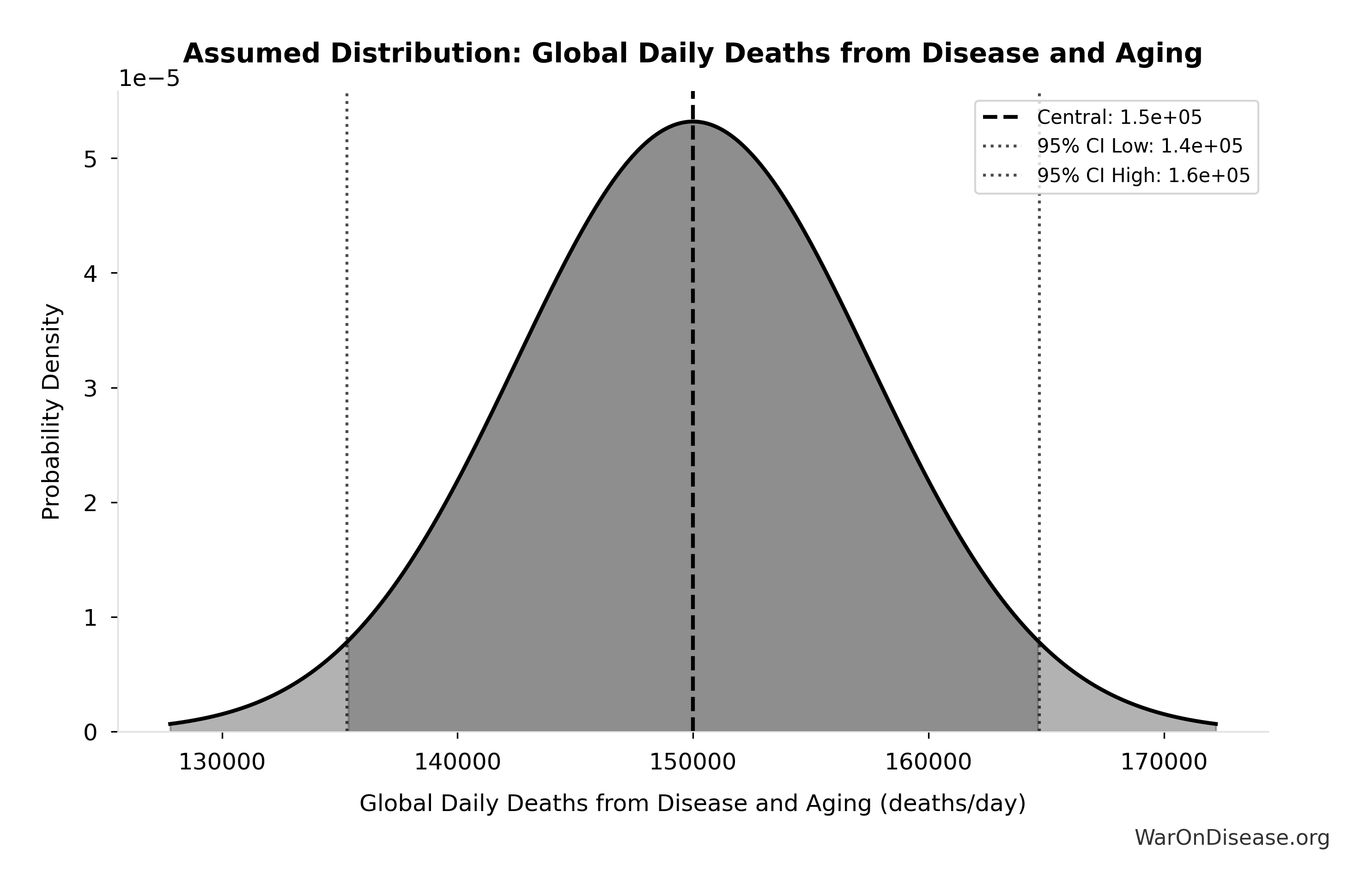

- Regulatory Delay for Efficacy Testing Post-Safety Verification 📊: 8.2 years (SE: ±2 years)

- Global Daily Deaths from Disease and Aging 📊: 150 thousand deaths/day (SE: ±7.50 thousand deaths/day)

\[ \begin{gathered} Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \end{gathered} \]

~ Medium confidence

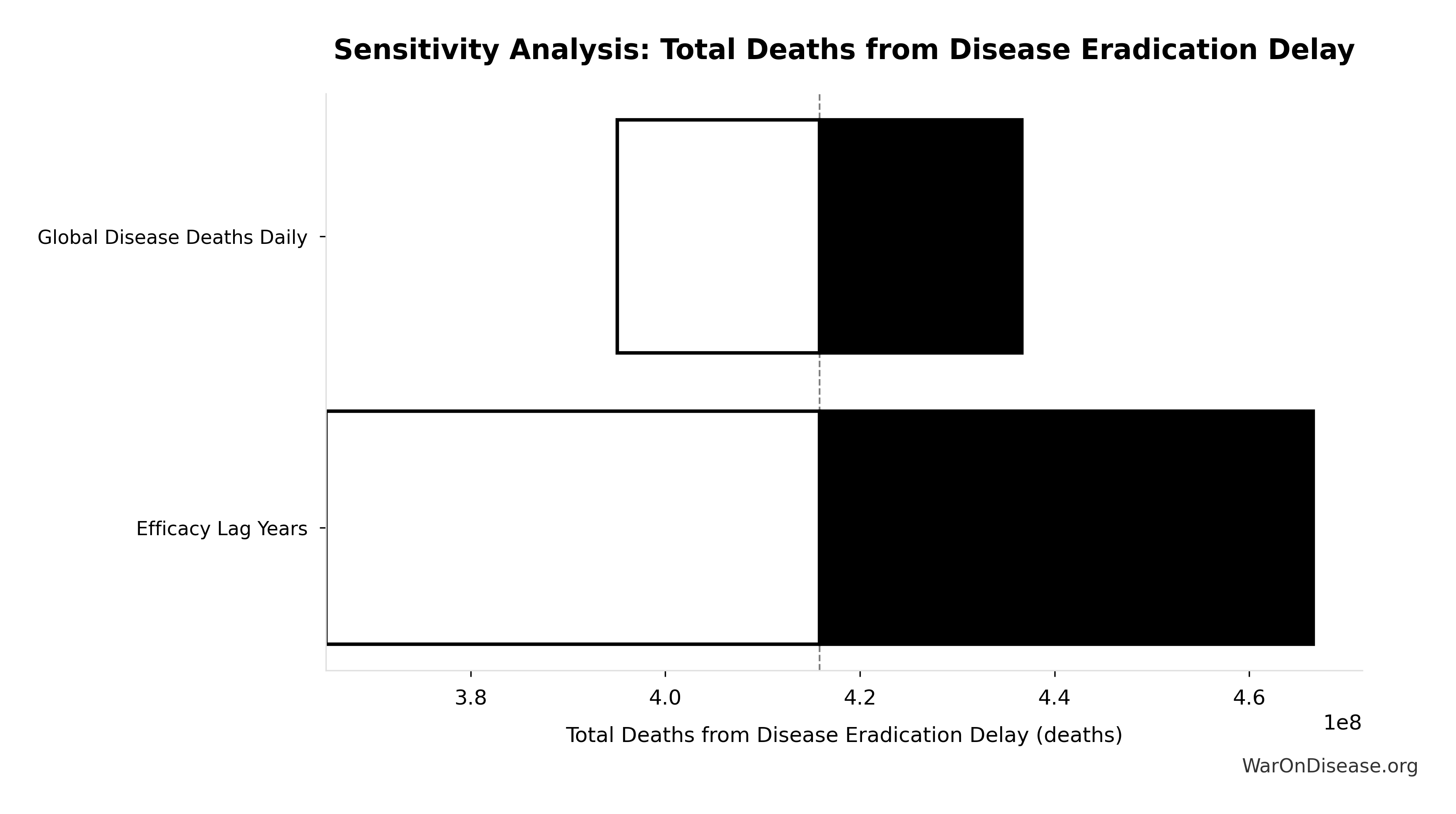

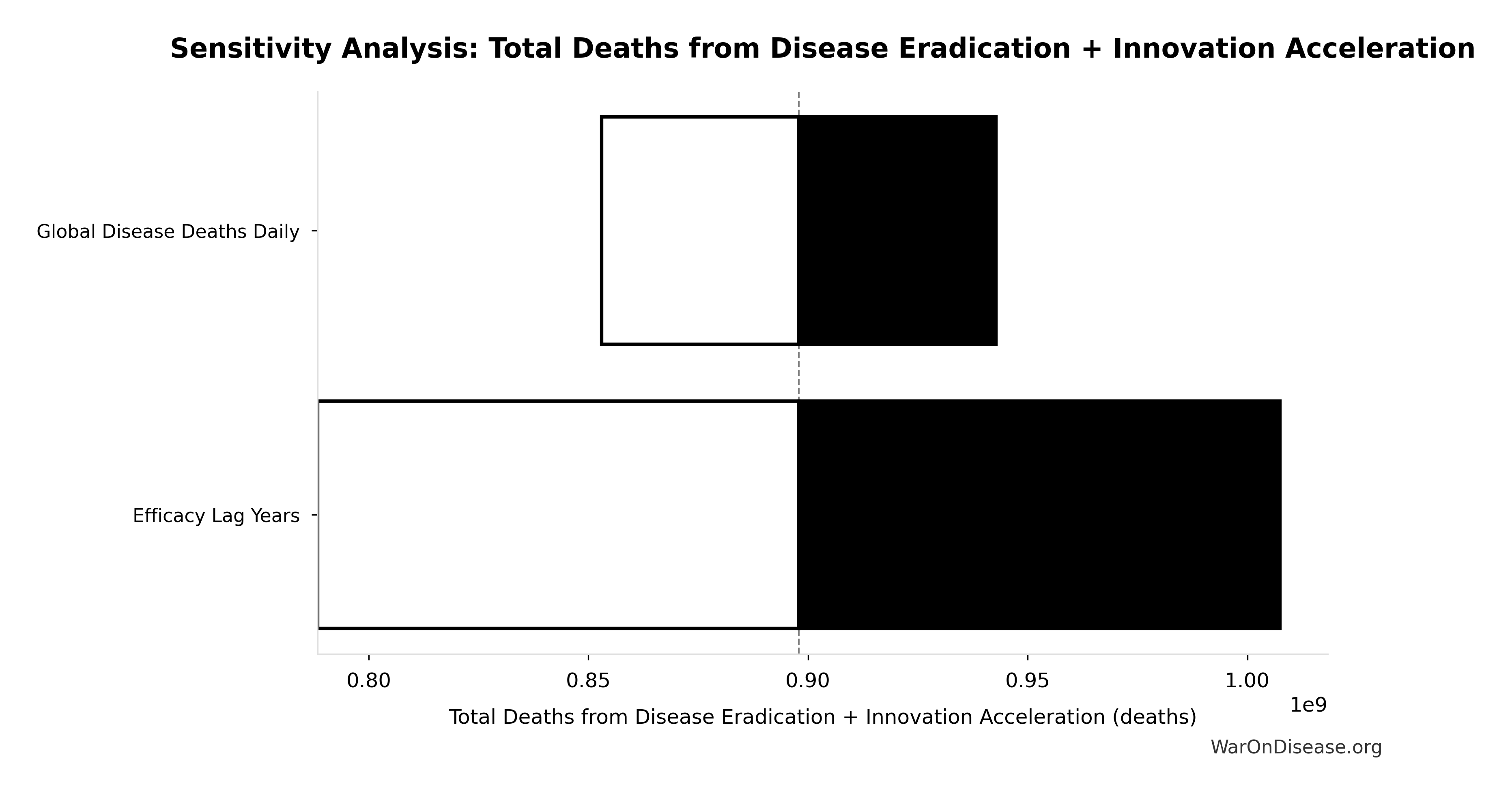

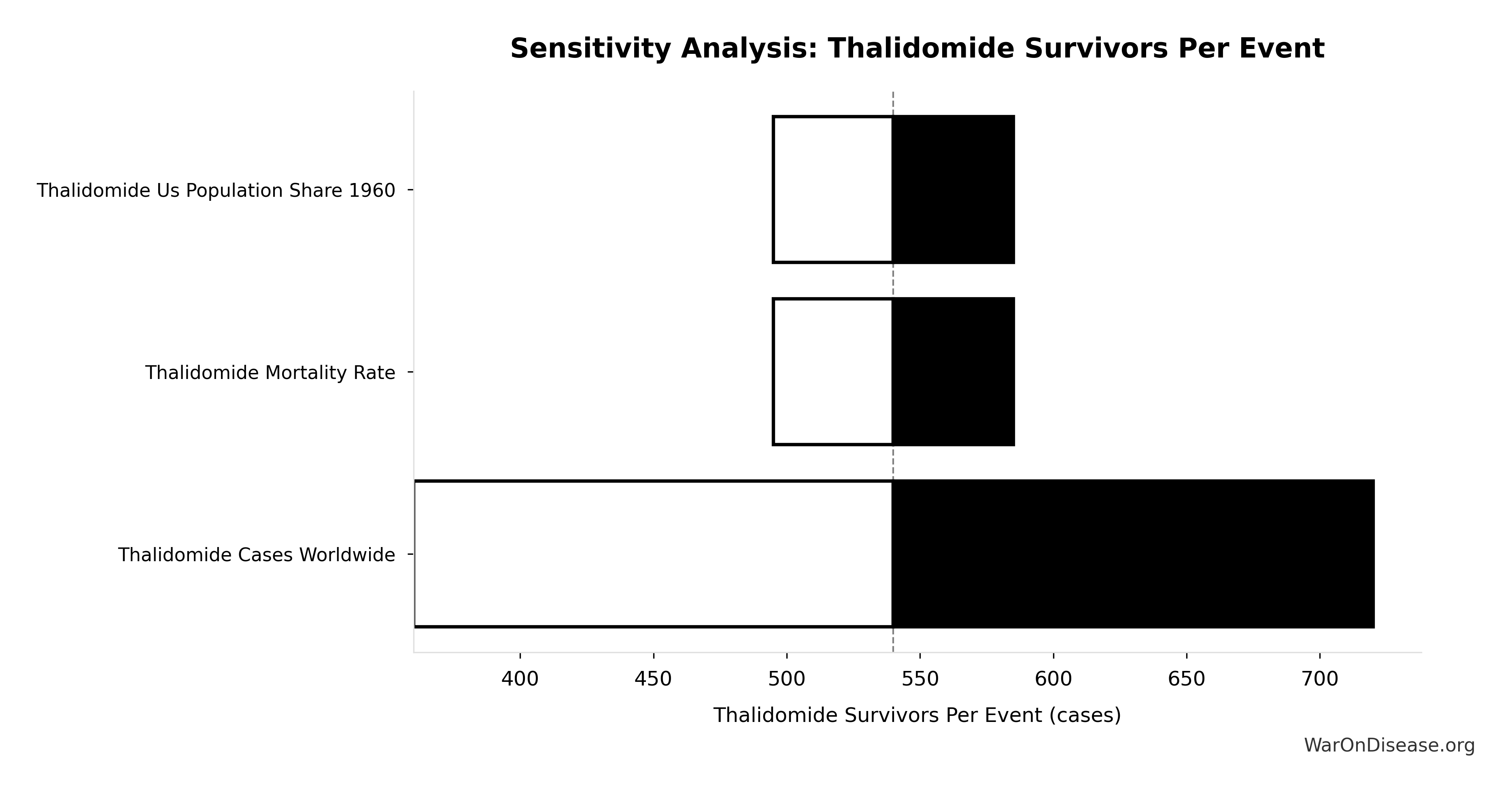

Sensitivity Analysis

Sensitivity Indices for Total Deaths from Disease Eradication Delay

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| Efficacy Lag Years | 1.1404 | Strong driver |

| Global Disease Deaths Daily | -0.1422 | Weak driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

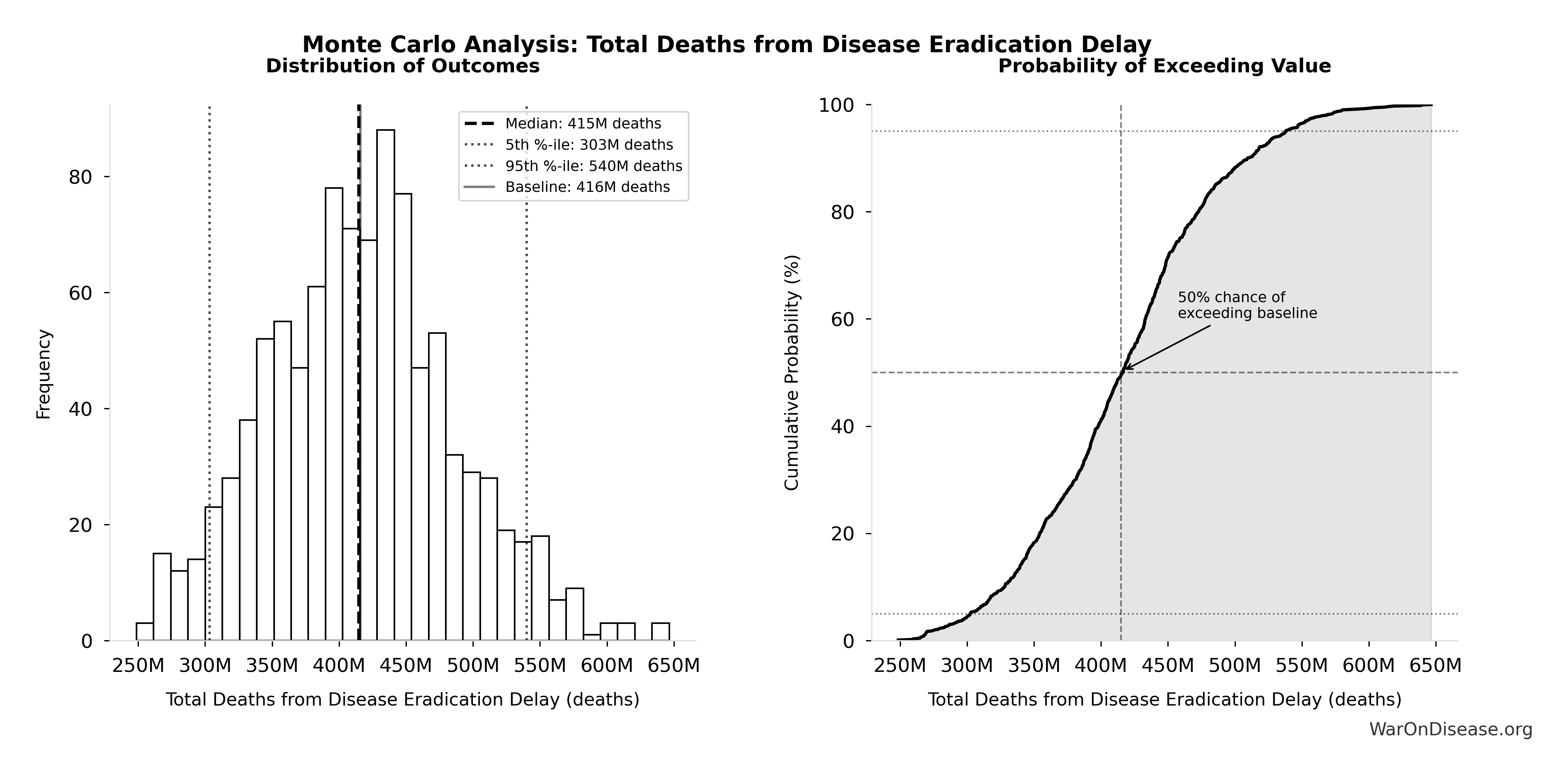

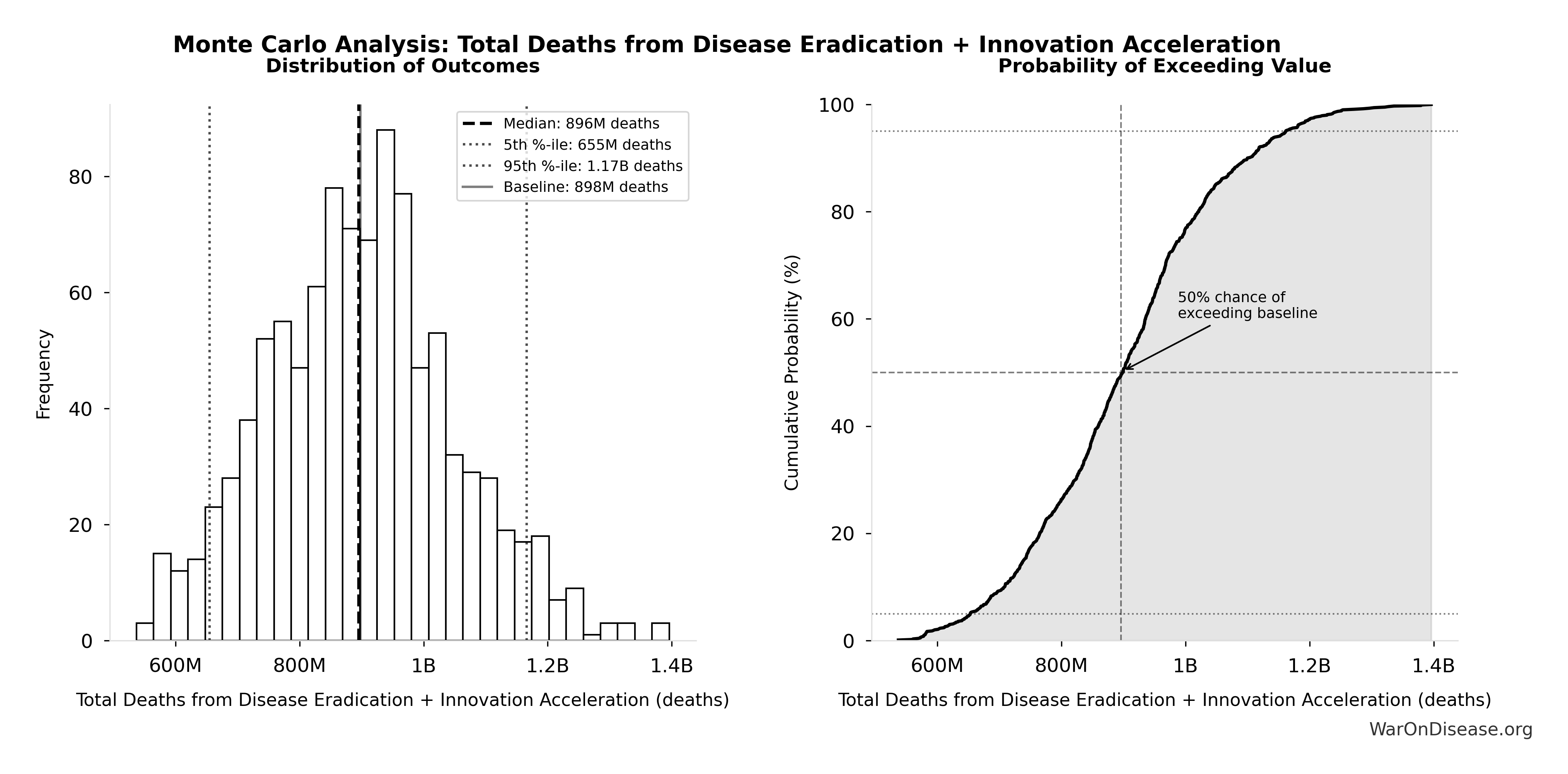

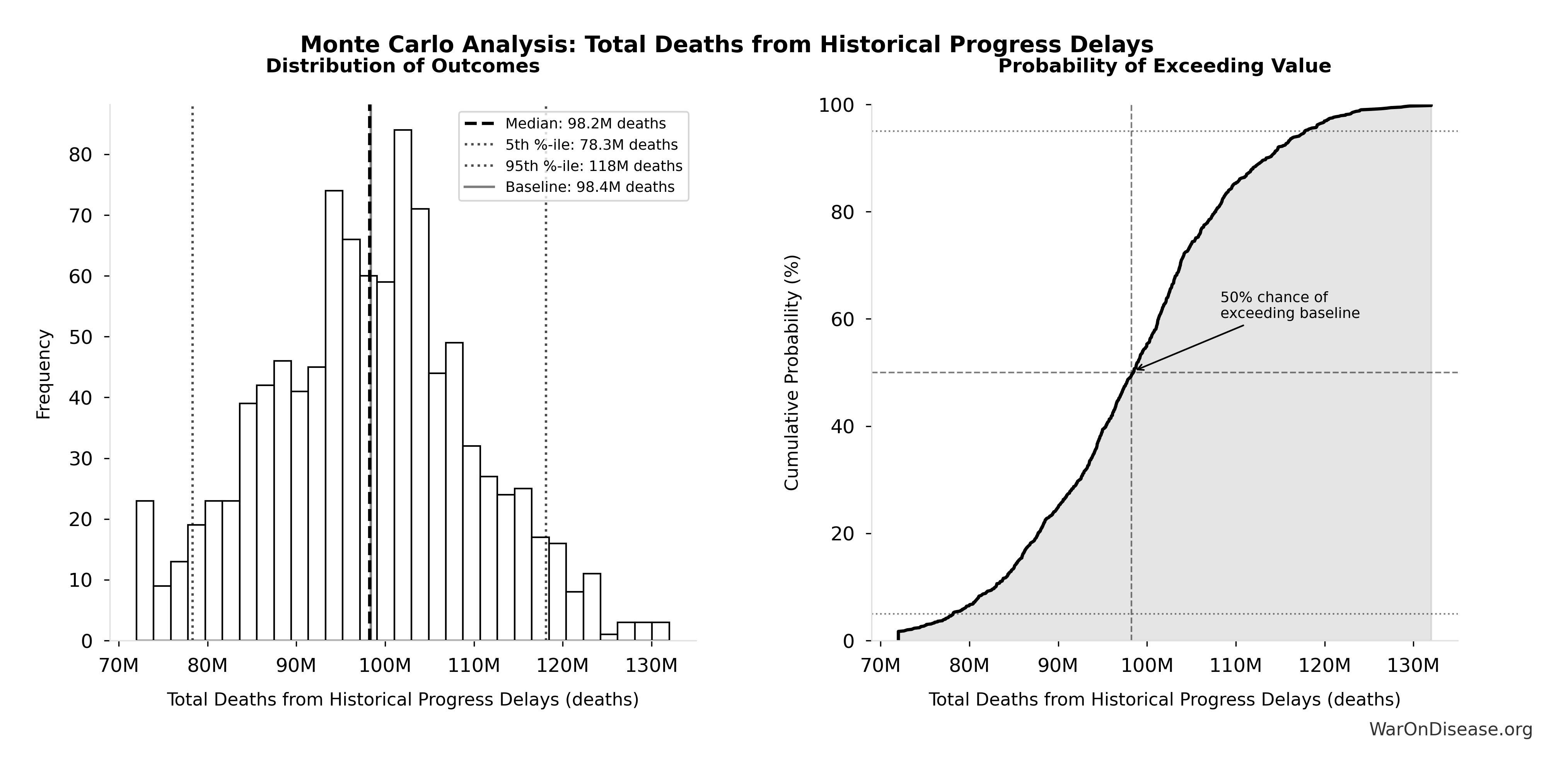

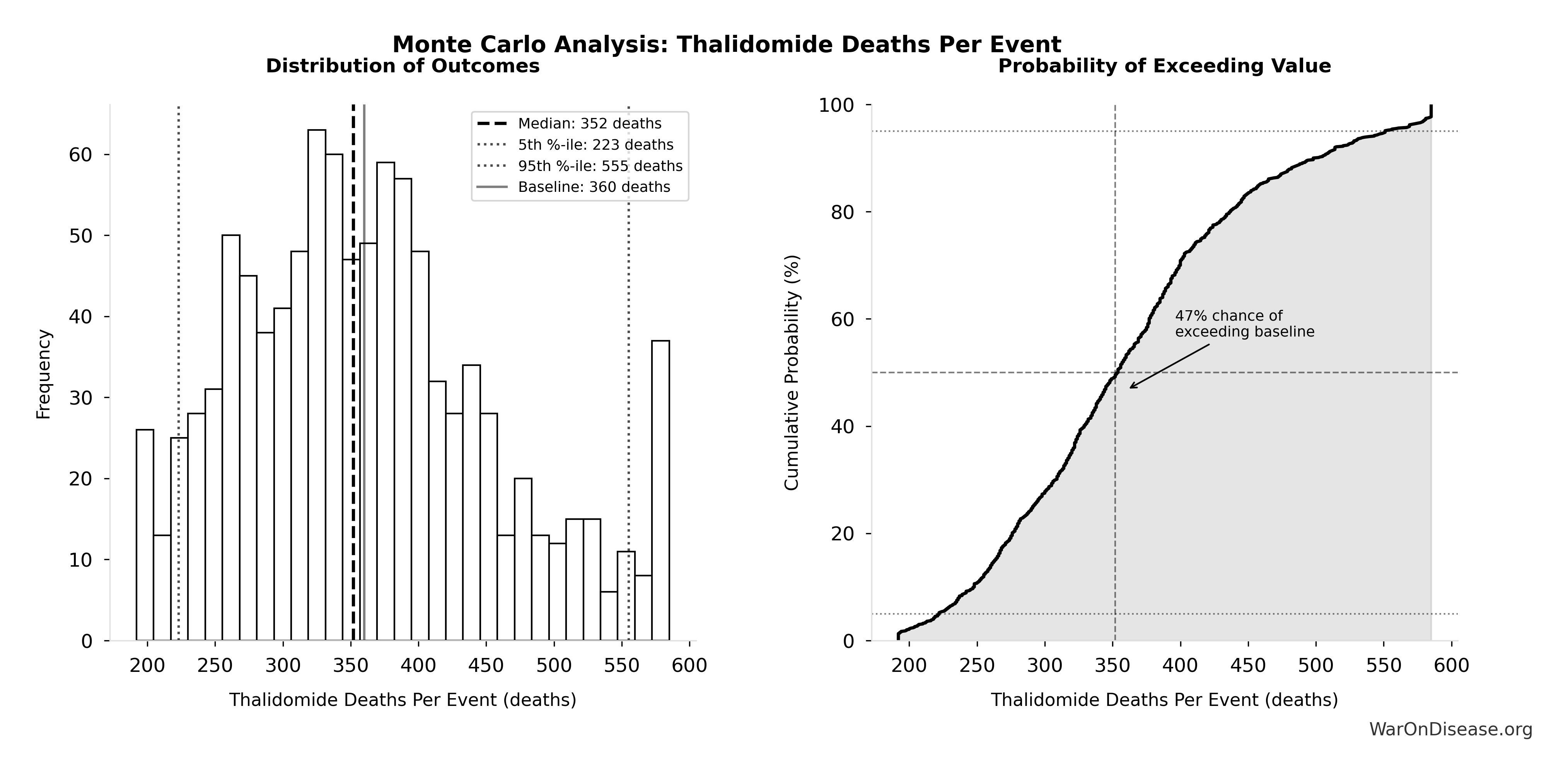

Monte Carlo Distribution

Simulation Results Summary: Total Deaths from Disease Eradication Delay

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 416 million |

| Mean (expected value) | 420 million |

| Median (50th percentile) | 414 million |

| Standard Deviation | 122 million |

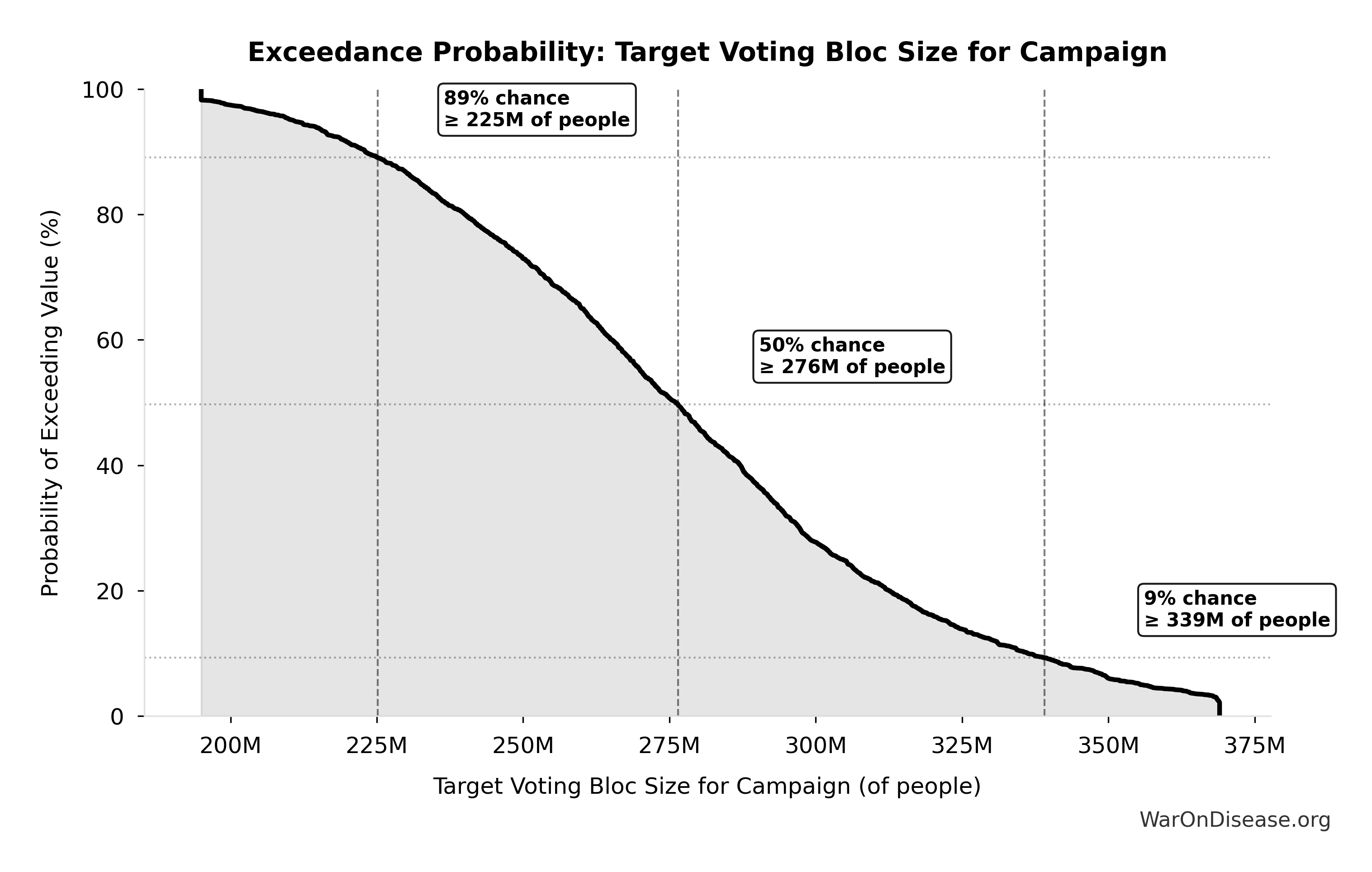

| 90% Range (5th-95th percentile) | [225 million, 630 million] |

The histogram shows the distribution of Total Deaths from Disease Eradication Delay across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

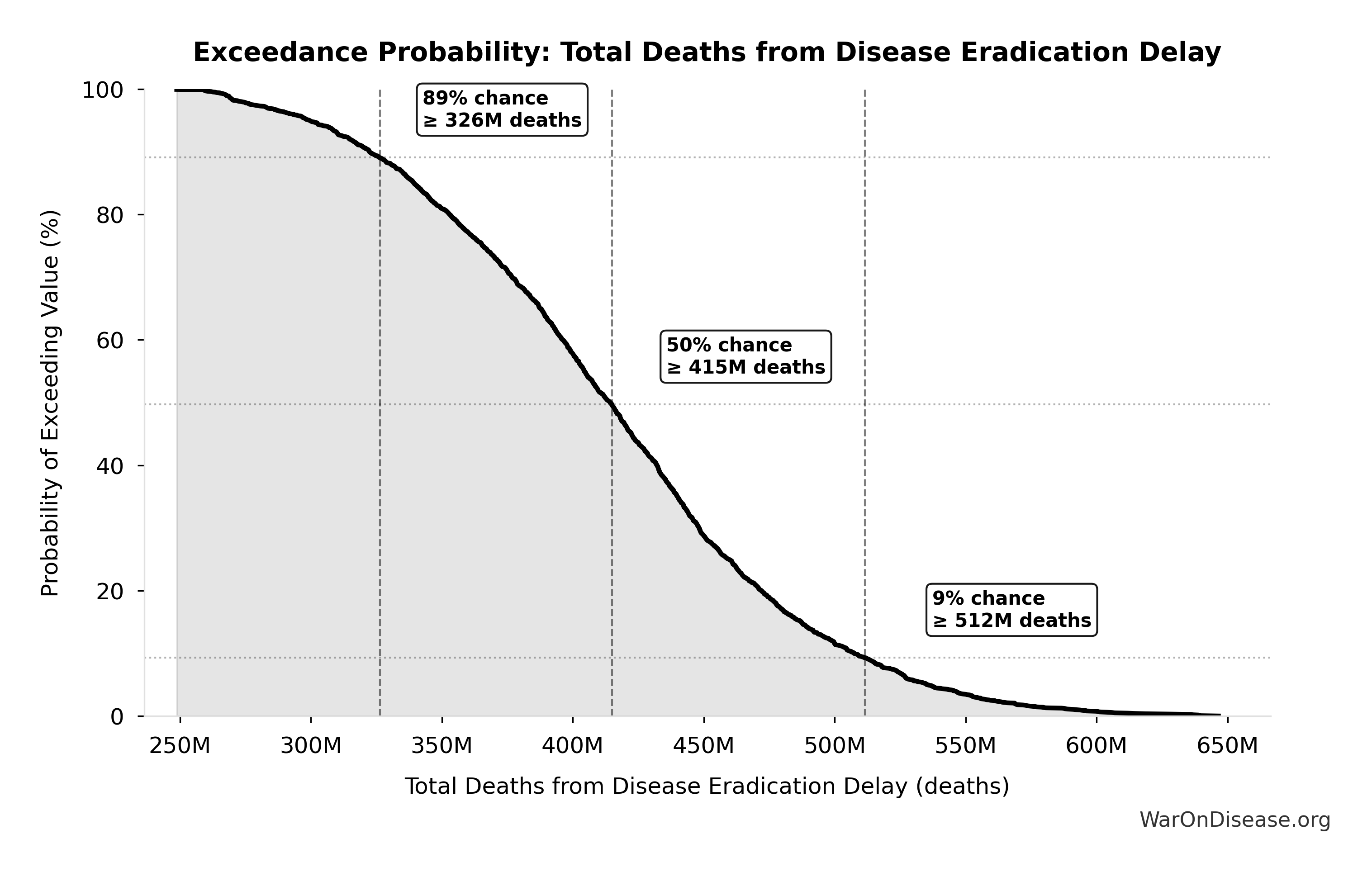

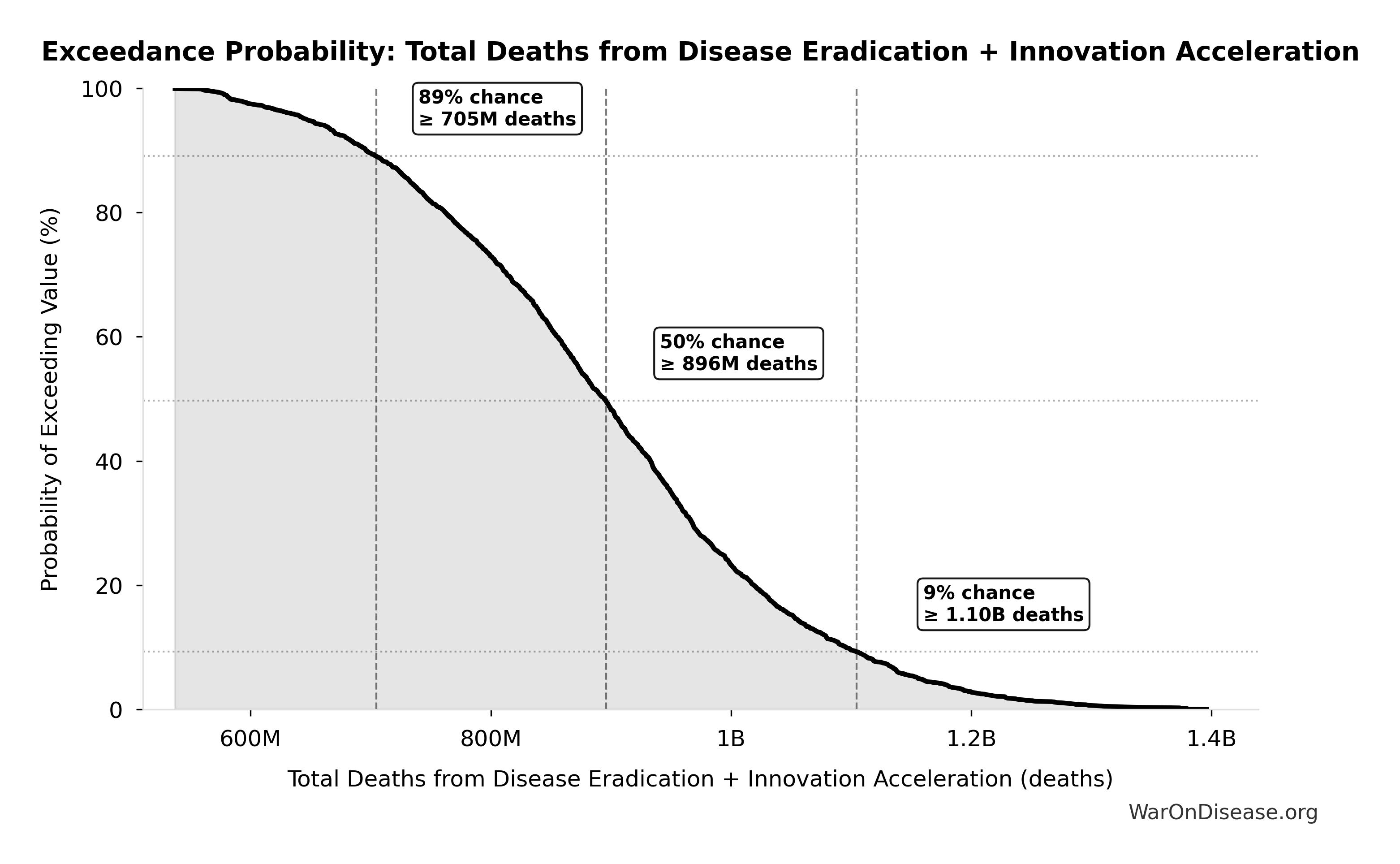

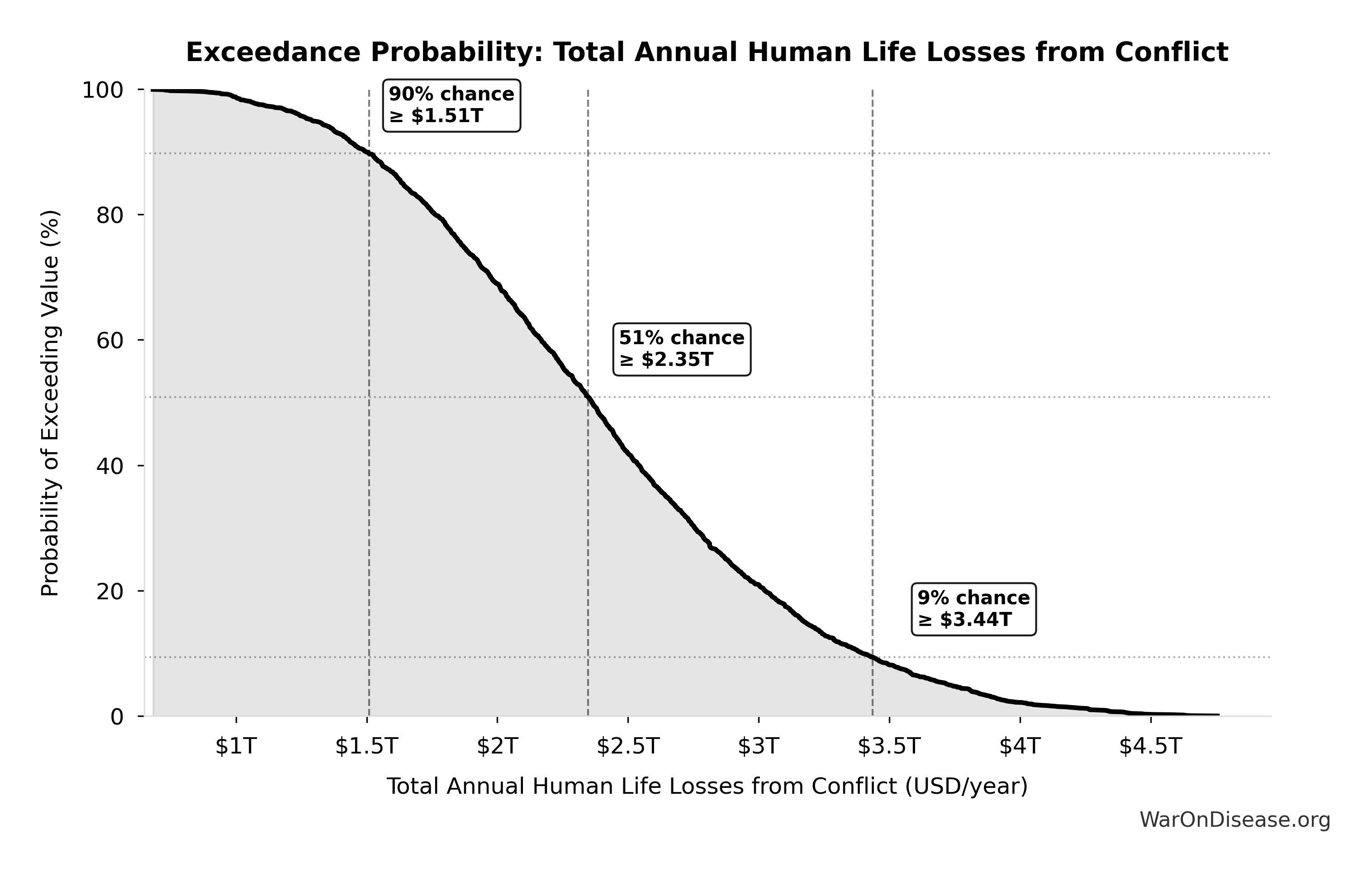

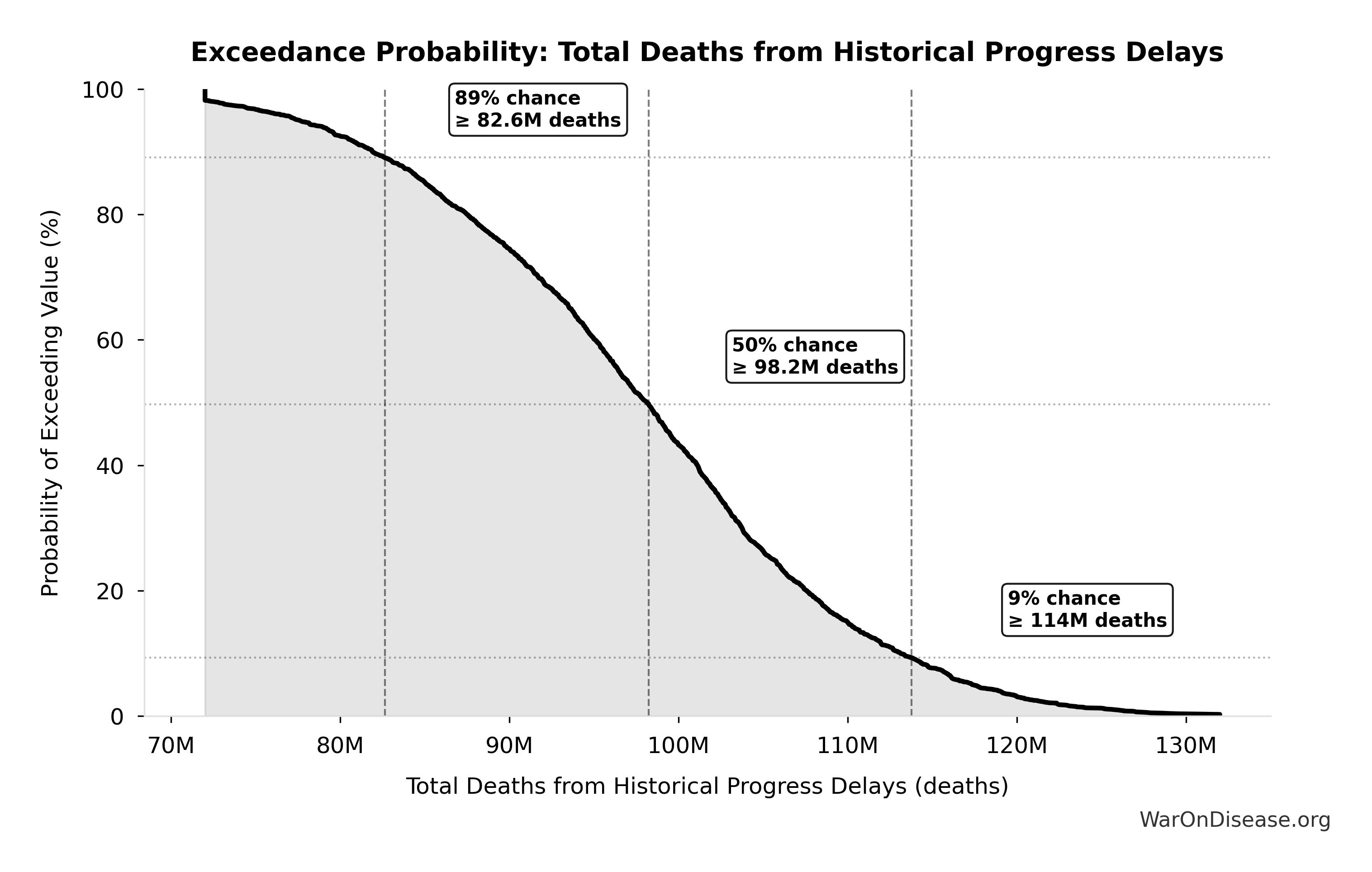

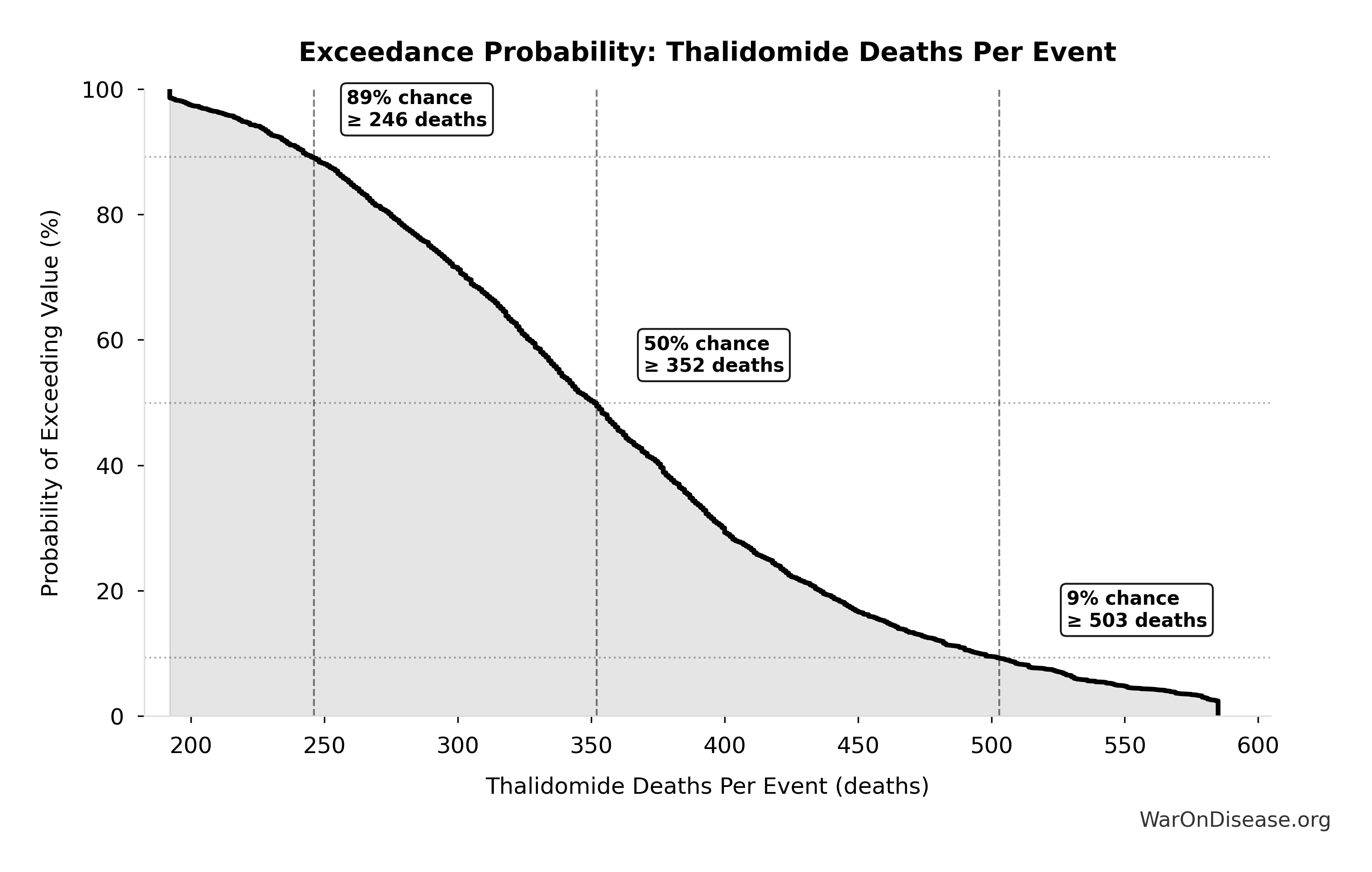

Exceedance Probability

This exceedance probability chart shows the likelihood that Total Deaths from Disease Eradication Delay will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

