Global Clinical Trial Spending by Phase

war-on-disease, 1-percent-treaty, medical-research, public-health, peace-dividend, decentralized-trials, dfda, dih, victory-bonds, health-economics, cost-benefit-analysis, clinical-trials, drug-development, regulatory-reform, military-spending, peace-economics, decentralized-governance, wishocracy, blockchain-governance, impact-investing

Here’s where every dollar goes in the global clinical trials industry, broken down by who’s paying and which phase they’re funding.

The Bottom Line: $83 Billion Annually (2024)

The global clinical trials market was valued at approximately $83 billion in 2024, with estimates ranging from $54 billion to $84 billion depending on methodology.

Growth trajectory

- 2024: $83 billion

- 2030: Projected $83-132 billion

- 2034: Projected $95-150 billion

How Many People Participate? The Missing Data

Critical data gap: No global database tracks annual clinical trial participant enrollment.

What we know

- US cumulative enrollment (direct API analysis): 12.2 million participants across 100,000 active/recruiting/completed trials

- Estimated annual US enrollment: 4-5 million participants/year (based on average trial durations)

- Estimated global annual enrollment: 6-10 million participants/year (scaling from US 54% market share)

Regional snapshots

- England: 1.05 million participants in 2023/24

- US active trials (2009): Seeking 2.8 million participants

Median participants per trial (from ClinicalTrials.gov data):

- Phase 1: 33 participants

- Phase 2: 60 participants

- Phase 3: 237 participants

- Phase 4: 90 participants

Cost per participant (if $83B ÷ 5M participants): ~$16,600 annually

The tragedy: Only 0.06% of humanity participates in clinical trials each year while 150,000 die daily from disease.

See The 0.06% Problem for the full analysis.