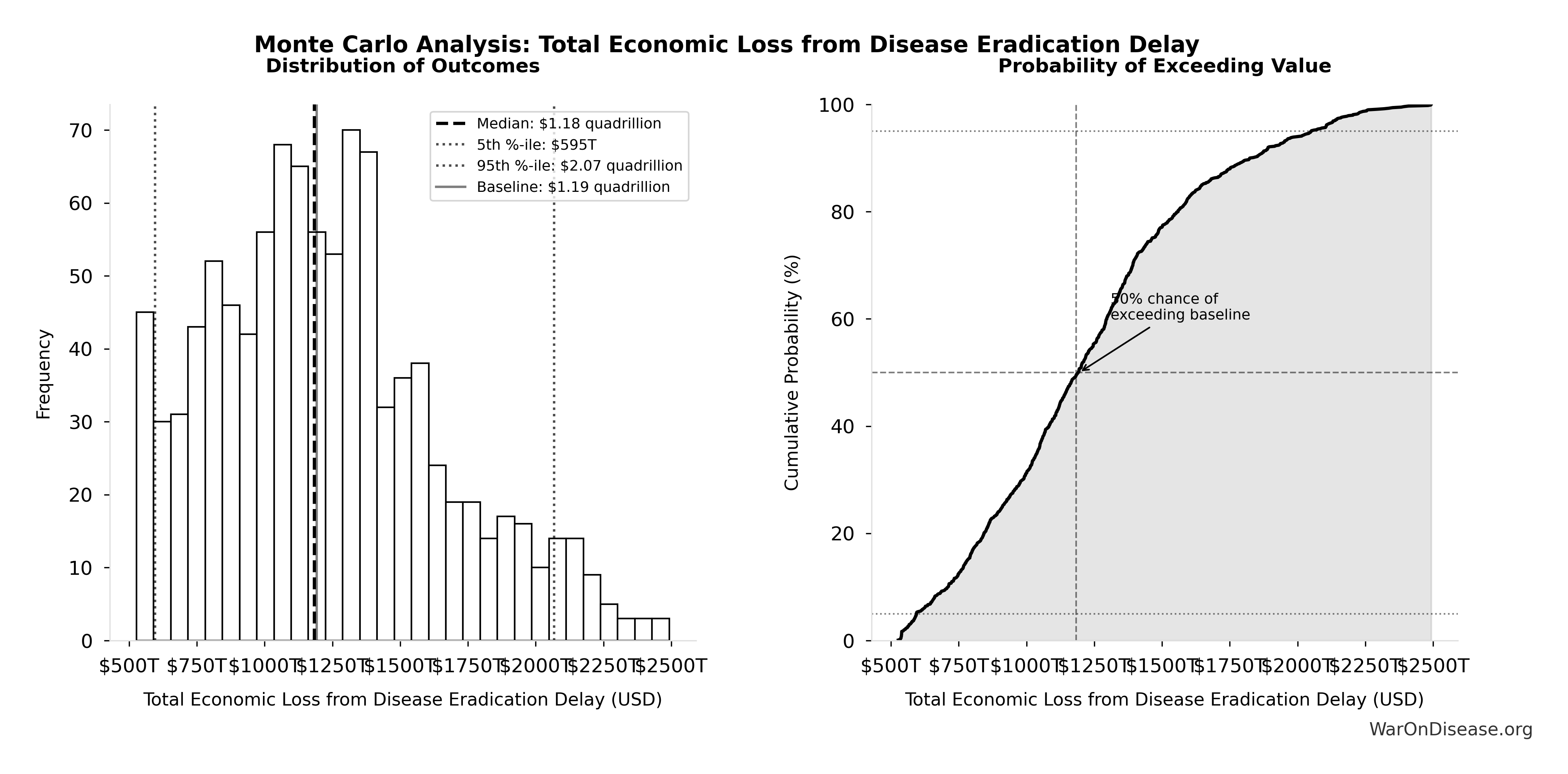

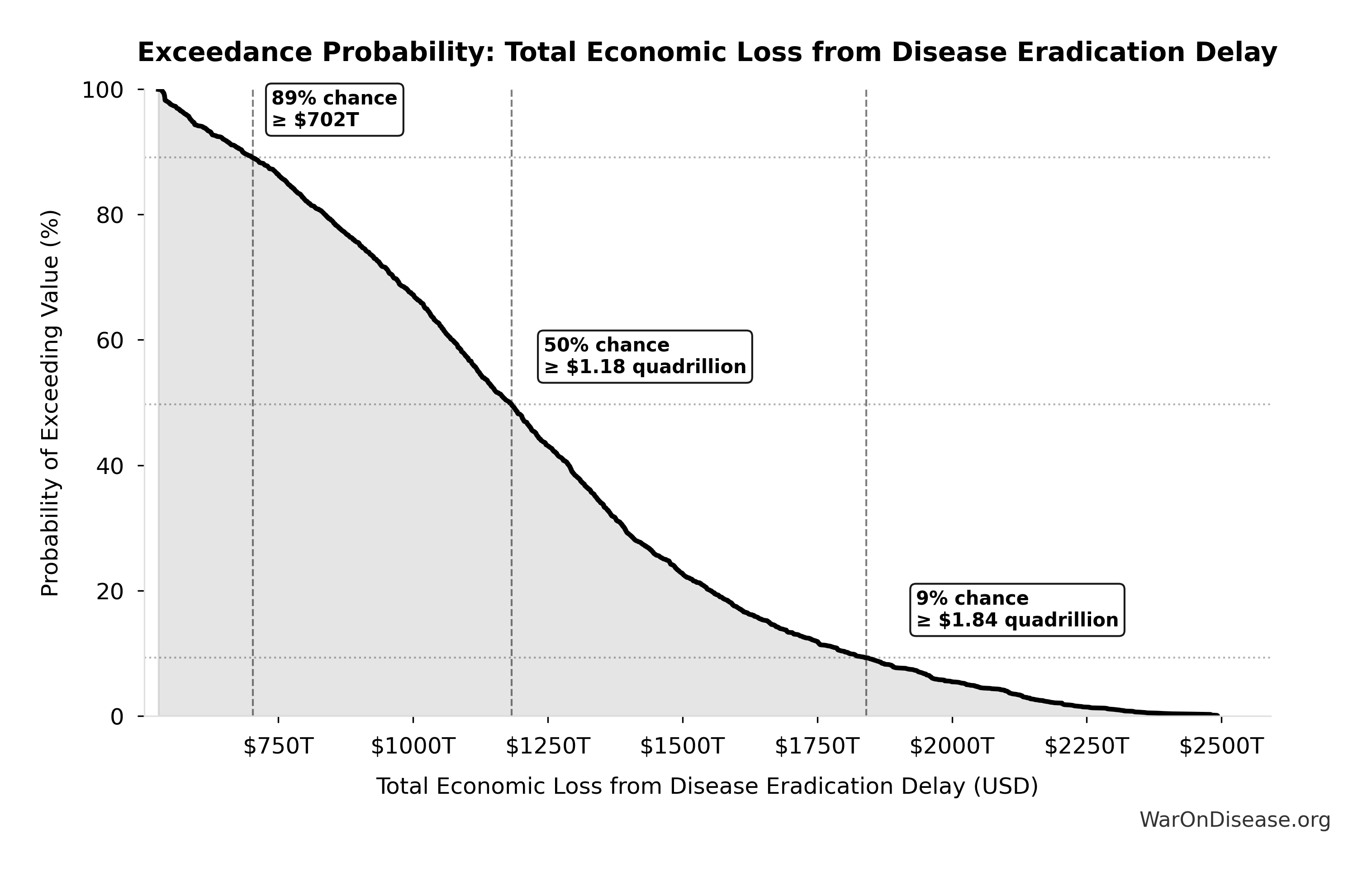

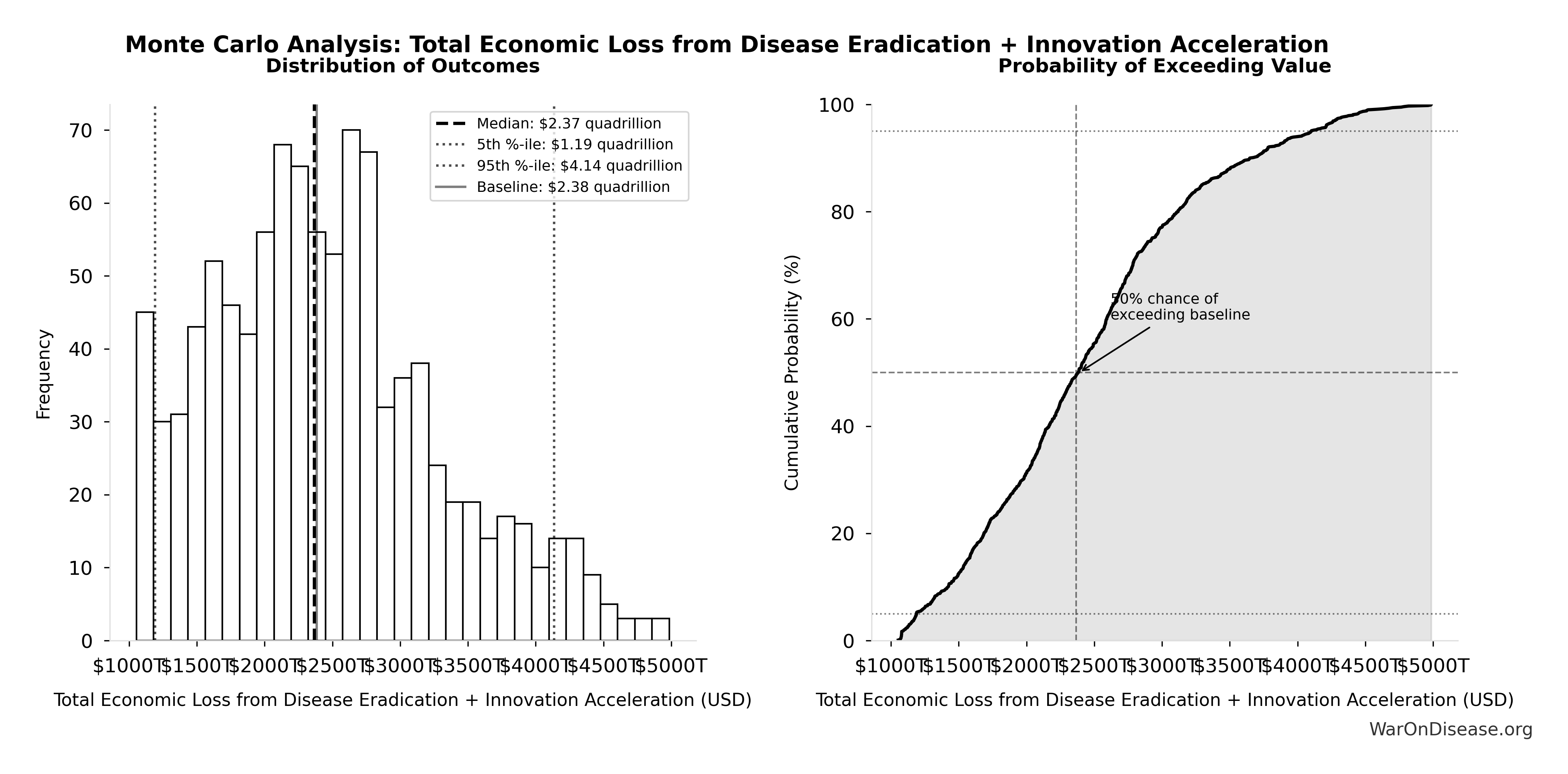

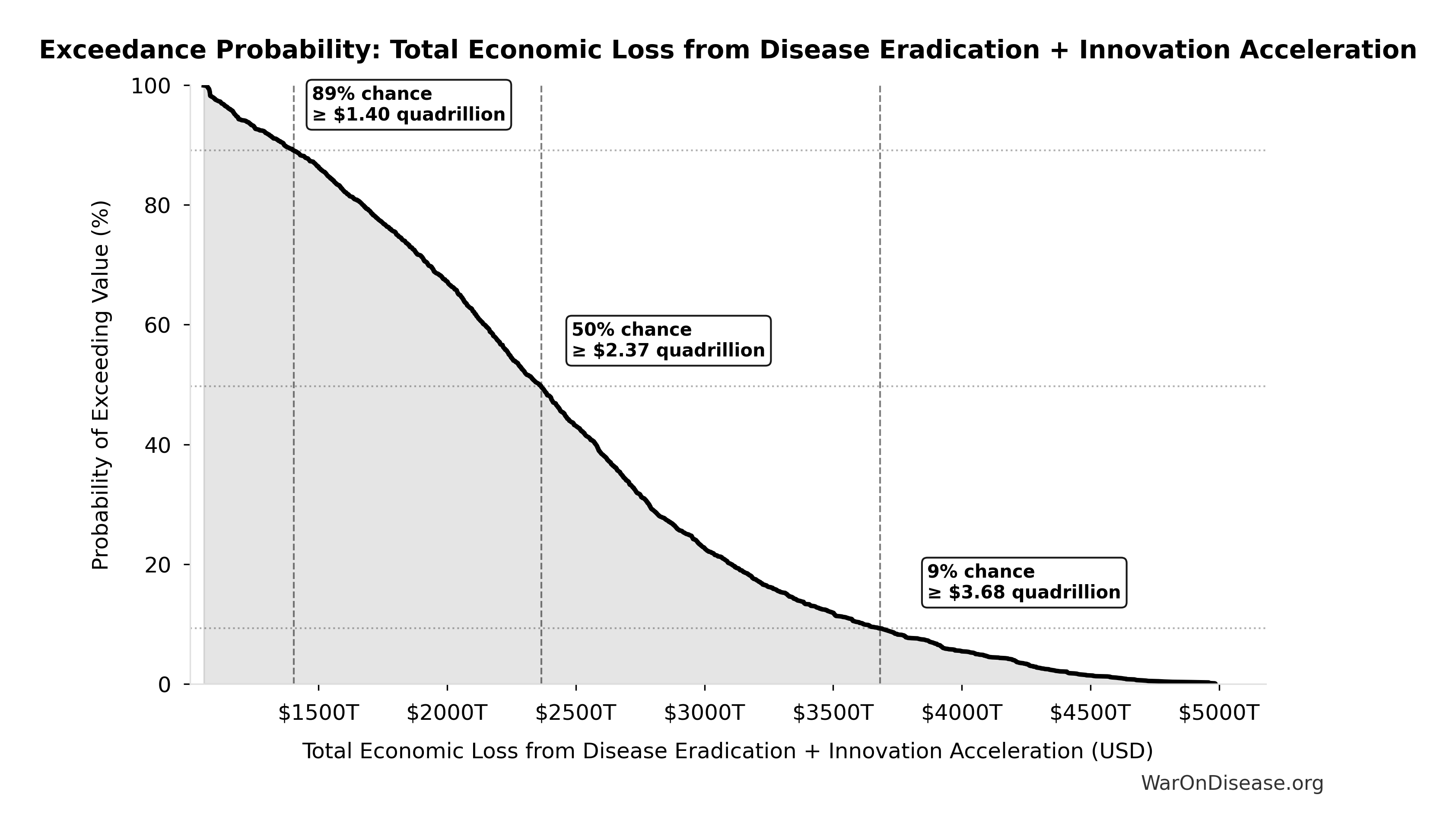

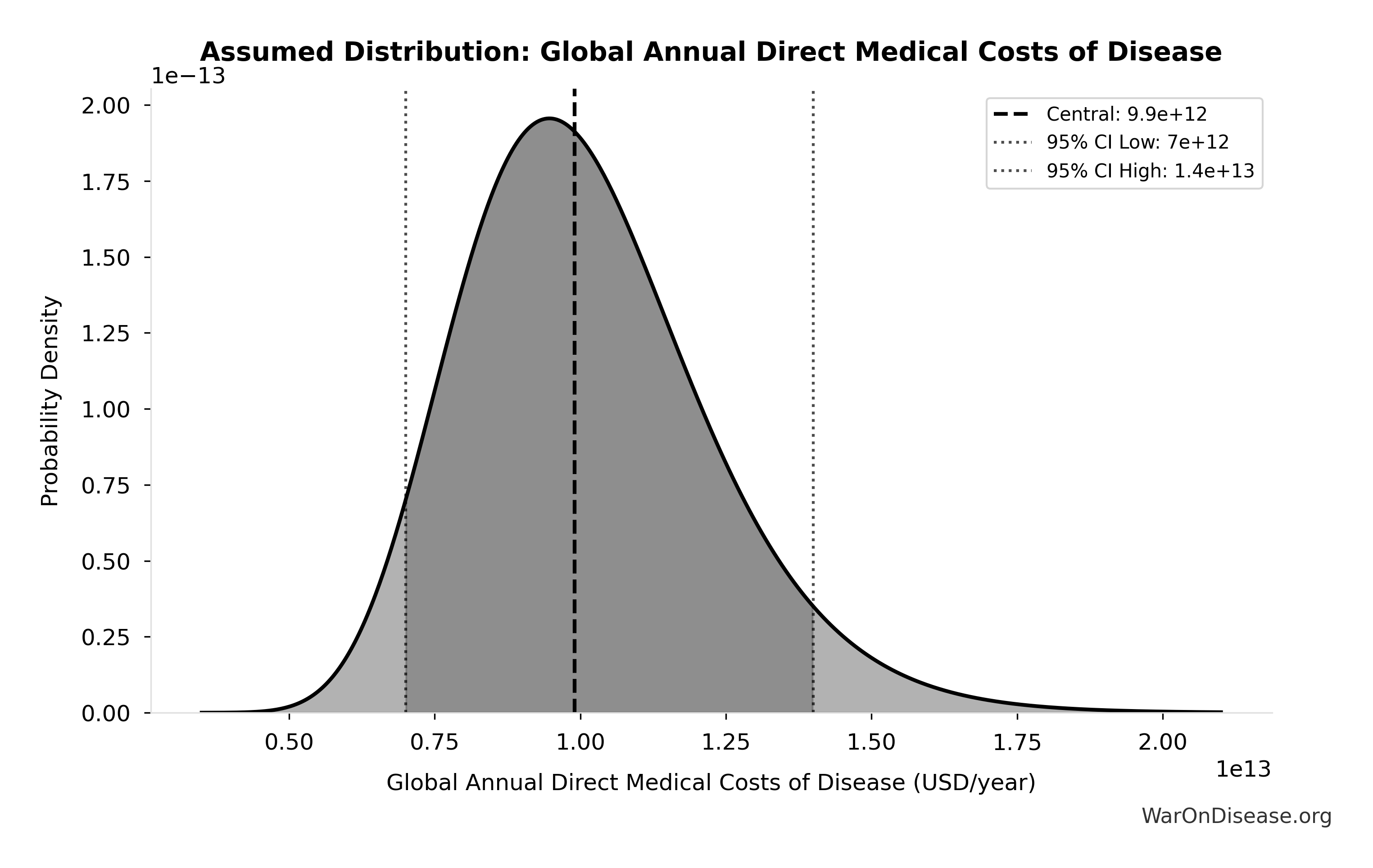

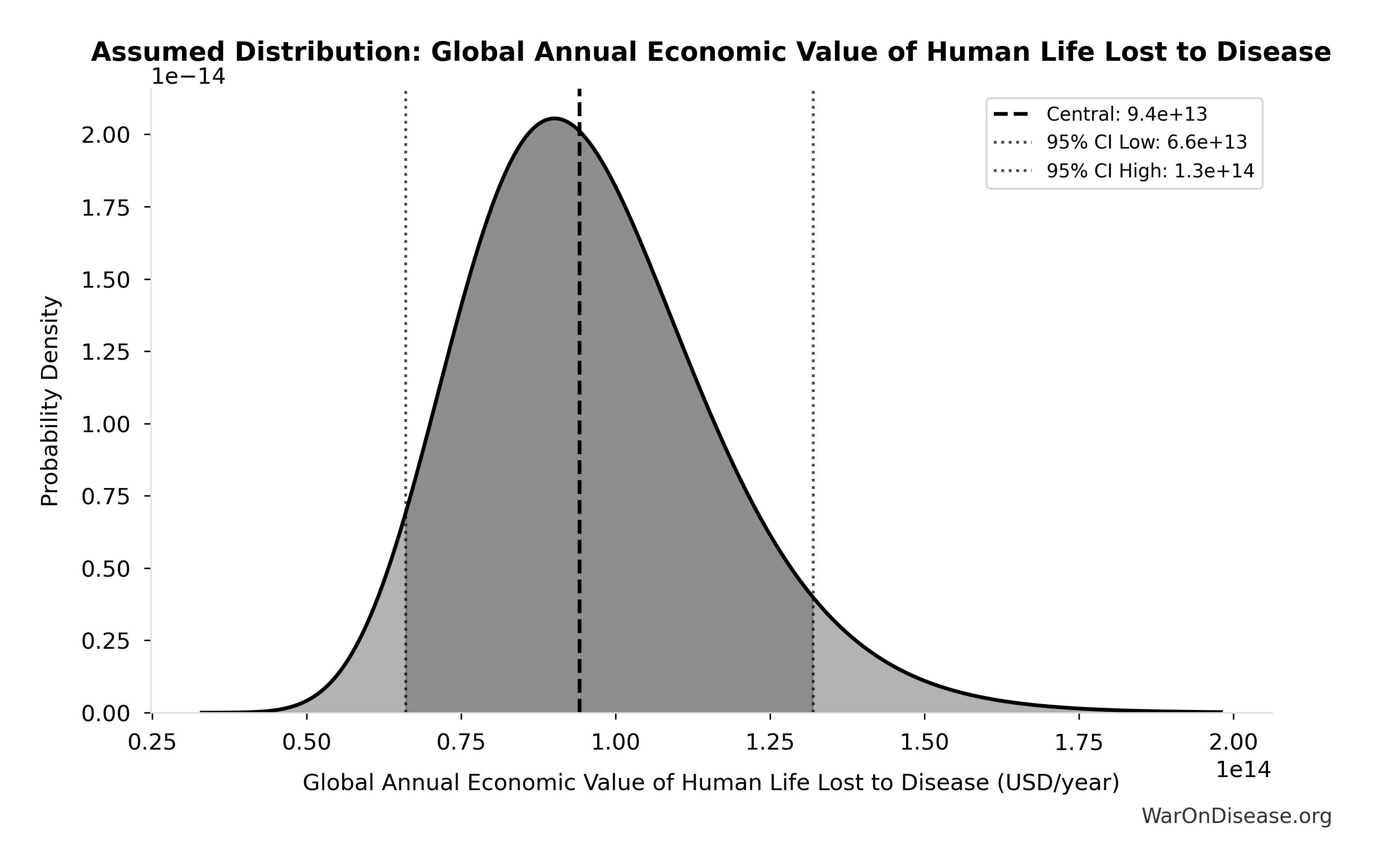

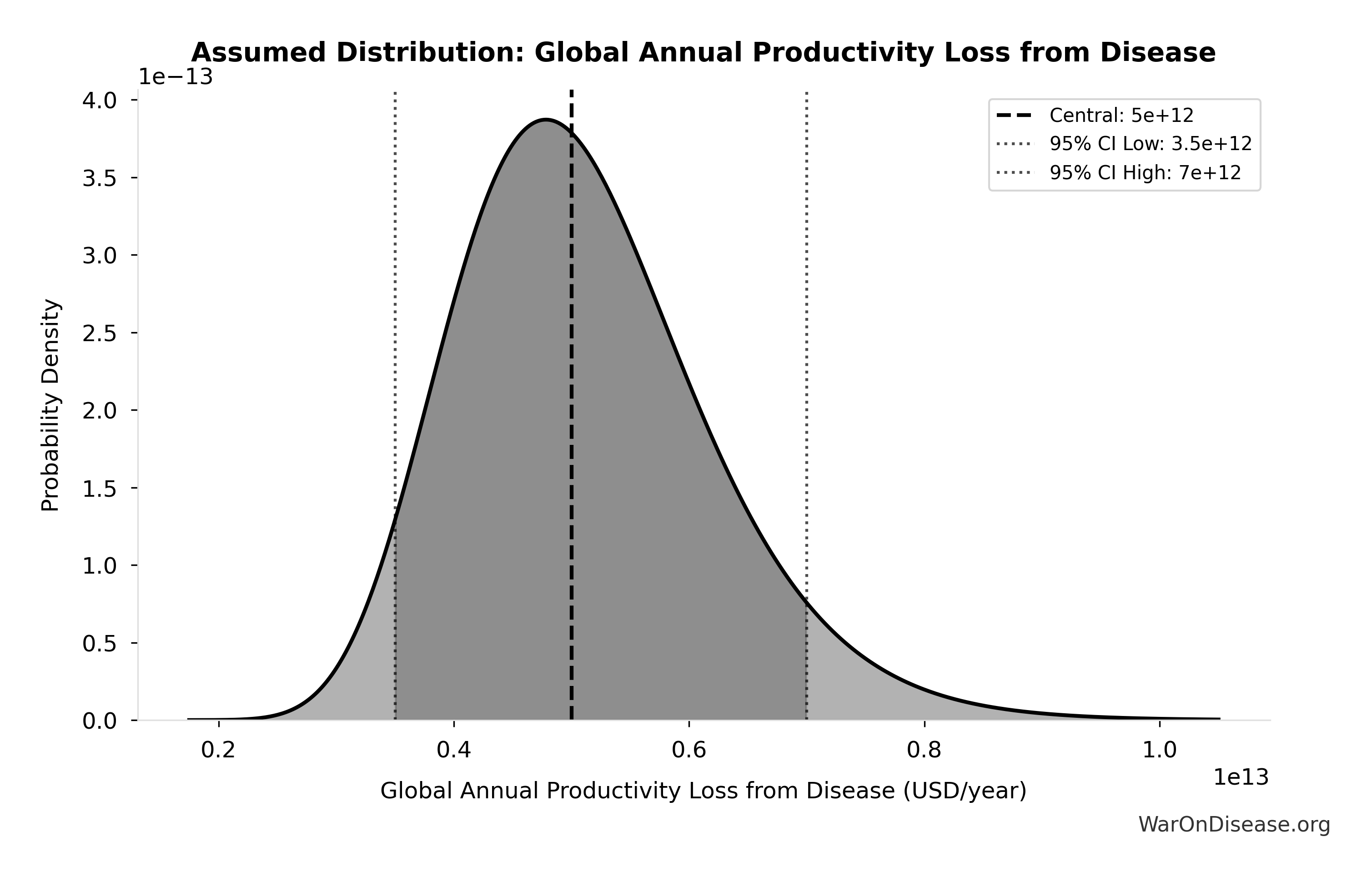

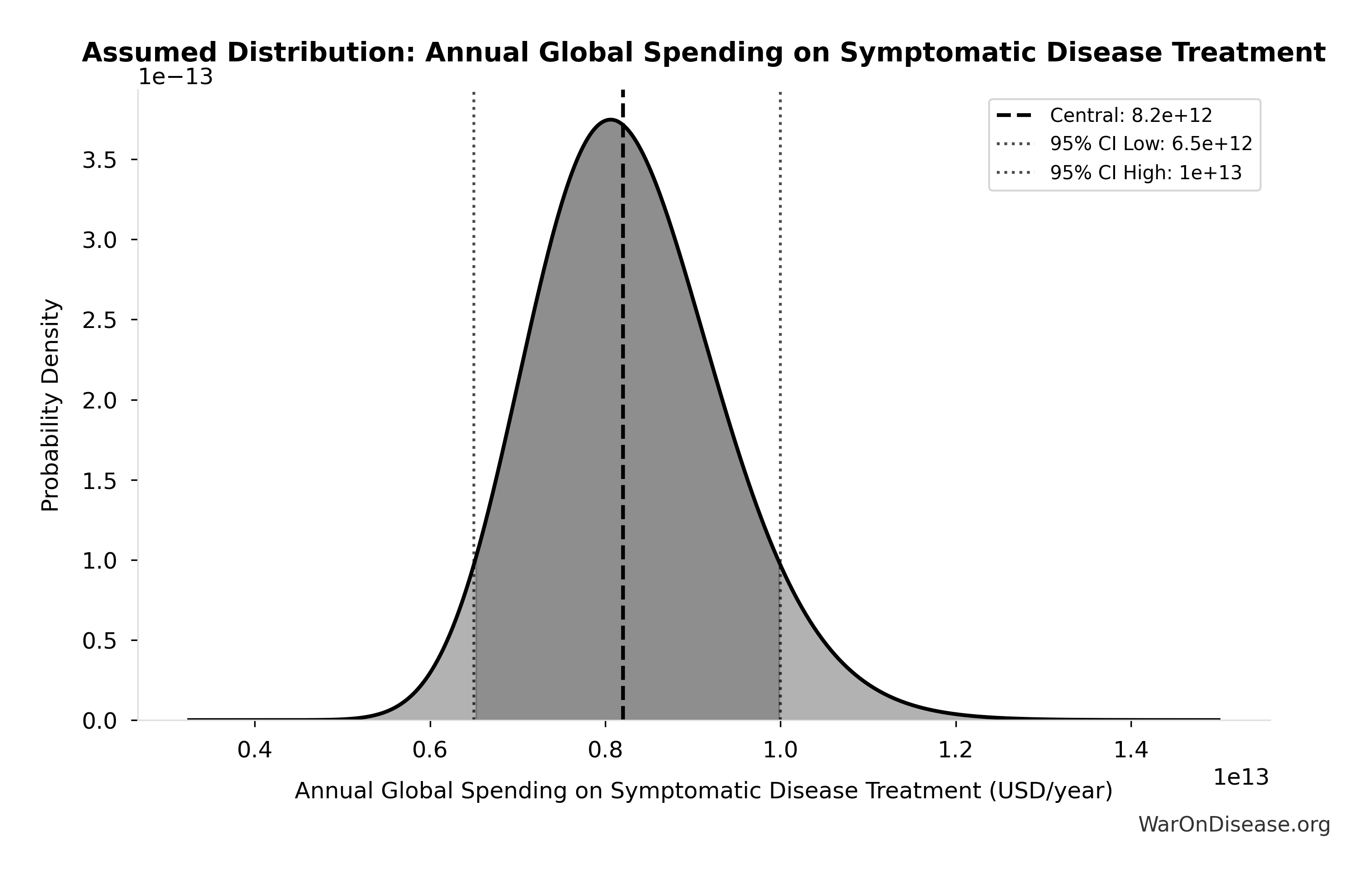

Total Economic Loss from Disease Eradication Delay: $1.19 quadrillion

Total economic loss from delaying disease eradication by 8.2 years (PRIMARY estimate, 2024 USD). Values global DALYs at standardized US/International normative rate ($150k) rather than local ability-to-pay, representing the full human capital loss.

Inputs:

- Total DALYs Lost from Disease Eradication Delay 🔢: 7.94 billion DALYs

- Standard Economic Value per QALY 📊: $150K (SE: ±$30K)

\[ \begin{gathered} Value_{lag} \\ = DALYs_{lag} \times Value_{QALY} \\ = 7.94B \times \$150K \\ = \$1190T \\[0.5em] \text{where } DALYs_{lag} = YLL_{lag} + YLD_{lag} = 7.07B + 873M = 7.94B \\[0.5em] \text{where } YLL_{lag} \\ = Deaths_{lag} \times (LE_{global} - Age_{death,delay}) \\ = 416M \times (79 - 62) \\ = 7.07B \\[0.5em] \text{where } Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \\[0.5em] \text{where } YLD_{lag} \\ = Deaths_{lag} \times T_{suffering} \times DW_{chronic} \\ = 416M \times 6 \times 0.35 \\ = 873M \\[0.5em] \text{where } Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \end{gathered} \]

~ Medium confidence

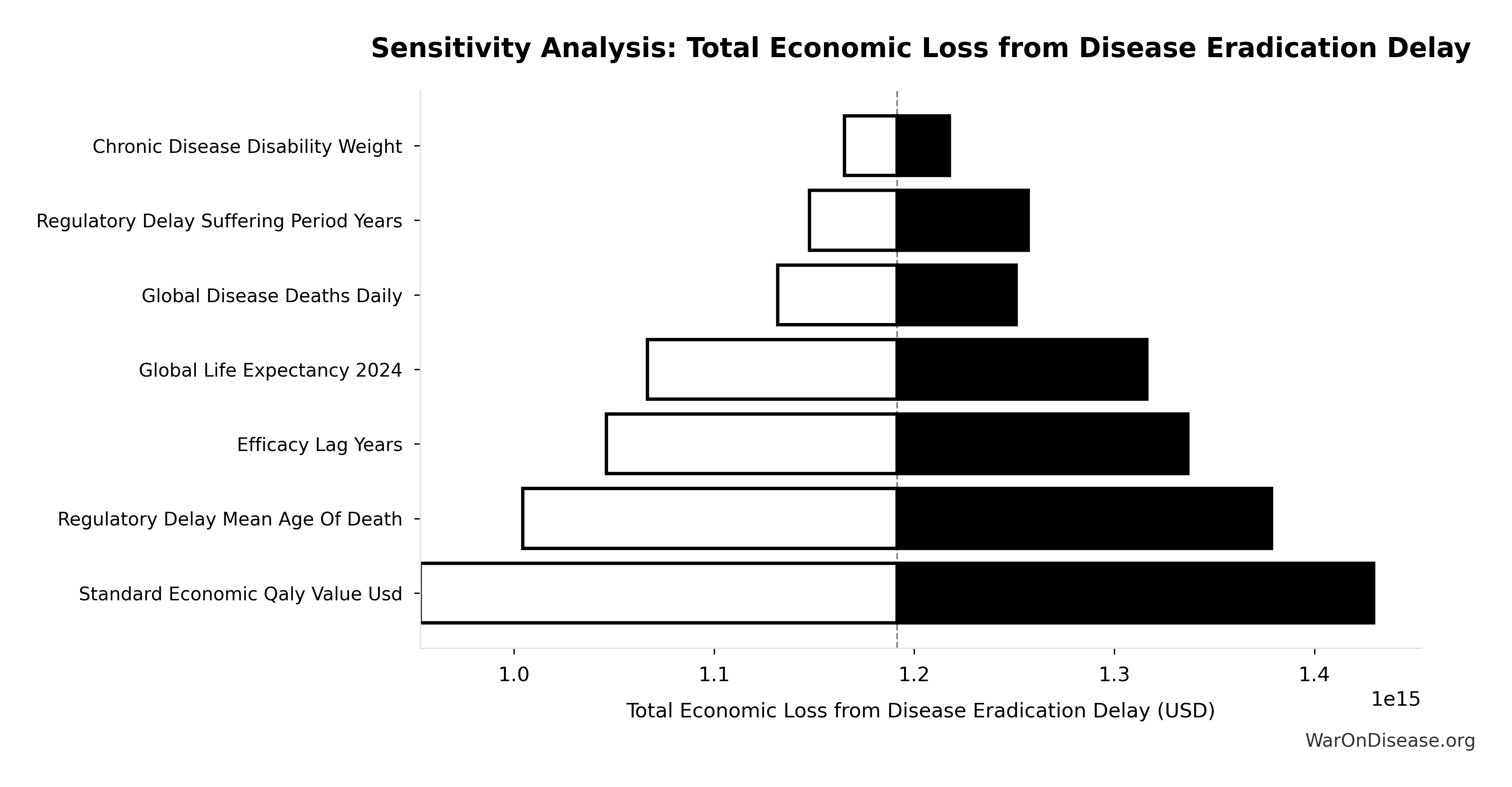

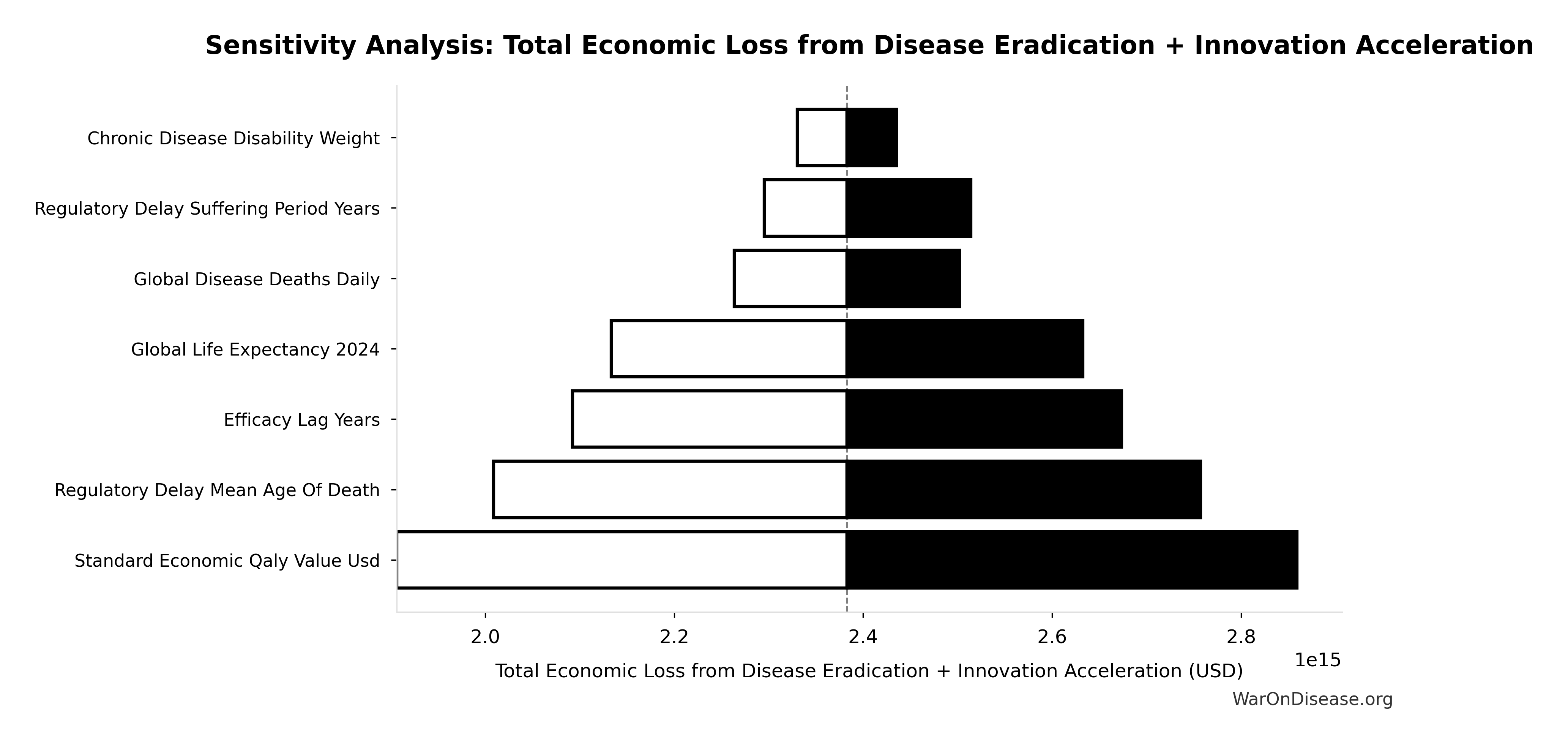

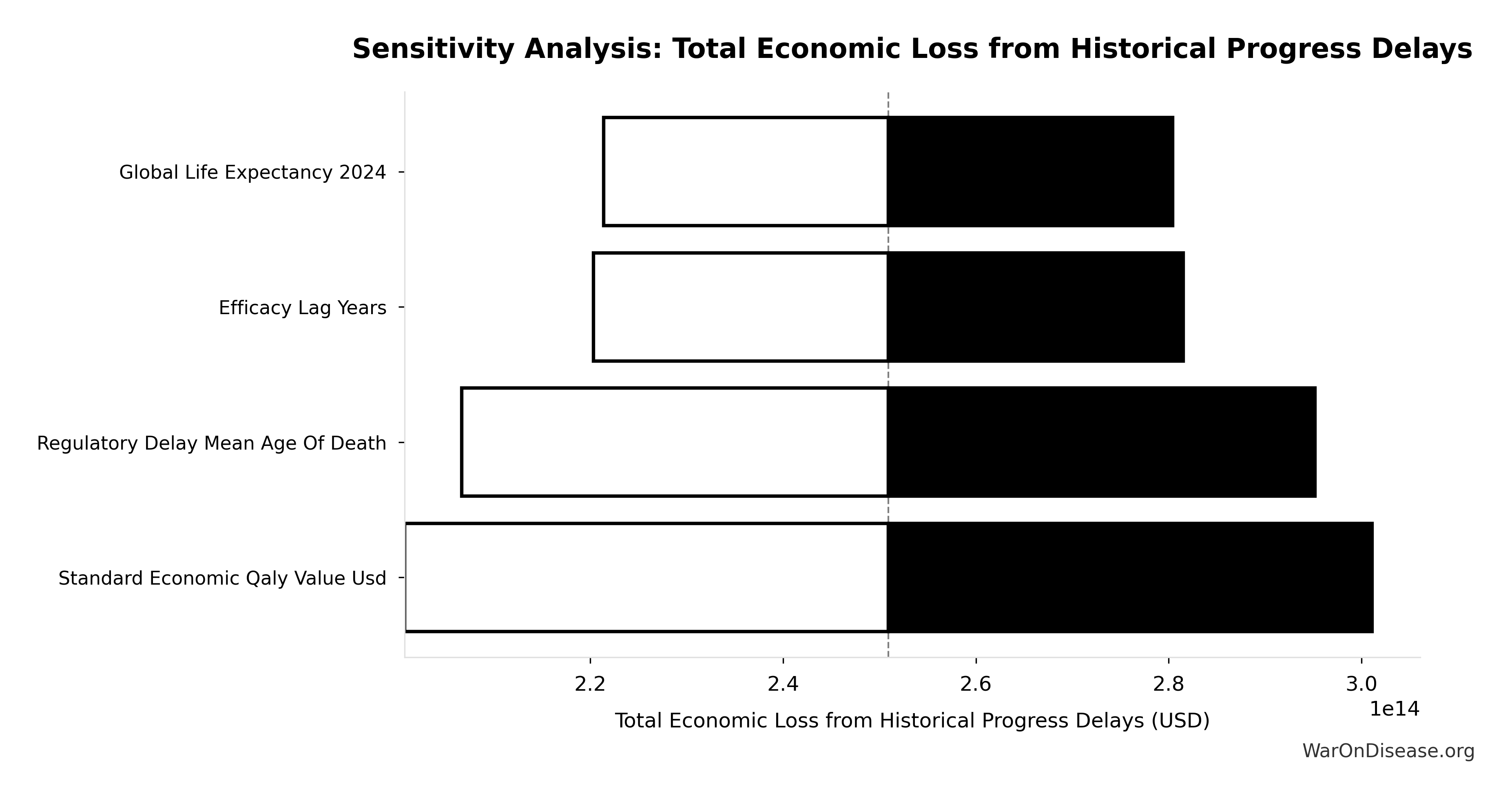

Sensitivity Analysis

Sensitivity Indices for Total Economic Loss from Disease Eradication Delay

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Efficacy Lag Elimination DALYs | 1.0671 | Strong driver |

| Standard Economic QALY Value Usd | -0.0733 | Minimal effect |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

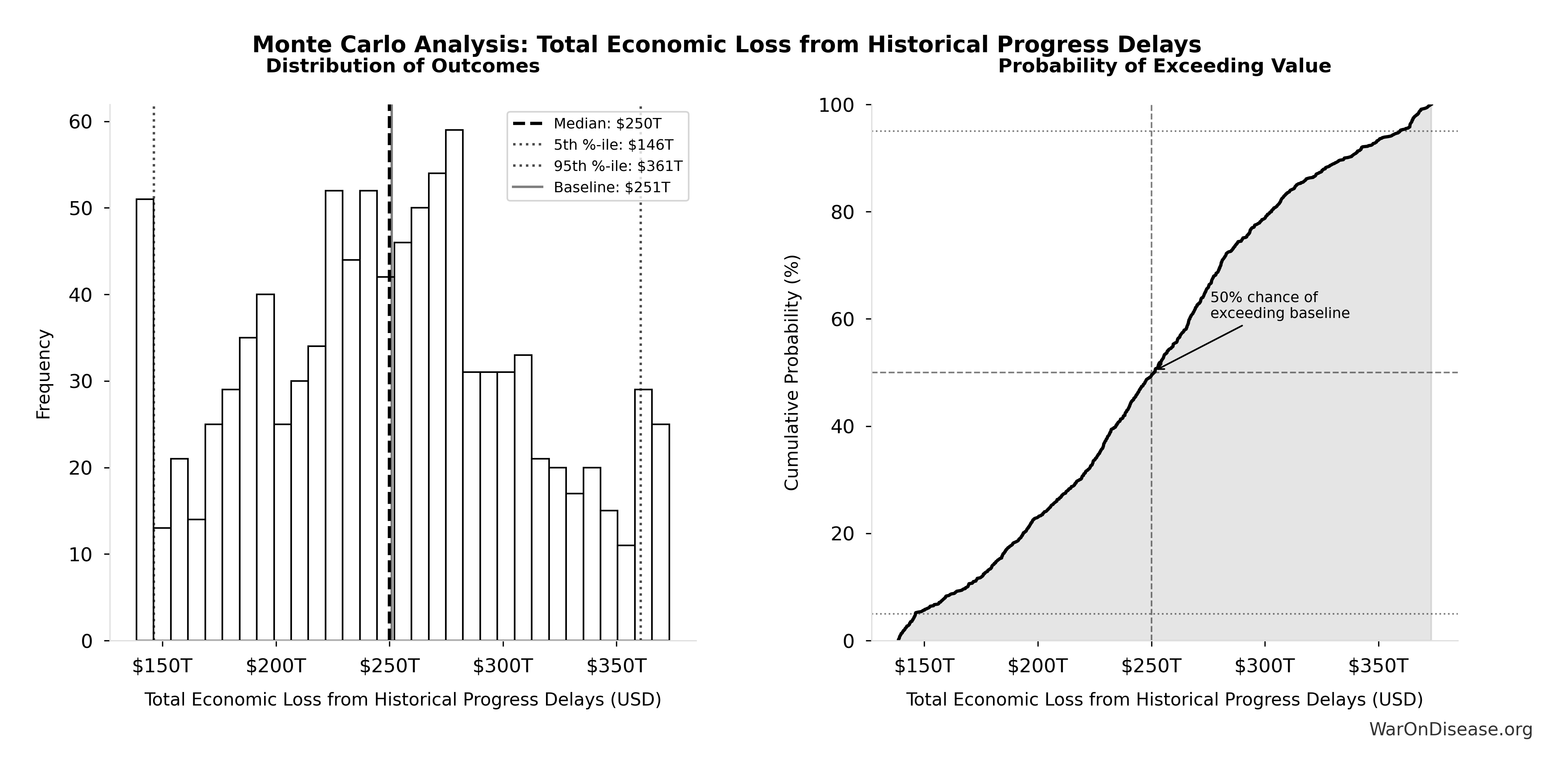

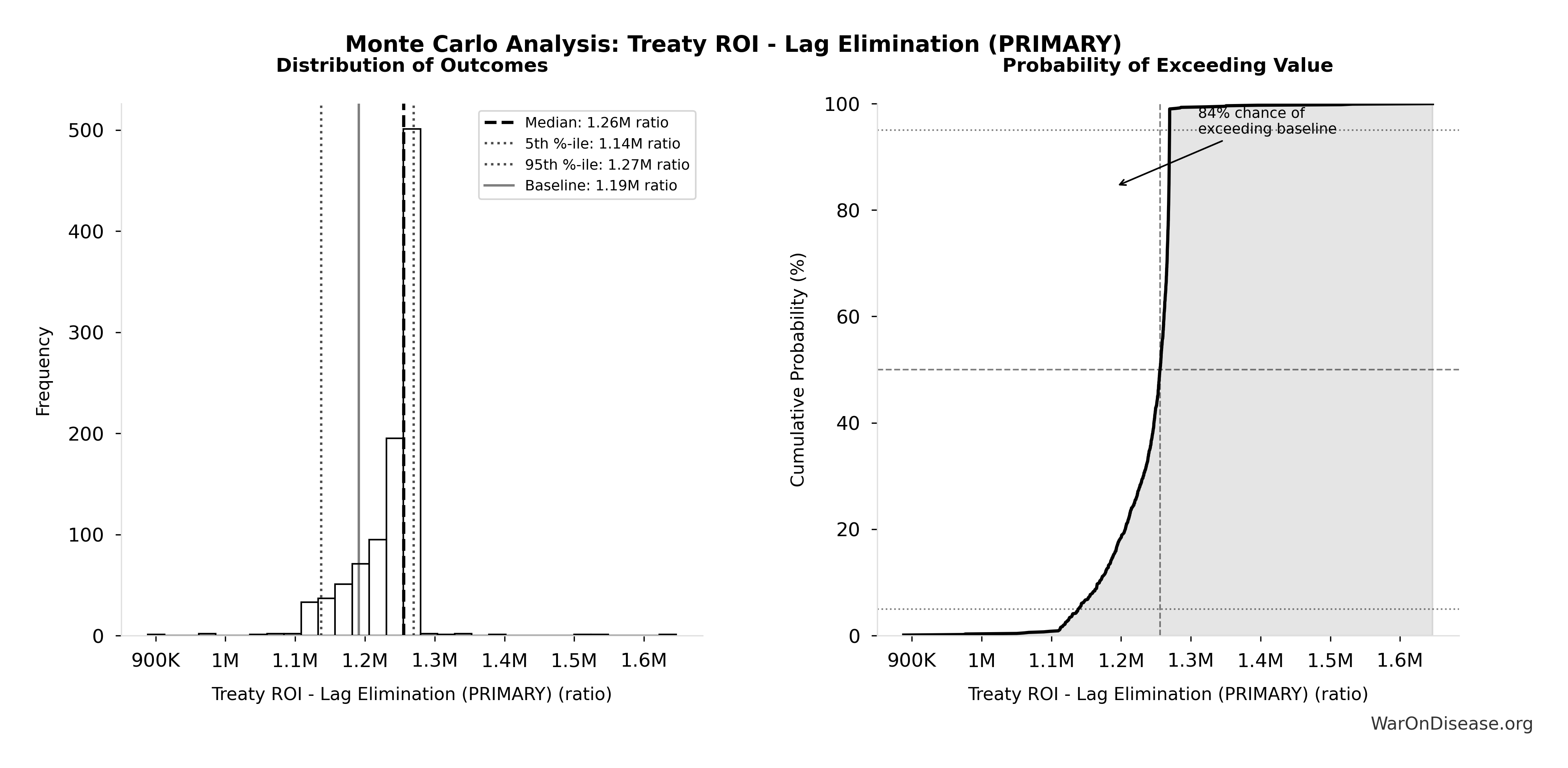

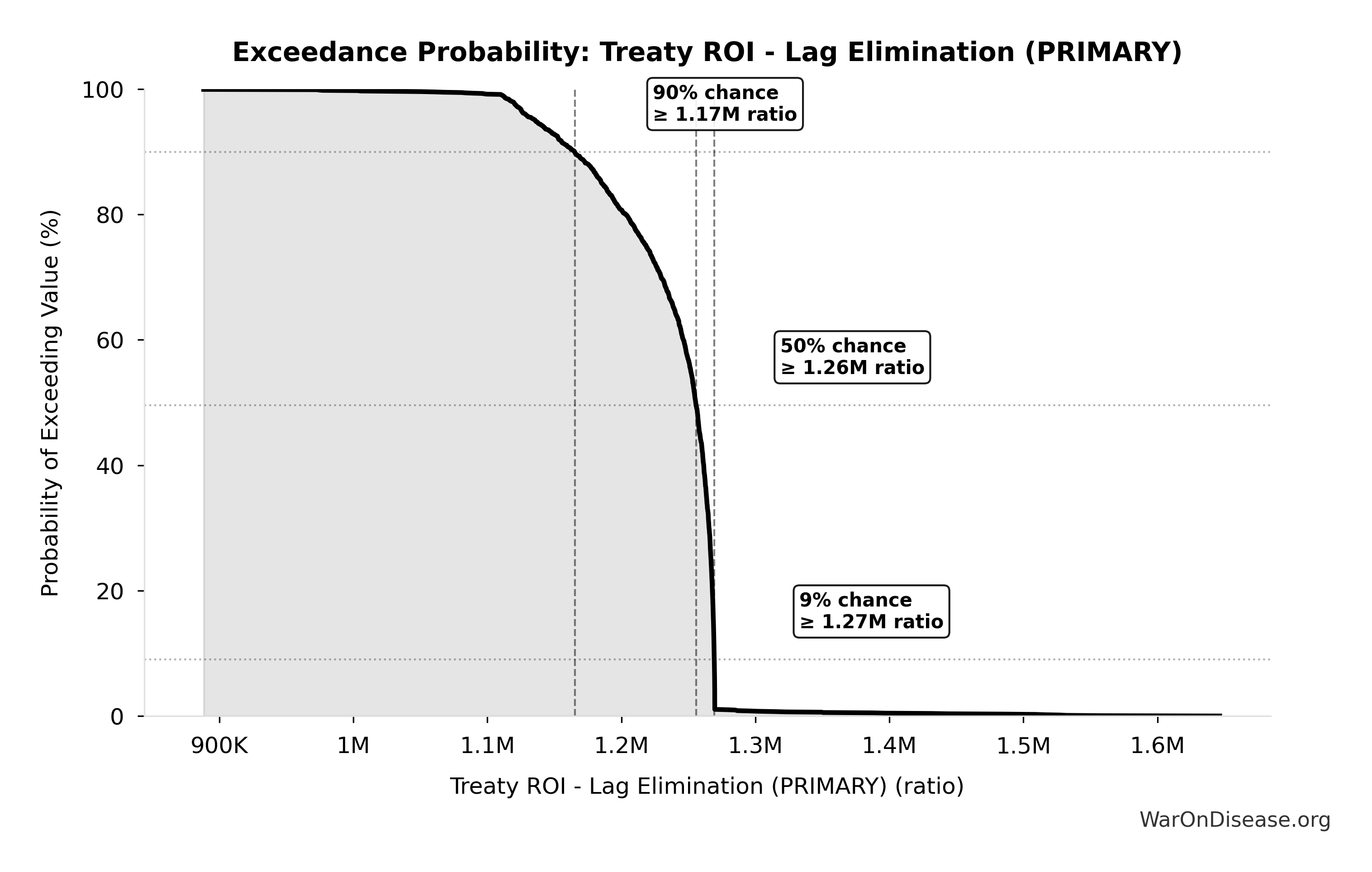

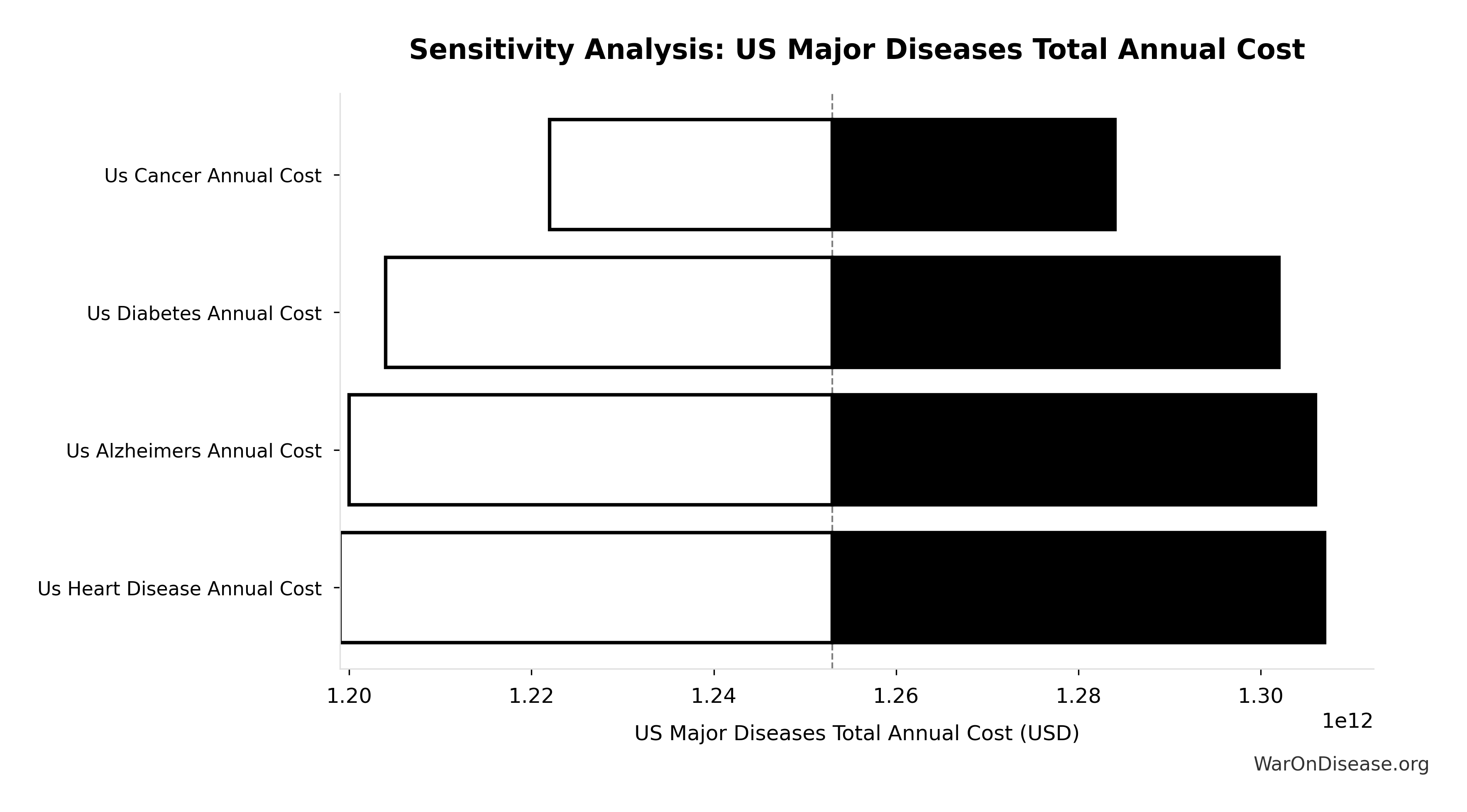

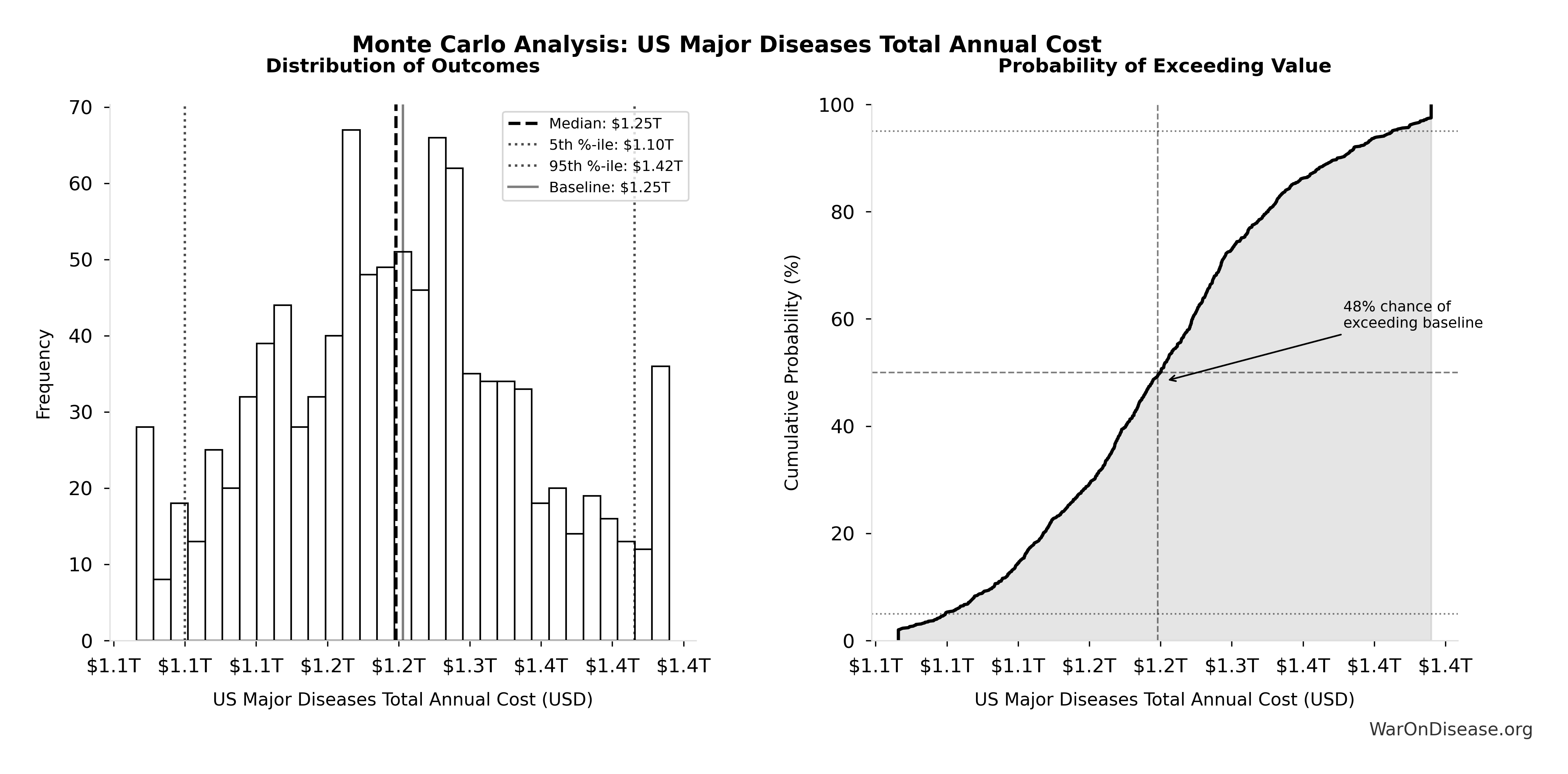

Monte Carlo Distribution

Simulation Results Summary: Total Economic Loss from Disease Eradication Delay

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $1.19 quadrillion |

| Mean (expected value) | $1.27 quadrillion |

| Median (50th percentile) | $1.18 quadrillion |

| Standard Deviation | $581T |

| 90% Range (5th-95th percentile) | [$443T, $2.41 quadrillion] |

The histogram shows the distribution of Total Economic Loss from Disease Eradication Delay across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

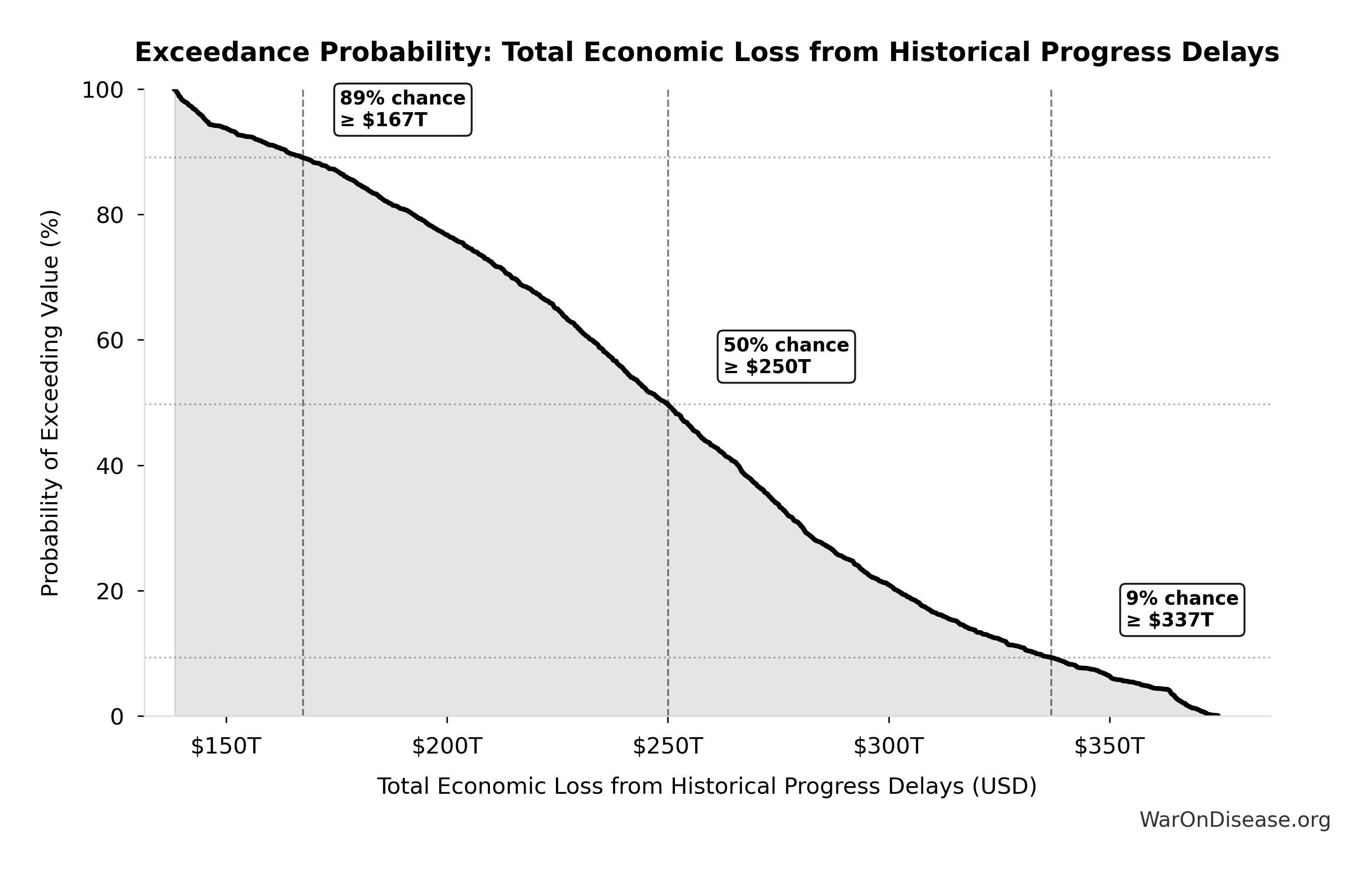

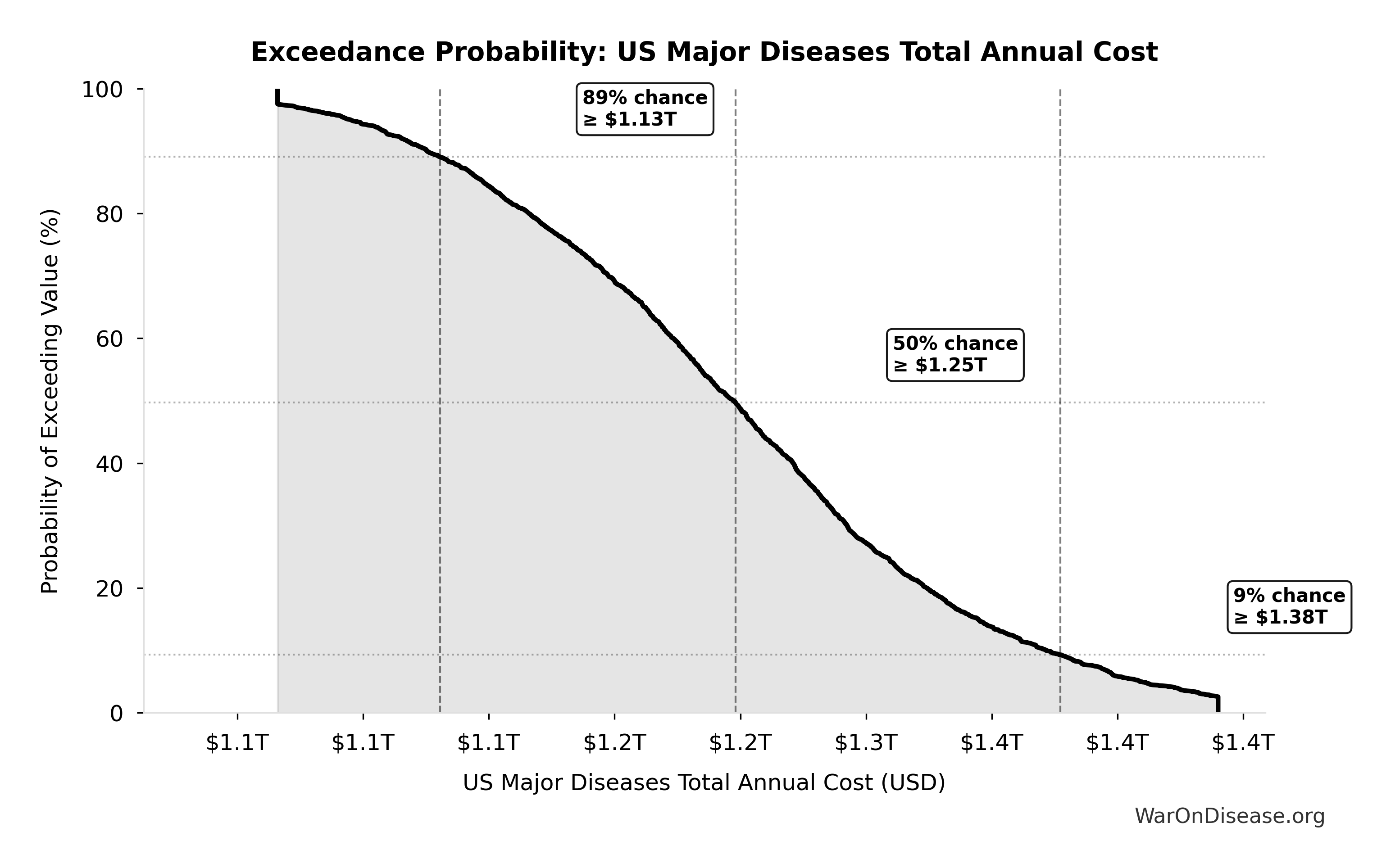

Exceedance Probability

This exceedance probability chart shows the likelihood that Total Economic Loss from Disease Eradication Delay will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

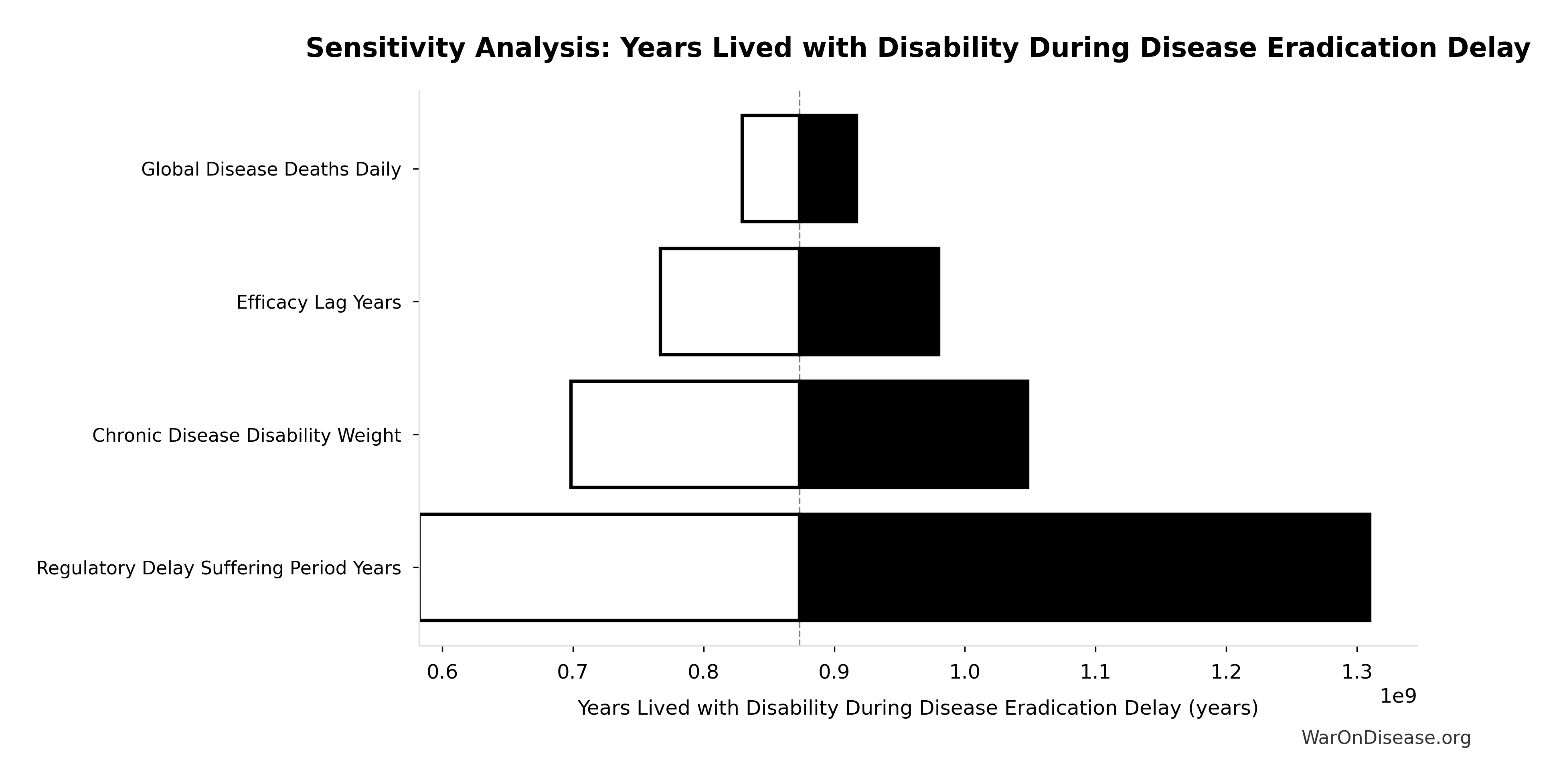

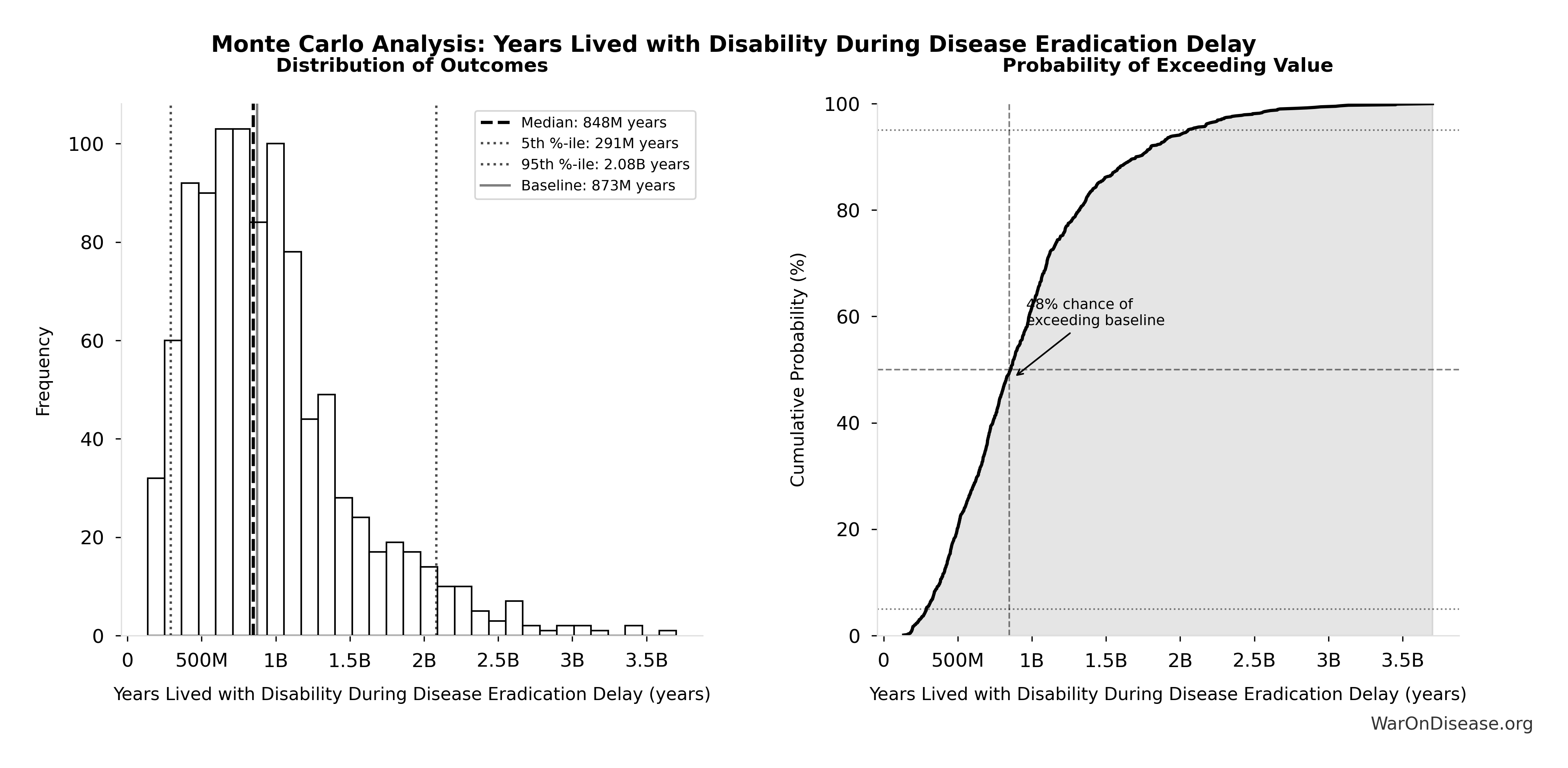

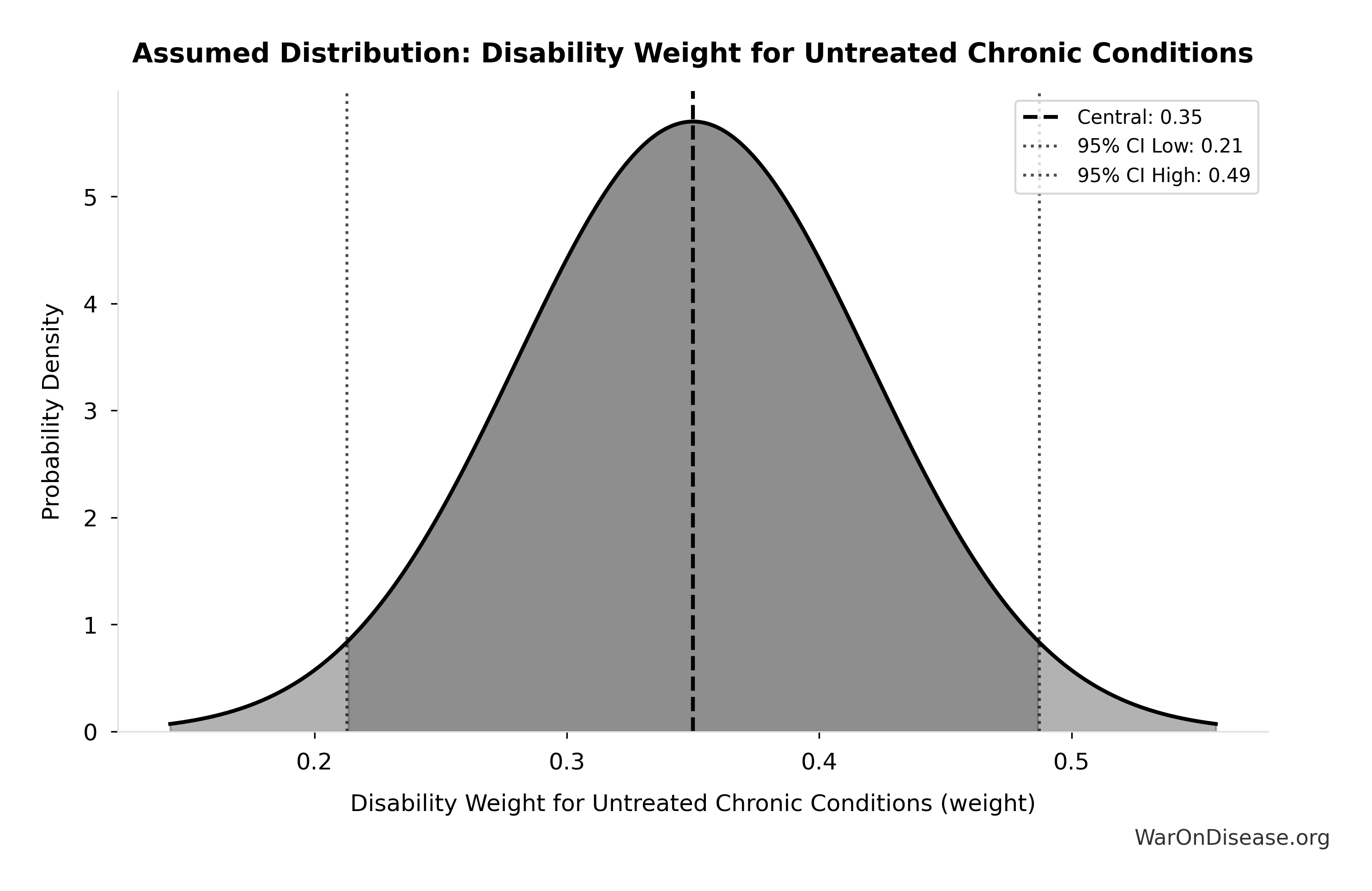

Years Lived with Disability During Disease Eradication Delay: 873 million years

Years Lived with Disability during disease eradication delay (PRIMARY estimate)

Inputs:

- Total Deaths from Disease Eradication Delay 🔢: 416 million deaths

- Pre-Death Suffering Period During Post-Safety Efficacy Delay 📊: 6 years (95% CI: 4 years - 9 years)

- Disability Weight for Untreated Chronic Conditions 📊: 0.35 weight (SE: ±0.07 weight)

\[ \begin{gathered} YLD_{lag} \\ = Deaths_{lag} \times T_{suffering} \times DW_{chronic} \\ = 416M \times 6 \times 0.35 \\ = 873M \\[0.5em] \text{where } Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \end{gathered} \]

~ Medium confidence

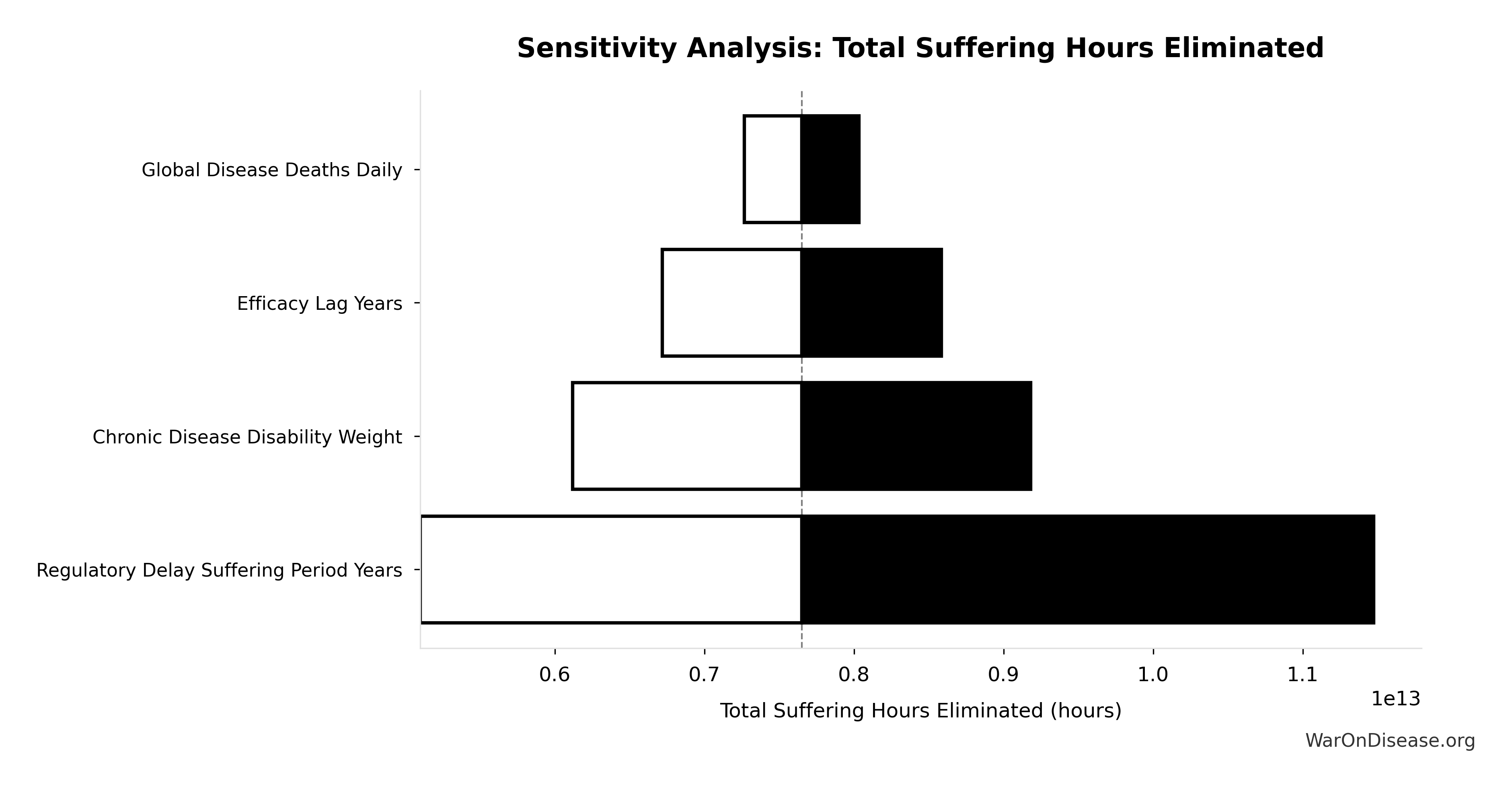

Sensitivity Analysis

Sensitivity Indices for Years Lived with Disability During Disease Eradication Delay

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| Regulatory Delay Suffering Period Years | 2.0883 | Strong driver |

| Chronic Disease Disability Weight | -0.9003 | Strong driver |

| dFDA Efficacy Lag Elimination Deaths Averted | -0.2255 | Weak driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

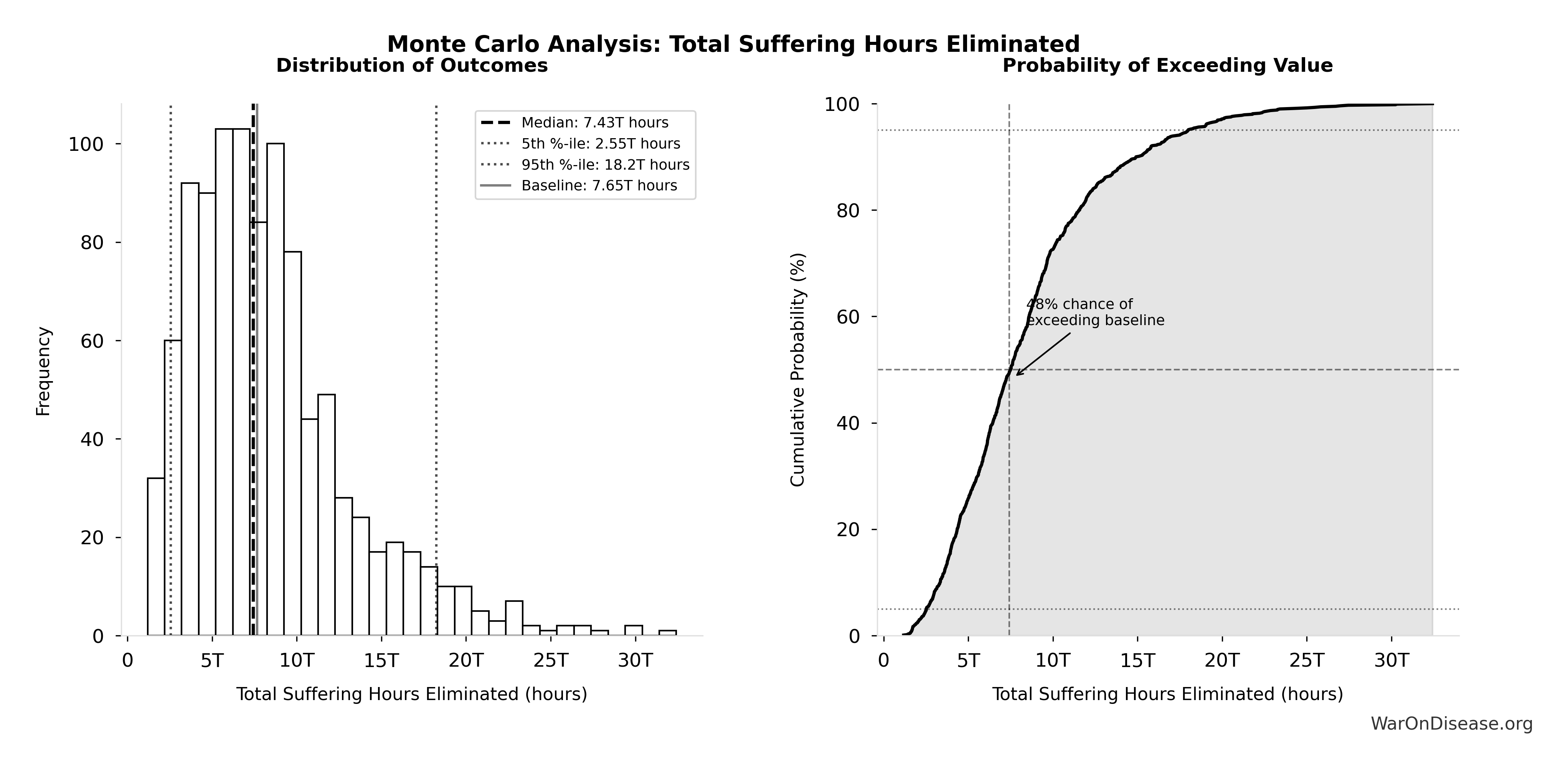

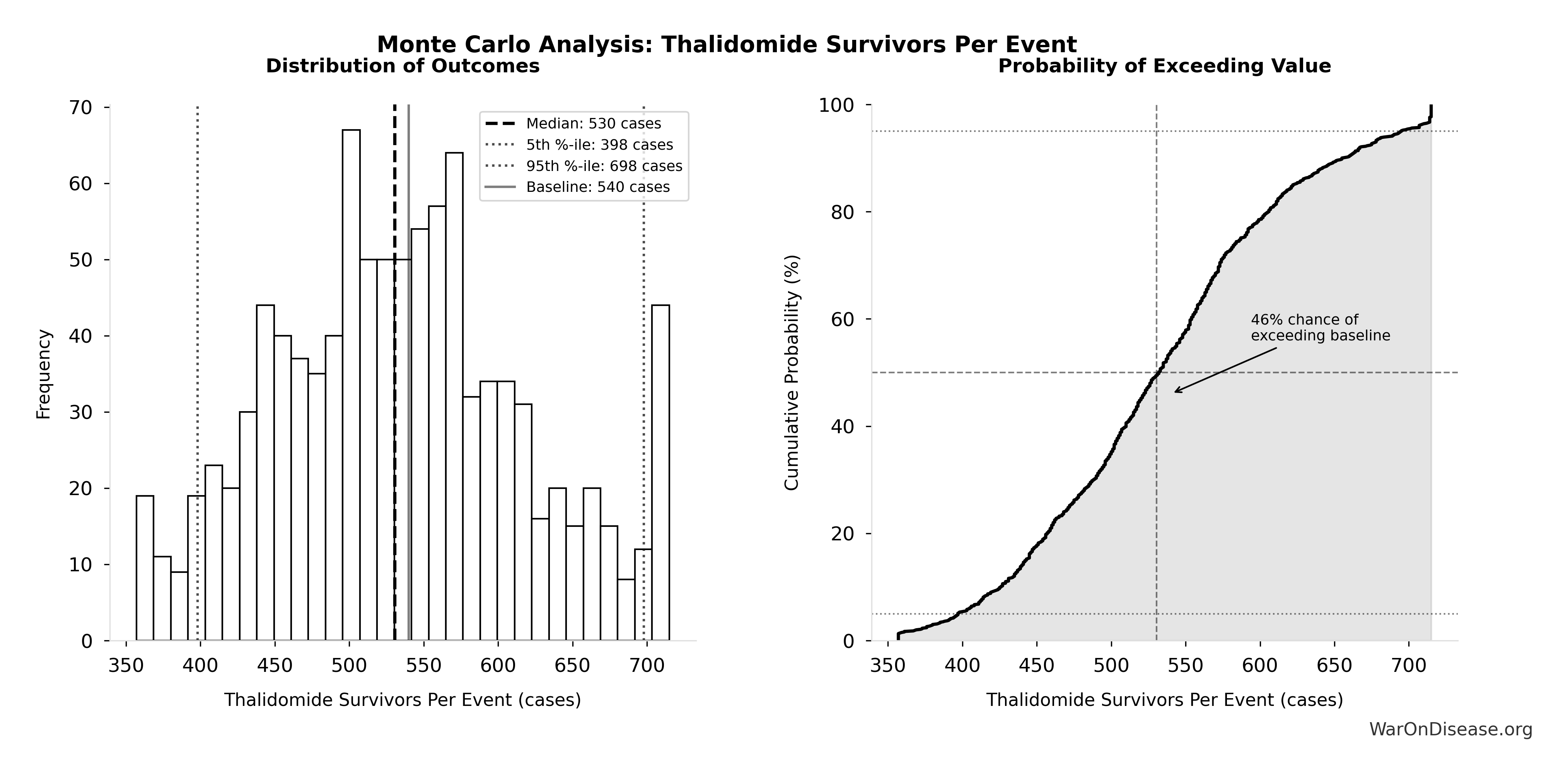

Monte Carlo Distribution

Simulation Results Summary: Years Lived with Disability During Disease Eradication Delay

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 873 million |

| Mean (expected value) | 1.02 billion |

| Median (50th percentile) | 846 million |

| Standard Deviation | 716 million |

| 90% Range (5th-95th percentile) | [217 million, 2.43 billion] |

The histogram shows the distribution of Years Lived with Disability During Disease Eradication Delay across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

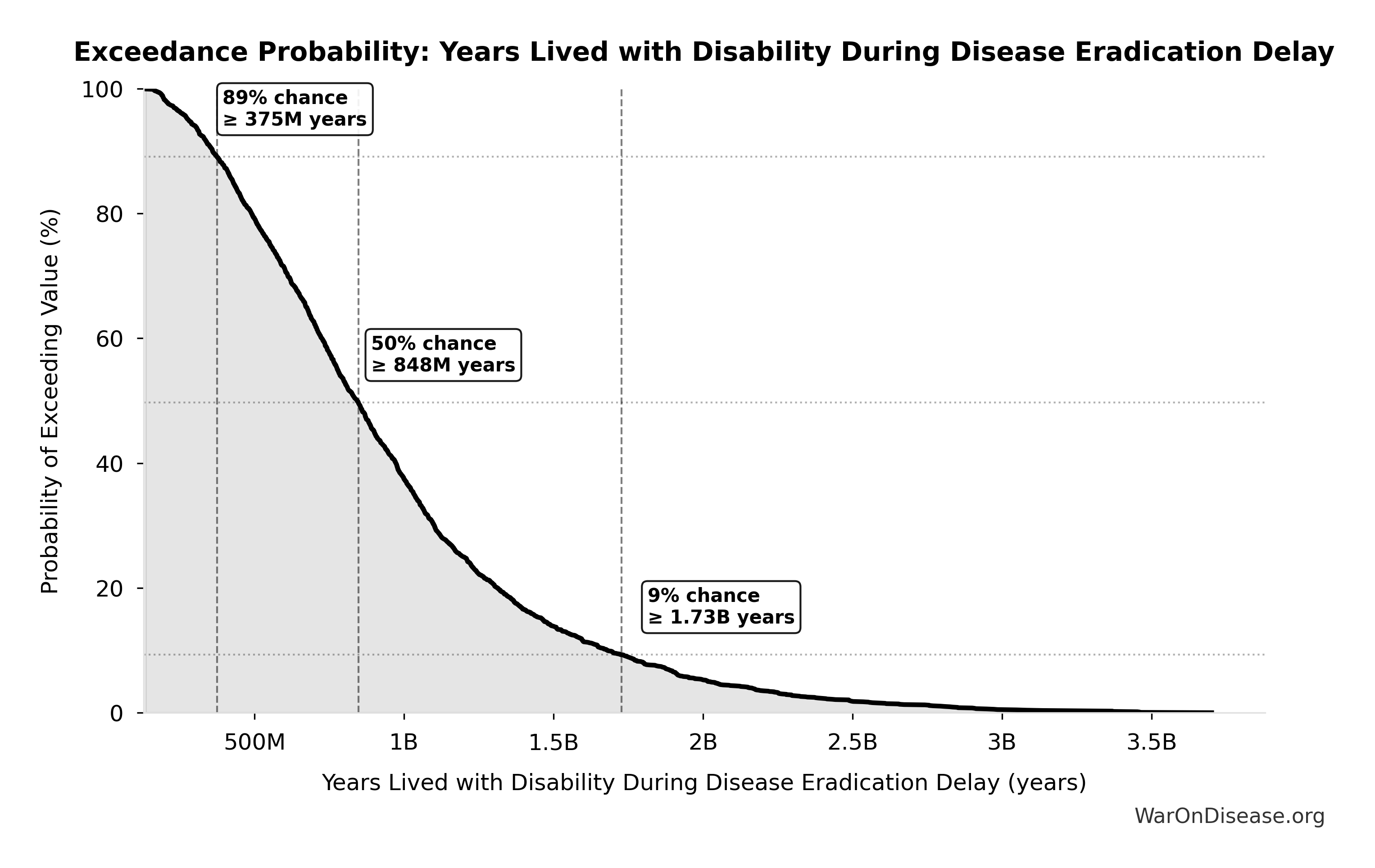

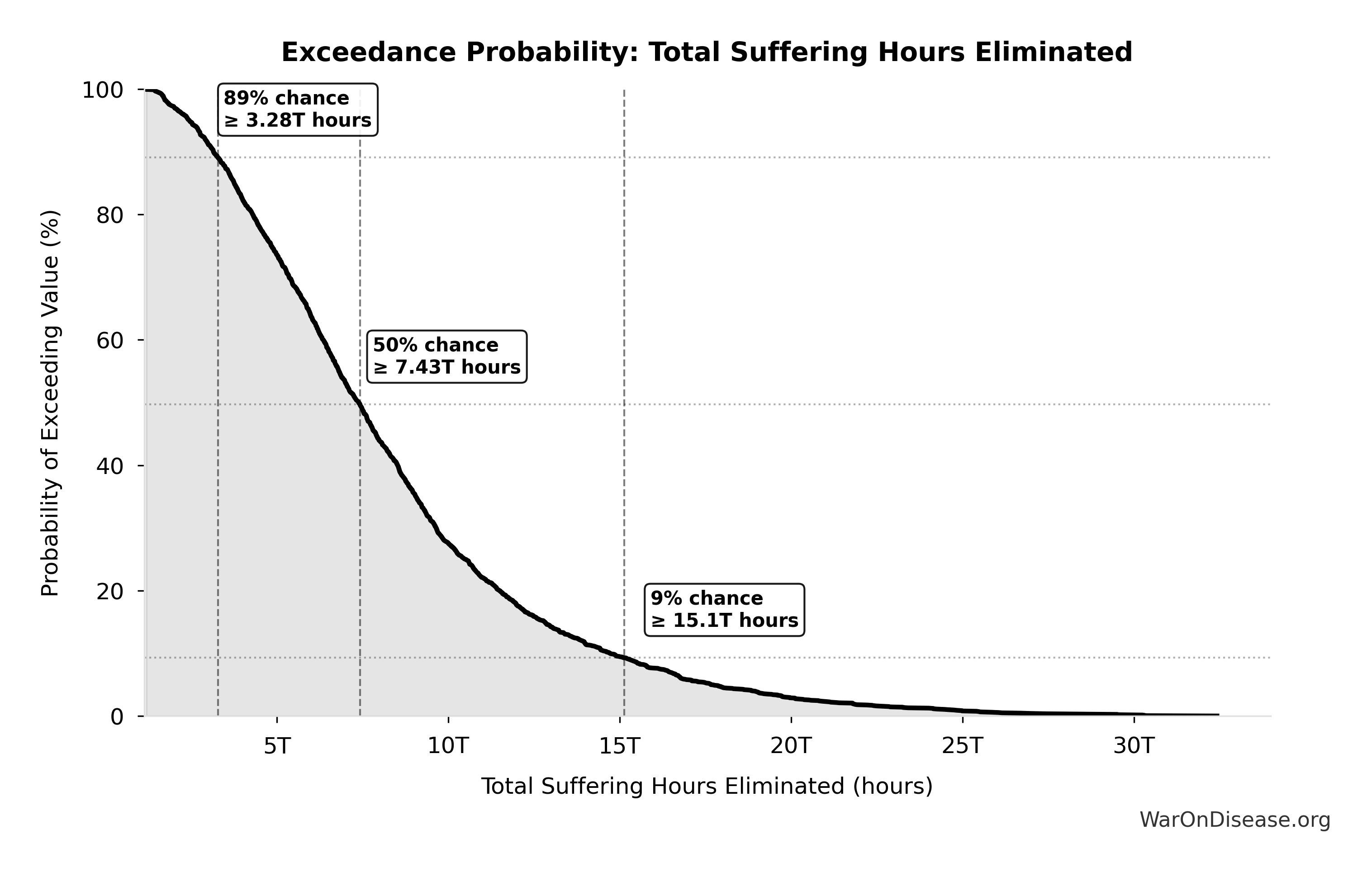

Exceedance Probability

This exceedance probability chart shows the likelihood that Years Lived with Disability During Disease Eradication Delay will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

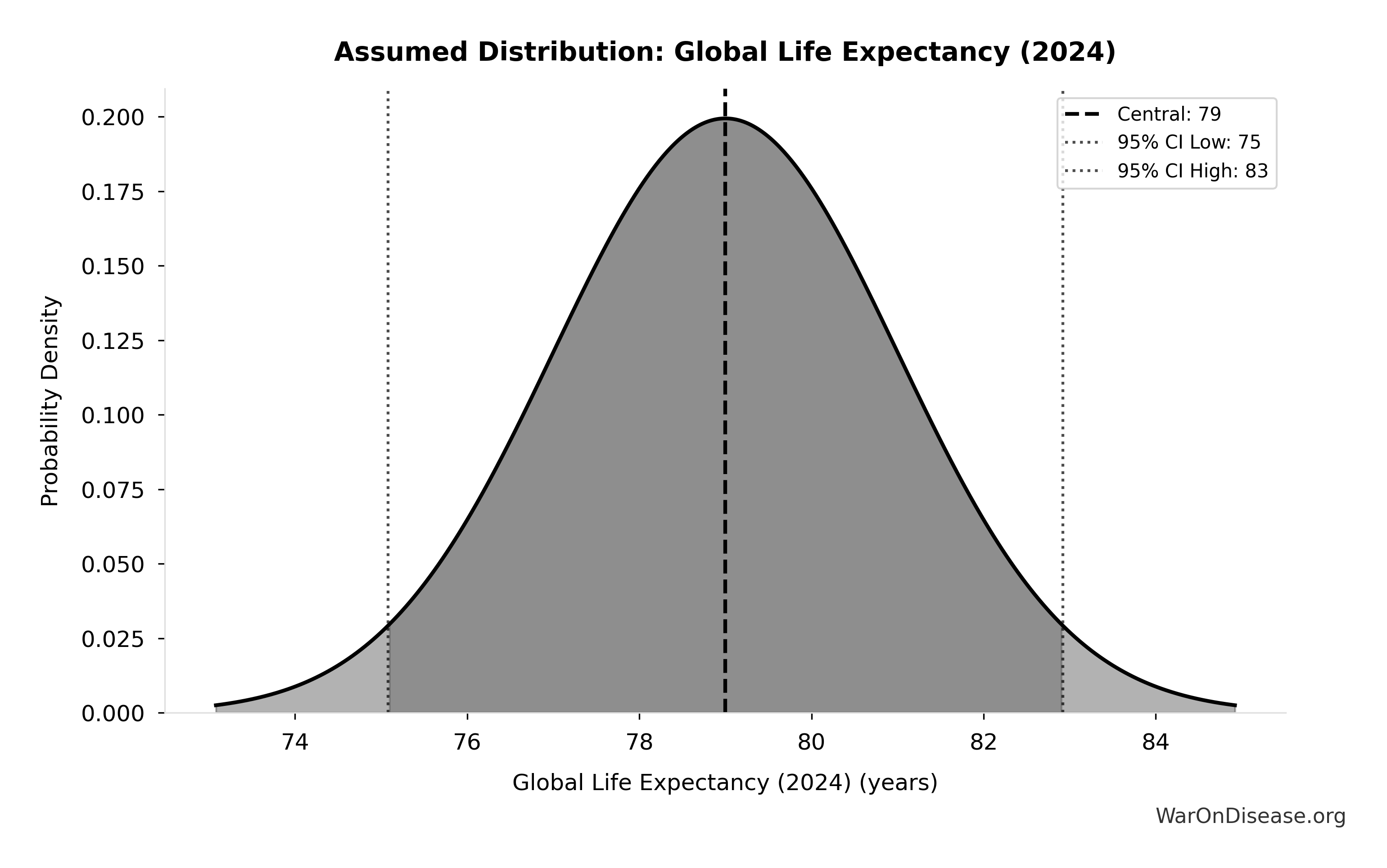

Years of Life Lost from Disease Eradication Delay: 7.07 billion years

Years of Life Lost from disease eradication delay deaths (PRIMARY estimate)

Inputs:

- Total Deaths from Disease Eradication Delay 🔢: 416 million deaths

- Global Life Expectancy (2024) 📊: 79 years (SE: ±2 years)

- Mean Age of Preventable Death from Post-Safety Efficacy Delay 📊: 62 years (SE: ±3 years)

\[ \begin{gathered} YLL_{lag} \\ = Deaths_{lag} \times (LE_{global} - Age_{death,delay}) \\ = 416M \times (79 - 62) \\ = 7.07B \\[0.5em] \text{where } Deaths_{lag} \\ = T_{lag} \times Deaths_{disease,daily} \times 338 \\ = 8.2 \times 150{,}000 \times 338 \\ = 416M \end{gathered} \]

~ Medium confidence

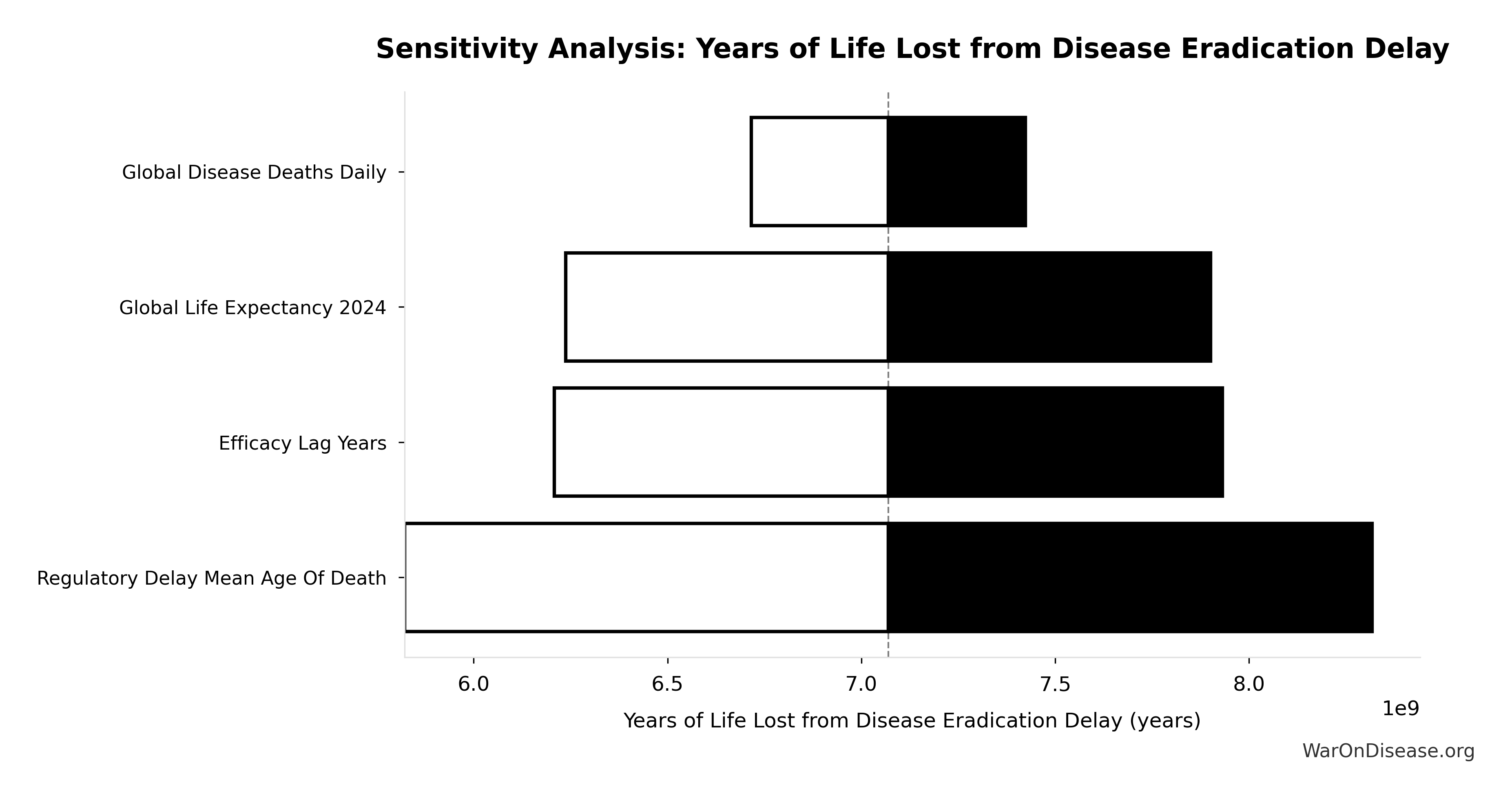

Sensitivity Analysis

Sensitivity Indices for Years of Life Lost from Disease Eradication Delay

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| Global Life Expectancy 2024 | 2.0066 | Strong driver |

| Regulatory Delay Mean Age Of Death | -1.3852 | Strong driver |

| dFDA Efficacy Lag Elimination Deaths Averted | 0.3779 | Moderate driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

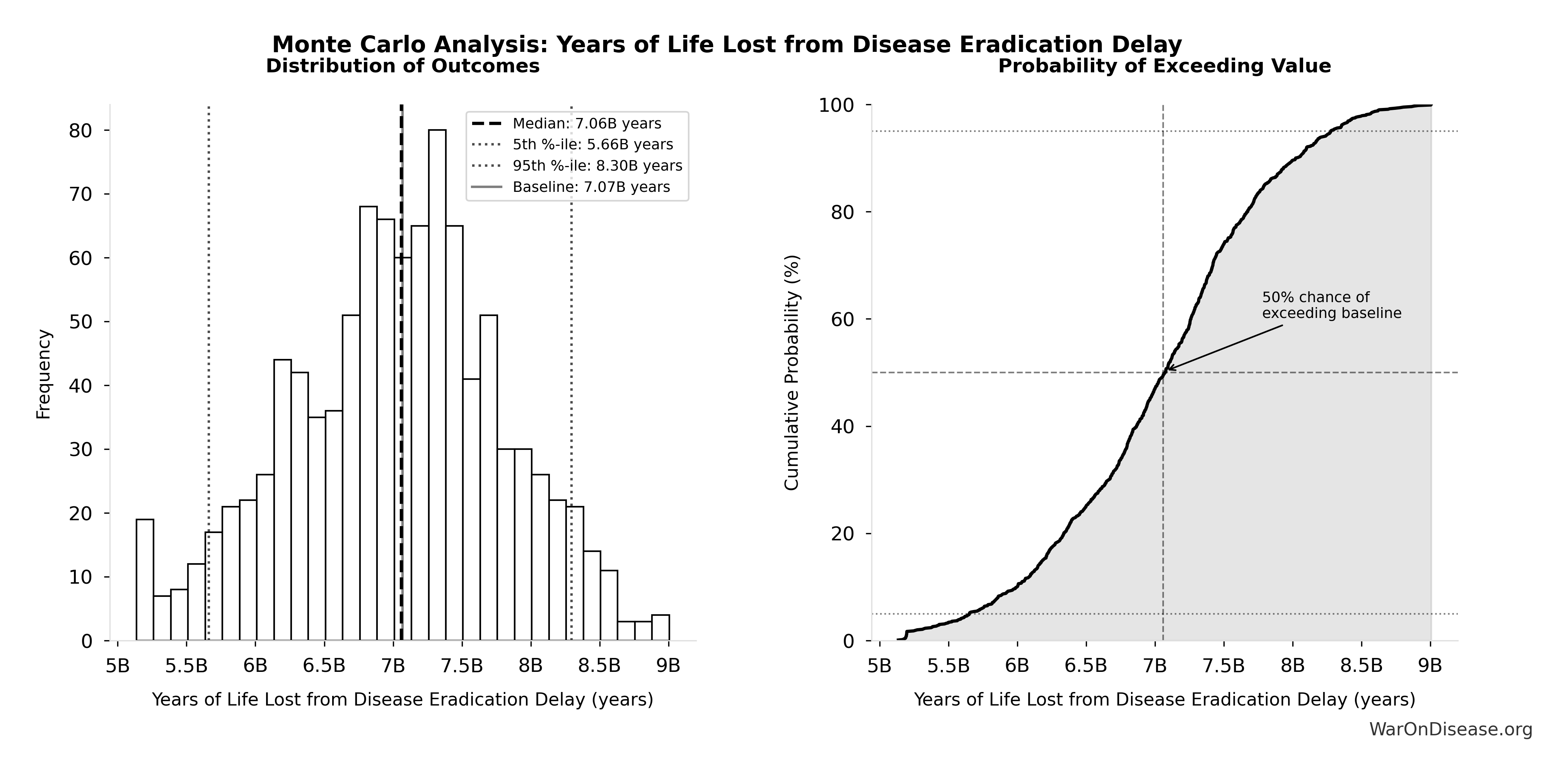

Monte Carlo Distribution

Simulation Results Summary: Years of Life Lost from Disease Eradication Delay

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 7.07 billion |

| Mean (expected value) | 7.03 billion |

| Median (50th percentile) | 7.05 billion |

| Standard Deviation | 1.62 billion |

| 90% Range (5th-95th percentile) | [4.21 billion, 9.68 billion] |

The histogram shows the distribution of Years of Life Lost from Disease Eradication Delay across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

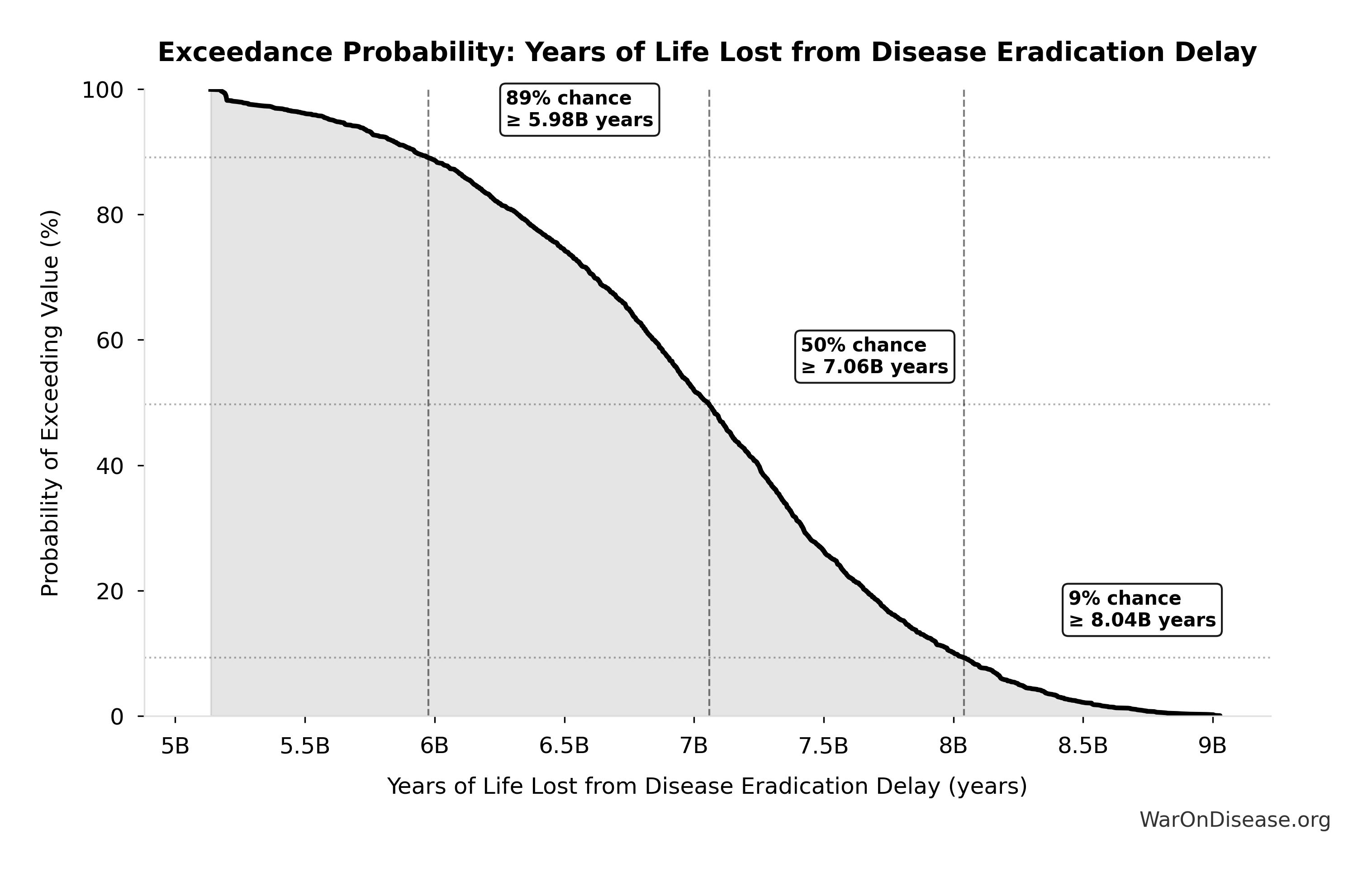

Exceedance Probability

This exceedance probability chart shows the likelihood that Years of Life Lost from Disease Eradication Delay will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

dFDA New Treatments Per Year: 185 diseases/year

Diseases per year receiving their first effective treatment with dFDA. Scales proportionally with trial capacity multiplier.