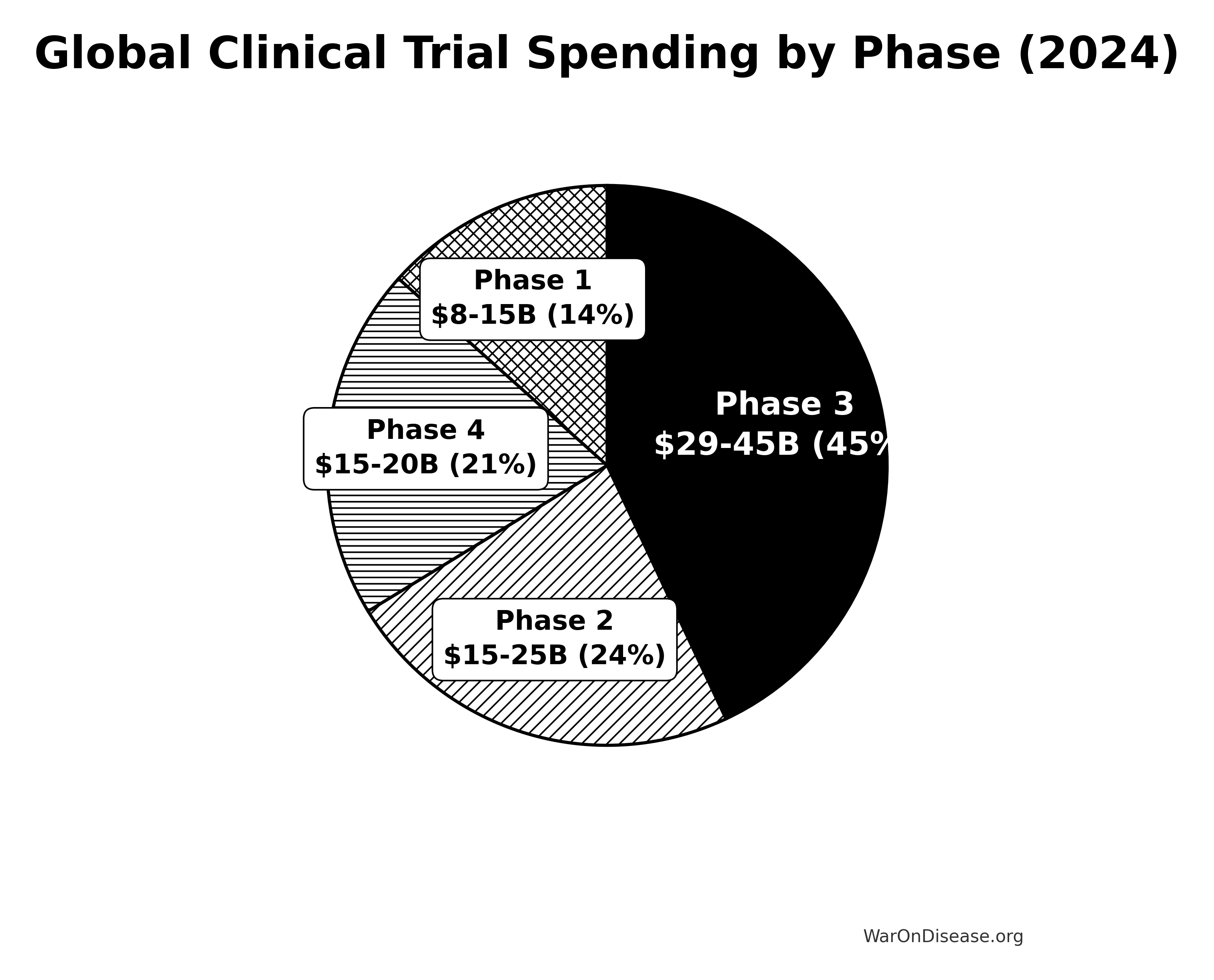

Spending by Clinical Trial Phase

Phase 3: The Money Pit

Global Spending: $29-45 billion annually (~53-55% of total market)

Why Phase 3 dominates:

- Largest market share at 53.3% of all clinical trial spending (2024)

- Requires 300-3,000 participants

- Longest treatment periods (38 months average)