Inputs:

- Diseases Getting First Treatment Per Year 📊: 15 diseases/year (95% CI: 8 diseases/year - 30 diseases/year)

- Trial Capacity Multiplier 🔢: 12.3x

\[ \begin{gathered} Treatments_{dFDA,ann} \\ = Treatments_{new,ann} \times k_{capacity} \\ = 15 \times 12.3 \\ = 185 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

? Low confidence

Sensitivity Analysis

Sensitivity Indices for dFDA New Treatments Per Year

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Trial Capacity Multiplier | 0.9380 | Strong driver |

| New Disease First Treatments Per Year | -0.0784 | Minimal effect |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

Monte Carlo Distribution

Simulation Results Summary: dFDA New Treatments Per Year

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 185 |

| Mean (expected value) | 254 |

| Median (50th percentile) | 224 |

| Standard Deviation | 140 |

| 90% Range (5th-95th percentile) | [107, 490] |

The histogram shows the distribution of dFDA New Treatments Per Year across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

Exceedance Probability

This exceedance probability chart shows the likelihood that dFDA New Treatments Per Year will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

Decentralized Framework for Drug Assessment Annual Net Savings (R&D Only): $58.6B

Annual net savings from R&D cost reduction only (gross savings minus operational costs, excludes regulatory delay value)

Inputs:

- Decentralized Framework for Drug Assessment Annual Benefit: R&D Savings 🔢: $58.6B

- Total Annual Decentralized Framework for Drug Assessment Operational Costs 🔢: $40M

\[ \begin{gathered} Savings_{RD,ann} \\ = Benefit_{RD,ann} - OPEX_{dFDA} \\ = \$58.6B - \$40M \\ = \$58.6B \\[0.5em] \text{where } Benefit_{RD,ann} \\ = Spending_{trials} \times Reduce_{pct} \\ = \$60B \times 97.7\% \\ = \$58.6B \\[0.5em] \text{where } Reduce_{pct} \\ = 1 - \frac{Cost_{pragmatic,pt}}{Cost_{P3,pt}} \\ = 1 - \frac{\$929}{\$41K} \\ = 97.7\% \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \end{gathered} \]

✓ High confidence

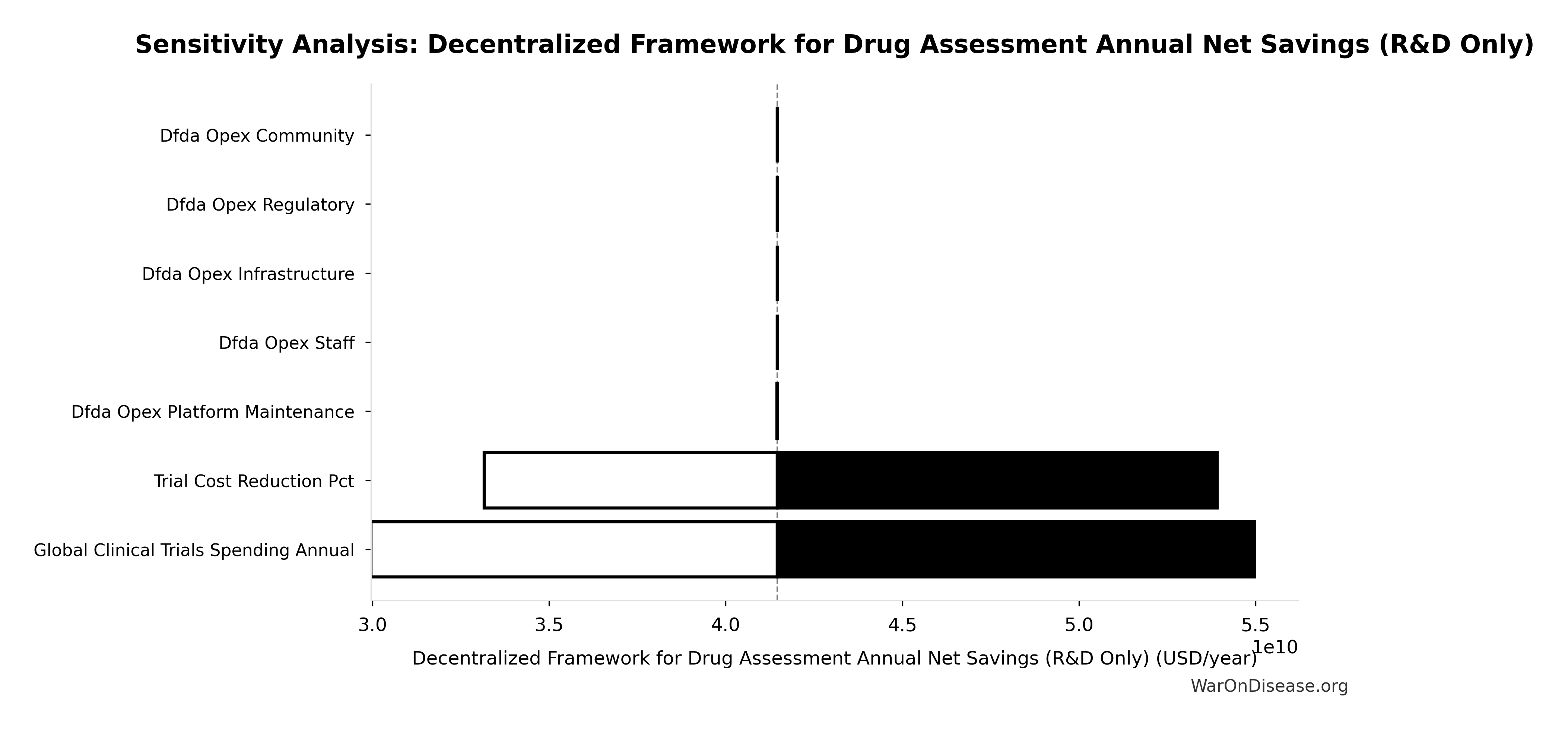

Sensitivity Analysis

Sensitivity Indices for Decentralized Framework for Drug Assessment Annual Net Savings (R&D Only)

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Benefit R&D Only Annual | 1.0011 | Strong driver |

| dFDA Annual OPEX | -0.0011 | Minimal effect |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

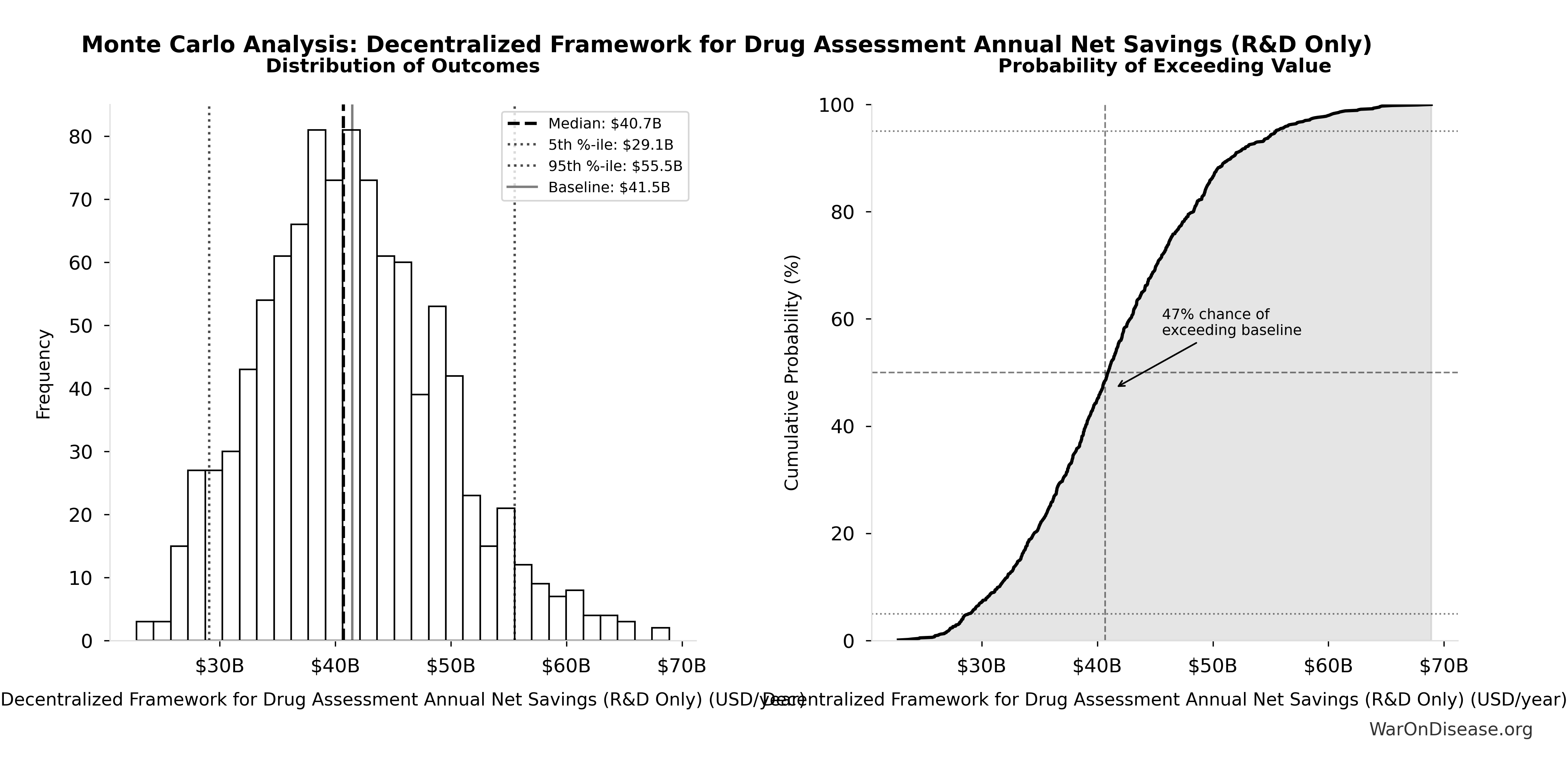

Monte Carlo Distribution

Simulation Results Summary: Decentralized Framework for Drug Assessment Annual Net Savings (R&D Only)

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $58.6B |

| Mean (expected value) | $58.8B |

| Median (50th percentile) | $57.8B |

| Standard Deviation | $7.66B |

| 90% Range (5th-95th percentile) | [$49.2B, $73B] |

The histogram shows the distribution of Decentralized Framework for Drug Assessment Annual Net Savings (R&D Only) across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

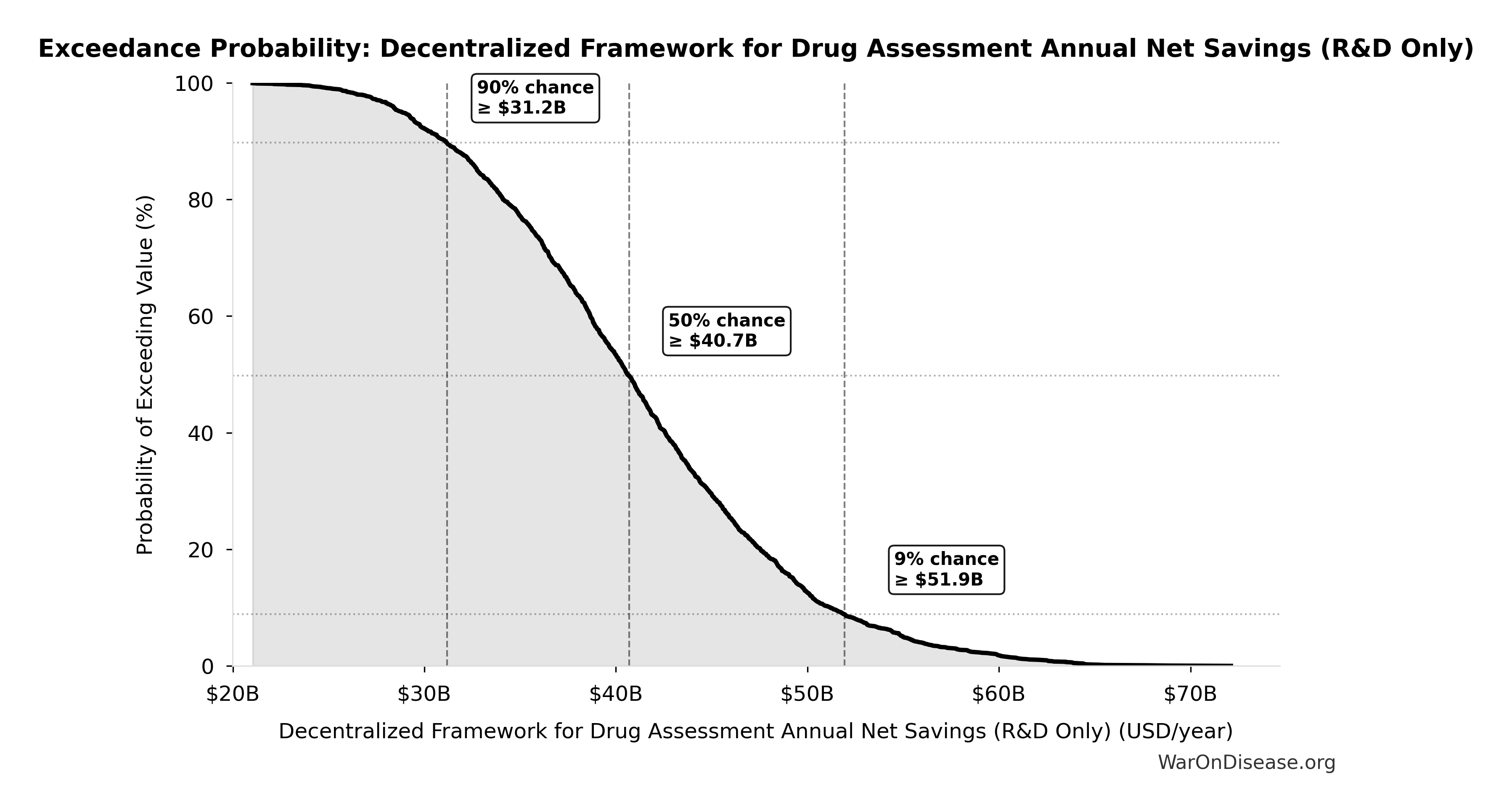

Exceedance Probability

This exceedance probability chart shows the likelihood that Decentralized Framework for Drug Assessment Annual Net Savings (R&D Only) will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

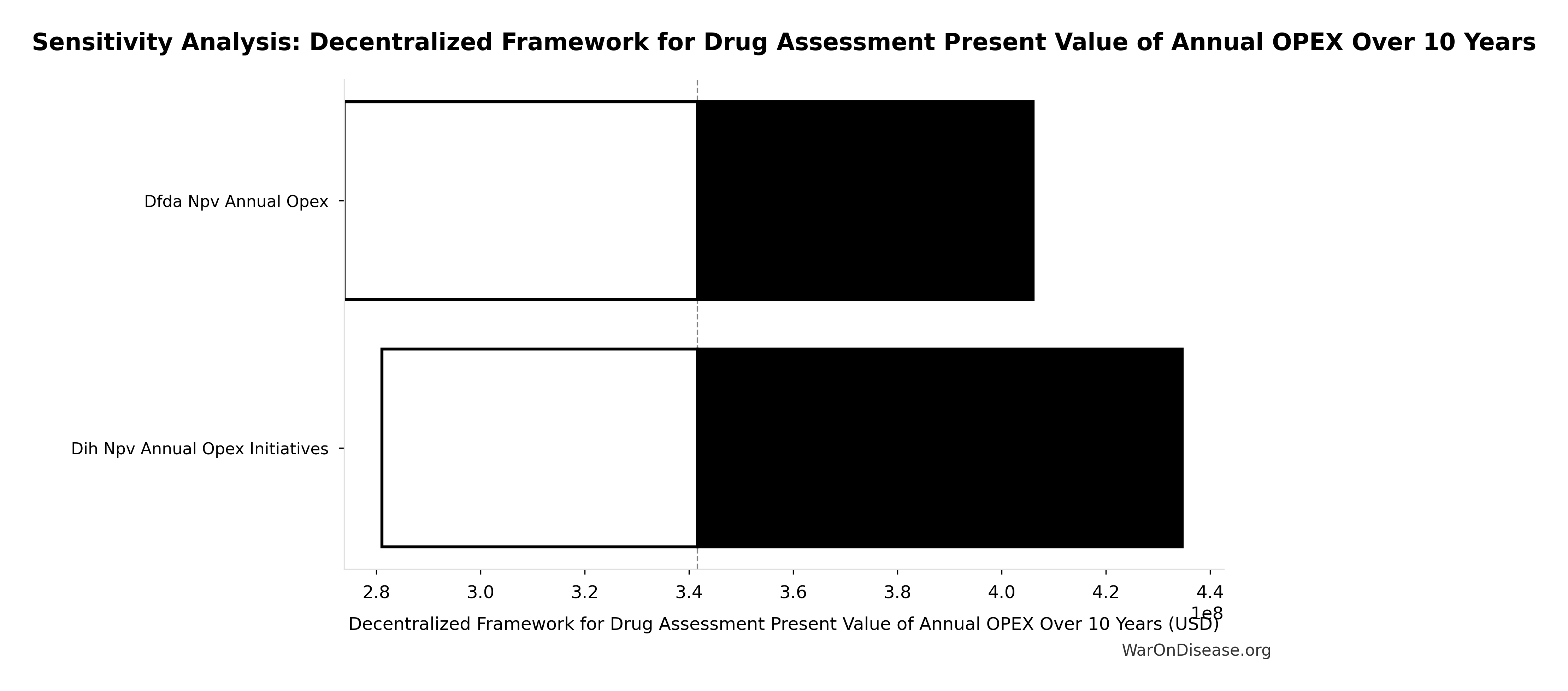

Decentralized Framework for Drug Assessment Total NPV Annual OPEX: $40M

Total NPV annual opex (Decentralized Framework for Drug Assessment core + DIH initiatives)

Inputs:

- Decentralized Framework for Drug Assessment Core framework Annual OPEX: $18.9M (95% CI: $11M - $26.5M)

- DIH Broader Initiatives Annual OPEX: $21.1M (95% CI: $14M - $32M)

\[ \begin{gathered} OPEX_{total} \\ = OPEX_{ann} + OPEX_{DIH,ann} \\ = \$18.9M + \$21.1M \\ = \$40M \end{gathered} \]

✓ High confidence

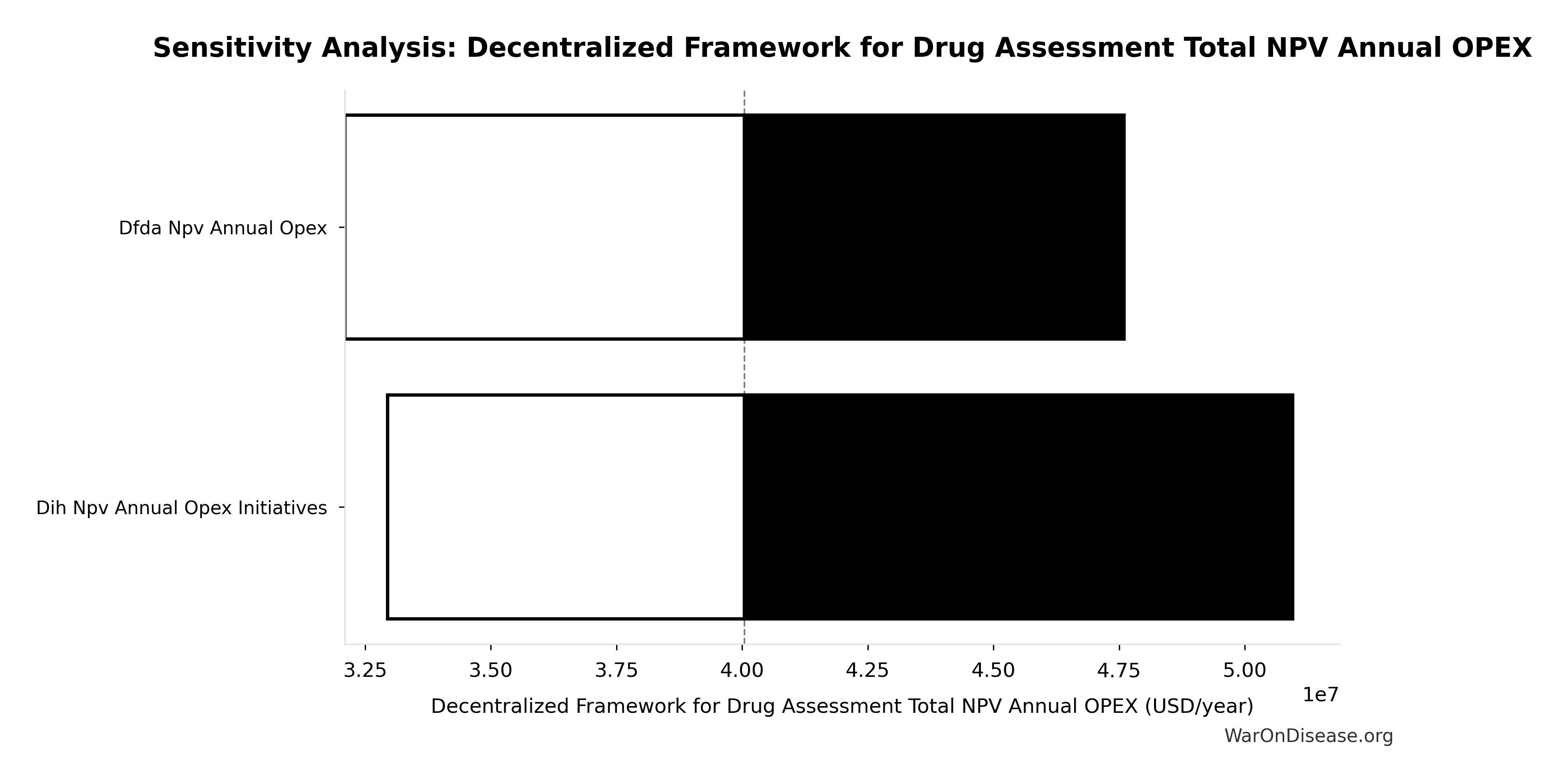

Sensitivity Analysis

Sensitivity Indices for Decentralized Framework for Drug Assessment Total NPV Annual OPEX

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| DIH NPV Annual OPEX Initiatives | 0.5419 | Strong driver |

| dFDA NPV Annual OPEX | 0.4592 | Moderate driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

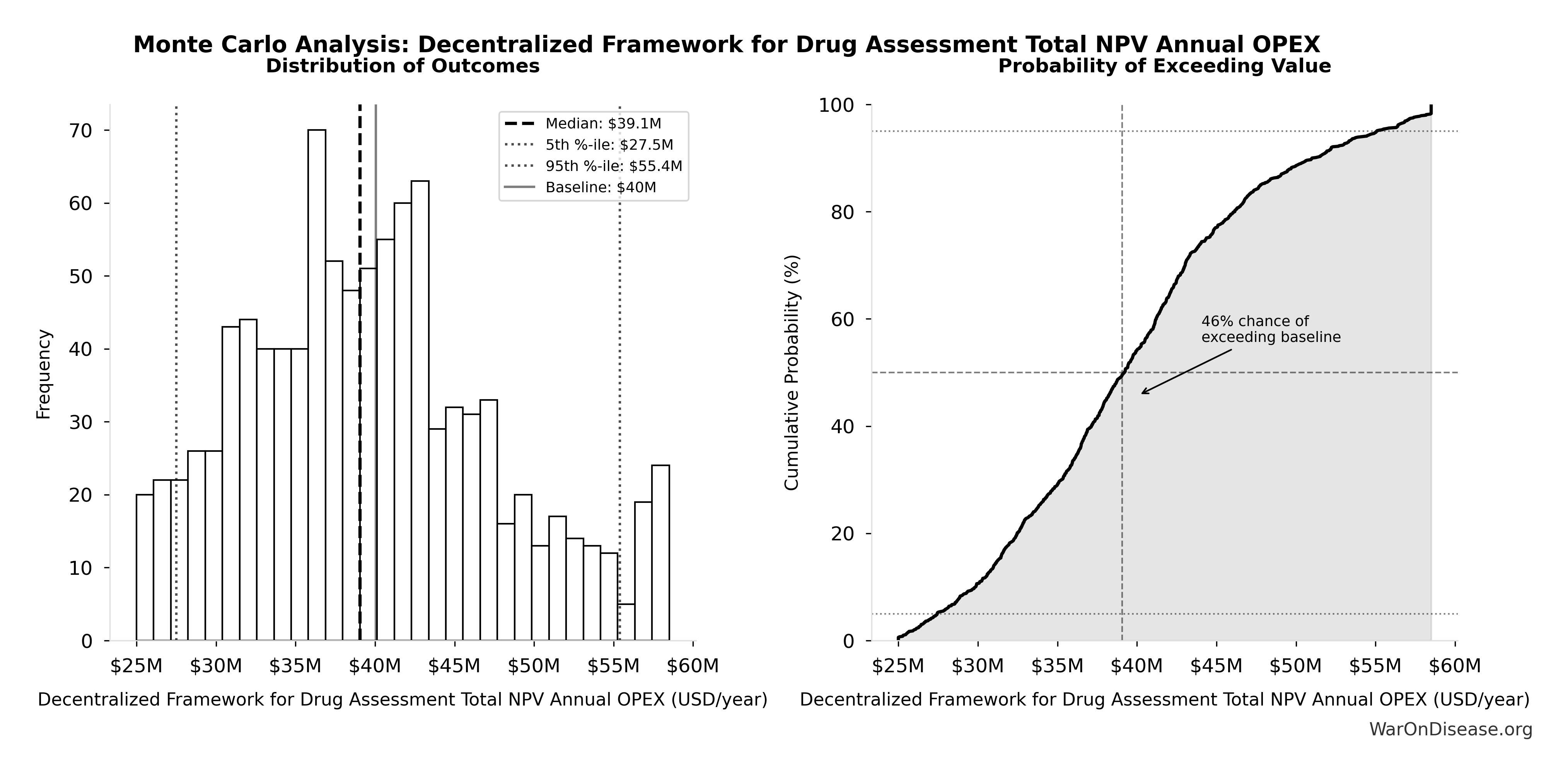

Monte Carlo Distribution

Simulation Results Summary: Decentralized Framework for Drug Assessment Total NPV Annual OPEX

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $40M |

| Mean (expected value) | $39.9M |

| Median (50th percentile) | $39.1M |

| Standard Deviation | $8.04M |

| 90% Range (5th-95th percentile) | [$27.5M, $55.4M] |

The histogram shows the distribution of Decentralized Framework for Drug Assessment Total NPV Annual OPEX across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

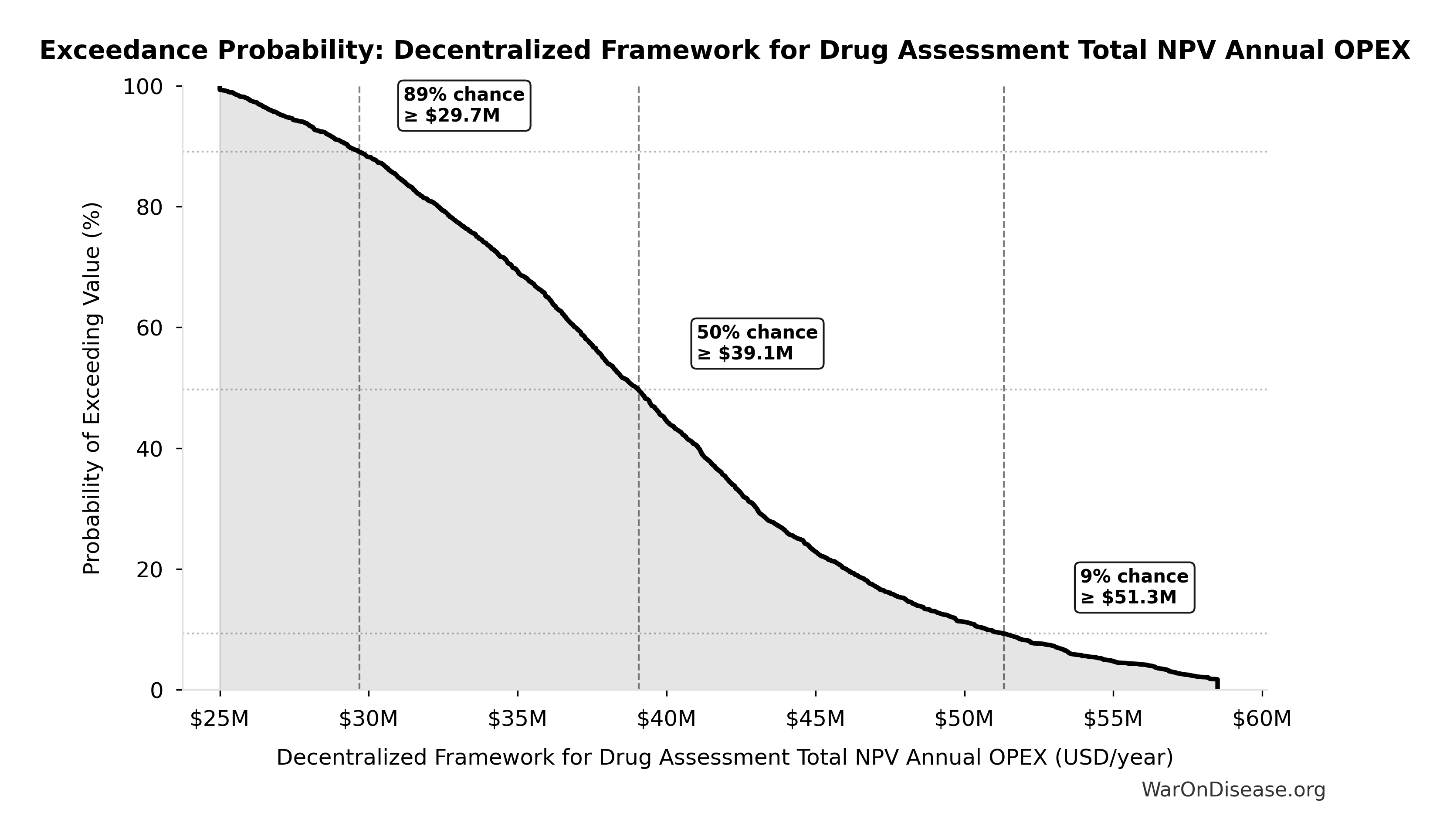

Exceedance Probability

This exceedance probability chart shows the likelihood that Decentralized Framework for Drug Assessment Total NPV Annual OPEX will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

NPV of Decentralized Framework for Drug Assessment Benefits (R&D Only, 10-Year Discounted): $389B

NPV of Decentralized Framework for Drug Assessment R&D savings only with 5-year adoption ramp (10-year horizon, most conservative financial estimate)

Inputs:

- Decentralized Framework for Drug Assessment Annual Net Savings (R&D Only) 🔢: $58.6B

- Standard Discount Rate for NPV Analysis: 3%

\[ \begin{gathered} NPV_{RD} \\ = \sum_{t=1}^{10} \frac{Savings_{RD,ann} \times \frac{\min(t,5)}{5}}{(1+r)^t} \end{gathered} \]

✓ High confidence

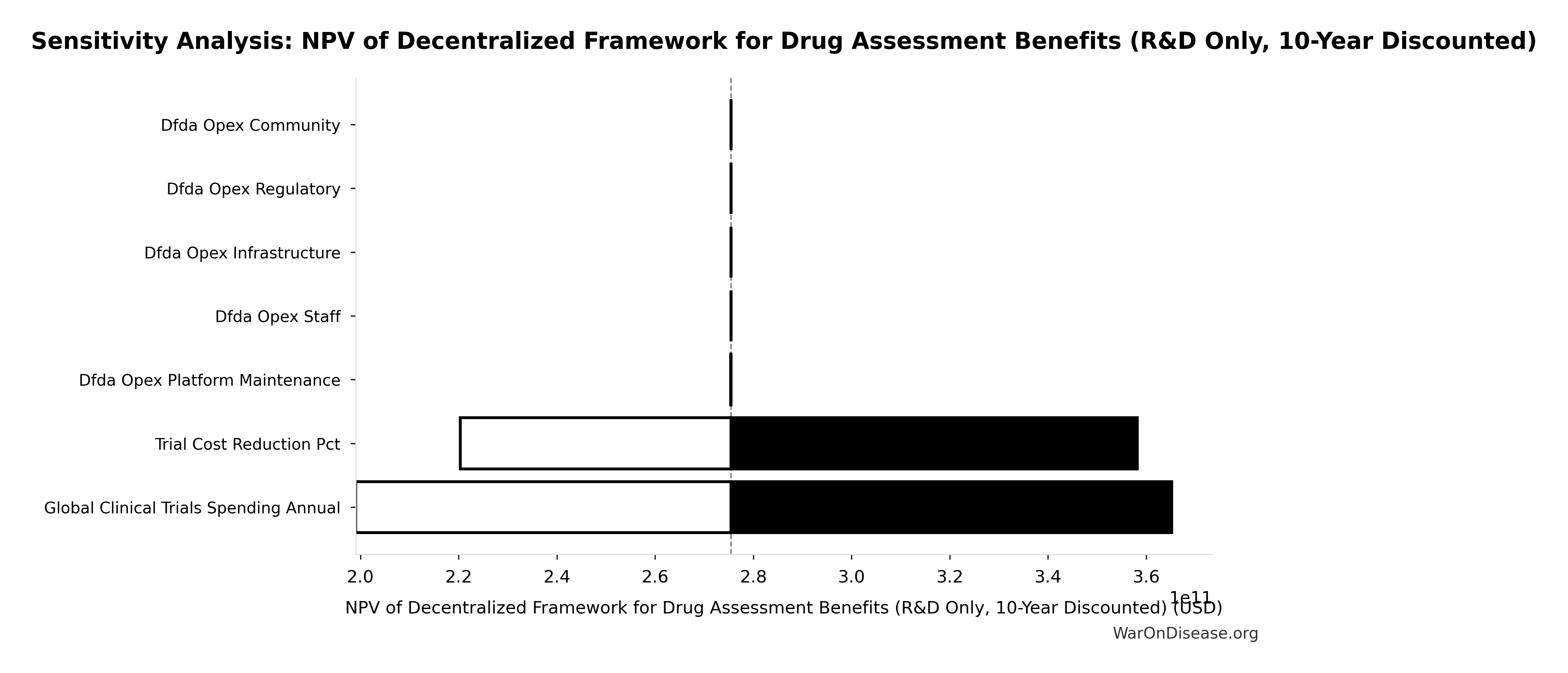

Sensitivity Analysis

Sensitivity Indices for NPV of Decentralized Framework for Drug Assessment Benefits (R&D Only, 10-Year Discounted)

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Net Savings R&D Only Annual | 1.0000 | Strong driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

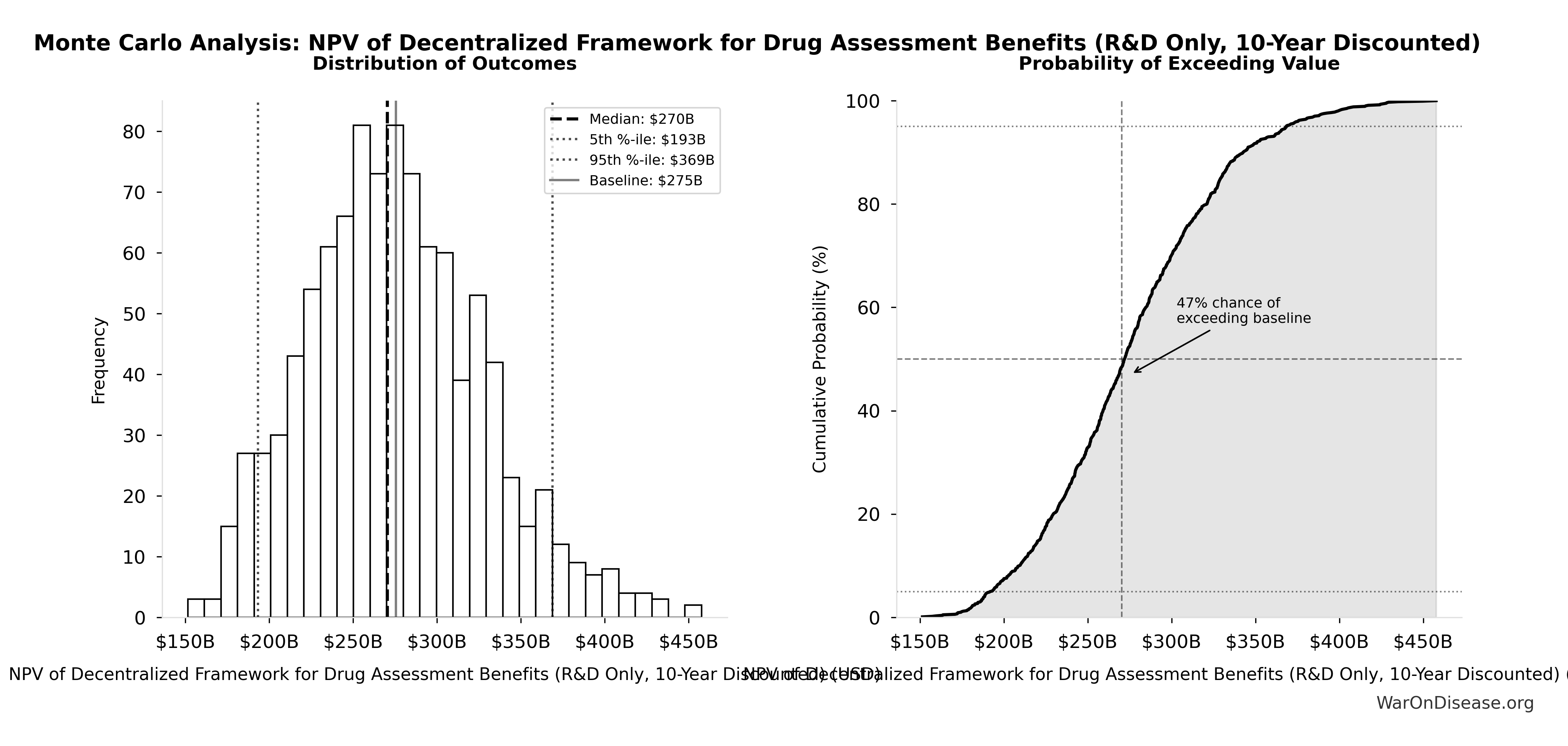

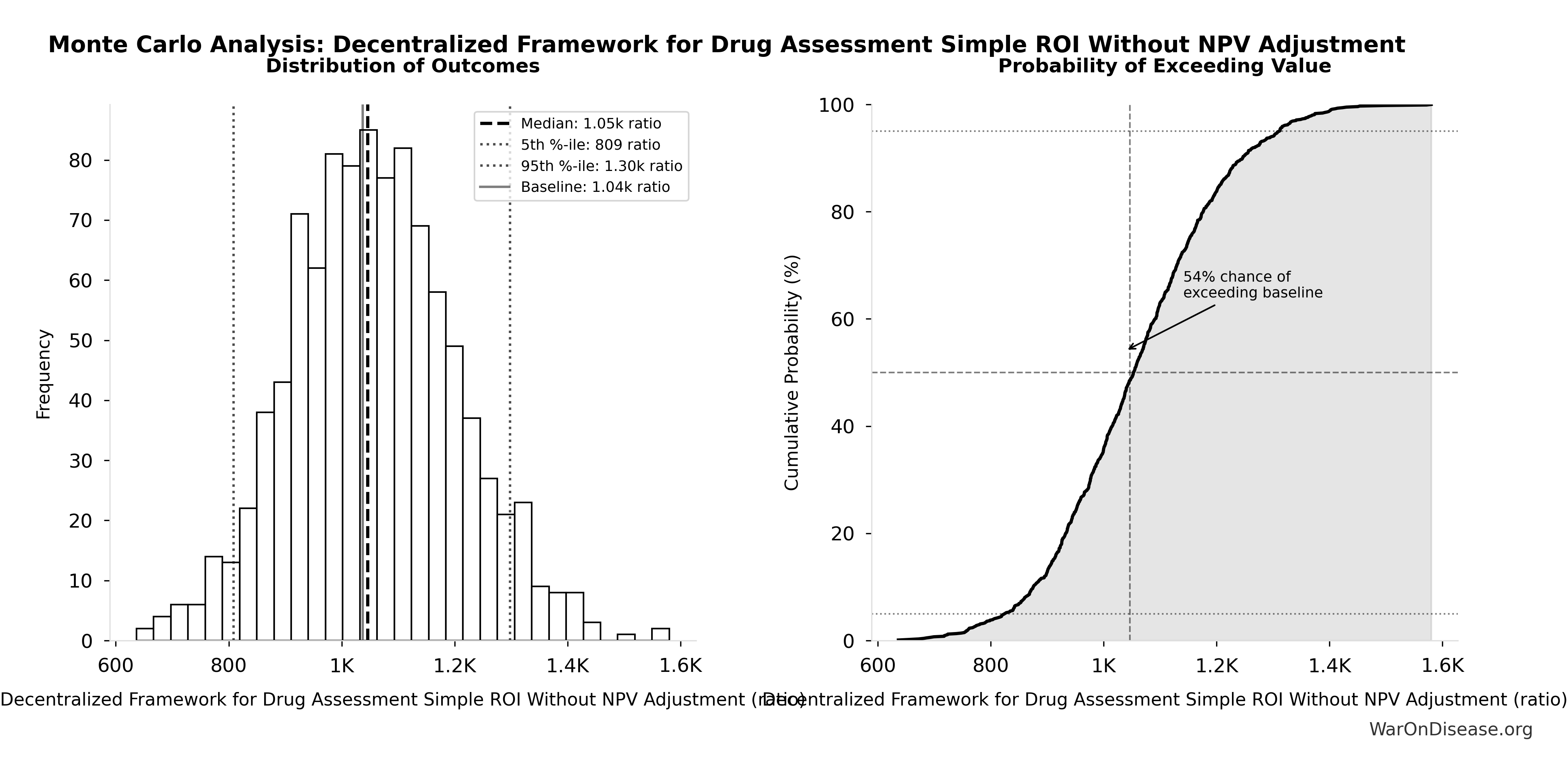

Monte Carlo Distribution

Simulation Results Summary: NPV of Decentralized Framework for Drug Assessment Benefits (R&D Only, 10-Year Discounted)

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $389B |

| Mean (expected value) | $391B |

| Median (50th percentile) | $384B |

| Standard Deviation | $50.9B |

| 90% Range (5th-95th percentile) | [$327B, $485B] |

The histogram shows the distribution of NPV of Decentralized Framework for Drug Assessment Benefits (R&D Only, 10-Year Discounted) across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

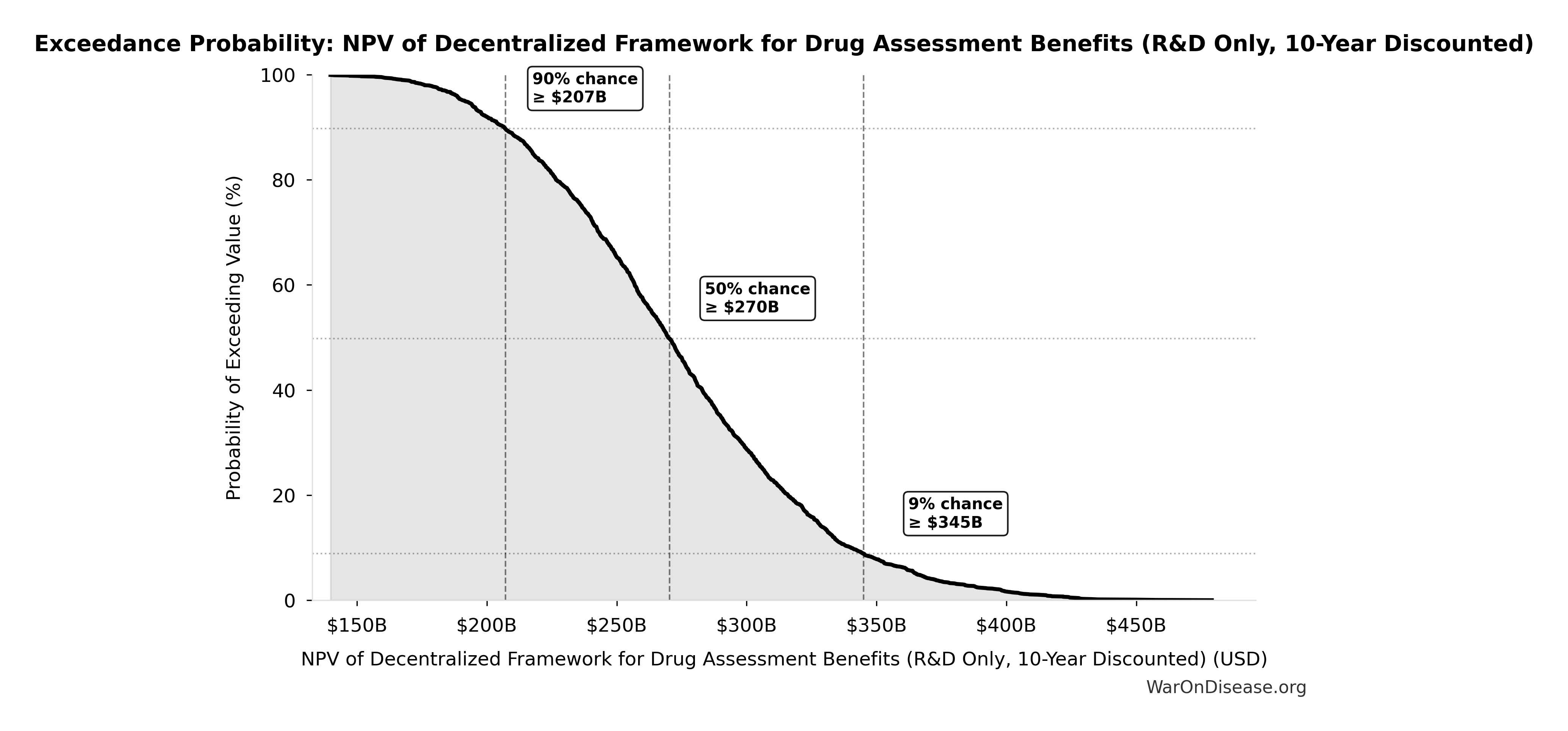

Exceedance Probability

This exceedance probability chart shows the likelihood that NPV of Decentralized Framework for Drug Assessment Benefits (R&D Only, 10-Year Discounted) will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

NPV Net Benefit (R&D Only): $389B

NPV net benefit using R&D savings only (benefits minus costs)

Inputs:

- NPV of Decentralized Framework for Drug Assessment Benefits (R&D Only, 10-Year Discounted) 🔢: $389B

- Decentralized Framework for Drug Assessment Total NPV Cost 🔢: $611M

\[ \begin{gathered} NPV_{net,RD} \\ = NPV_{RD} - Cost_{dFDA,total} \\ = \$389B - \$611M \\ = \$389B \\[0.5em] \text{where } NPV_{RD} = \sum_{t=1}^{10} \frac{Savings_{RD,ann} \times \frac{\min(t,5)}{5}}{(1+r)^t} \\[0.5em] \text{where } Savings_{RD,ann} \\ = Benefit_{RD,ann} - OPEX_{dFDA} \\ = \$58.6B - \$40M \\ = \$58.6B \\[0.5em] \text{where } Benefit_{RD,ann} \\ = Spending_{trials} \times Reduce_{pct} \\ = \$60B \times 97.7\% \\ = \$58.6B \\[0.5em] \text{where } Reduce_{pct} \\ = 1 - \frac{Cost_{pragmatic,pt}}{Cost_{P3,pt}} \\ = 1 - \frac{\$929}{\$41K} \\ = 97.7\% \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Cost_{dFDA,total} \\ = PV_{OPEX} + Cost_{upfront,total} \\ = \$342M + \$270M \\ = \$611M \\[0.5em] \text{where } PV_{OPEX} = OPEX_{ann} \times \frac{1 - (1+r)^{-T}}{r} \\[0.5em] \text{where } OPEX_{total} \\ = OPEX_{ann} + OPEX_{DIH,ann} \\ = \$18.9M + \$21.1M \\ = \$40M \\[0.5em] \text{where } Cost_{upfront,total} \\ = Cost_{upfront} + Cost_{DIH,init} \\ = \$40M + \$230M \\ = \$270M \end{gathered} \]

✓ High confidence

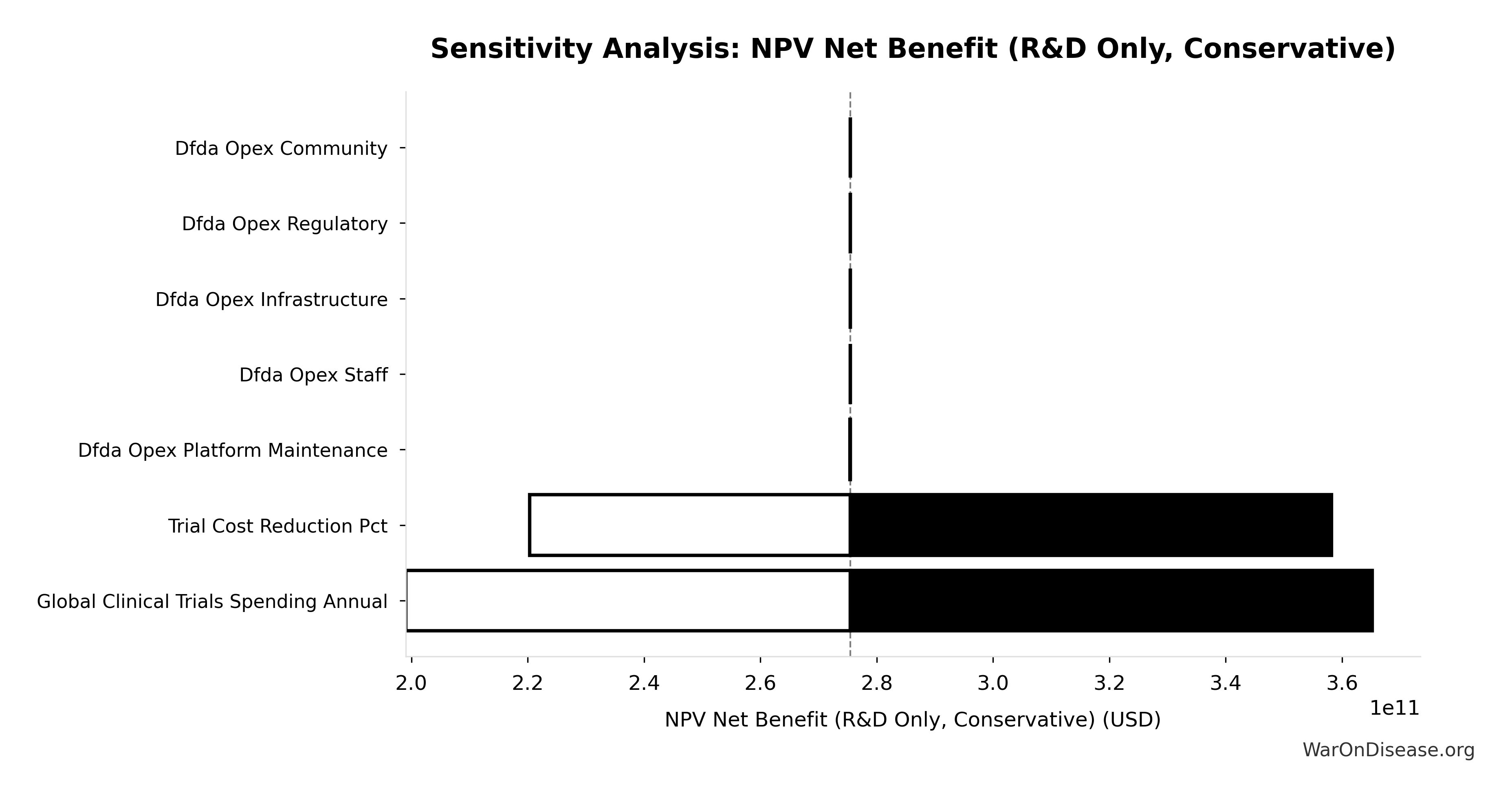

Sensitivity Analysis

Sensitivity Indices for NPV Net Benefit (R&D Only)

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA NPV Benefit R&D Only | 1.0025 | Strong driver |

| dFDA NPV Total Cost | -0.0025 | Minimal effect |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

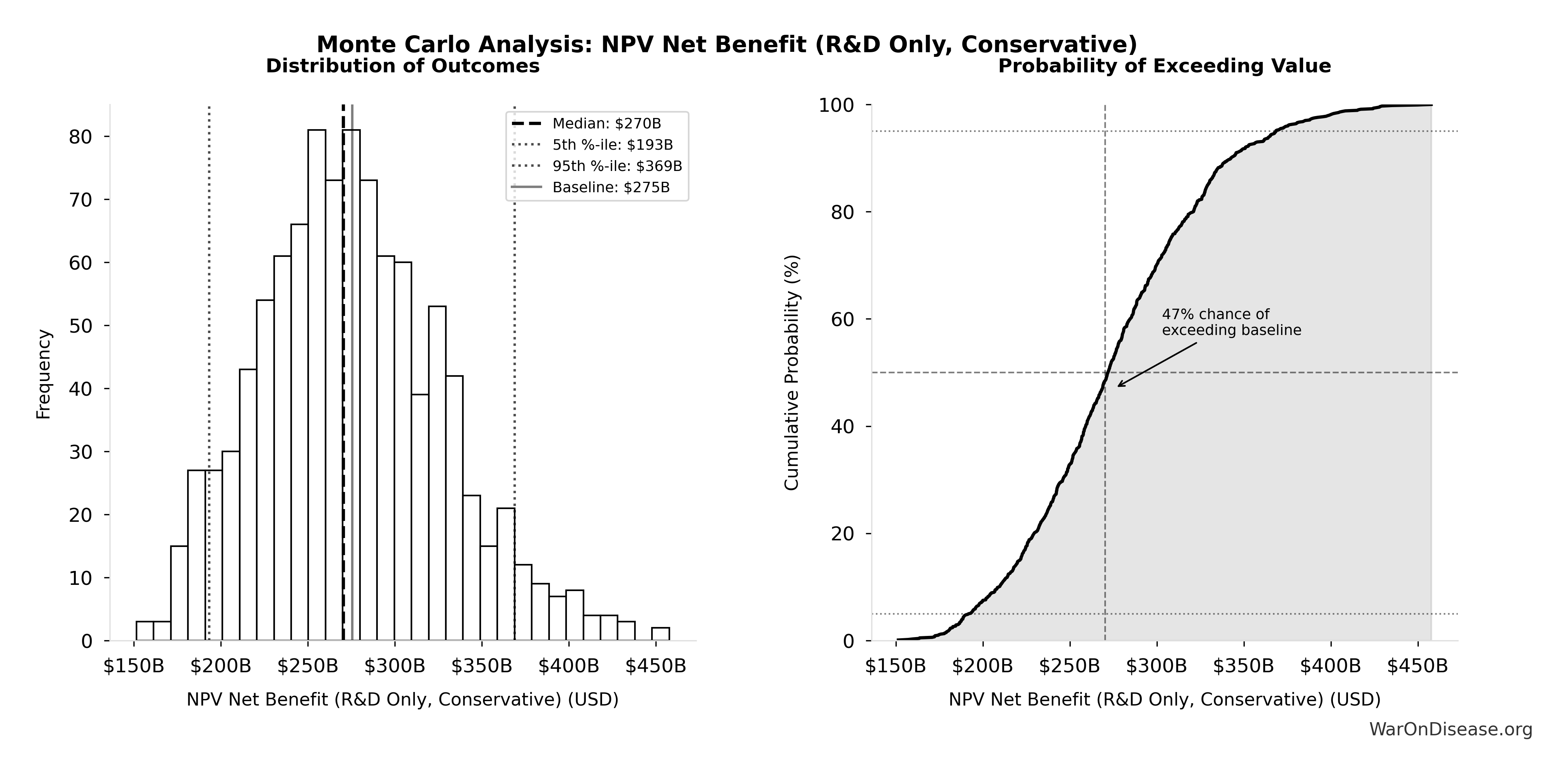

Monte Carlo Distribution

Simulation Results Summary: NPV Net Benefit (R&D Only)

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $389B |

| Mean (expected value) | $390B |

| Median (50th percentile) | $383B |

| Standard Deviation | $50.7B |

| 90% Range (5th-95th percentile) | [$326B, $484B] |

The histogram shows the distribution of NPV Net Benefit (R&D Only) across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

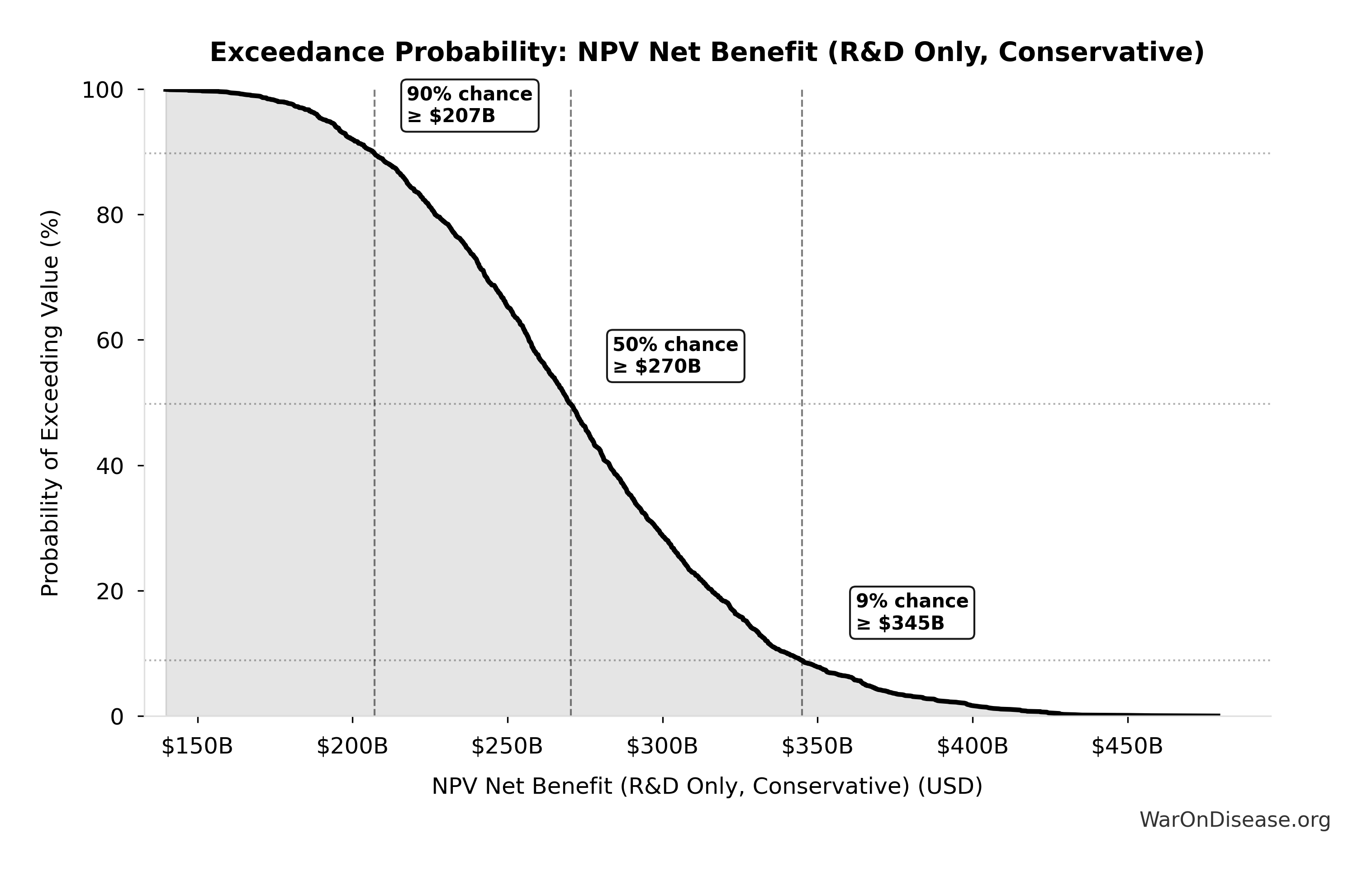

Exceedance Probability

This exceedance probability chart shows the likelihood that NPV Net Benefit (R&D Only) will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

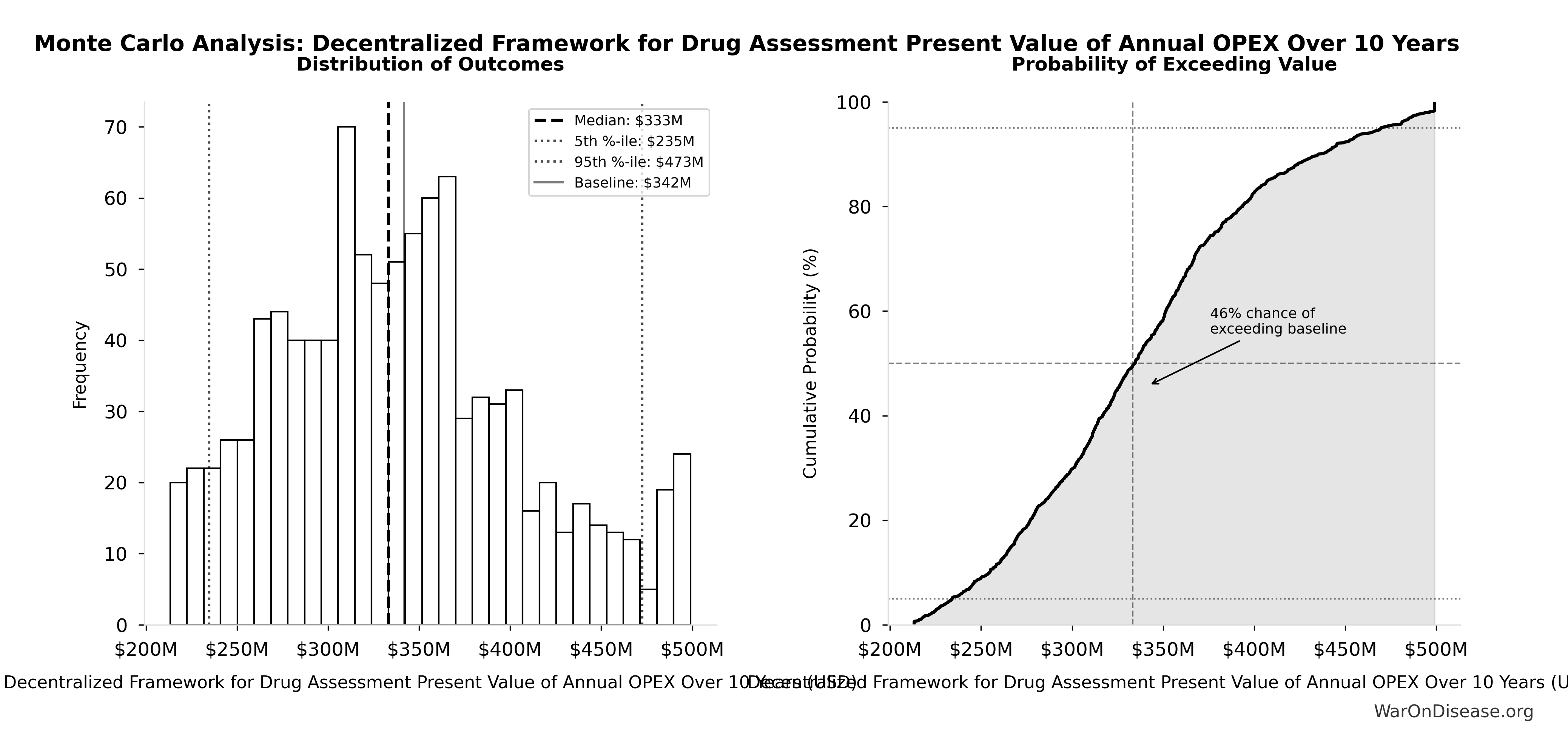

Decentralized Framework for Drug Assessment Present Value of Annual OPEX Over 10 Years: $342M

Present value of annual opex over 10 years (NPV formula)

Inputs:

- Decentralized Framework for Drug Assessment Total NPV Annual OPEX 🔢: $40M

- Standard Discount Rate for NPV Analysis: 3%

- Standard Time Horizon for NPV Analysis: 10 years

\[ PV_{OPEX} = OPEX_{ann} \times \frac{1 - (1+r)^{-T}}{r} \]

✓ High confidence

Sensitivity Analysis

Sensitivity Indices for Decentralized Framework for Drug Assessment Present Value of Annual OPEX Over 10 Years

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA NPV Annual OPEX Total | 1.0000 | Strong driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

Monte Carlo Distribution

Simulation Results Summary: Decentralized Framework for Drug Assessment Present Value of Annual OPEX Over 10 Years

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $342M |

| Mean (expected value) | $340M |

| Median (50th percentile) | $333M |

| Standard Deviation | $68.6M |

| 90% Range (5th-95th percentile) | [$235M, $473M] |

The histogram shows the distribution of Decentralized Framework for Drug Assessment Present Value of Annual OPEX Over 10 Years across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

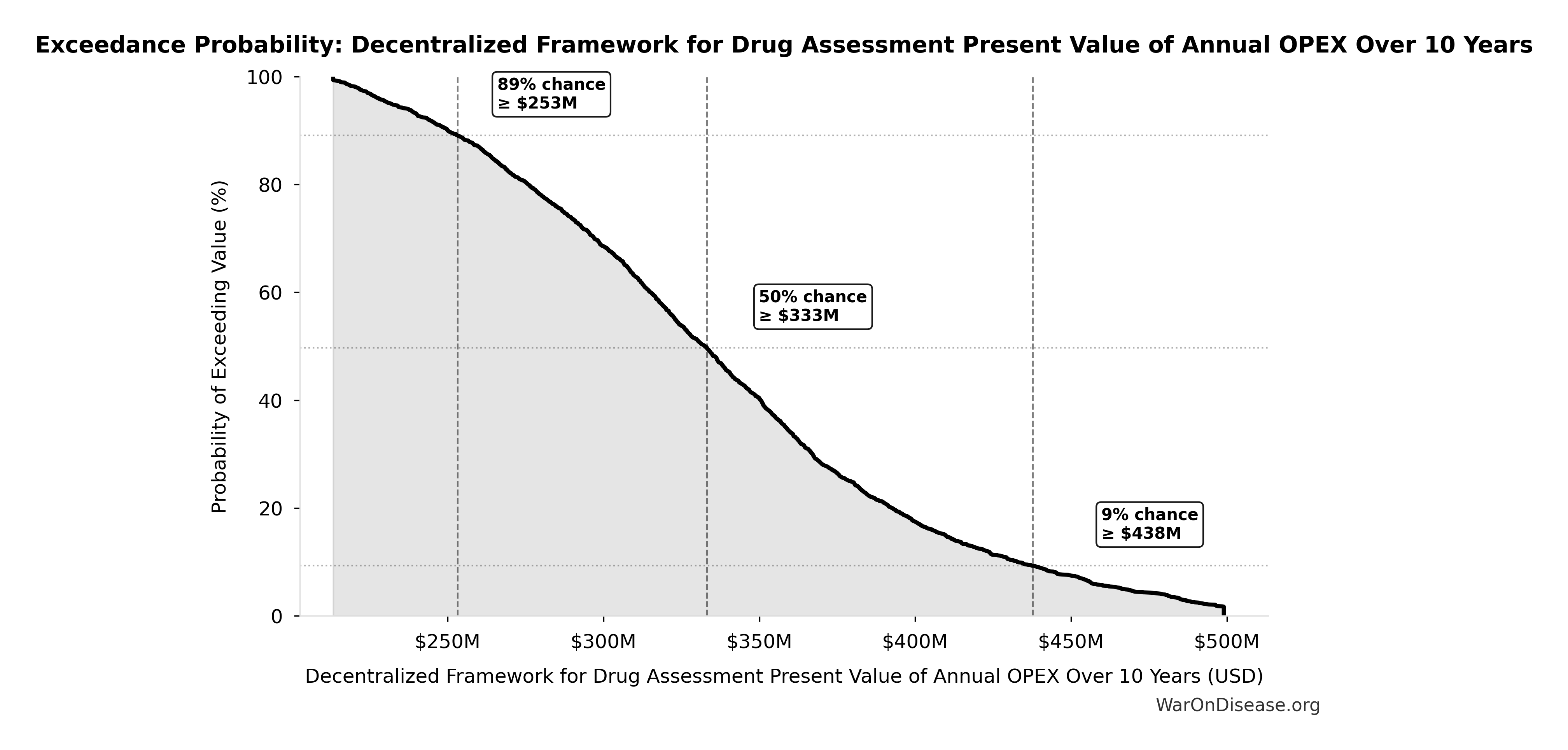

Exceedance Probability

This exceedance probability chart shows the likelihood that Decentralized Framework for Drug Assessment Present Value of Annual OPEX Over 10 Years will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

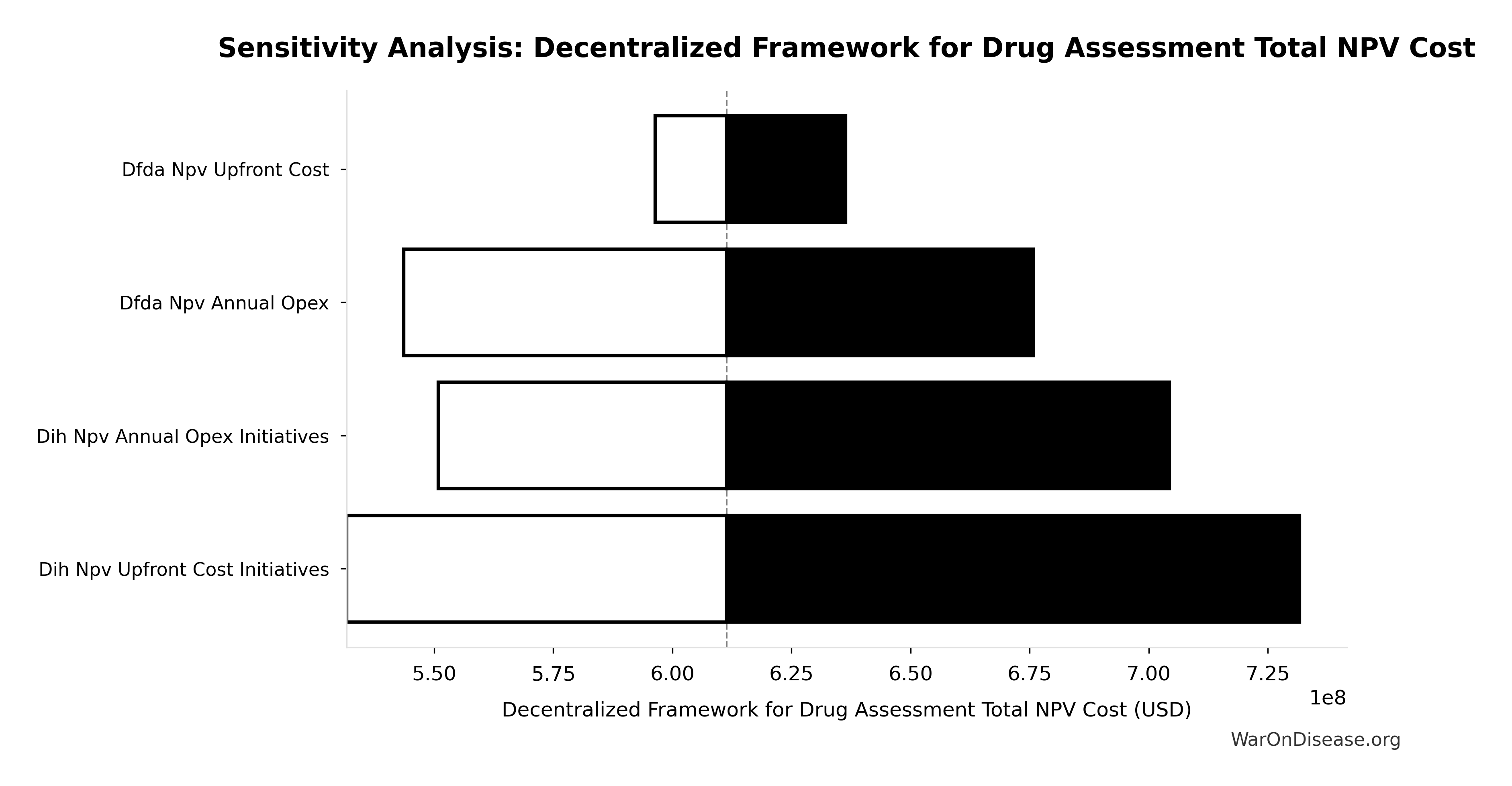

Decentralized Framework for Drug Assessment Total NPV Cost: $611M

Total NPV cost (upfront + PV of annual opex)

Inputs:

- Decentralized Framework for Drug Assessment Present Value of Annual OPEX Over 10 Years 🔢: $342M

- Decentralized Framework for Drug Assessment Total NPV Upfront Costs 🔢: $270M

\[ \begin{gathered} Cost_{dFDA,total} \\ = PV_{OPEX} + Cost_{upfront,total} \\ = \$342M + \$270M \\ = \$611M \\[0.5em] \text{where } PV_{OPEX} = OPEX_{ann} \times \frac{1 - (1+r)^{-T}}{r} \\[0.5em] \text{where } OPEX_{total} \\ = OPEX_{ann} + OPEX_{DIH,ann} \\ = \$18.9M + \$21.1M \\ = \$40M \\[0.5em] \text{where } Cost_{upfront,total} \\ = Cost_{upfront} + Cost_{DIH,init} \\ = \$40M + \$230M \\ = \$270M \end{gathered} \]

✓ High confidence

Sensitivity Analysis

Sensitivity Indices for Decentralized Framework for Drug Assessment Total NPV Cost

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA NPV Pv Annual OPEX | 0.5417 | Strong driver |

| dFDA NPV Upfront Cost Total | 0.4585 | Moderate driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

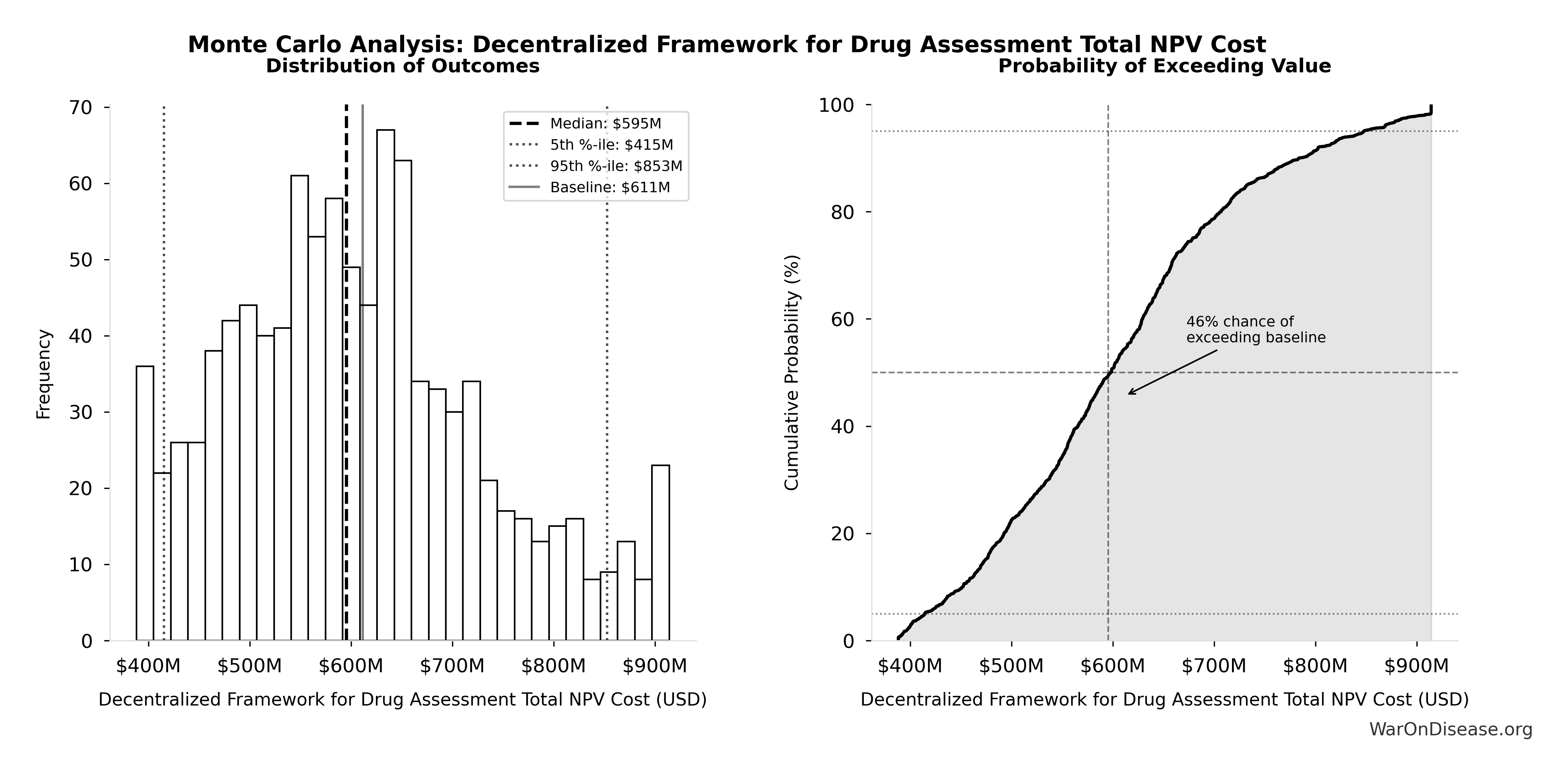

Monte Carlo Distribution

Simulation Results Summary: Decentralized Framework for Drug Assessment Total NPV Cost

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $611M |

| Mean (expected value) | $609M |

| Median (50th percentile) | $595M |

| Standard Deviation | $127M |

| 90% Range (5th-95th percentile) | [$415M, $853M] |

The histogram shows the distribution of Decentralized Framework for Drug Assessment Total NPV Cost across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

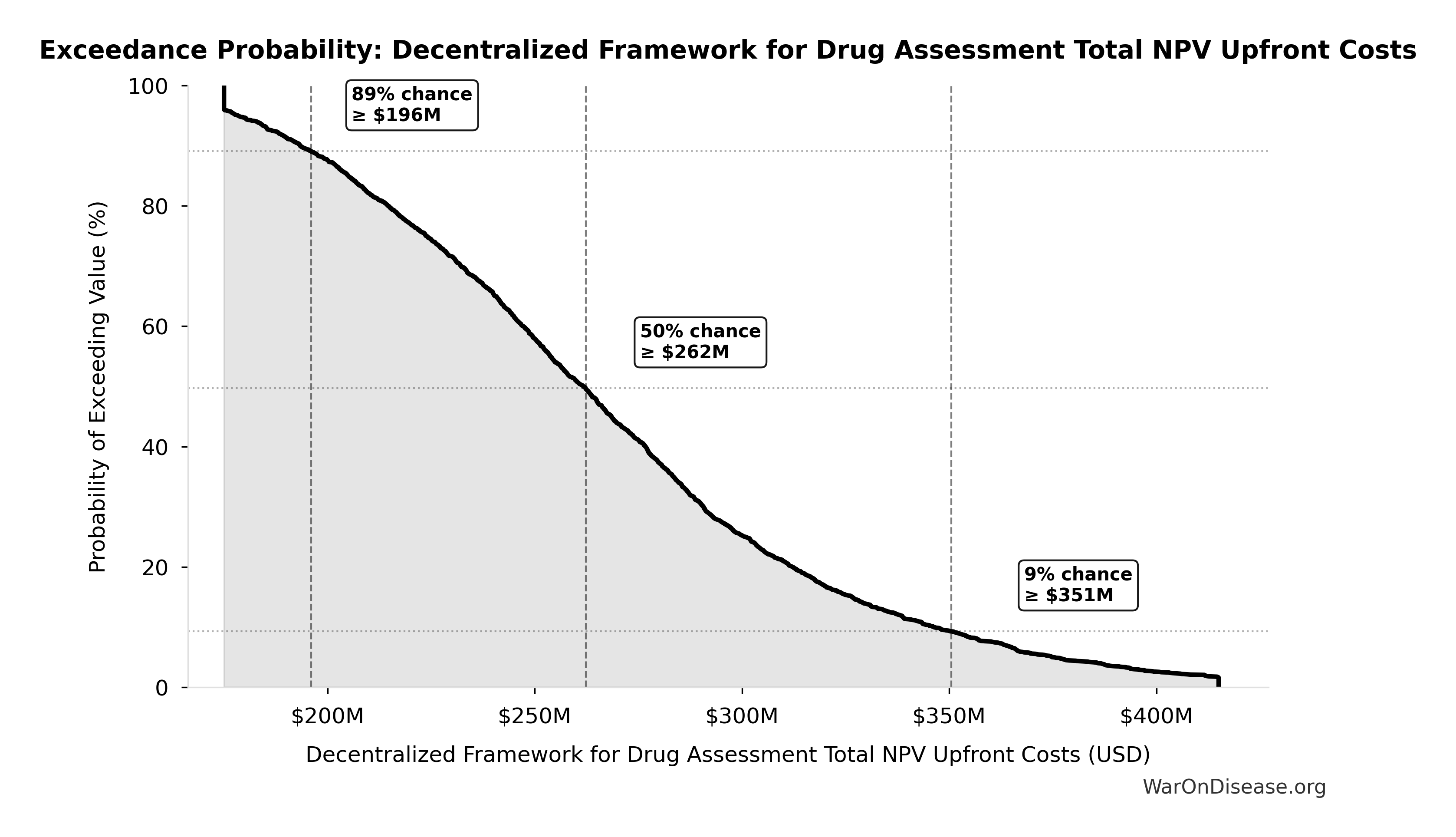

Exceedance Probability

This exceedance probability chart shows the likelihood that Decentralized Framework for Drug Assessment Total NPV Cost will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

Decentralized Framework for Drug Assessment Total NPV Upfront Costs: $270M

Total NPV upfront costs (Decentralized Framework for Drug Assessment core + DIH initiatives)

Inputs:

- Decentralized Framework for Drug Assessment Core framework Build Cost: $40M (95% CI: $25M - $65M)

- DIH Broader Initiatives Upfront Cost: $230M (95% CI: $150M - $350M)

\[ \begin{gathered} Cost_{upfront,total} \\ = Cost_{upfront} + Cost_{DIH,init} \\ = \$40M + \$230M \\ = \$270M \end{gathered} \]

✓ High confidence

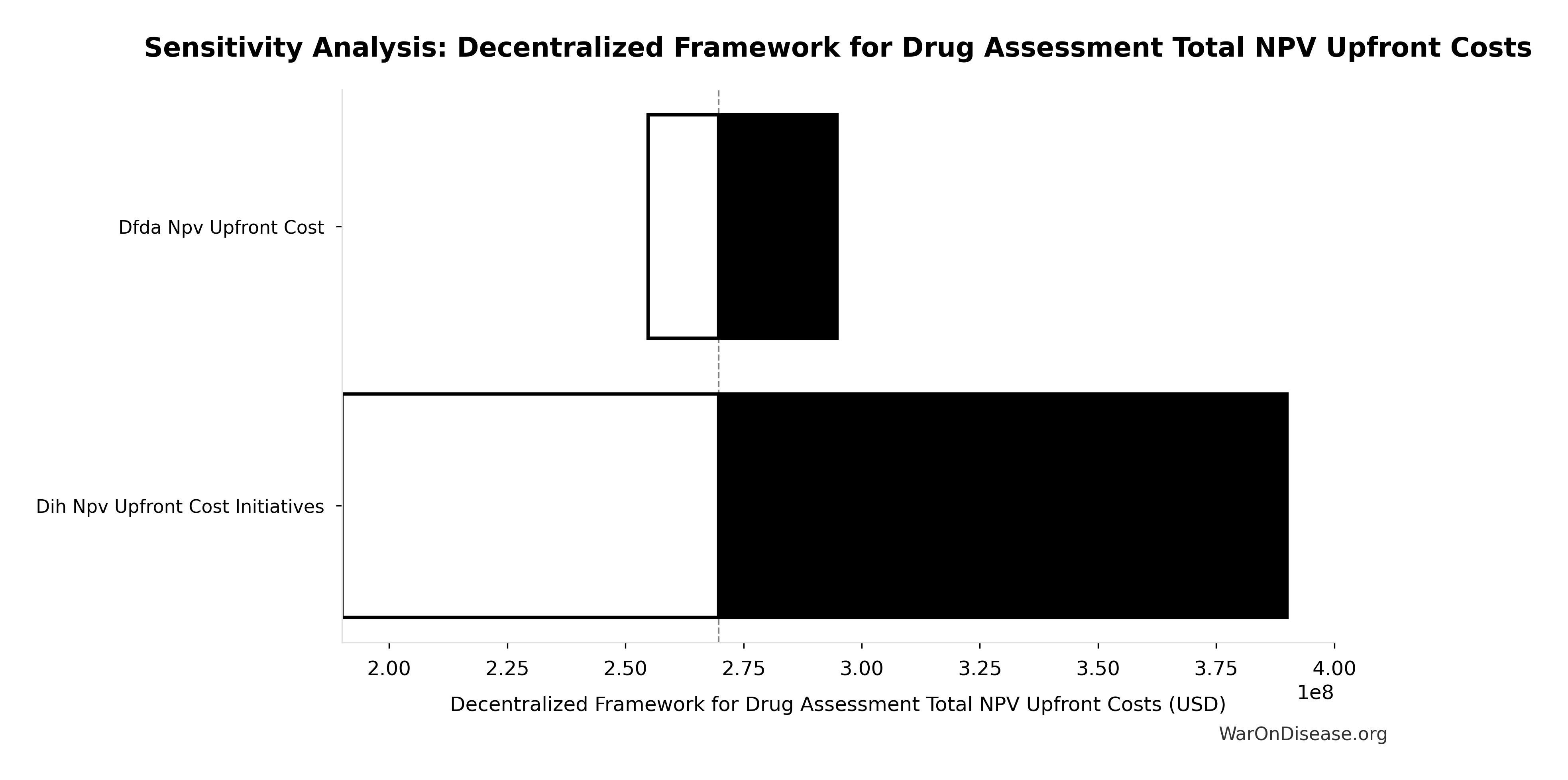

Sensitivity Analysis

Sensitivity Indices for Decentralized Framework for Drug Assessment Total NPV Upfront Costs

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| DIH NPV Upfront Cost Initiatives | 0.8338 | Strong driver |

| dFDA NPV Upfront Cost | 0.1662 | Weak driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

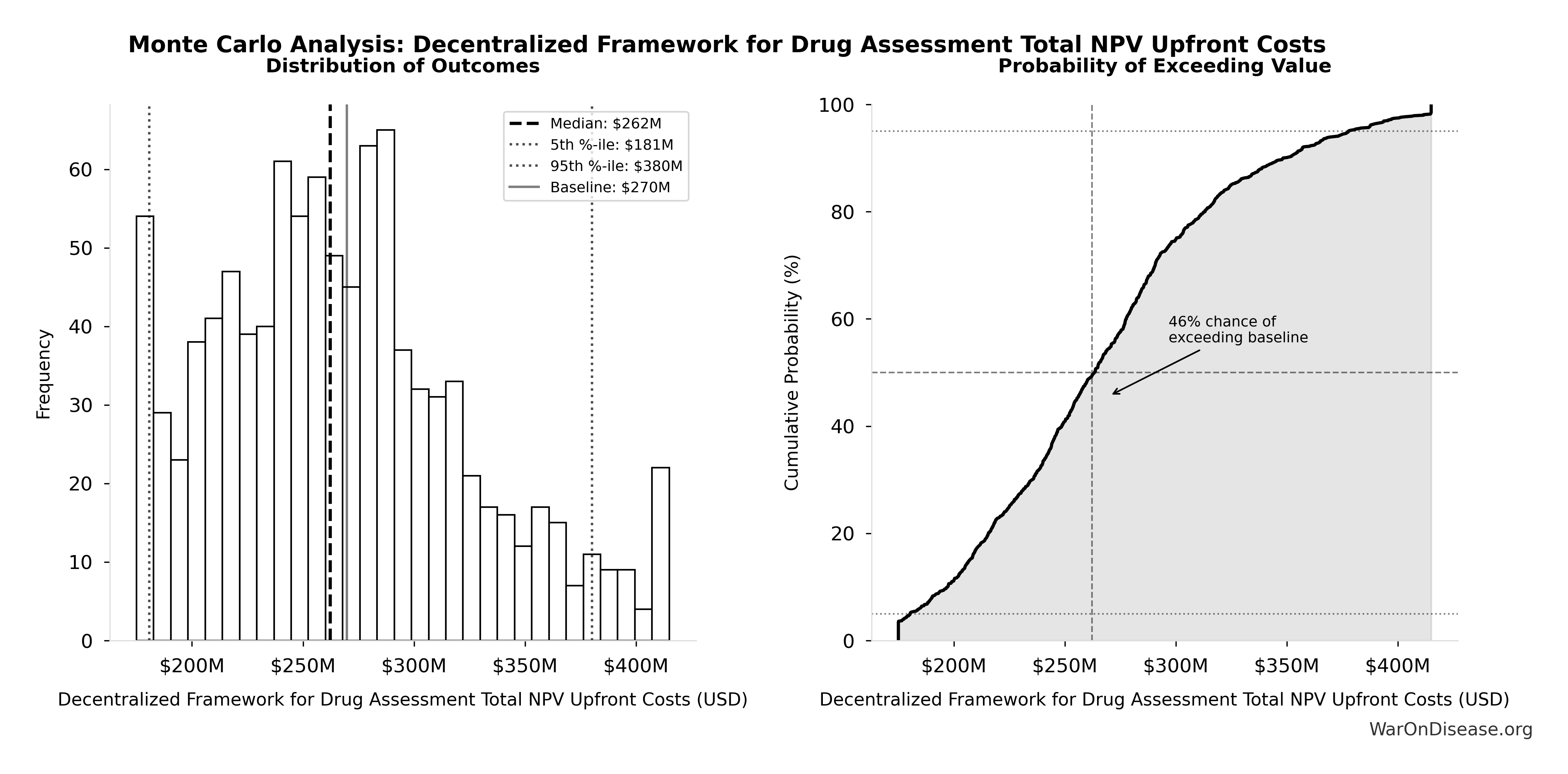

Monte Carlo Distribution

Simulation Results Summary: Decentralized Framework for Drug Assessment Total NPV Upfront Costs

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $270M |

| Mean (expected value) | $269M |

| Median (50th percentile) | $262M |

| Standard Deviation | $58.1M |

| 90% Range (5th-95th percentile) | [$181M, $380M] |

The histogram shows the distribution of Decentralized Framework for Drug Assessment Total NPV Upfront Costs across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

Exceedance Probability

This exceedance probability chart shows the likelihood that Decentralized Framework for Drug Assessment Total NPV Upfront Costs will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

Decentralized Framework for Drug Assessment Overhead Percentage of Treaty Funding: 0.147%

Percentage of treaty funding allocated to Decentralized Framework for Drug Assessment framework overhead

Inputs:

- Total Annual Decentralized Framework for Drug Assessment Operational Costs 🔢: $40M

- Annual Funding from 1% of Global Military Spending Redirected to DIH 🔢: $27.2B

\[ \begin{gathered} OPEX_{pct} = \frac{OPEX_{dFDA}}{Funding_{treaty}} = \frac{\$40M}{\$27.2B} = 0.147\% \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

✓ High confidence

Sensitivity Analysis

Sensitivity Indices for Decentralized Framework for Drug Assessment Overhead Percentage of Treaty Funding

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Annual OPEX | 1.0000 | Strong driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

Monte Carlo Distribution

Simulation Results Summary: Decentralized Framework for Drug Assessment Overhead Percentage of Treaty Funding

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 0.147% |

| Mean (expected value) | 0.147% |

| Median (50th percentile) | 0.143% |

| Standard Deviation | 0.0302% |

| 90% Range (5th-95th percentile) | [0.1%, 0.204%] |

The histogram shows the distribution of Decentralized Framework for Drug Assessment Overhead Percentage of Treaty Funding across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

Exceedance Probability

This exceedance probability chart shows the likelihood that Decentralized Framework for Drug Assessment Overhead Percentage of Treaty Funding will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

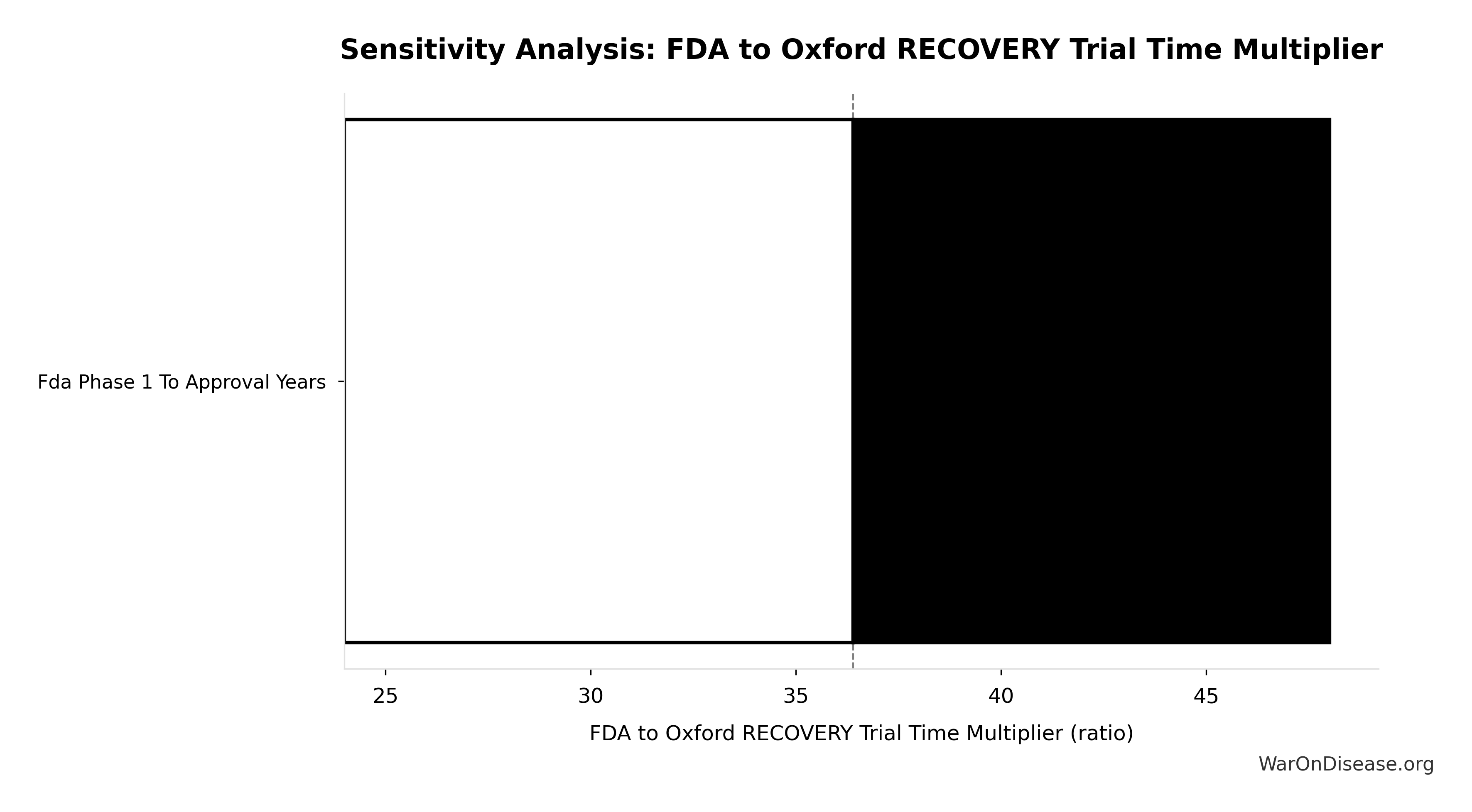

dFDA Therapeutic Space Exploration Time: 36 years

Years to explore the entire therapeutic search space with dFDA implementation. At increased discovery rate, finding first treatments for all currently untreatable diseases takes ~36 years instead of ~443.

Inputs:

- Status Quo Therapeutic Space Exploration Time 🔢: 443 years

- Trial Capacity Multiplier 🔢: 12.3x

\[ \begin{gathered} T_{queue,dFDA} = \frac{T_{queue,SQ}}{k_{capacity}} = \frac{443}{12.3} = 36 \\[0.5em] \text{where } T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

? Low confidence

Sensitivity Analysis

Sensitivity Indices for dFDA Therapeutic Space Exploration Time

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| Status Quo Queue Clearance Years | -1.3321 | Strong driver |

| dFDA Trial Capacity Multiplier | 0.4867 | Moderate driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

Monte Carlo Distribution

Simulation Results Summary: dFDA Therapeutic Space Exploration Time

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 36 |

| Mean (expected value) | 34.6 |

| Median (50th percentile) | 29.7 |

| Standard Deviation | 19.9 |

| 90% Range (5th-95th percentile) | [11.6, 77.2] |

The histogram shows the distribution of dFDA Therapeutic Space Exploration Time across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

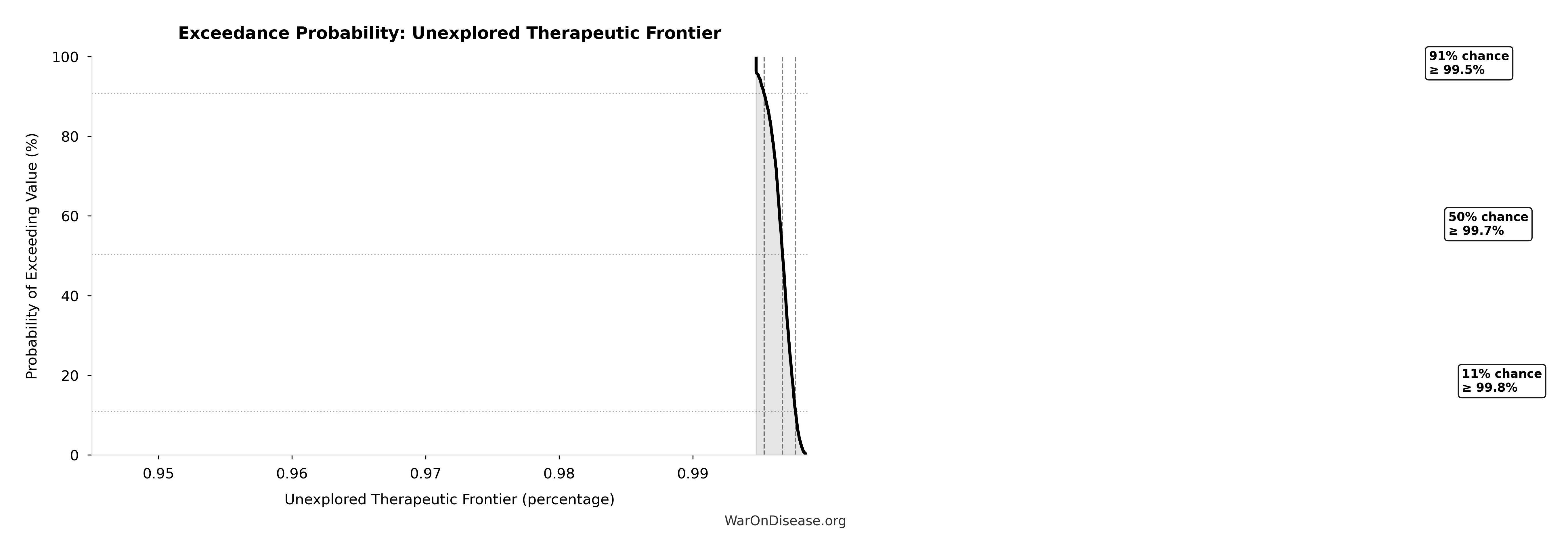

Exceedance Probability

This exceedance probability chart shows the likelihood that dFDA Therapeutic Space Exploration Time will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

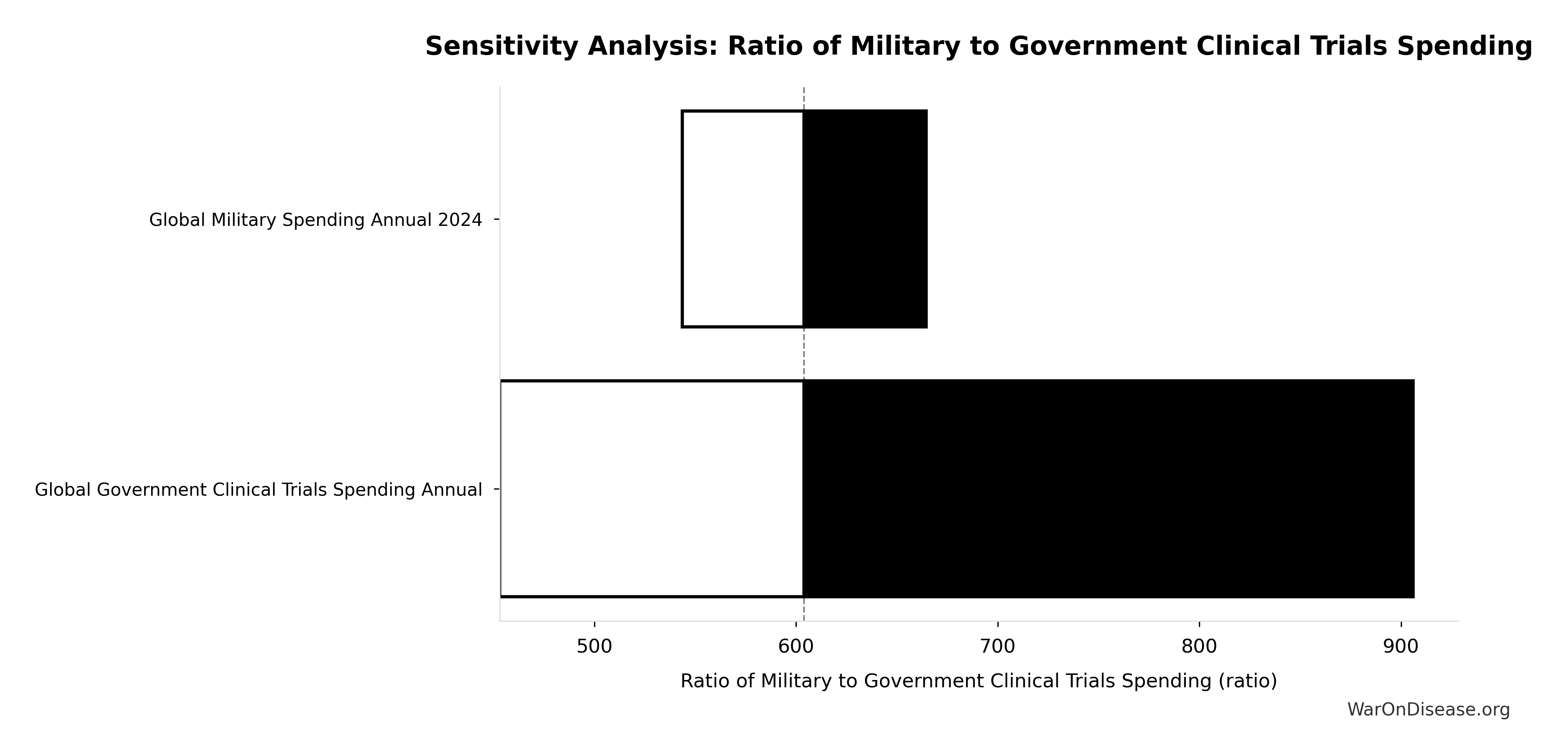

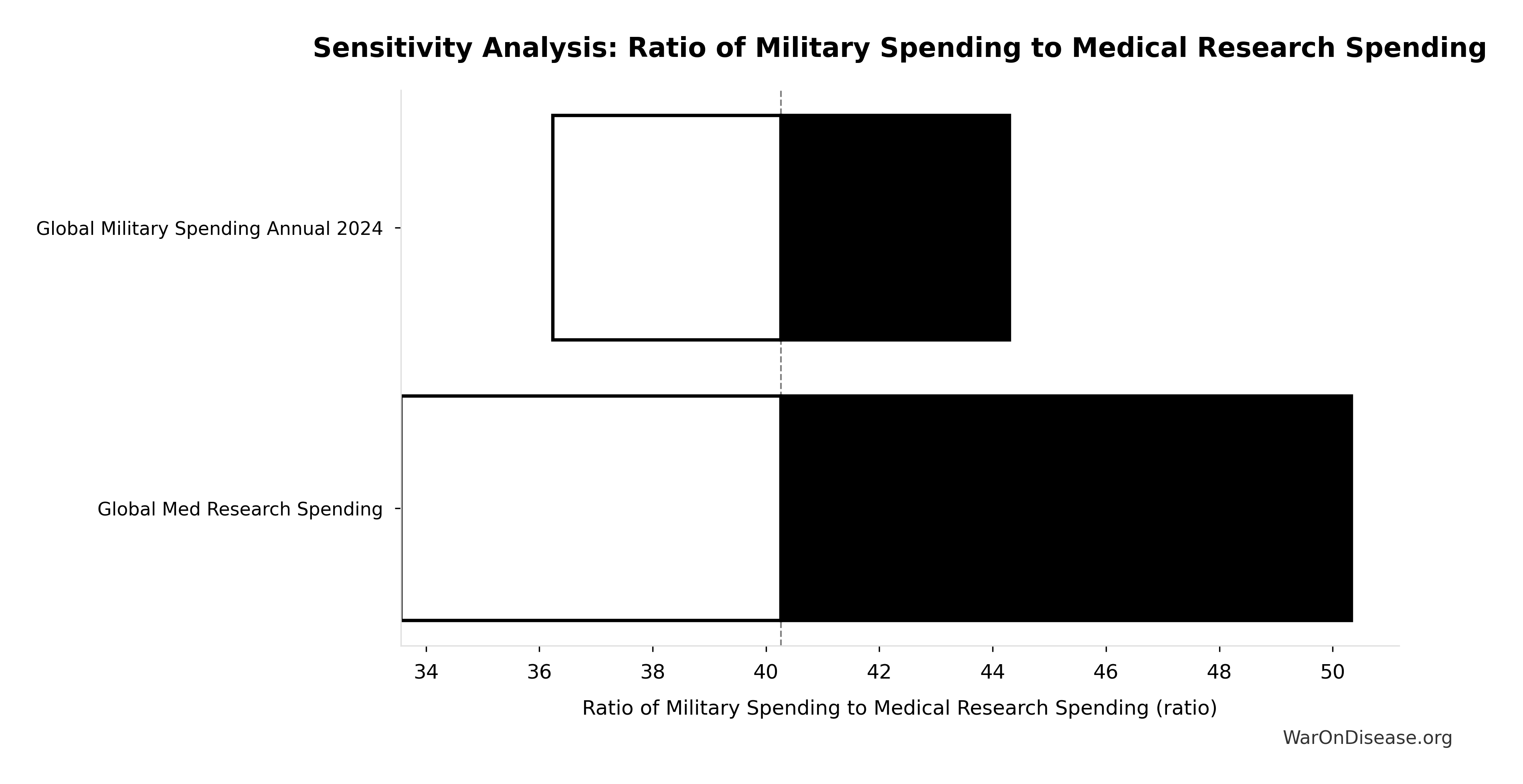

ROI from Decentralized Framework for Drug Assessment R&D Savings Only: 637:1

ROI from Decentralized Framework for Drug Assessment R&D savings only (10-year NPV, most conservative estimate)

Inputs:

- NPV of Decentralized Framework for Drug Assessment Benefits (R&D Only, 10-Year Discounted) 🔢: $389B

- Decentralized Framework for Drug Assessment Total NPV Cost 🔢: $611M

\[ \begin{gathered} ROI_{RD} = \frac{NPV_{RD}}{Cost_{dFDA,total}} = \frac{\$389B}{\$611M} = 637 \\[0.5em] \text{where } NPV_{RD} = \sum_{t=1}^{10} \frac{Savings_{RD,ann} \times \frac{\min(t,5)}{5}}{(1+r)^t} \\[0.5em] \text{where } Savings_{RD,ann} \\ = Benefit_{RD,ann} - OPEX_{dFDA} \\ = \$58.6B - \$40M \\ = \$58.6B \\[0.5em] \text{where } Benefit_{RD,ann} \\ = Spending_{trials} \times Reduce_{pct} \\ = \$60B \times 97.7\% \\ = \$58.6B \\[0.5em] \text{where } Reduce_{pct} \\ = 1 - \frac{Cost_{pragmatic,pt}}{Cost_{P3,pt}} \\ = 1 - \frac{\$929}{\$41K} \\ = 97.7\% \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Cost_{dFDA,total} \\ = PV_{OPEX} + Cost_{upfront,total} \\ = \$342M + \$270M \\ = \$611M \\[0.5em] \text{where } PV_{OPEX} = OPEX_{ann} \times \frac{1 - (1+r)^{-T}}{r} \\[0.5em] \text{where } OPEX_{total} \\ = OPEX_{ann} + OPEX_{DIH,ann} \\ = \$18.9M + \$21.1M \\ = \$40M \\[0.5em] \text{where } Cost_{upfront,total} \\ = Cost_{upfront} + Cost_{DIH,init} \\ = \$40M + \$230M \\ = \$270M \end{gathered} \]

✓ High confidence

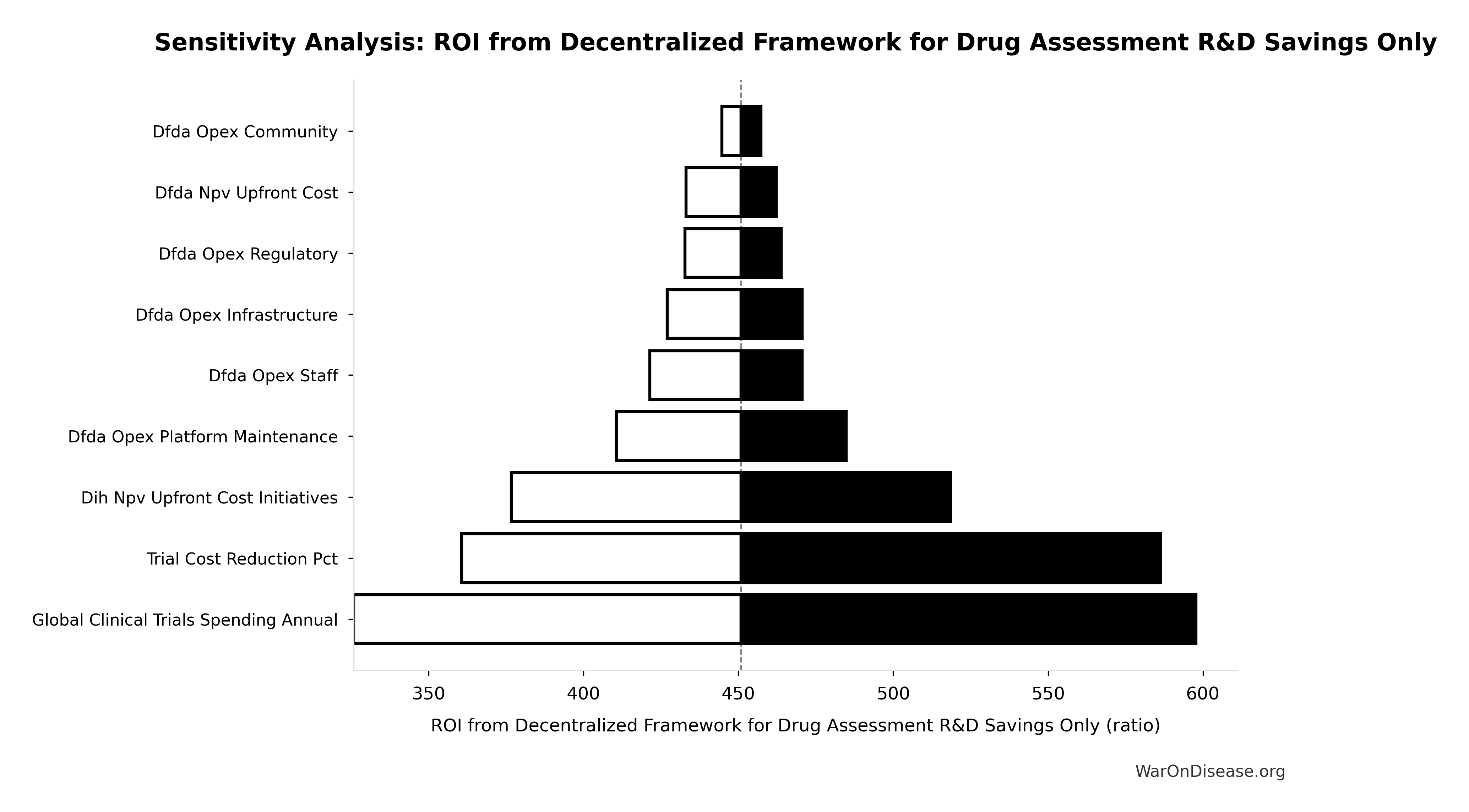

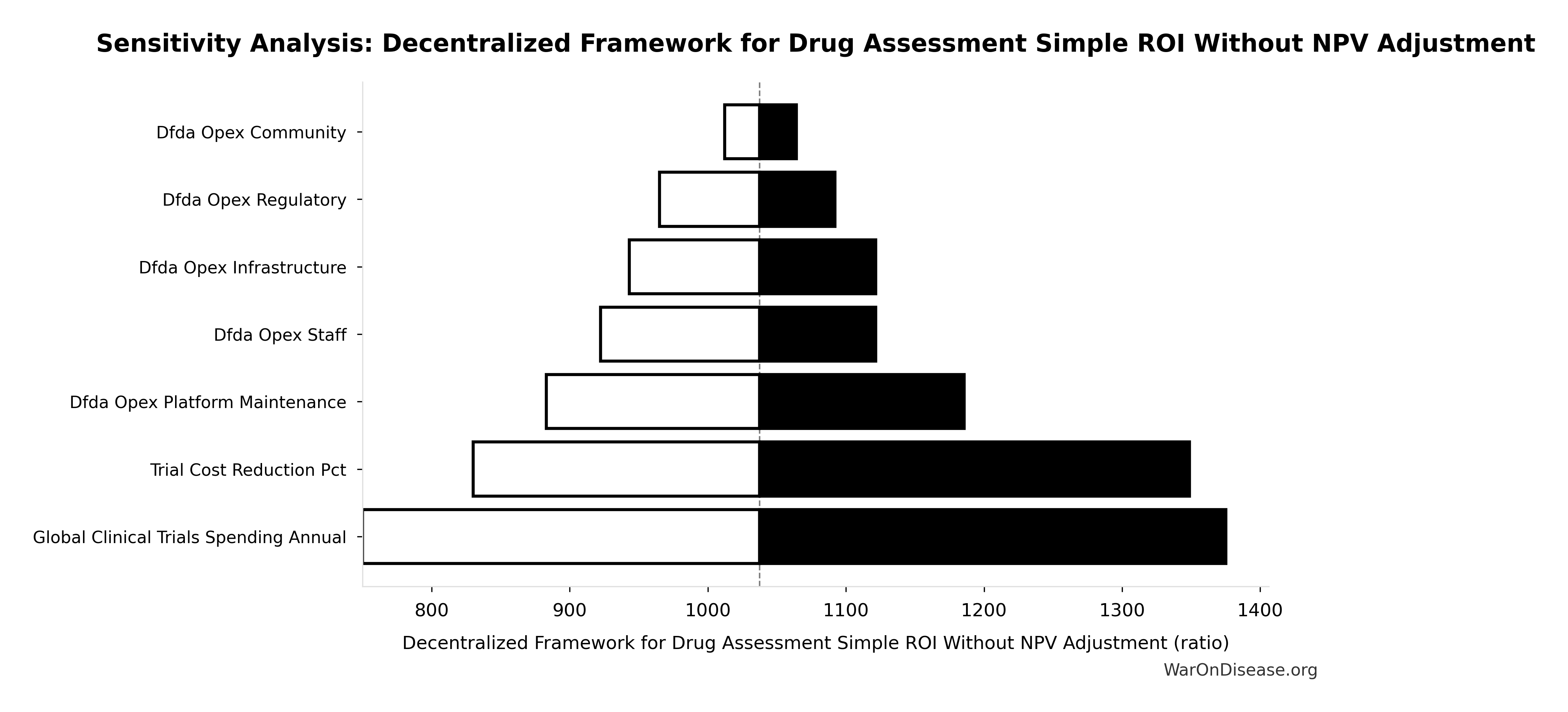

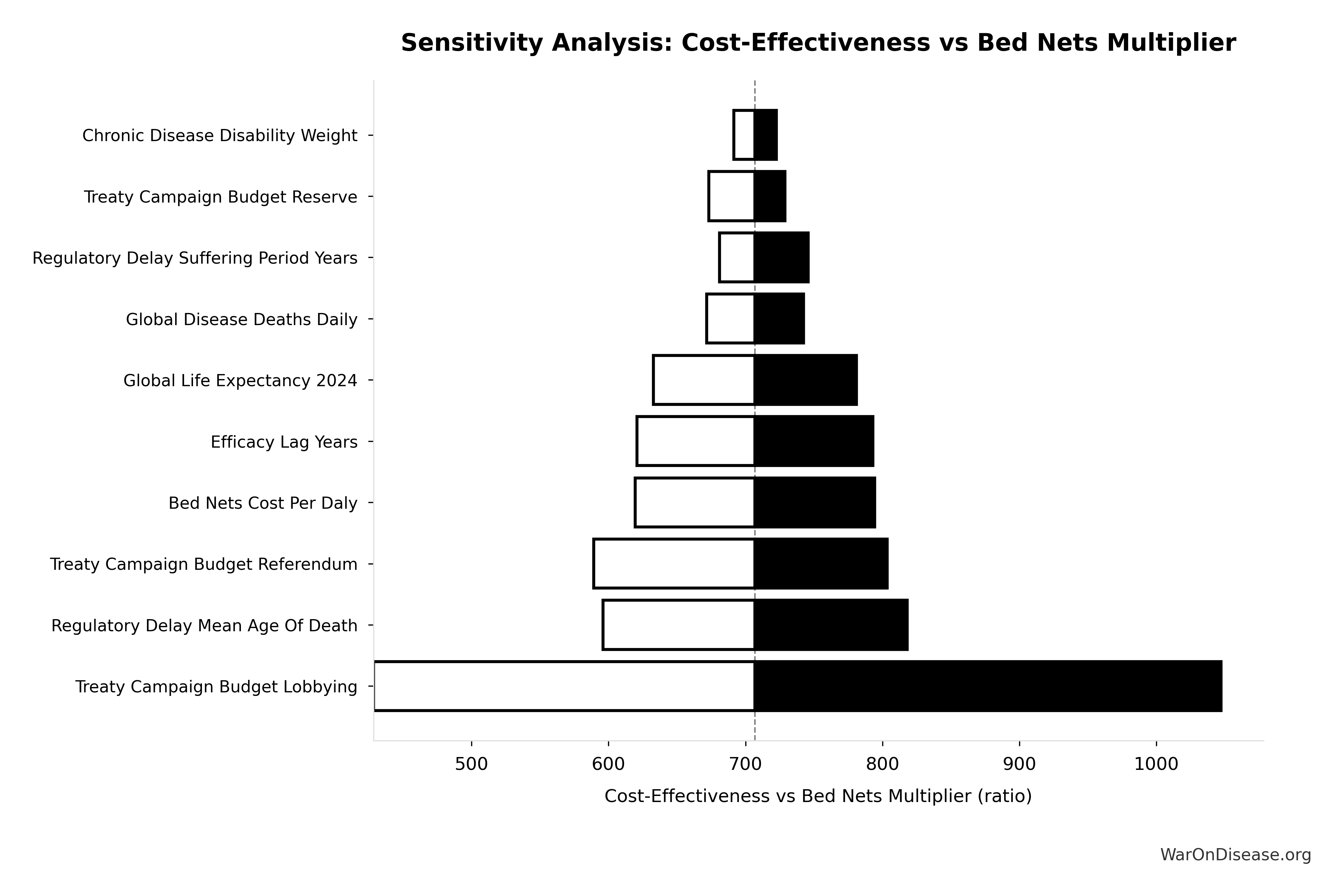

Sensitivity Analysis

Sensitivity Indices for ROI from Decentralized Framework for Drug Assessment R&D Savings Only

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA NPV Total Cost | -2.6305 | Strong driver |

| dFDA NPV Benefit R&D Only | 1.7615 | Strong driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

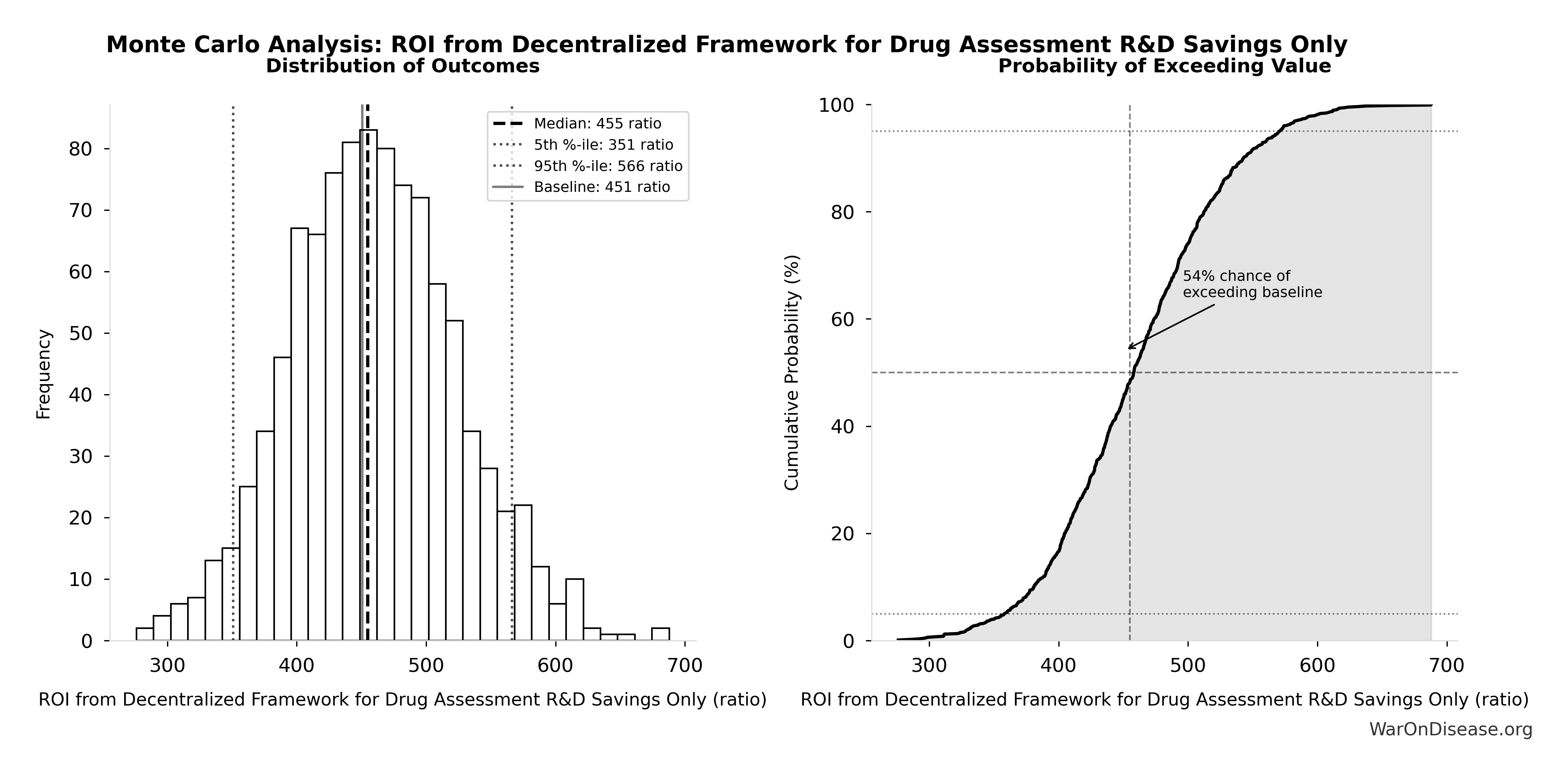

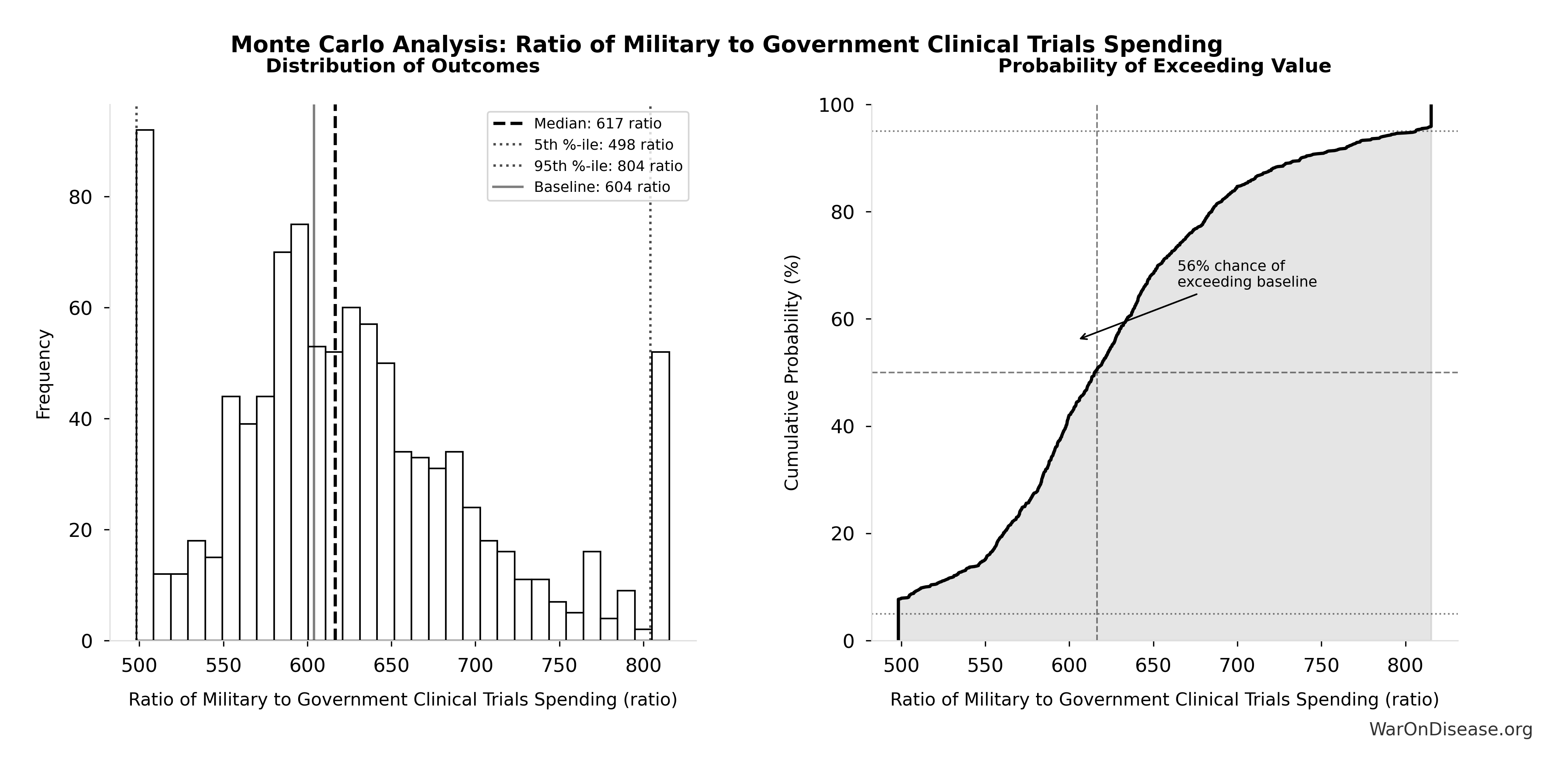

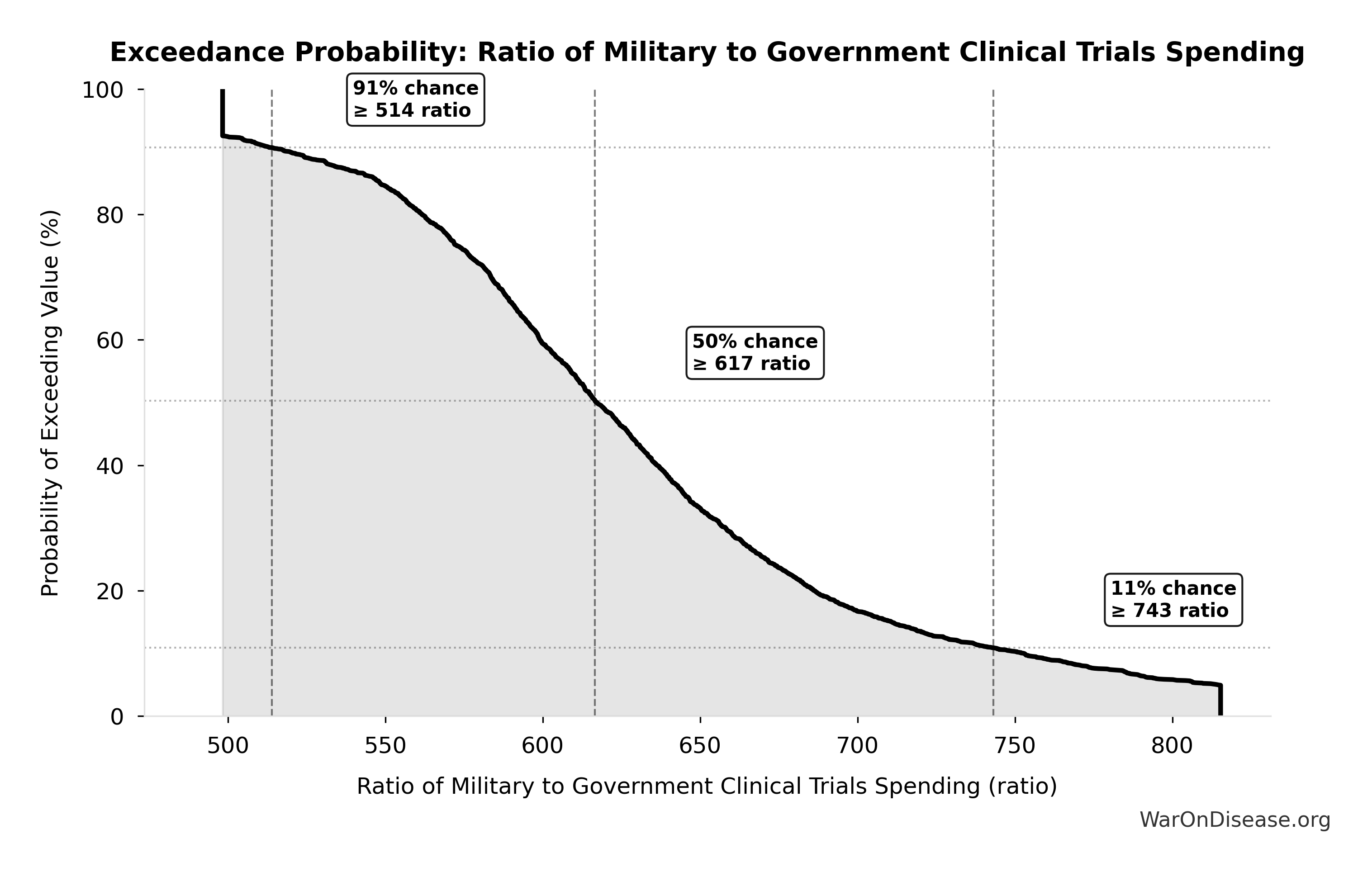

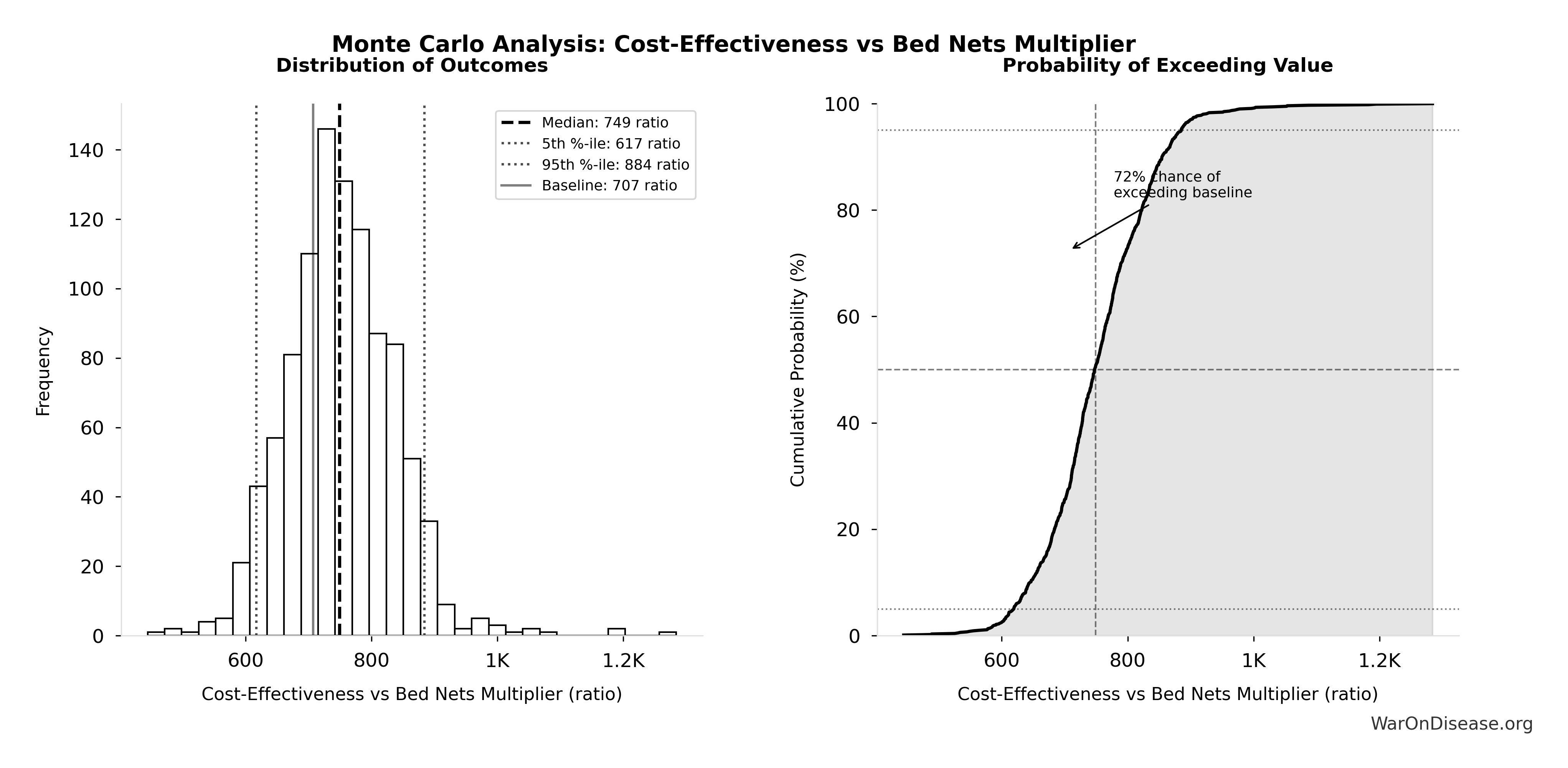

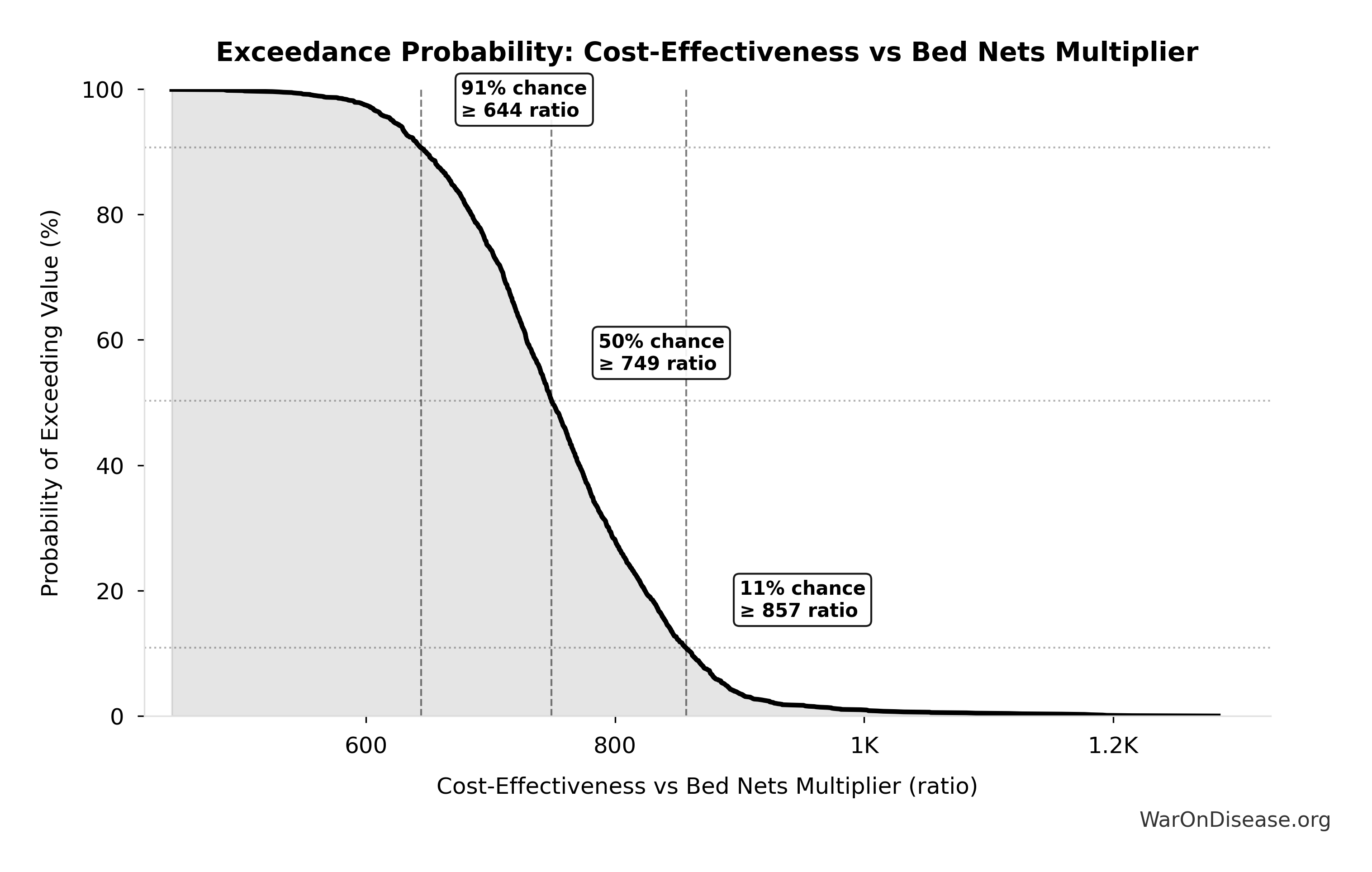

Monte Carlo Distribution

Simulation Results Summary: ROI from Decentralized Framework for Drug Assessment R&D Savings Only

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 637:1 |

| Mean (expected value) | 653:1 |

| Median (50th percentile) | 645:1 |

| Standard Deviation | 58.4:1 |

| 90% Range (5th-95th percentile) | [569:1, 790:1] |

The histogram shows the distribution of ROI from Decentralized Framework for Drug Assessment R&D Savings Only across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

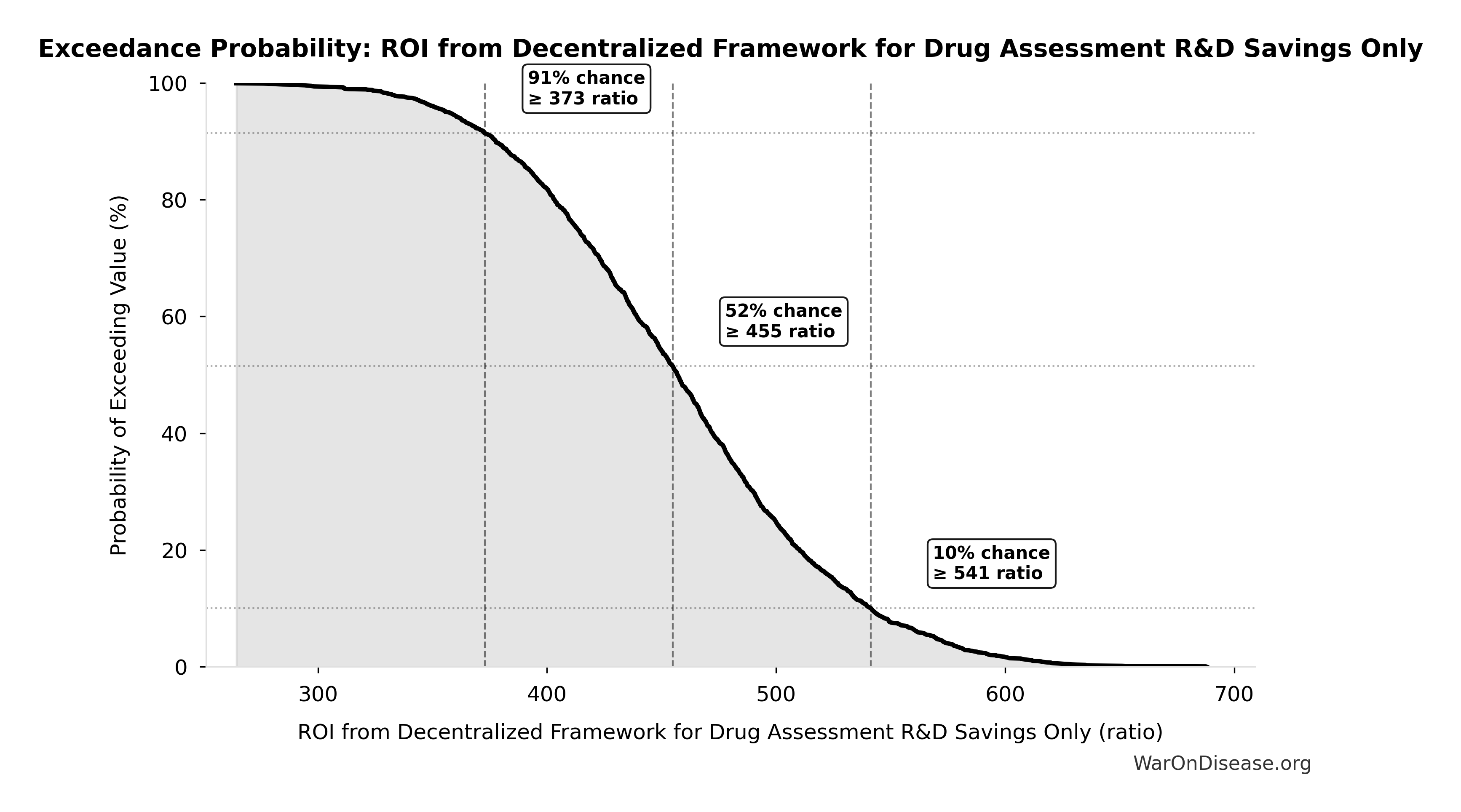

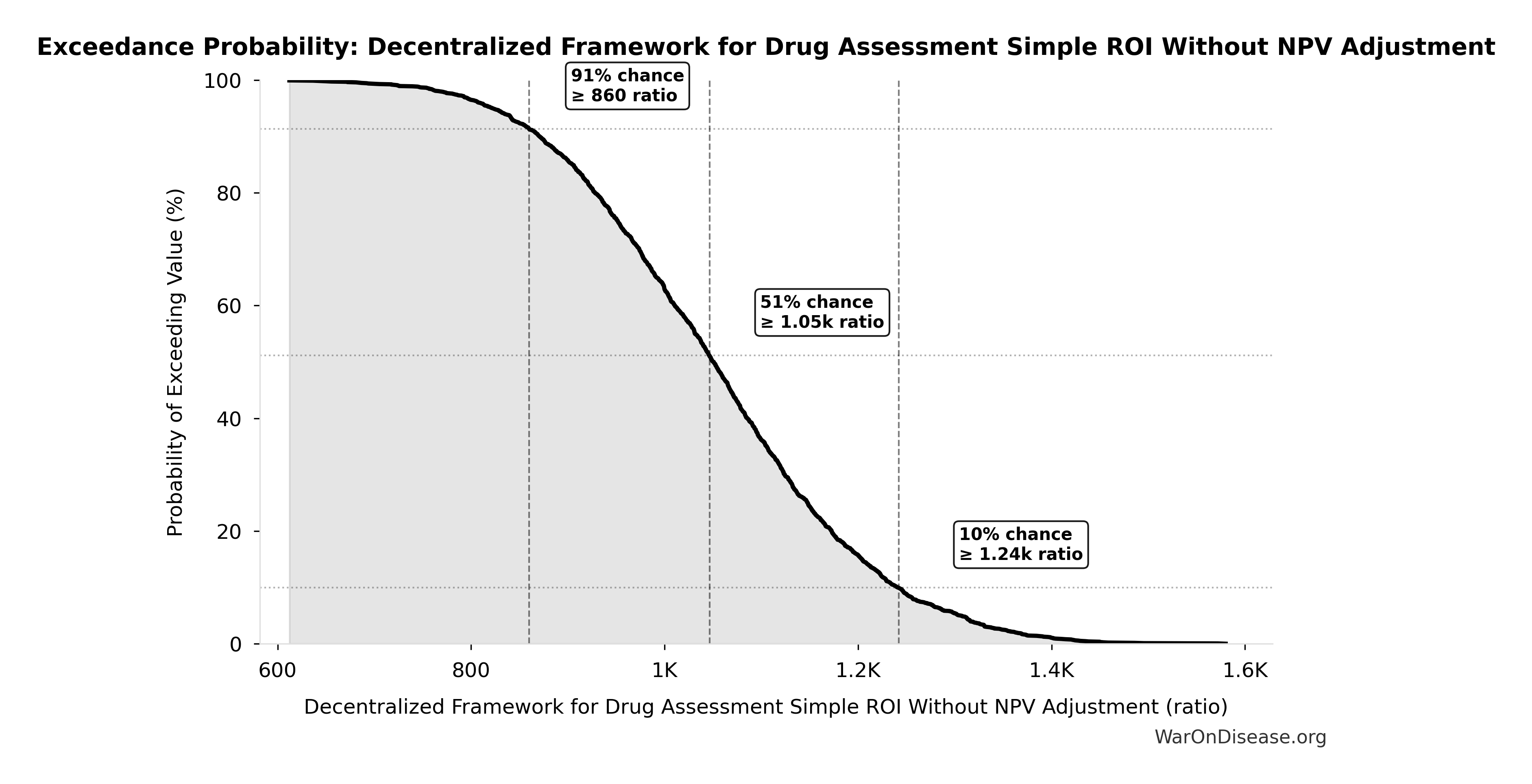

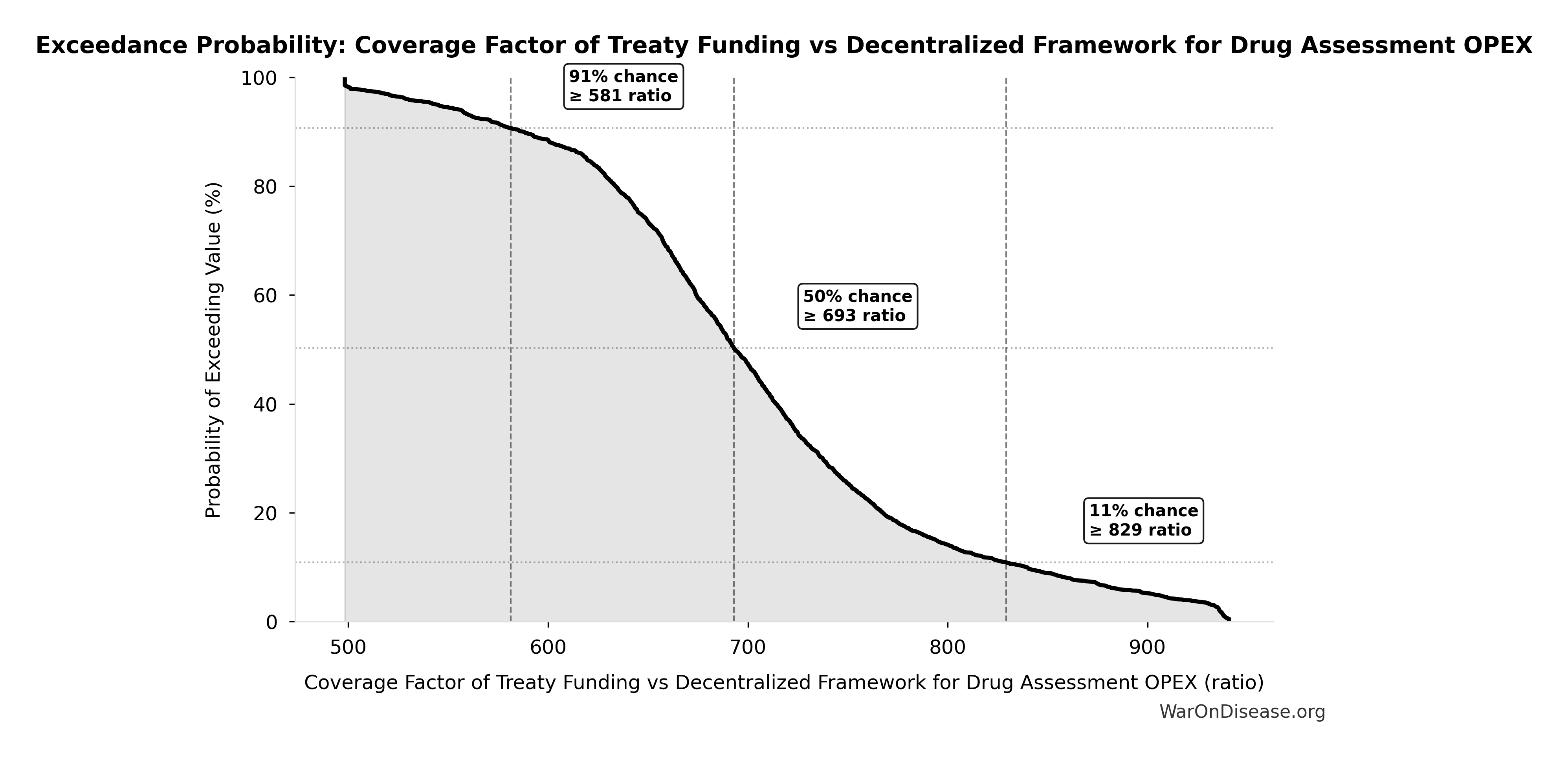

Exceedance Probability

This exceedance probability chart shows the likelihood that ROI from Decentralized Framework for Drug Assessment R&D Savings Only will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

Decentralized Framework for Drug Assessment Maximum Trials per Year: 40.6 thousand trials/year

Maximum trials per year possible with trial capacity multiplier

Inputs:

- Current Global Clinical Trials per Year 📊: 3.30 thousand trials/year (95% CI: 2.64 thousand trials/year - 3.96 thousand trials/year)

- Trial Capacity Multiplier 🔢: 12.3x

\[ \begin{gathered} Capacity_{trials} \\ = Trials_{ann,curr} \times k_{capacity} \\ = 3{,}300 \times 12.3 \\ = 40{,}600 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

✓ High confidence

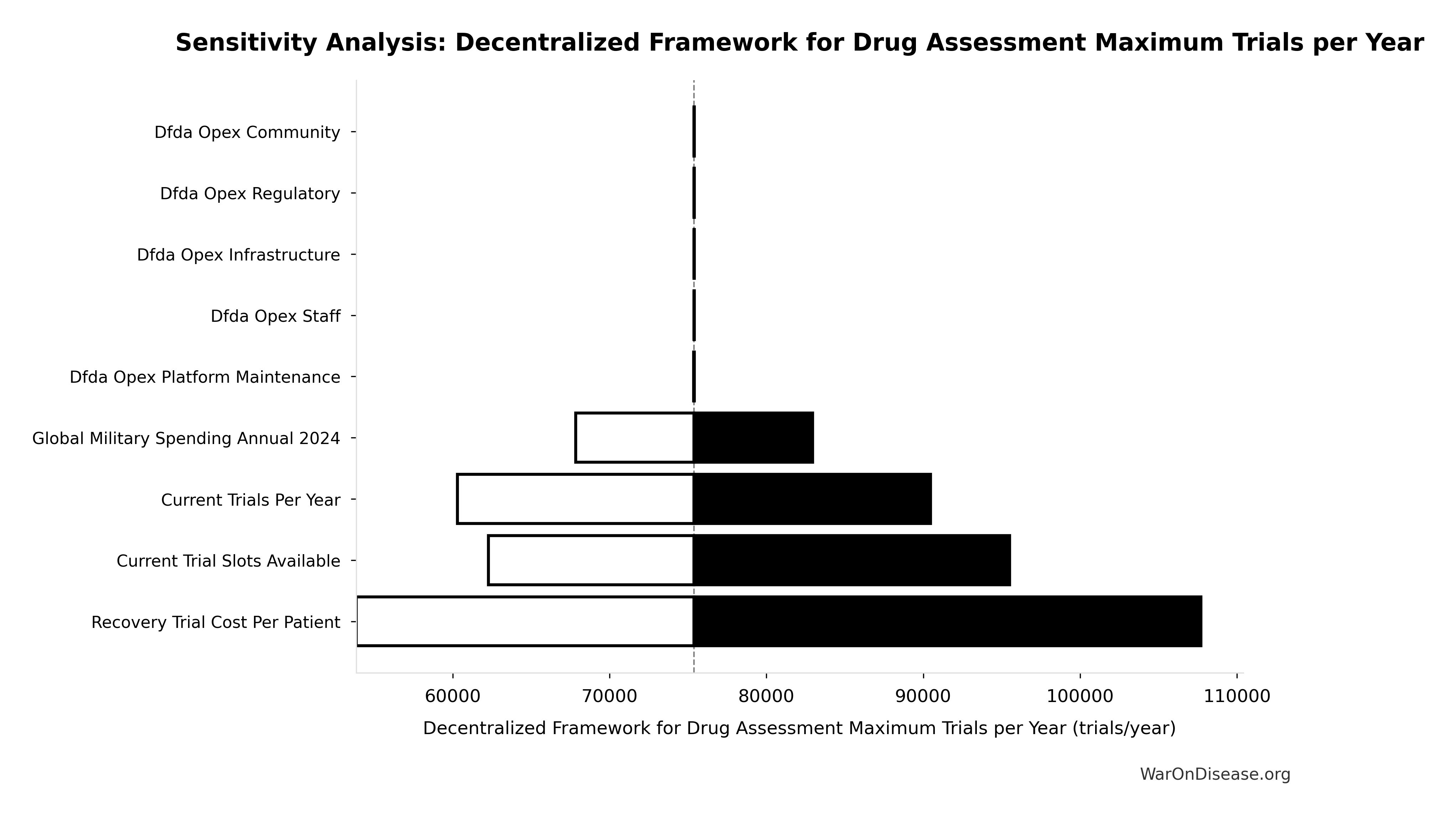

Sensitivity Analysis

Sensitivity Indices for Decentralized Framework for Drug Assessment Maximum Trials per Year

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Trial Capacity Multiplier | 0.9321 | Strong driver |

| Current Trials Per Year | -0.0802 | Minimal effect |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

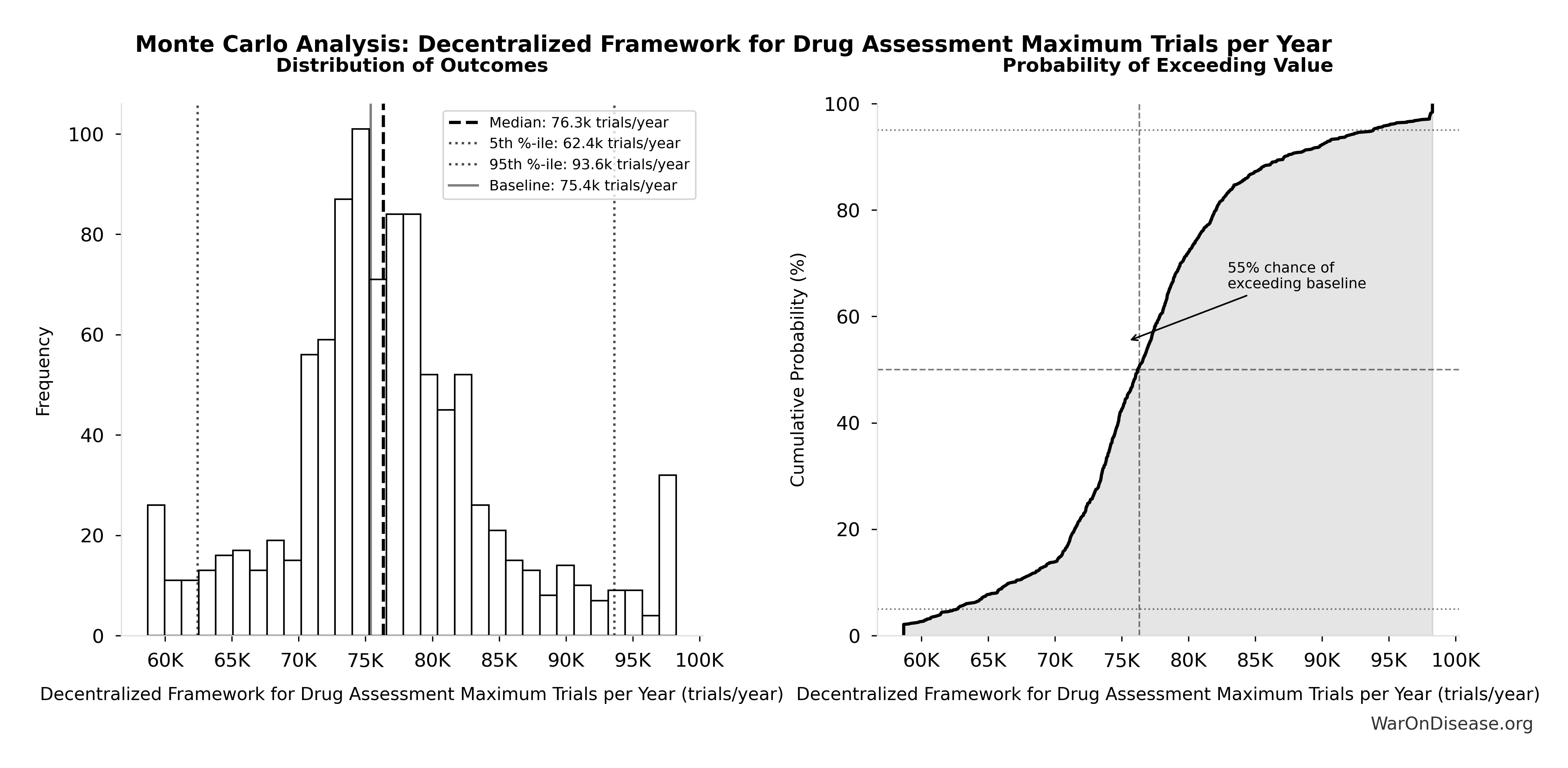

Monte Carlo Distribution

Simulation Results Summary: Decentralized Framework for Drug Assessment Maximum Trials per Year

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 40.6 thousand |

| Mean (expected value) | 67.3 thousand |

| Median (50th percentile) | 52.4 thousand |

| Standard Deviation | 53.1 thousand |

| 90% Range (5th-95th percentile) | [16.3 thousand, 170 thousand] |

The histogram shows the distribution of Decentralized Framework for Drug Assessment Maximum Trials per Year across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

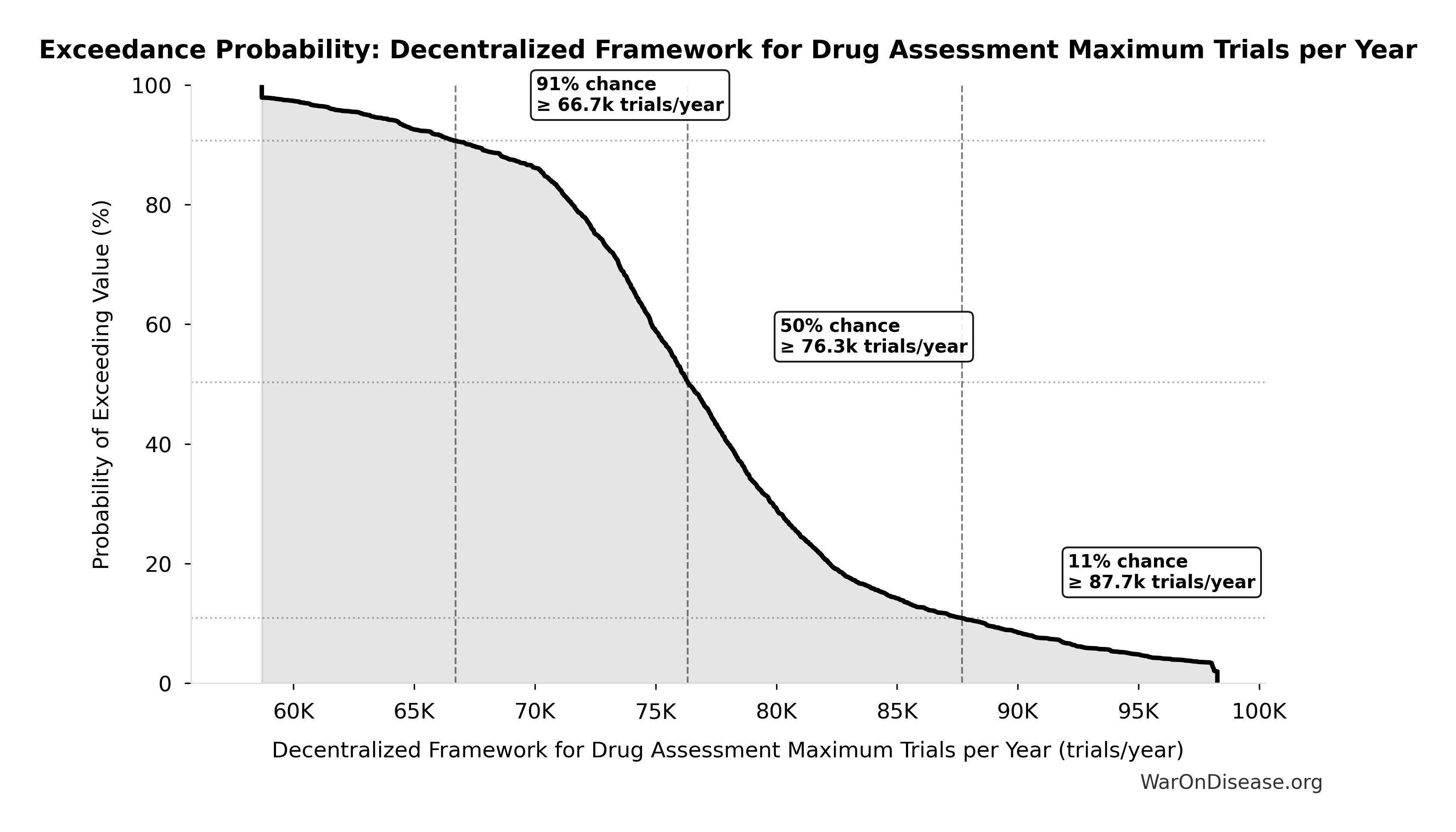

Exceedance Probability

This exceedance probability chart shows the likelihood that Decentralized Framework for Drug Assessment Maximum Trials per Year will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

Trial Capacity Multiplier: 12.3x

Trial capacity multiplier from DIH funding capacity vs. current global trial participation

Inputs:

- Annual Global Clinical Trial Participants 📊: 1.90 million patients/year (95% CI: 1.50 million patients/year - 2.30 million patients/year)

- Patients Fundable Annually 🔢: 23.4 million patients/year

\[ \begin{gathered} k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

✓ High confidence

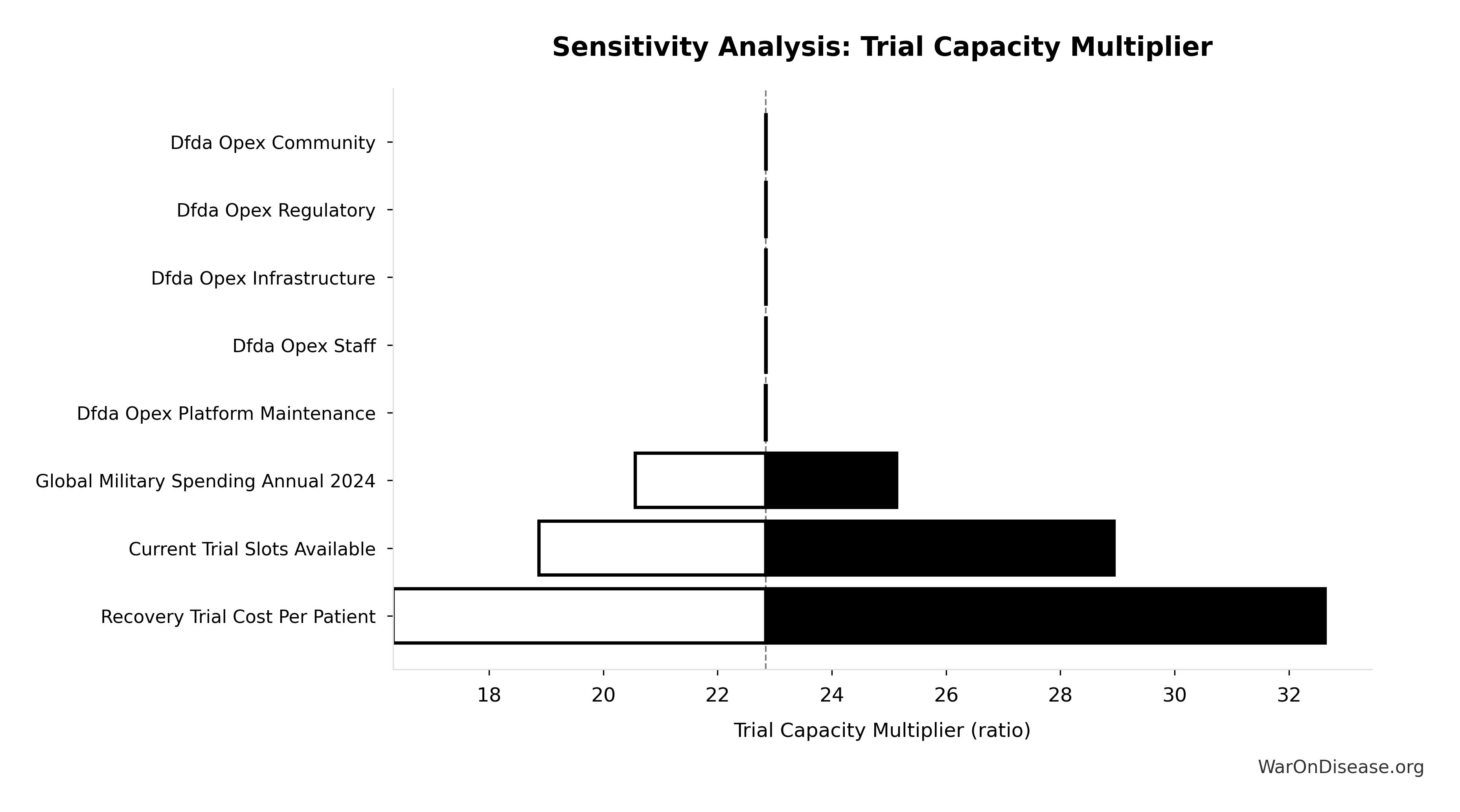

Sensitivity Analysis

Sensitivity Indices for Trial Capacity Multiplier

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| DIH Patients Fundable Annually | 1.0768 | Strong driver |

| Current Trial Slots Available | 0.0910 | Minimal effect |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

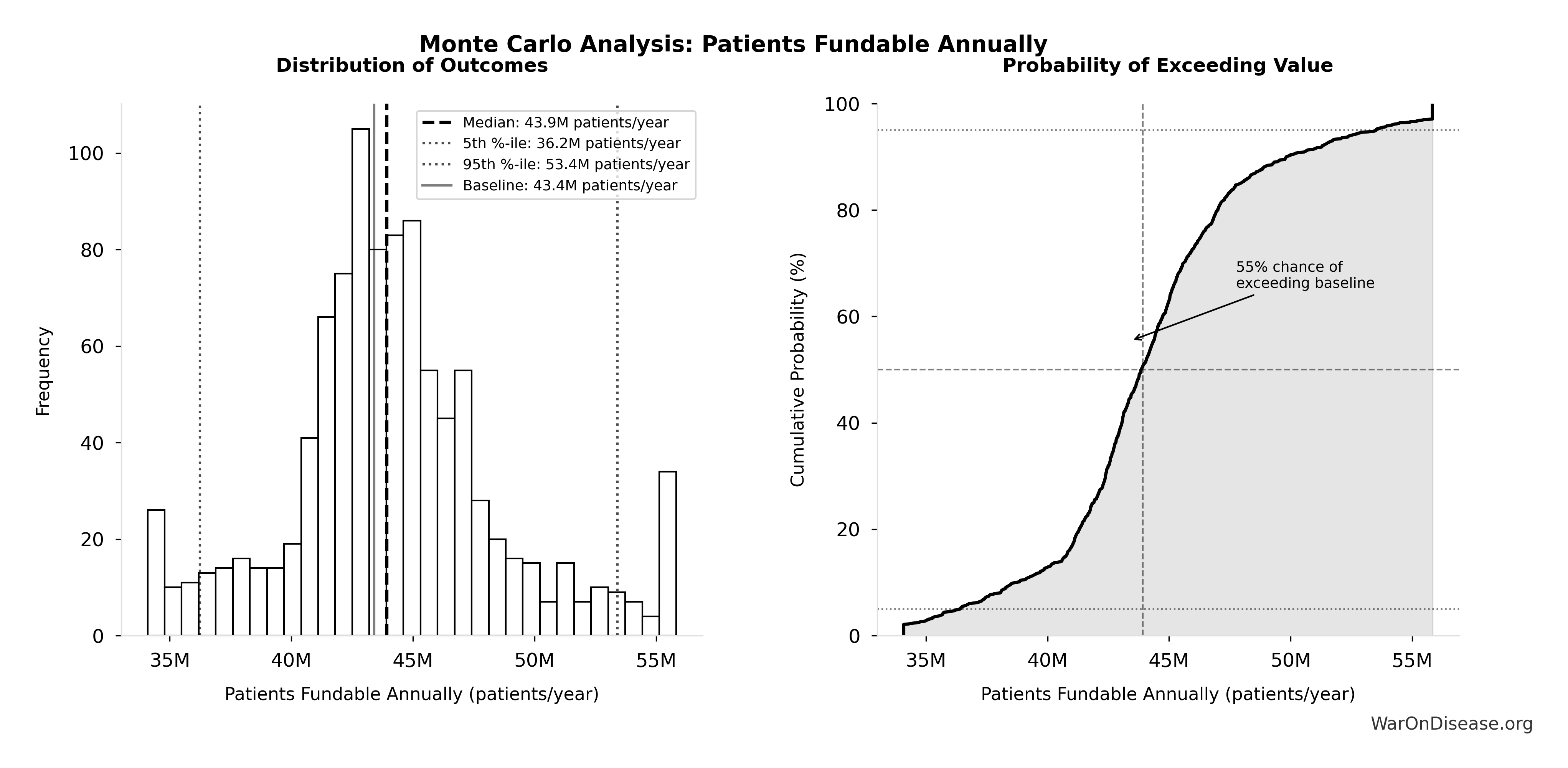

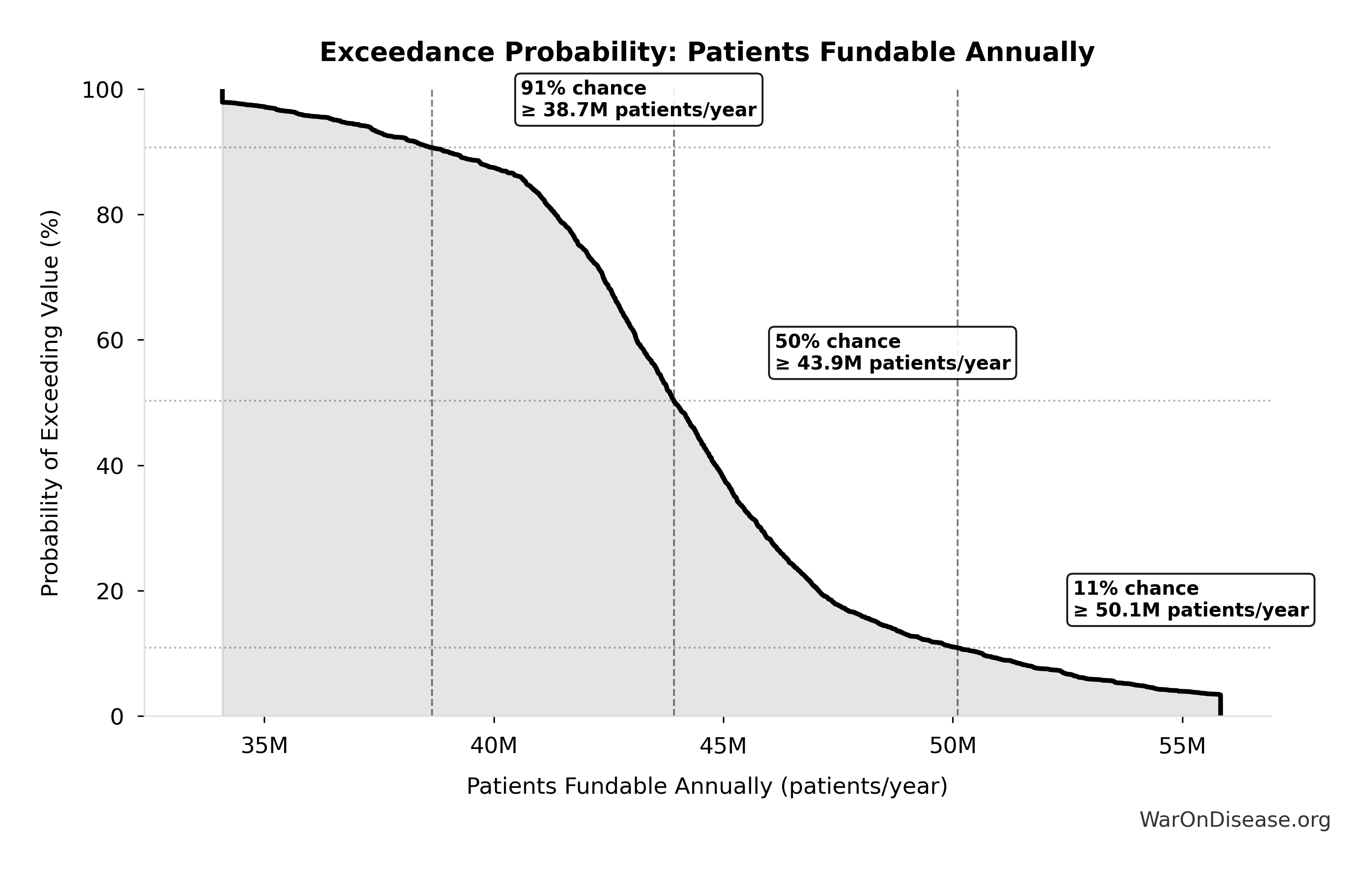

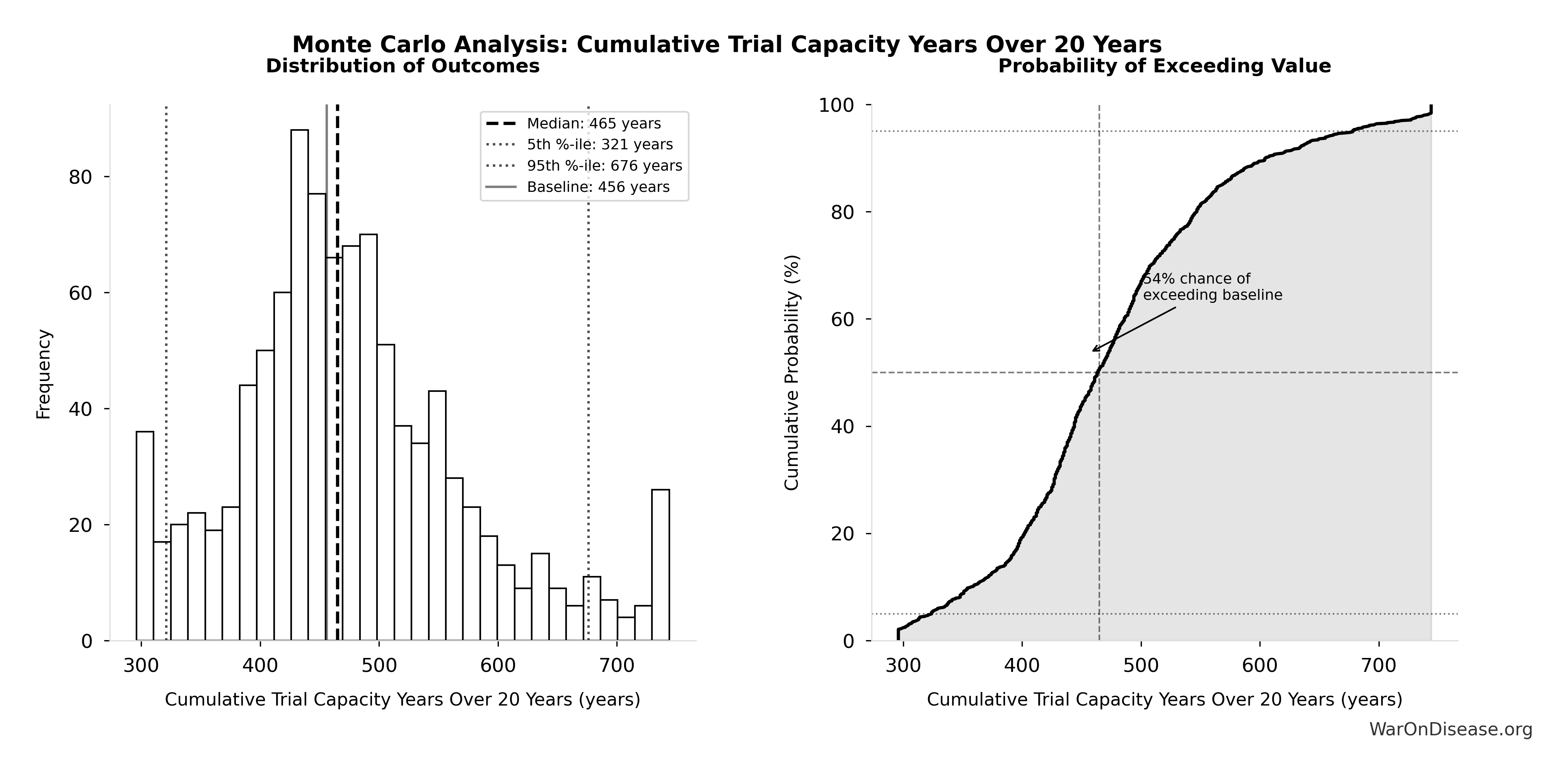

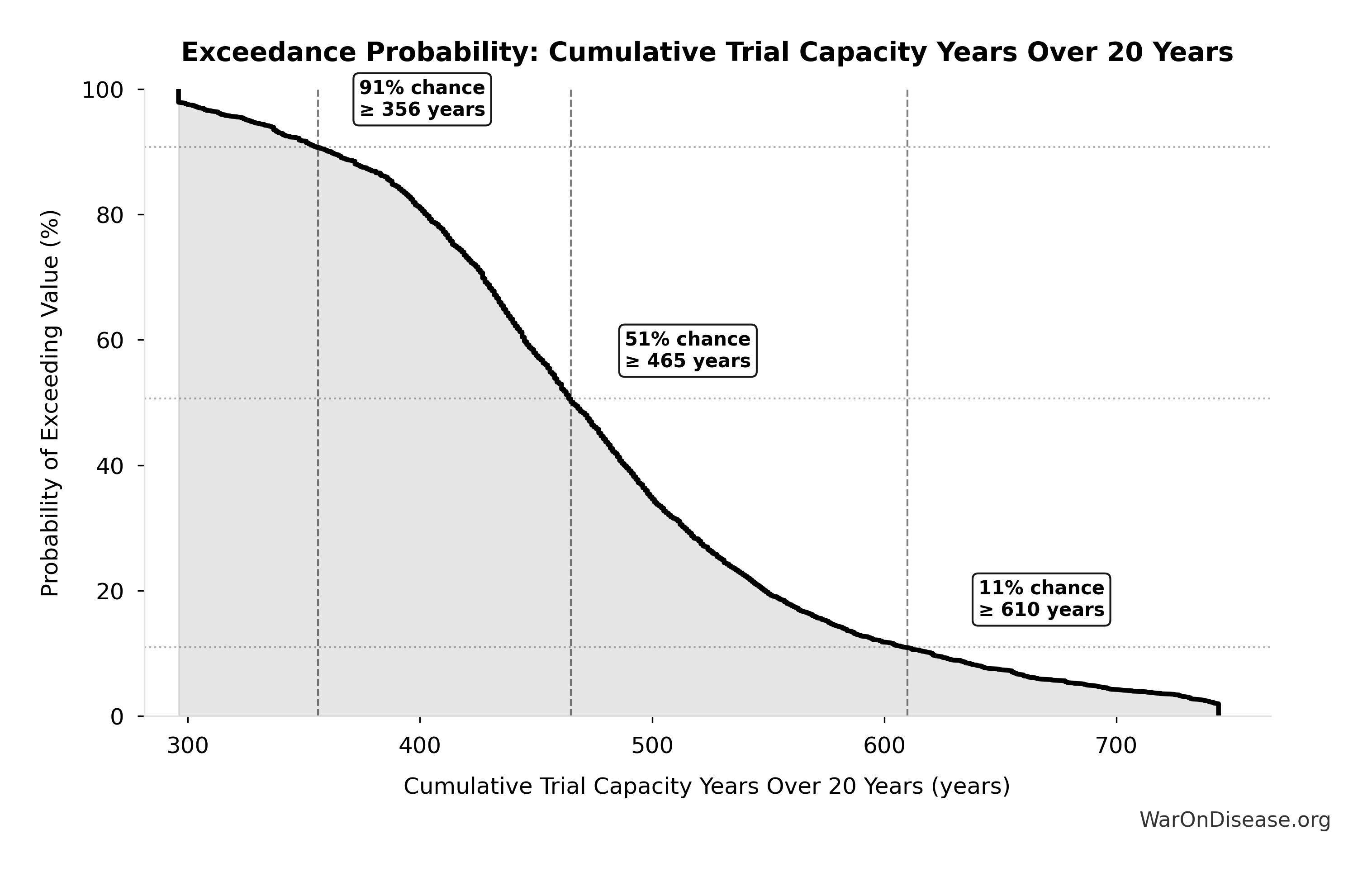

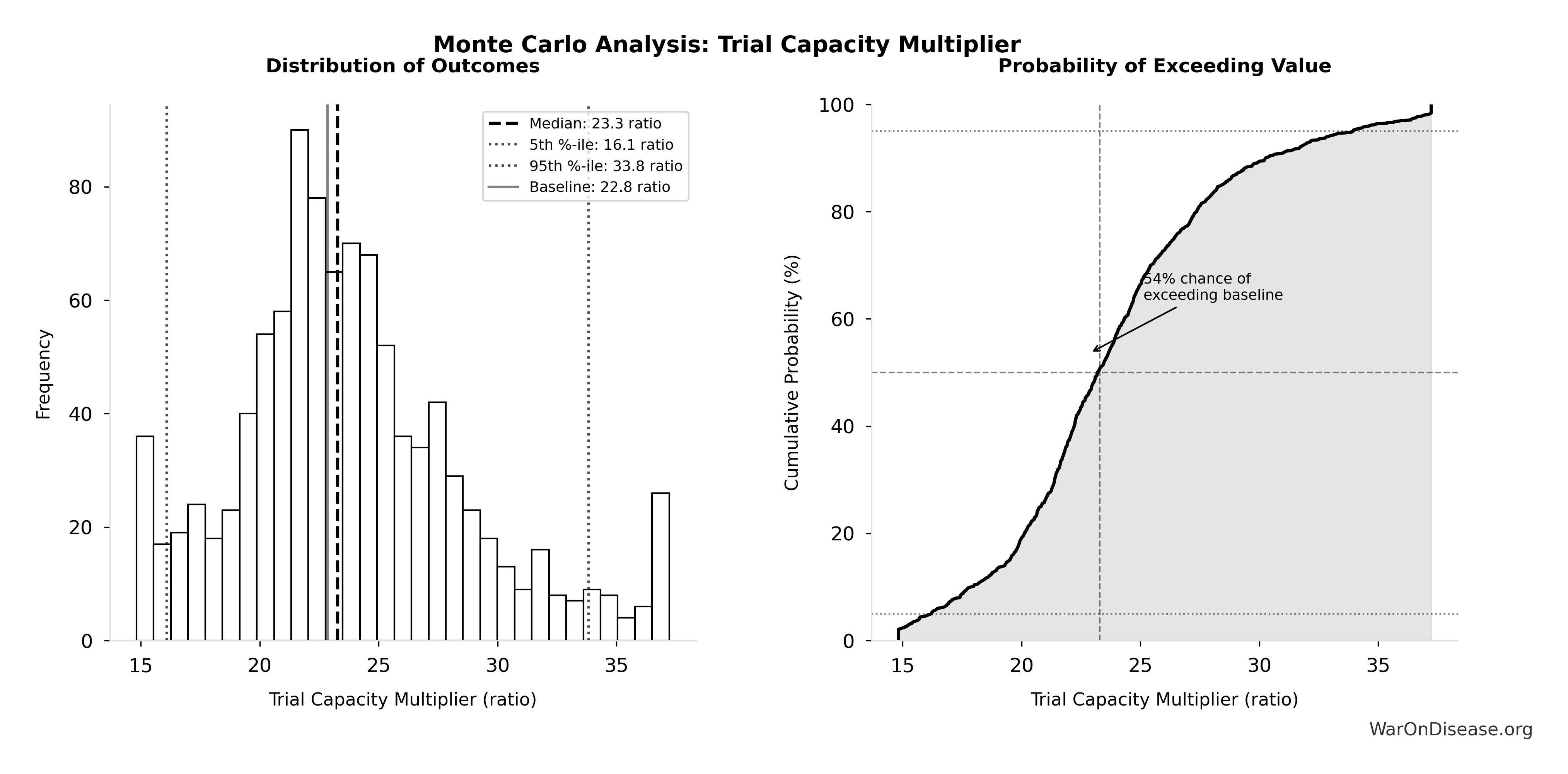

Monte Carlo Distribution

Simulation Results Summary: Trial Capacity Multiplier

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 12.3x |

| Mean (expected value) | 22.1x |

| Median (50th percentile) | 16x |

| Standard Deviation | 20.2x |

| 90% Range (5th-95th percentile) | [4.19x, 61.3x] |

The histogram shows the distribution of Trial Capacity Multiplier across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

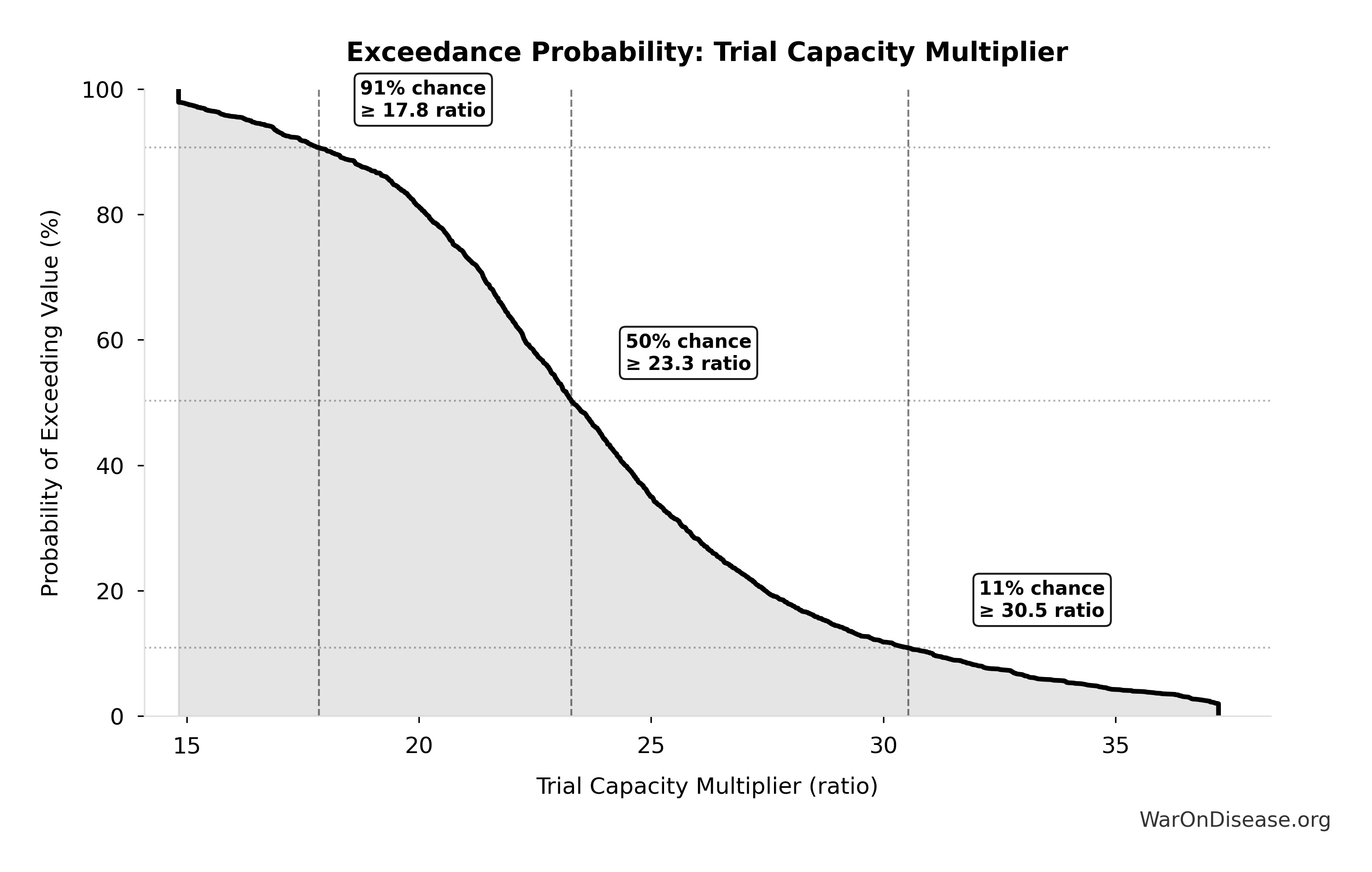

Exceedance Probability

This exceedance probability chart shows the likelihood that Trial Capacity Multiplier will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

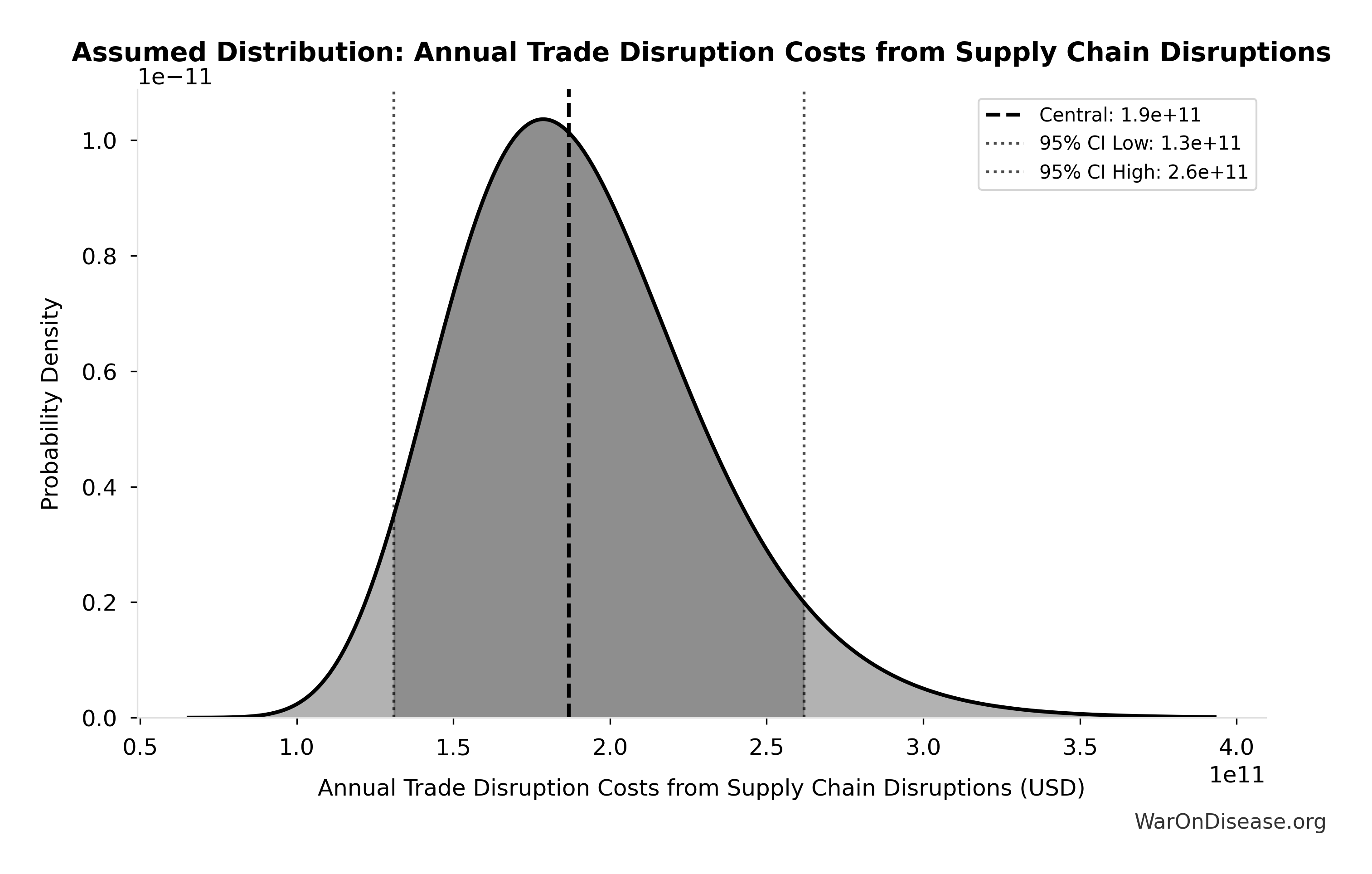

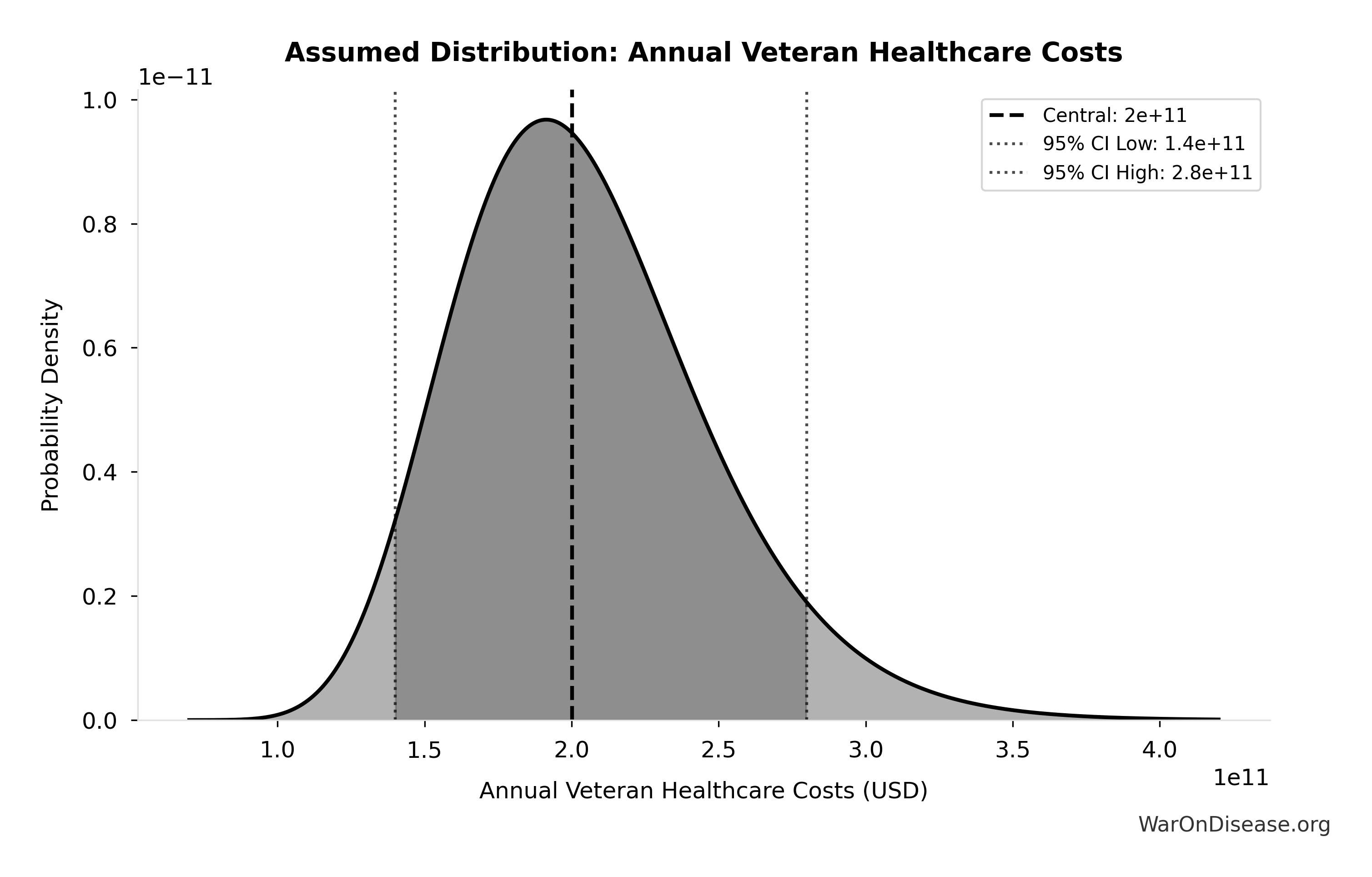

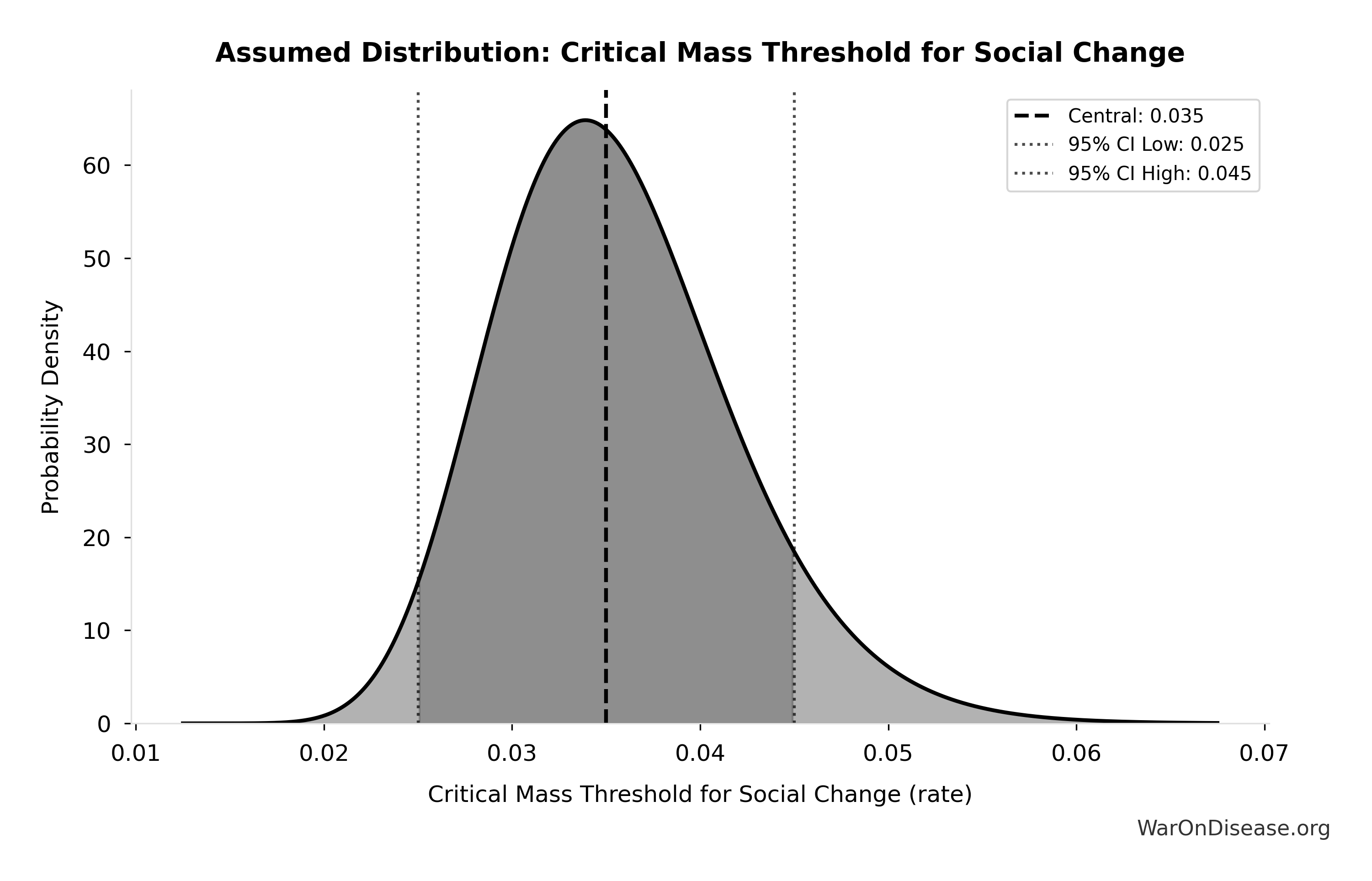

Total DALYs from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput: 565 billion DALYs

Total DALYs averted from the combined dFDA timeline shift. Calculated as annual global DALY burden × eventually avoidable percentage × timeline shift years. Includes both fatal and non-fatal diseases (WHO GBD methodology).

Inputs:

- Global Annual DALY Burden 📊: 2.88 billion DALYs/year (SE: ±150 million DALYs/year)

- Eventually Avoidable DALY Percentage: 92.6% (95% CI: 50% - 98%)

- dFDA Average Total Timeline Shift 🔢: 212 years

\[ \begin{gathered} DALYs_{max} \\ = DALYs_{global,ann} \times Pct_{avoid,DALY} \times T_{accel,max} \\ = 2.88B \times 92.6\% \times 212 \\ = 565B \\[0.5em] \text{where } T_{accel,max} = T_{accel} + T_{lag} = 204 + 8.2 = 212 \\[0.5em] \text{where } T_{accel} \\ = T_{first,SQ} \times \left(1 - \frac{1}{k_{capacity}}\right) \\ = 222 \times \left(1 - \frac{1}{12.3}\right) \\ = 204 \\[0.5em] \text{where } T_{first,SQ} = T_{queue,SQ} \times 0.5 = 443 \times 0.5 = 222 \\[0.5em] \text{where } T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

? Low confidence

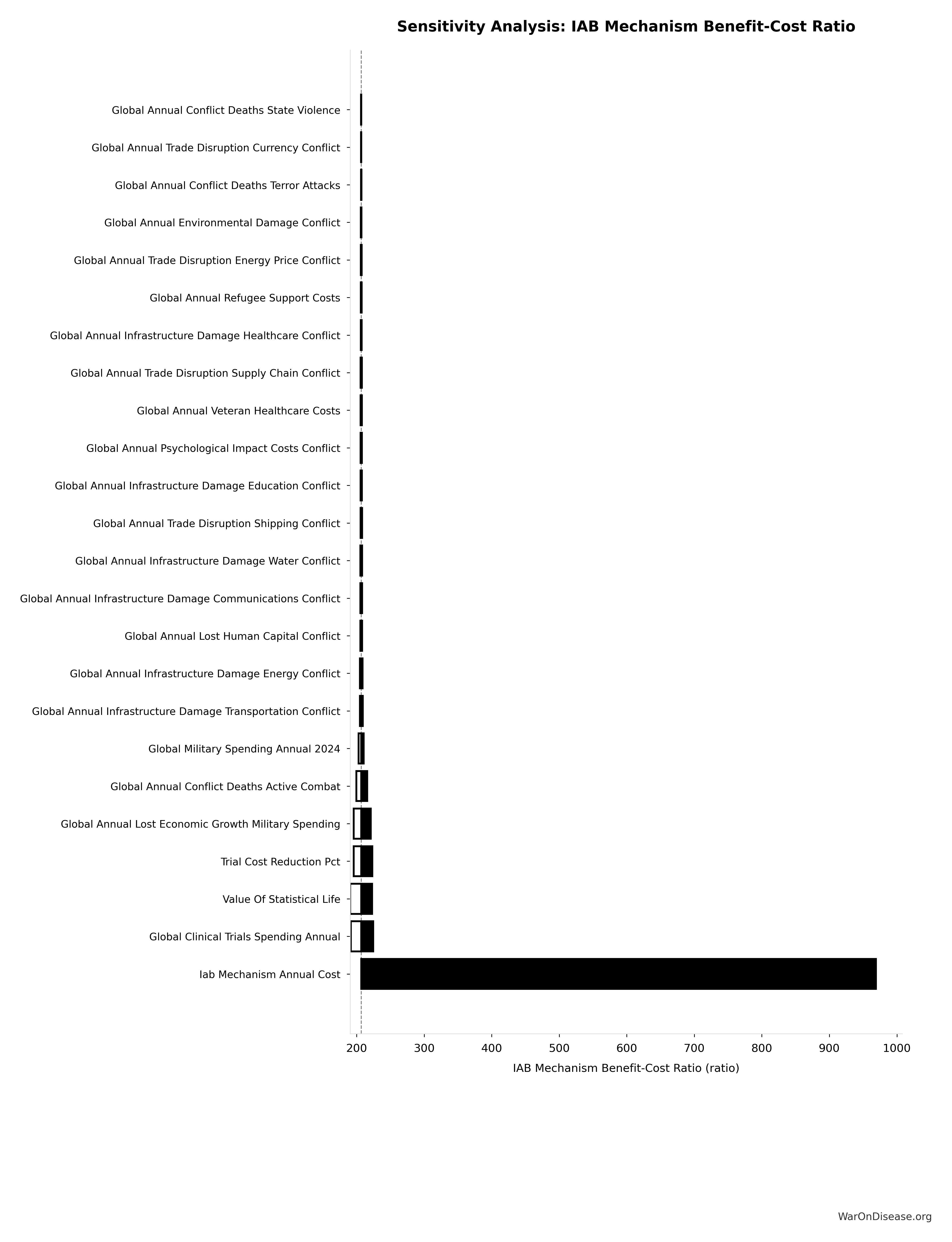

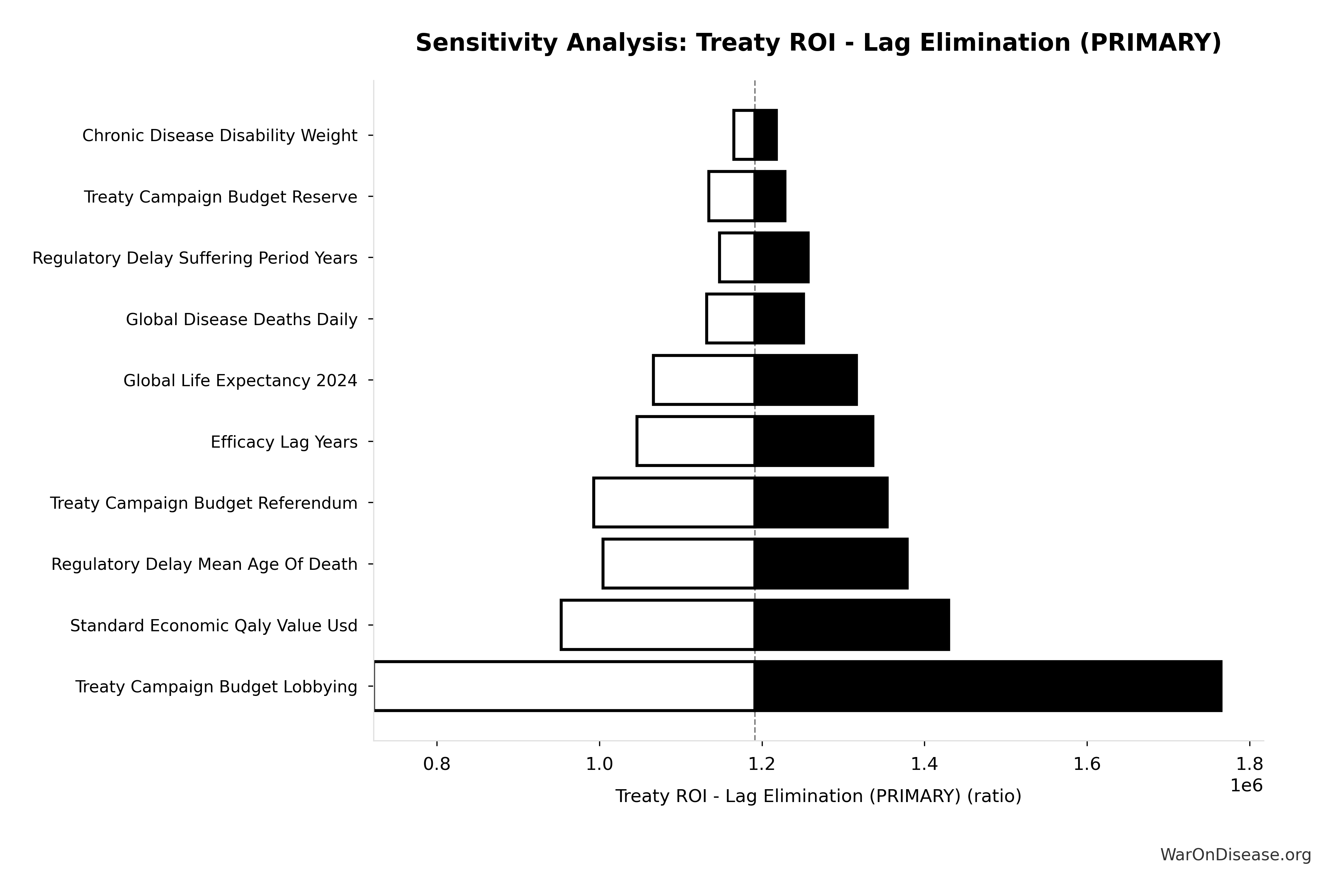

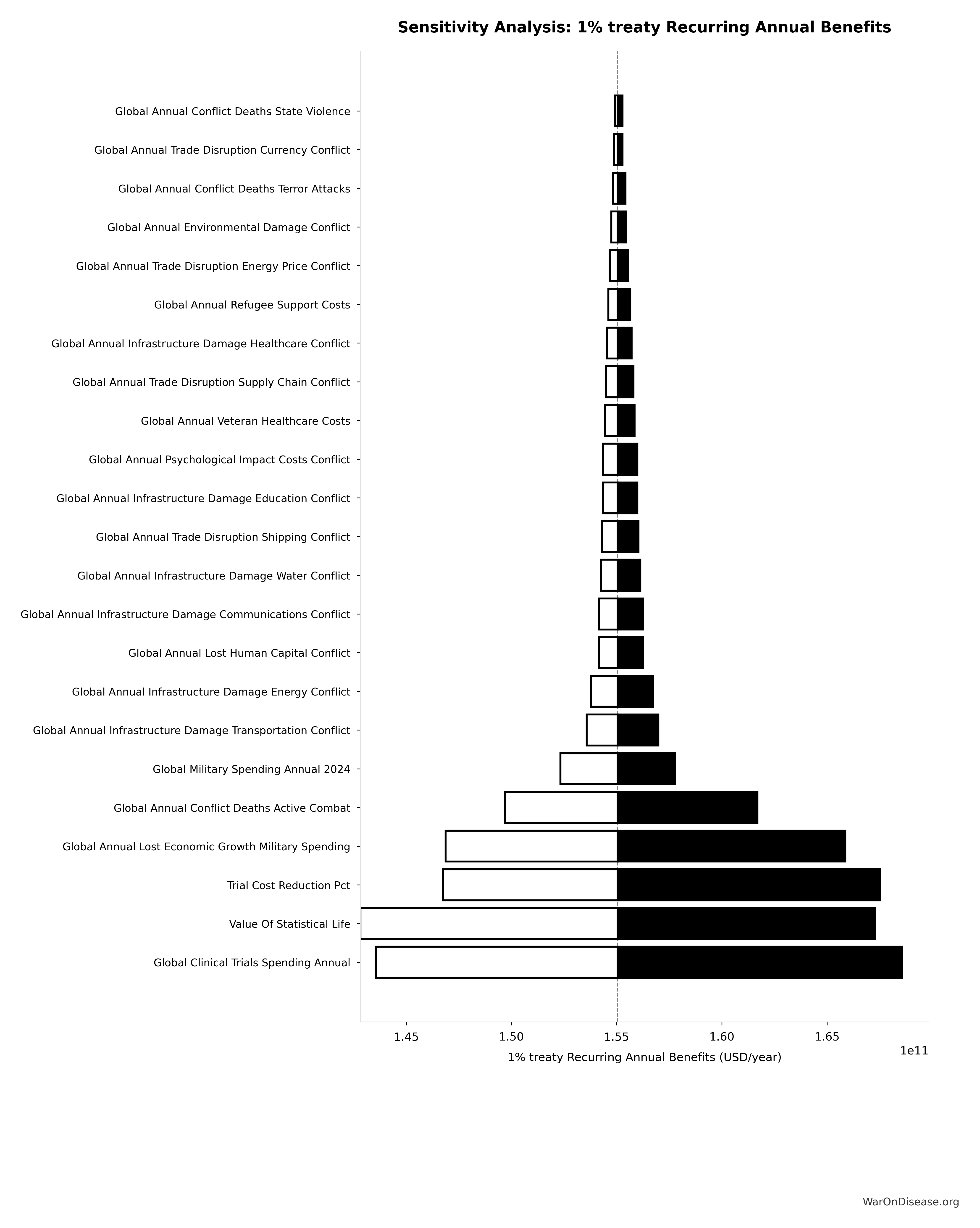

Sensitivity Analysis

Sensitivity Indices for Total DALYs from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Trial Capacity Plus Efficacy Lag Years | 0.9001 | Strong driver |

| Eventually Avoidable DALY % | 0.4864 | Moderate driver |

| Global Annual DALY Burden | 0.0433 | Minimal effect |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

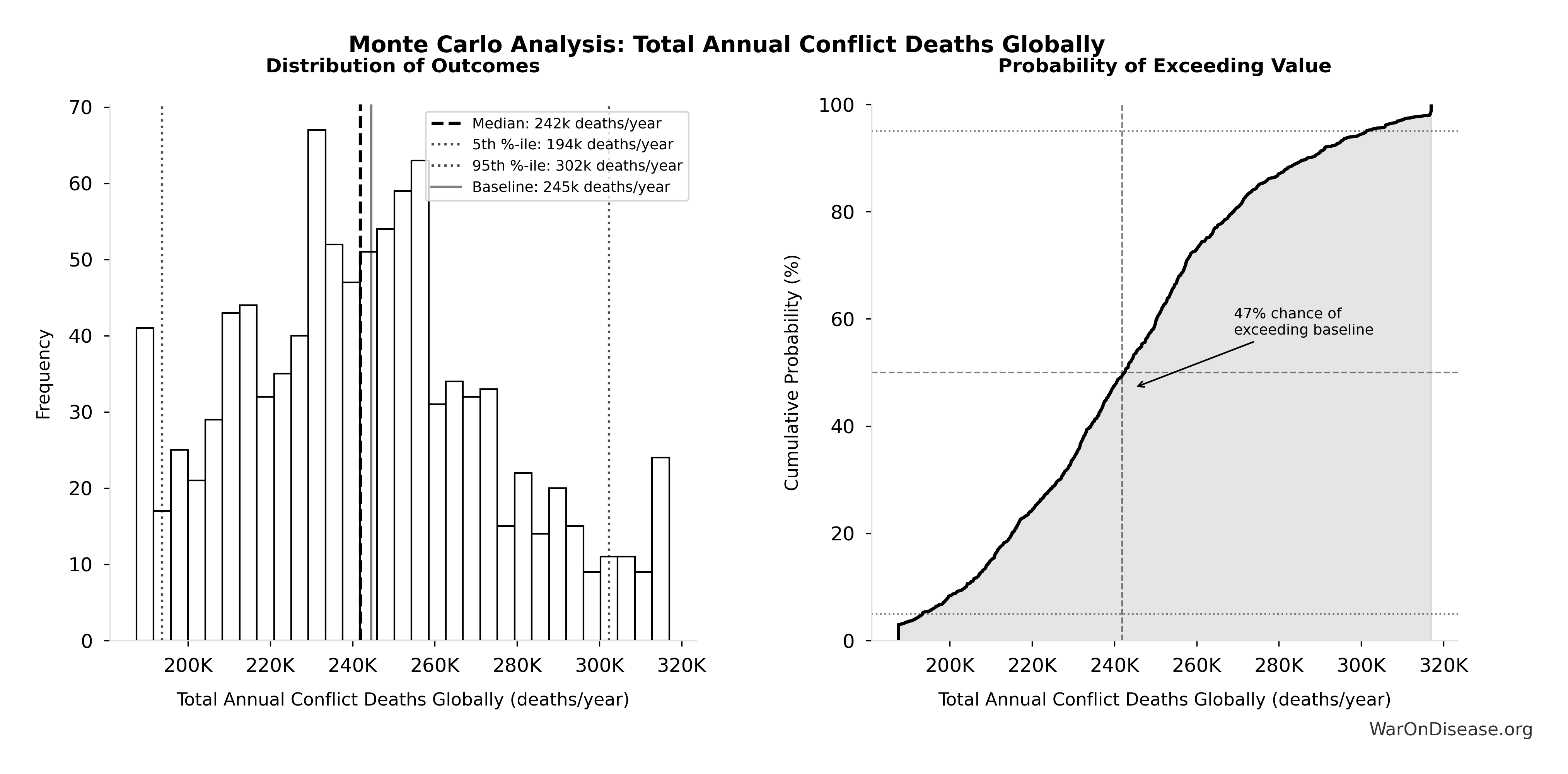

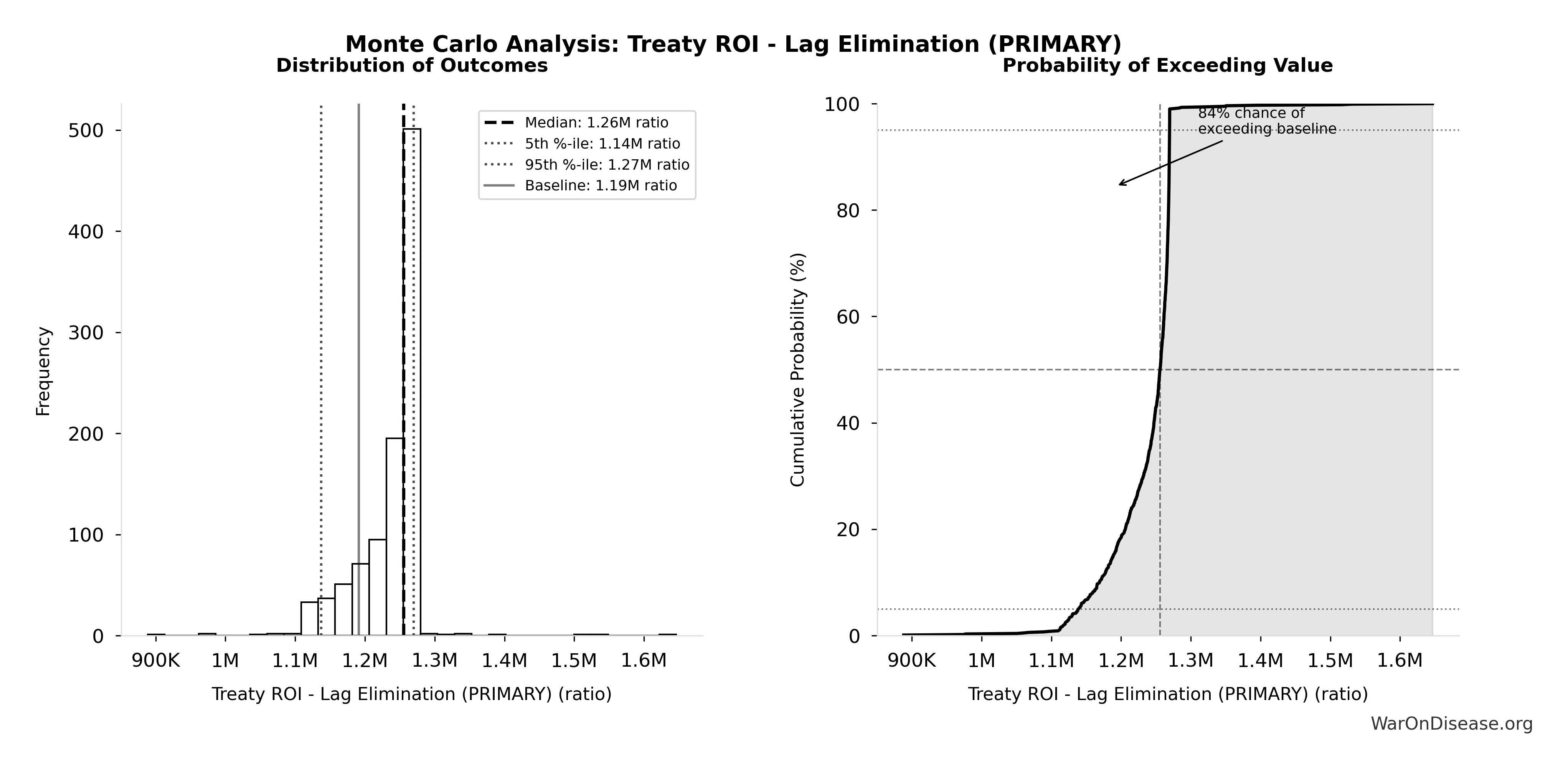

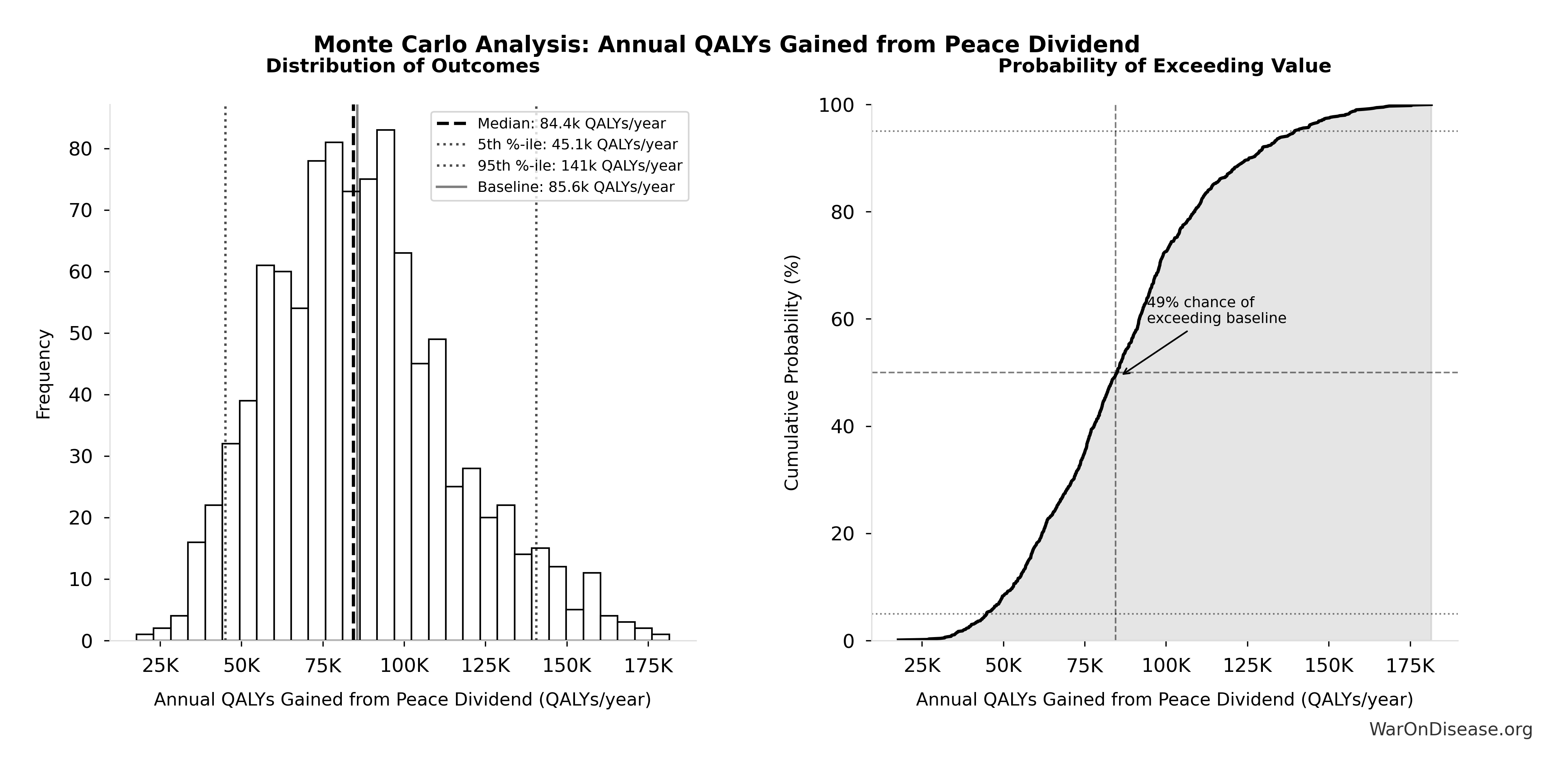

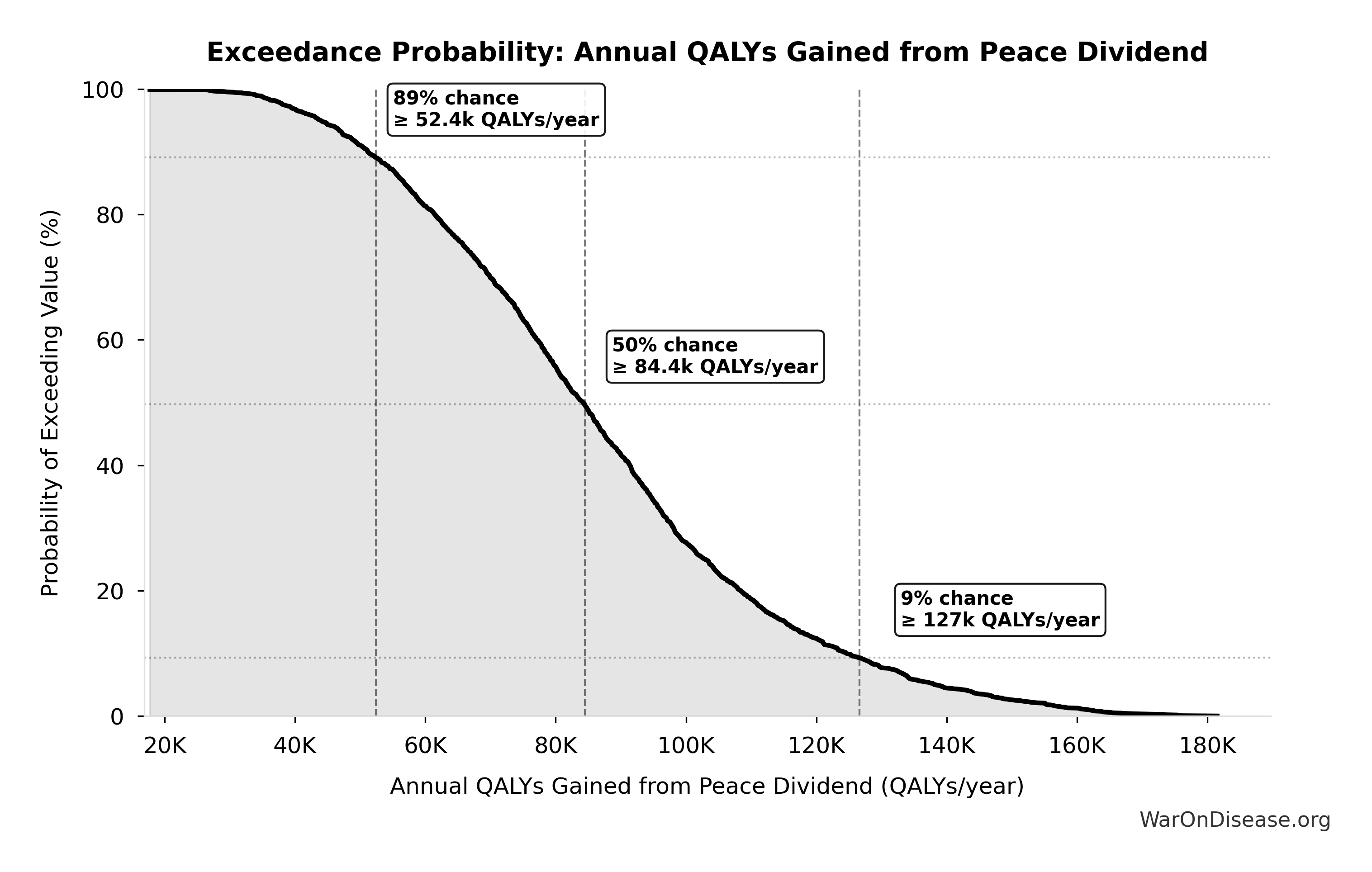

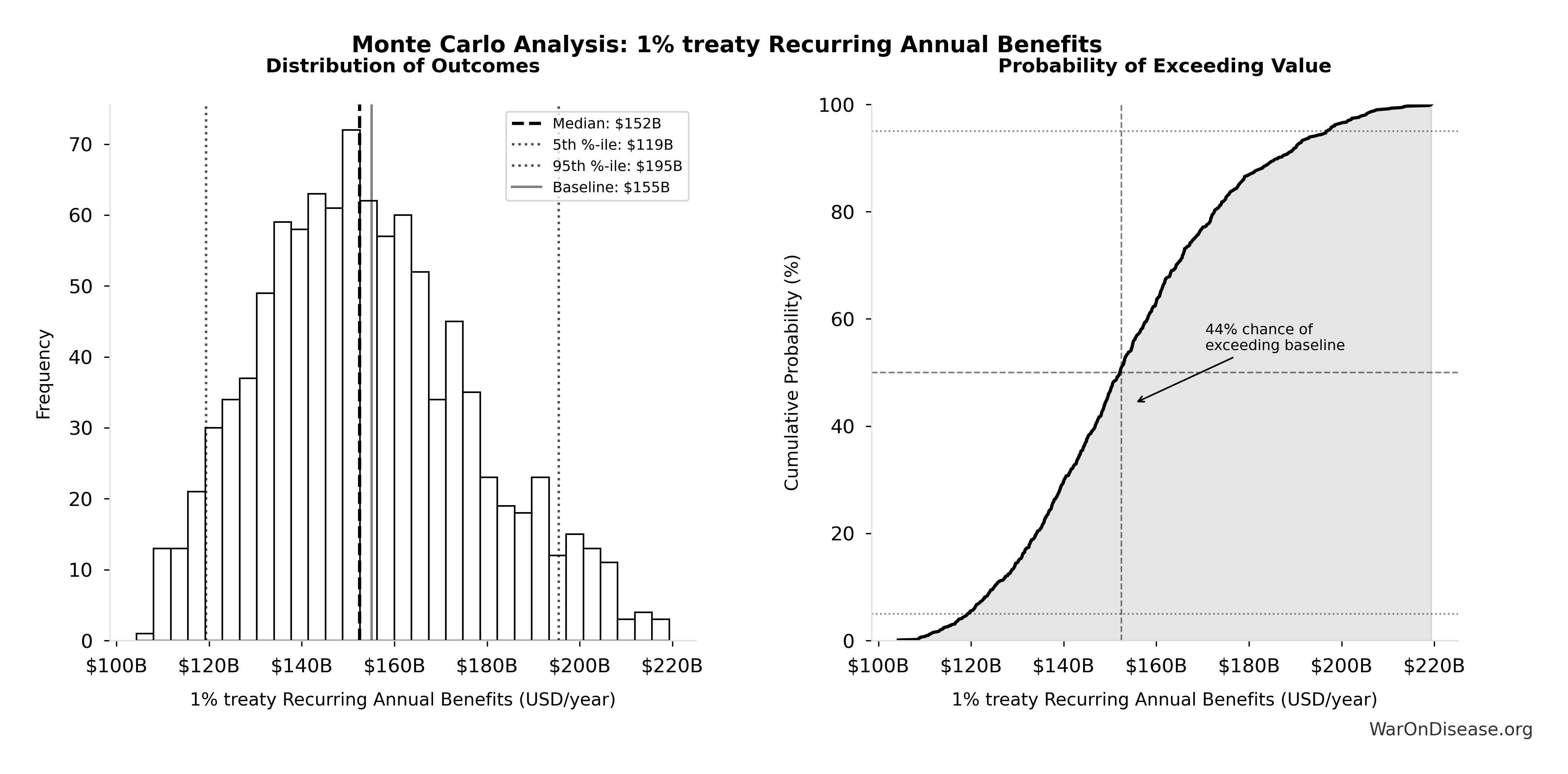

Monte Carlo Distribution

Simulation Results Summary: Total DALYs from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput

| Statistic | Value |

|---|---|

| Baseline (deterministic) | 565 billion |

| Mean (expected value) | 610 billion |

| Median (50th percentile) | 614 billion |

| Standard Deviation | 148 billion |

| 90% Range (5th-95th percentile) | [361 billion, 877 billion] |

The histogram shows the distribution of Total DALYs from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

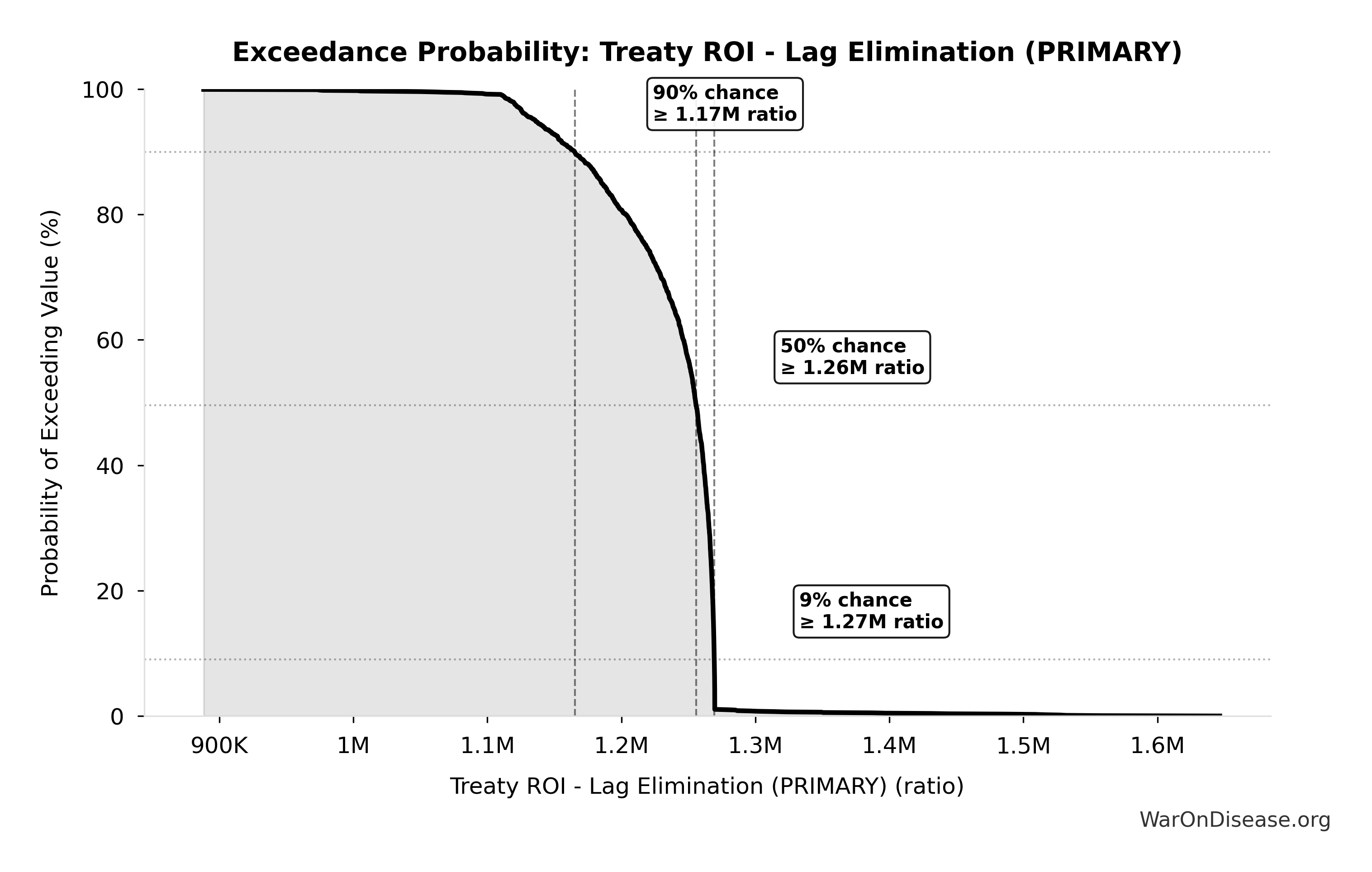

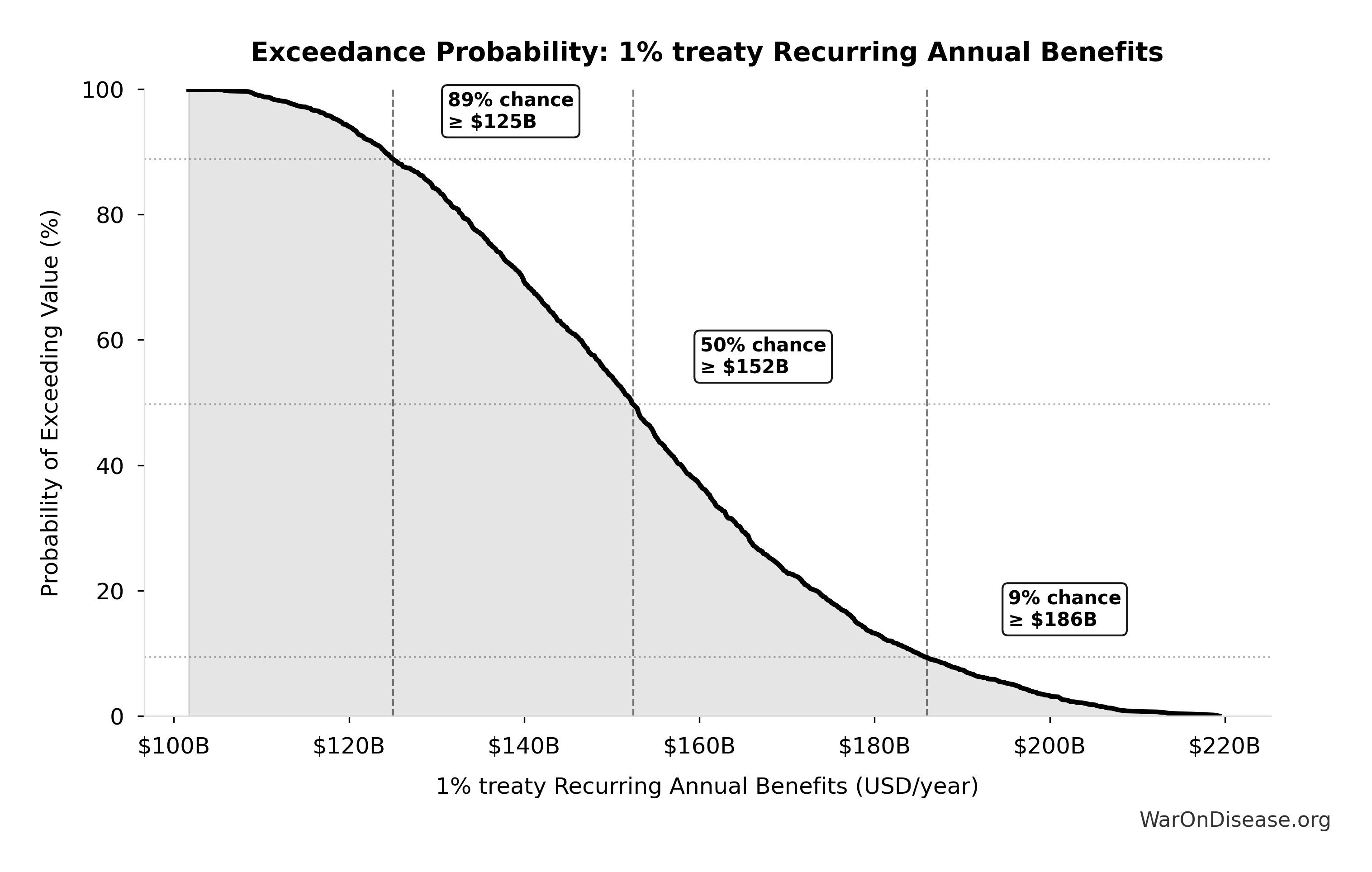

Exceedance Probability

This exceedance probability chart shows the likelihood that Total DALYs from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

Total Economic Benefit from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput: $84.8 quadrillion

Total economic value from the combined dFDA timeline shift. DALYs valued at standard economic rate.

Inputs:

- Total DALYs from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput 🔢: 565 billion DALYs

- Standard Economic Value per QALY 📊: $150K (SE: ±$30K)

\[ \begin{gathered} Value_{max} \\ = DALYs_{max} \times Value_{QALY} \\ = 565B \times \$150K \\ = \$84800T \\[0.5em] \text{where } DALYs_{max} \\ = DALYs_{global,ann} \times Pct_{avoid,DALY} \times T_{accel,max} \\ = 2.88B \times 92.6\% \times 212 \\ = 565B \\[0.5em] \text{where } T_{accel,max} = T_{accel} + T_{lag} = 204 + 8.2 = 212 \\[0.5em] \text{where } T_{accel} \\ = T_{first,SQ} \times \left(1 - \frac{1}{k_{capacity}}\right) \\ = 222 \times \left(1 - \frac{1}{12.3}\right) \\ = 204 \\[0.5em] \text{where } T_{first,SQ} = T_{queue,SQ} \times 0.5 = 443 \times 0.5 = 222 \\[0.5em] \text{where } T_{queue,SQ} = \frac{N_{untreated}}{Treatments_{new,ann}} = \frac{6{,}650}{15} = 443 \\[0.5em] \text{where } N_{untreated} = N_{rare} \times 0.95 = 7{,}000 \times 0.95 = 6{,}650 \\[0.5em] \text{where } k_{capacity} = \frac{N_{fundable,ann}}{Slots_{curr}} = \frac{23.4M}{1.9M} = 12.3 \\[0.5em] \text{where } N_{fundable,ann} \\ = \frac{Subsidies_{trial,ann}}{Cost_{pragmatic,pt}} \\ = \frac{\$21.7B}{\$929} \\ = 23.4M \\[0.5em] \text{where } Subsidies_{trial,ann} \\ = Treasury_{RD,ann} - OPEX_{dFDA} \\ = \$21.8B - \$40M \\ = \$21.7B \\[0.5em] \text{where } OPEX_{dFDA} \\ = Cost_{platform} + Cost_{staff} + Cost_{infra} \\ + Cost_{regulatory} + Cost_{community} \\ = \$15M + \$10M + \$8M + \$5M + \$2M \\ = \$40M \\[0.5em] \text{where } Treasury_{RD,ann} \\ = Funding_{treaty} - Payout_{bond,ann} - Funding_{political,ann} \\ = \$27.2B - \$2.72B - \$2.72B \\ = \$21.8B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Payout_{bond,ann} \\ = Funding_{treaty} \times Pct_{bond} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \\[0.5em] \text{where } Funding_{political,ann} \\ = Funding_{treaty} \times Pct_{political} \\ = \$27.2B \times 10\% \\ = \$2.72B \\[0.5em] \text{where } Funding_{treaty} \\ = Spending_{mil} \times Reduce_{treaty} \\ = \$2.72T \times 1\% \\ = \$27.2B \end{gathered} \]

? Low confidence

Sensitivity Analysis

Sensitivity Indices for Total Economic Benefit from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput

Regression-based sensitivity showing which inputs explain the most variance in the output.

| Input Parameter | Sensitivity Coefficient | Interpretation |

|---|---|---|

| dFDA Trial Capacity Plus Efficacy Lag DALYs | 1.7790 | Strong driver |

| Standard Economic QALY Value Usd | 1.3377 | Strong driver |

Interpretation: Standardized coefficients show the change in output (in SD units) per 1 SD change in input. Values near ±1 indicate strong influence; values exceeding ±1 may occur with correlated inputs.

Monte Carlo Distribution

Simulation Results Summary: Total Economic Benefit from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput

| Statistic | Value |

|---|---|

| Baseline (deterministic) | $84.8 quadrillion |

| Mean (expected value) | $87.8 quadrillion |

| Median (50th percentile) | $92.8 quadrillion |

| Standard Deviation | $11.5 quadrillion |

| 90% Range (5th-95th percentile) | [$62.4 quadrillion, $97.3 quadrillion] |

The histogram shows the distribution of Total Economic Benefit from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput across 10,000 Monte Carlo simulations. The CDF (right) shows the probability of the outcome exceeding any given value, which is useful for risk assessment.

Exceedance Probability

This exceedance probability chart shows the likelihood that Total Economic Benefit from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput will exceed any given threshold. Higher curves indicate more favorable outcomes with greater certainty.

Total Lives Saved from Elimination of Efficacy Lag Plus Earlier Treatment Discovery from Higher Trial Throughput: 10.7 billion deaths

Total eventually avoidable deaths from the combined dFDA timeline shift. Represents deaths prevented when cures arrive earlier due to both increased trial capacity and eliminated efficacy lag.

Inputs:

- Global Daily Deaths from Disease and Aging 📊: 150 thousand deaths/day (SE: ±7.50 thousand deaths/day)

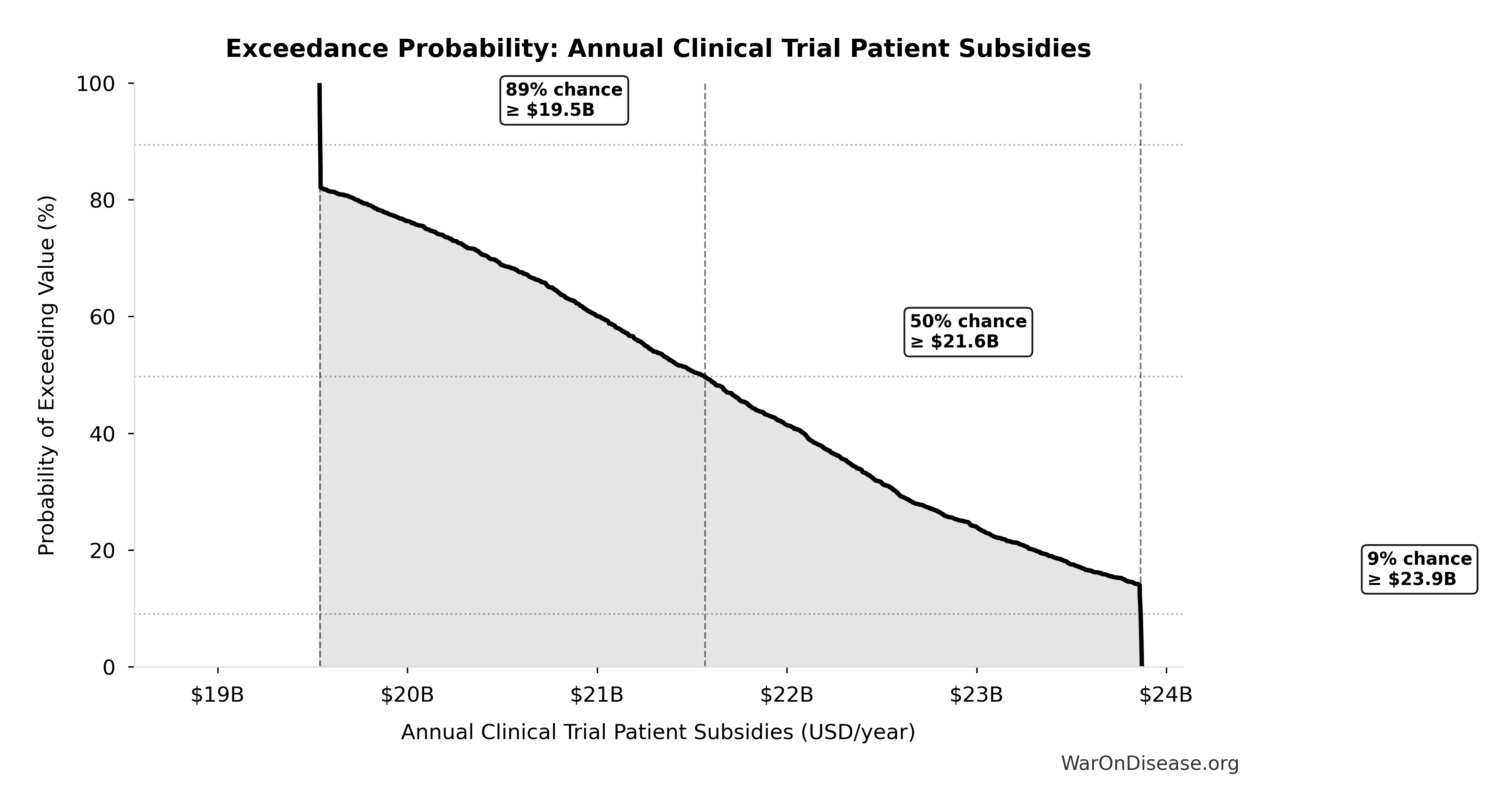

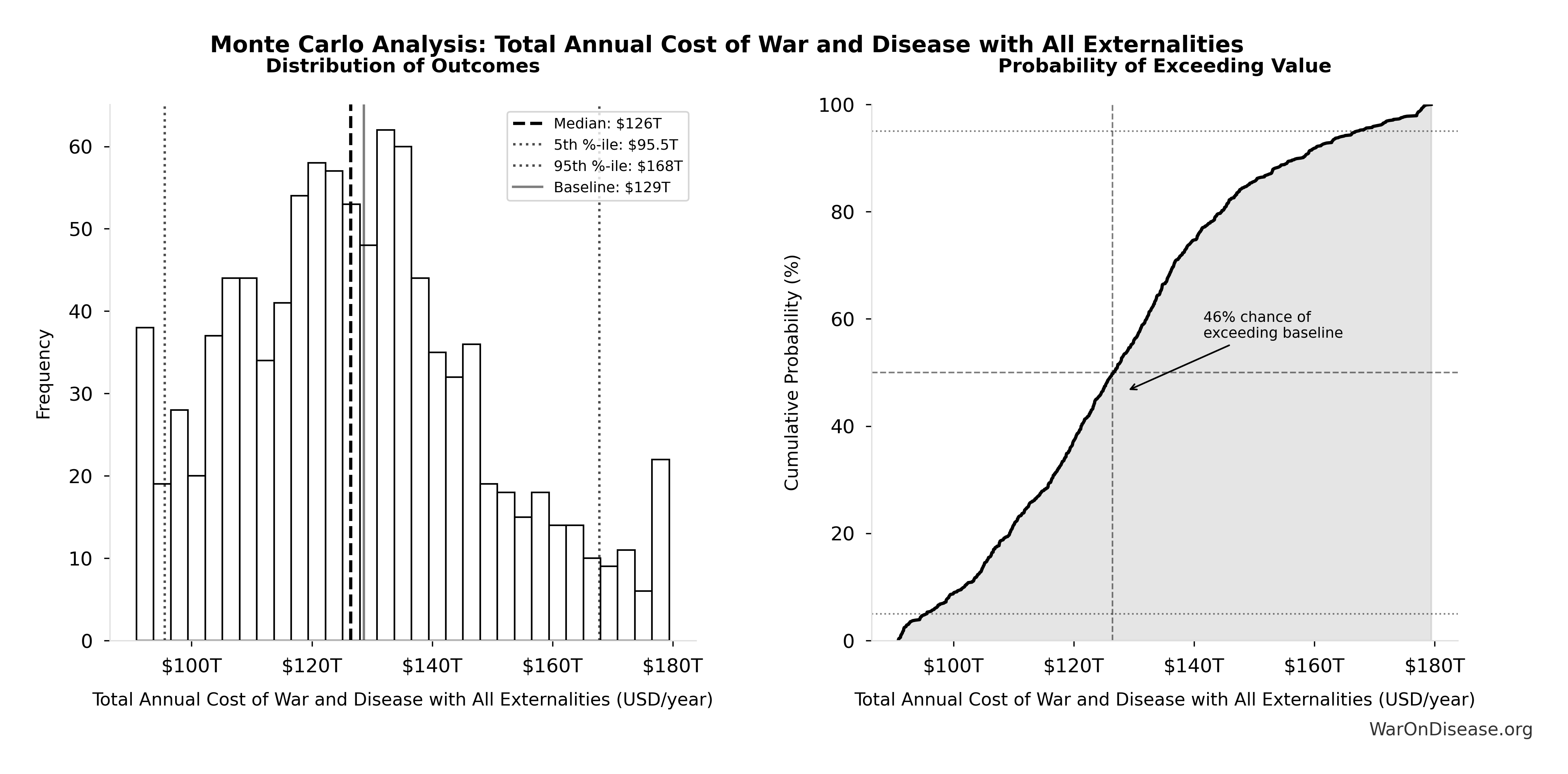

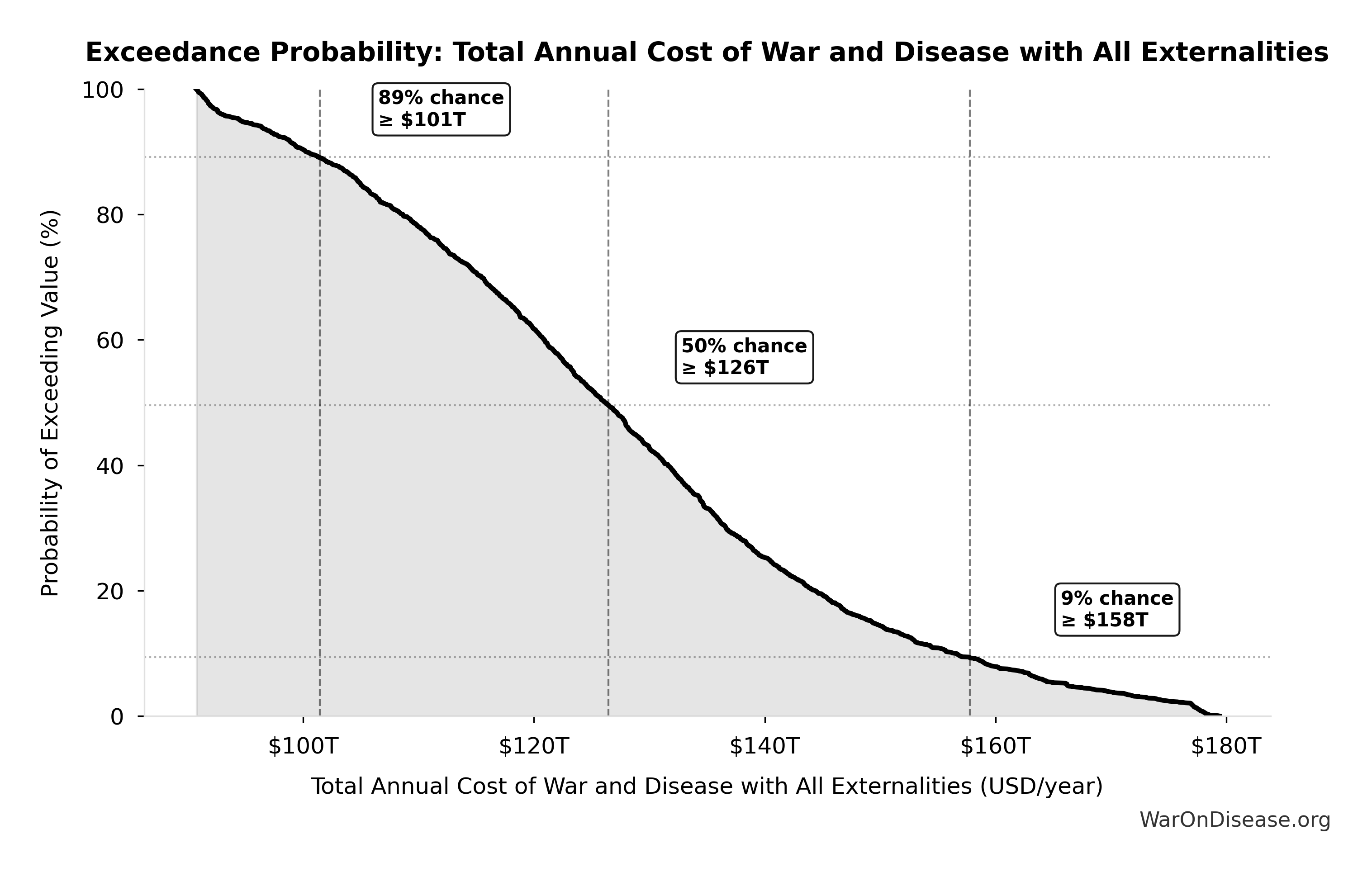

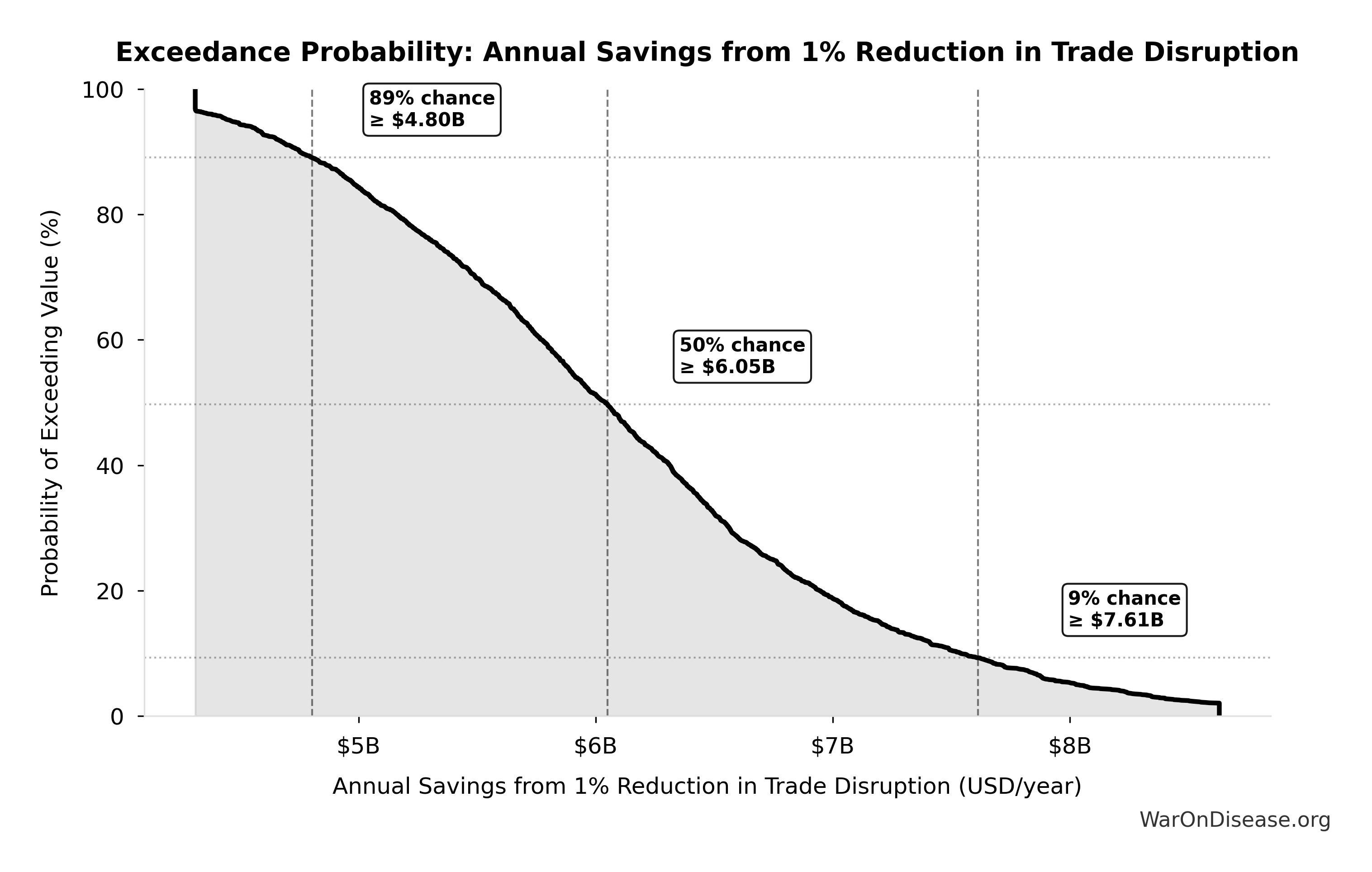

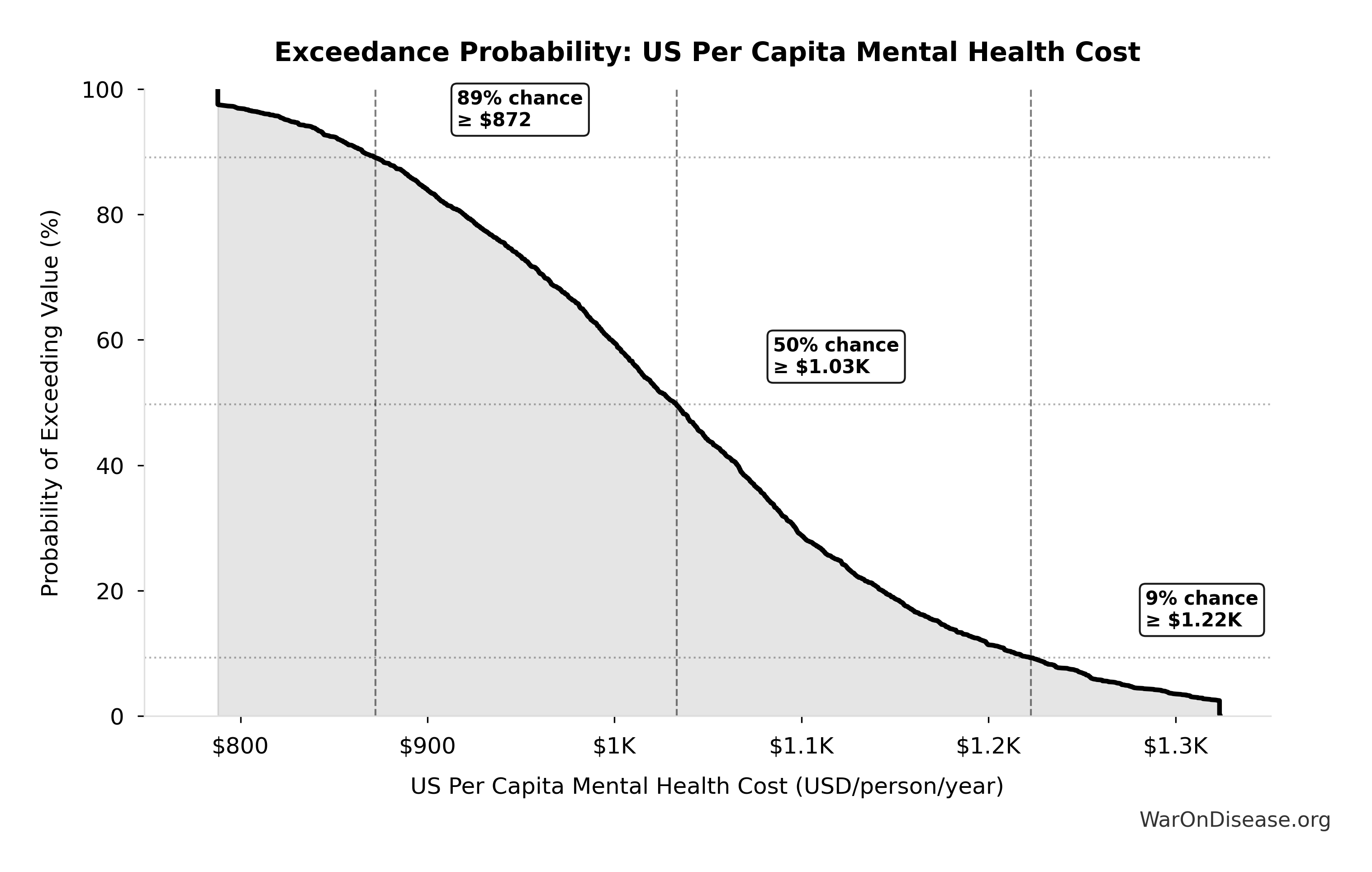

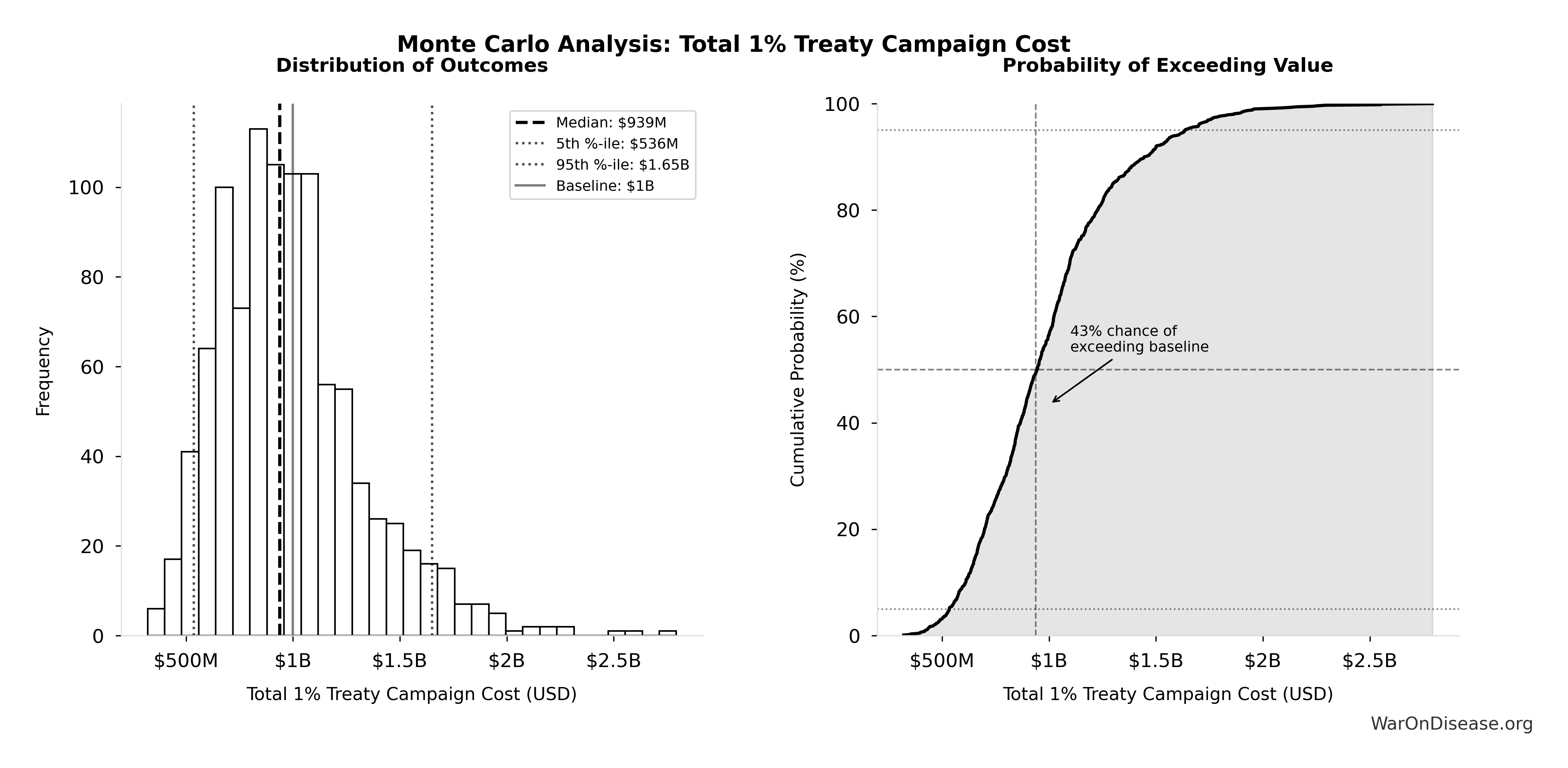

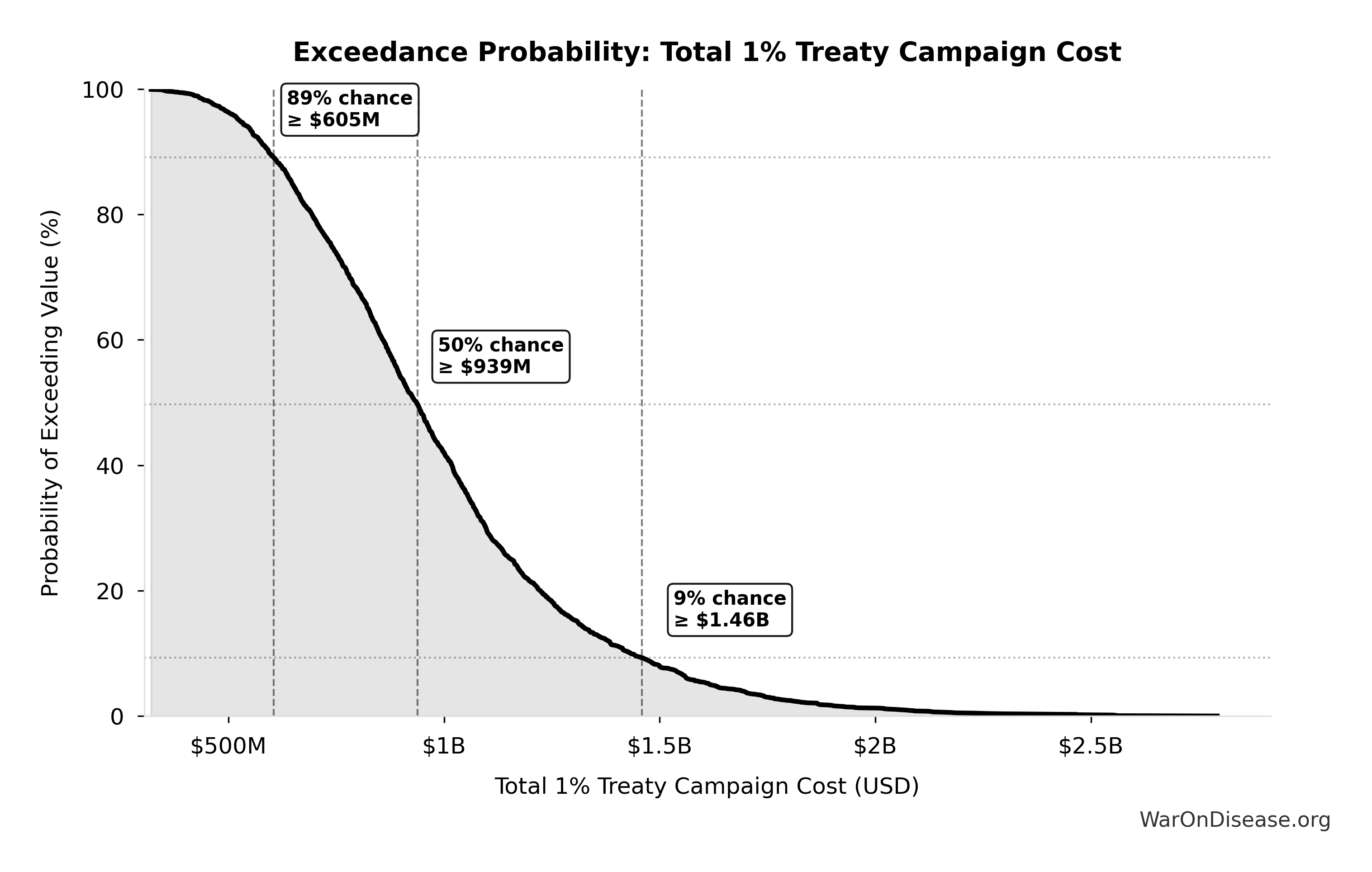

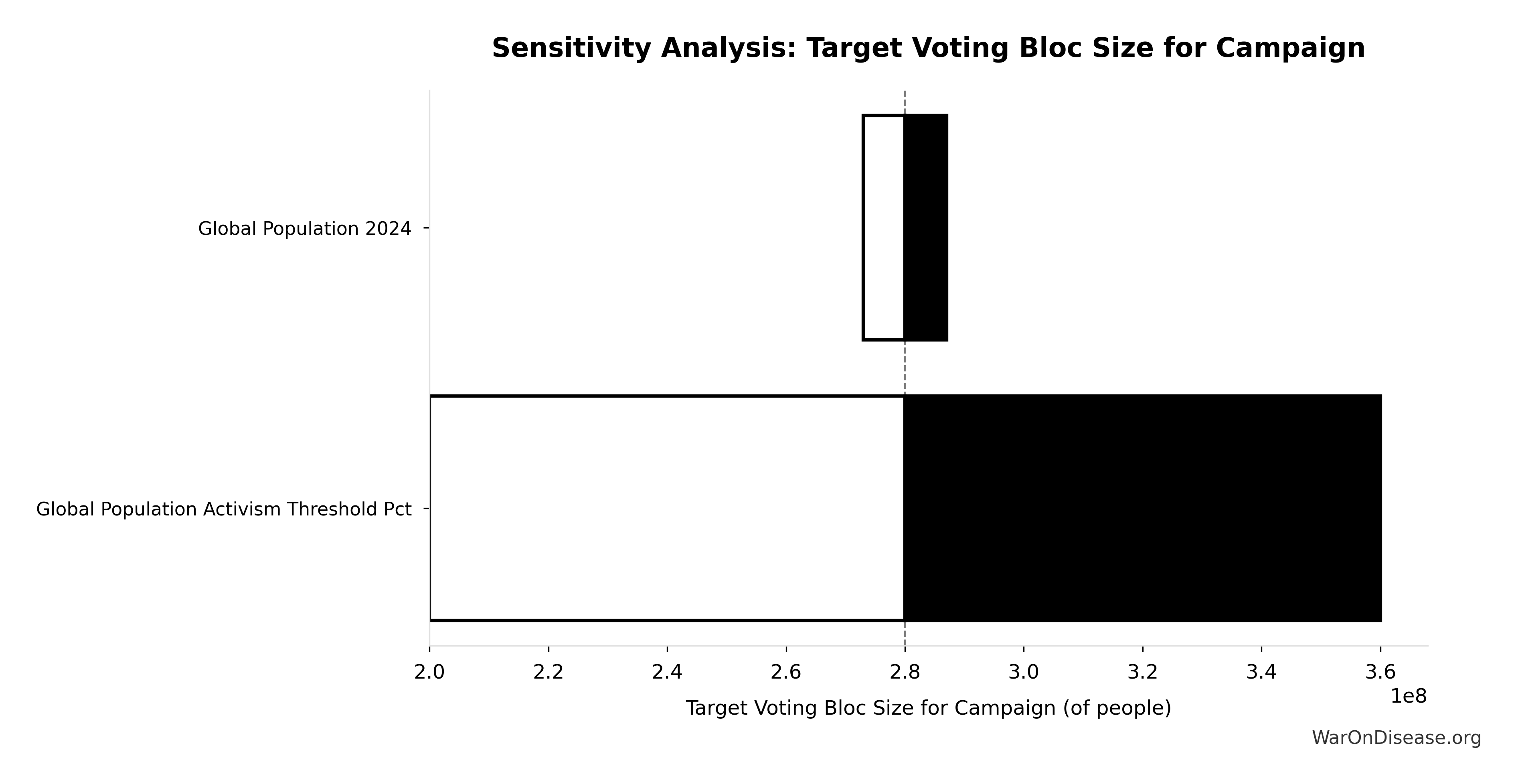

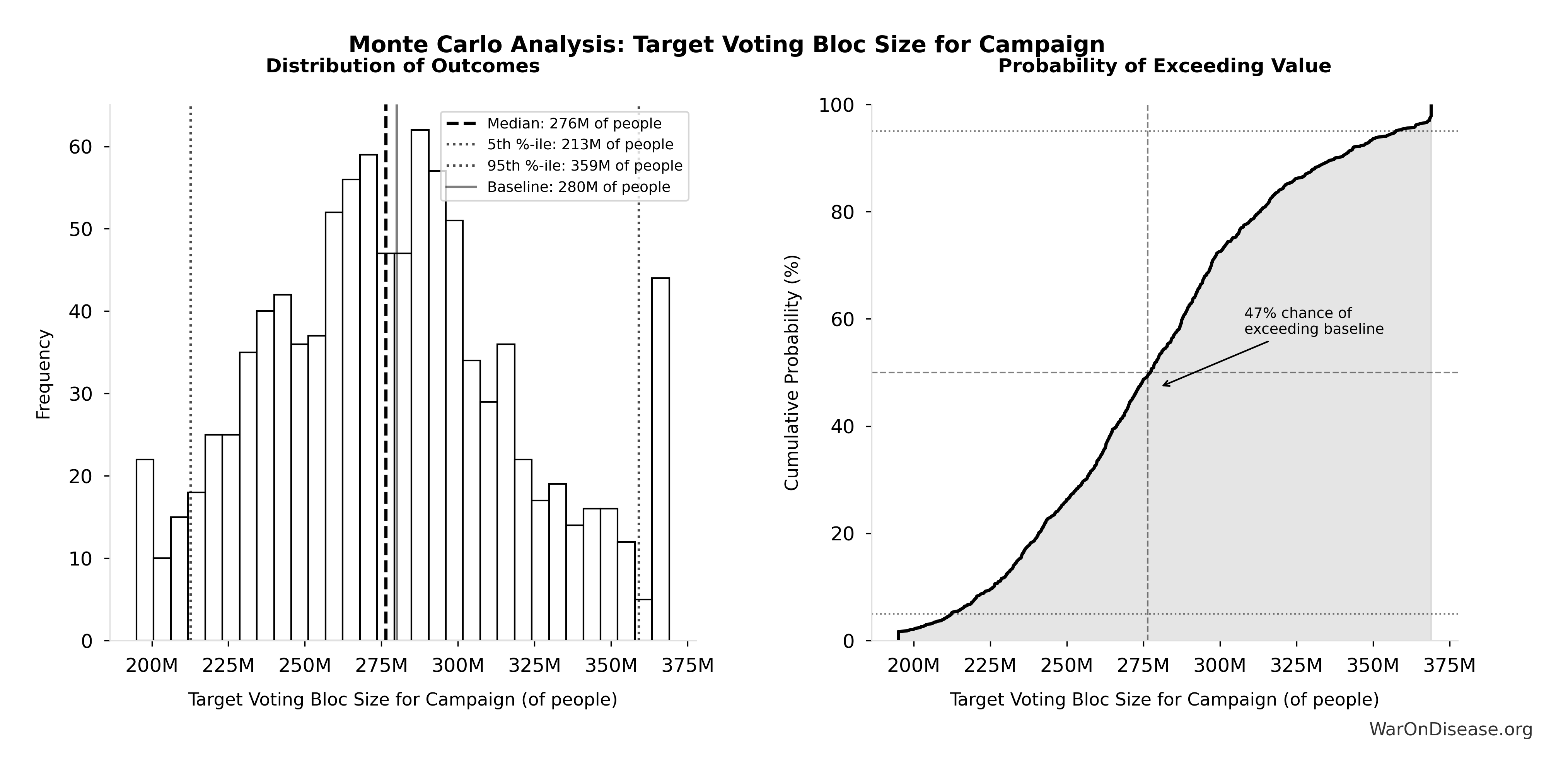

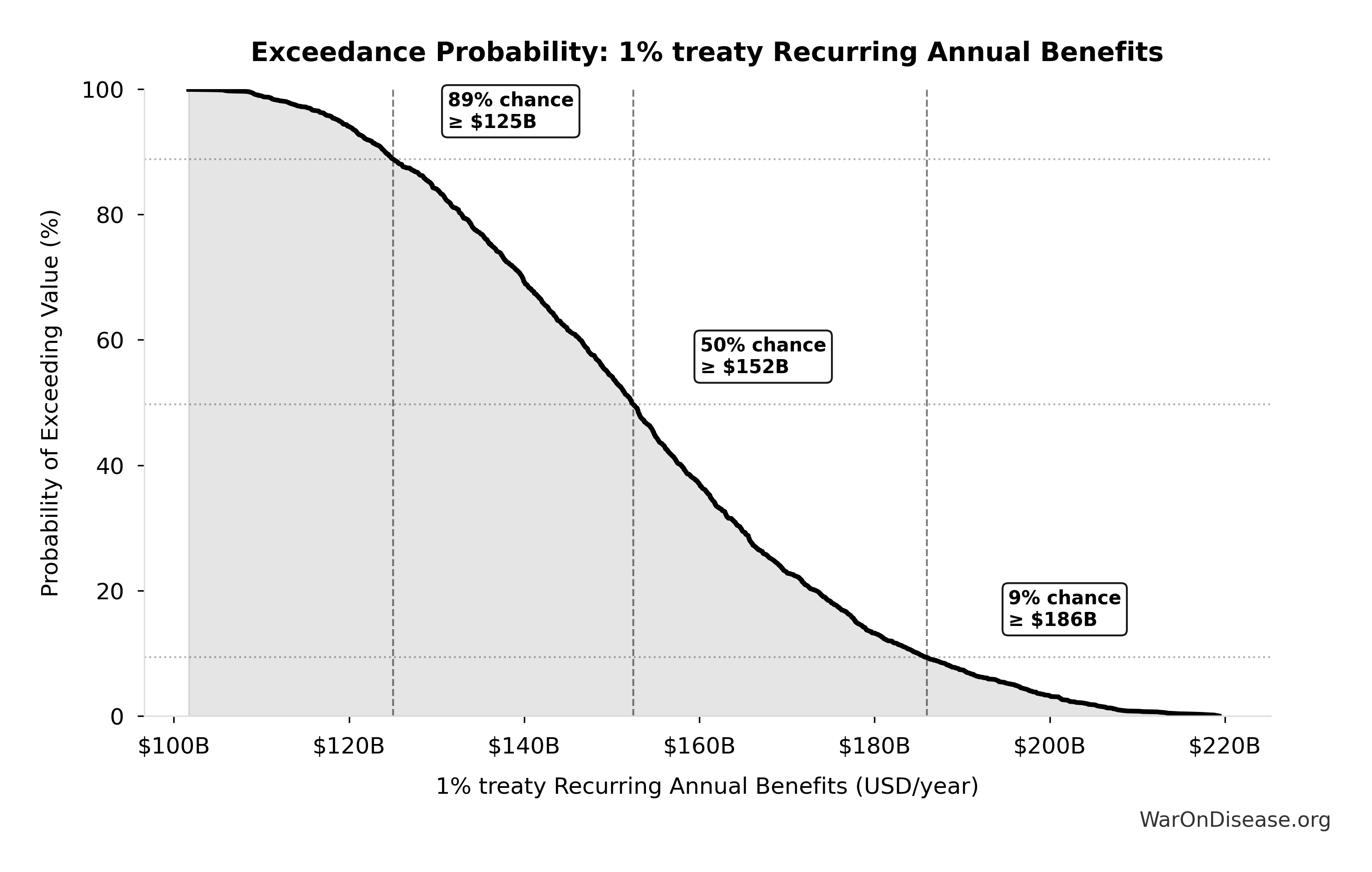

- dFDA Average Total Timeline Shift 🔢: 212 years