- Most expensive phase per trial

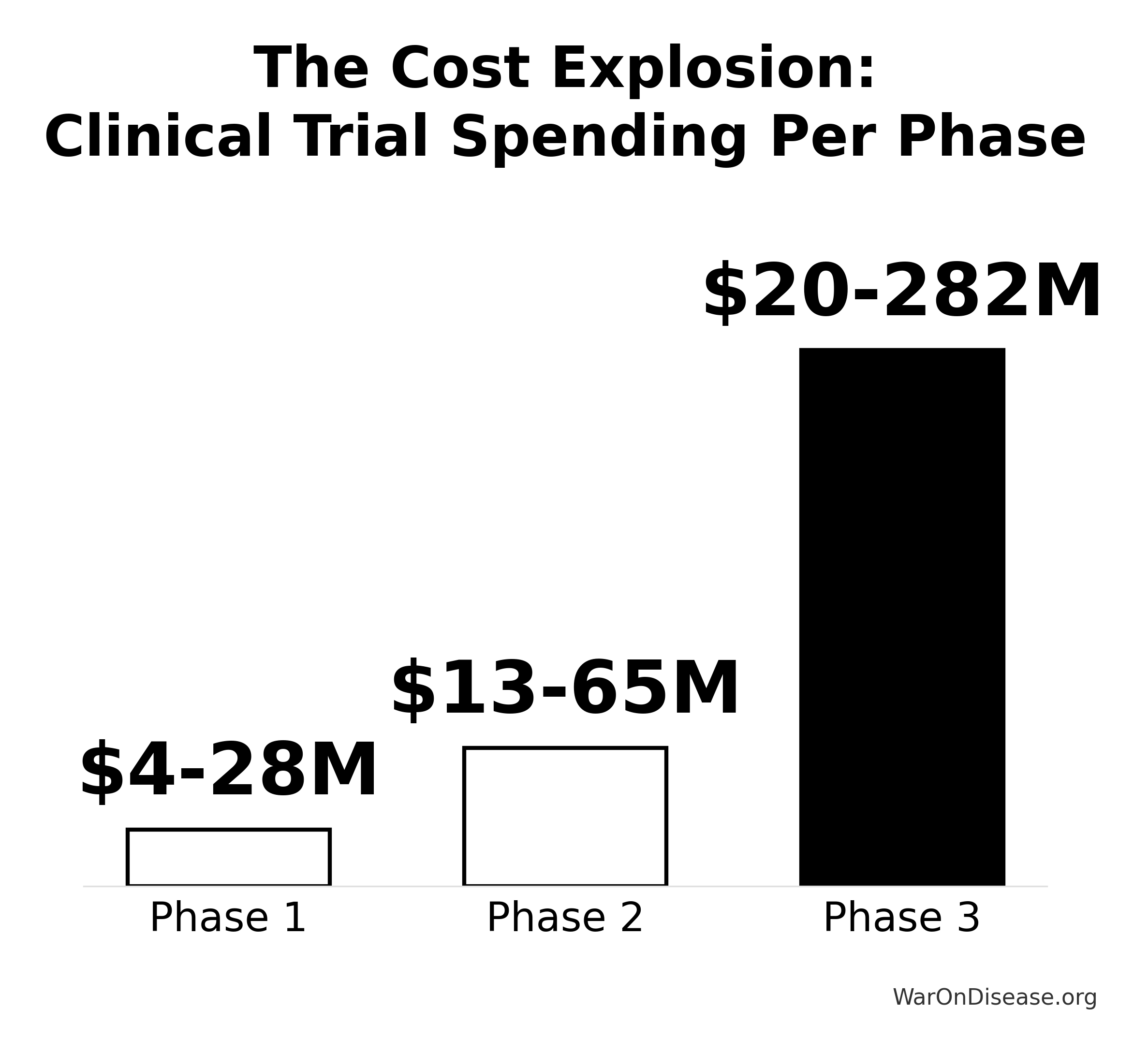

Cost per trial

- Average: $20-282 million per trial

- Median: Over $19 million per trial

- Range by therapeutic area: $11.5M (dermatology) to $52.9M (pain/anesthesia)

Cost per patient

- Traditional Phase 3: $40,000-$120,000 per patient

- Average: $113,000 per patient

As percentage of total drug development

- 39.8% of total R&D expenditure goes to Phase 3 trials

Phase 2: The Middle Child

Global Spending: $15-25 billion annually (estimated ~20-30% of market)

Cost per trial

- Average: $13-65 million per trial

- Range by therapeutic area: $7.0M (cardiovascular) to $19.6M (hematology)

Cost per patient

- Average: $130,000 per patient

As percentage of total drug development

- 17.4% of total R&D expenditure goes to Phase 2 trials

Trial characteristics

- Average participants: ~100-300 patients

- Average duration: 2-3 years

Phase 1: The Safety Gauntlet

Global Spending: $8-15 billion annually (estimated ~10-18% of market)

Cost per trial

- Average: $4-28 million per trial

- Typical: $25 million per trial

Cost per patient

- Average: $137,000 per patient (highest per-patient cost!)

As percentage of total drug development

- 9.2% of total R&D expenditure goes to Phase 1 trials (combined with proof of mechanism)

Trial characteristics

- Average participants: ~51 patients

- Average duration: 27.8 months

- 17% of all NIH-funded trials are Phase 1

Phase 4: The Forgotten Phase

Global Spending: $12+ billion annually (2007 estimate; likely ~$15-20 billion in 2024)

Key facts

- 11% of pharmaceutical R&D budgets allocated to Phase 4

- Growing at 23% annually (as of 2007)

- Also called “post-marketing surveillance” or “pharmacovigilance studies”

- Often mandated by FDA after approval

- 5% of NIH-funded trials are Phase 4

Why it matters

- Monitors long-term safety in real-world populations

- Detects rare adverse events not seen in smaller trials

- Evaluates effectiveness beyond controlled trial conditions

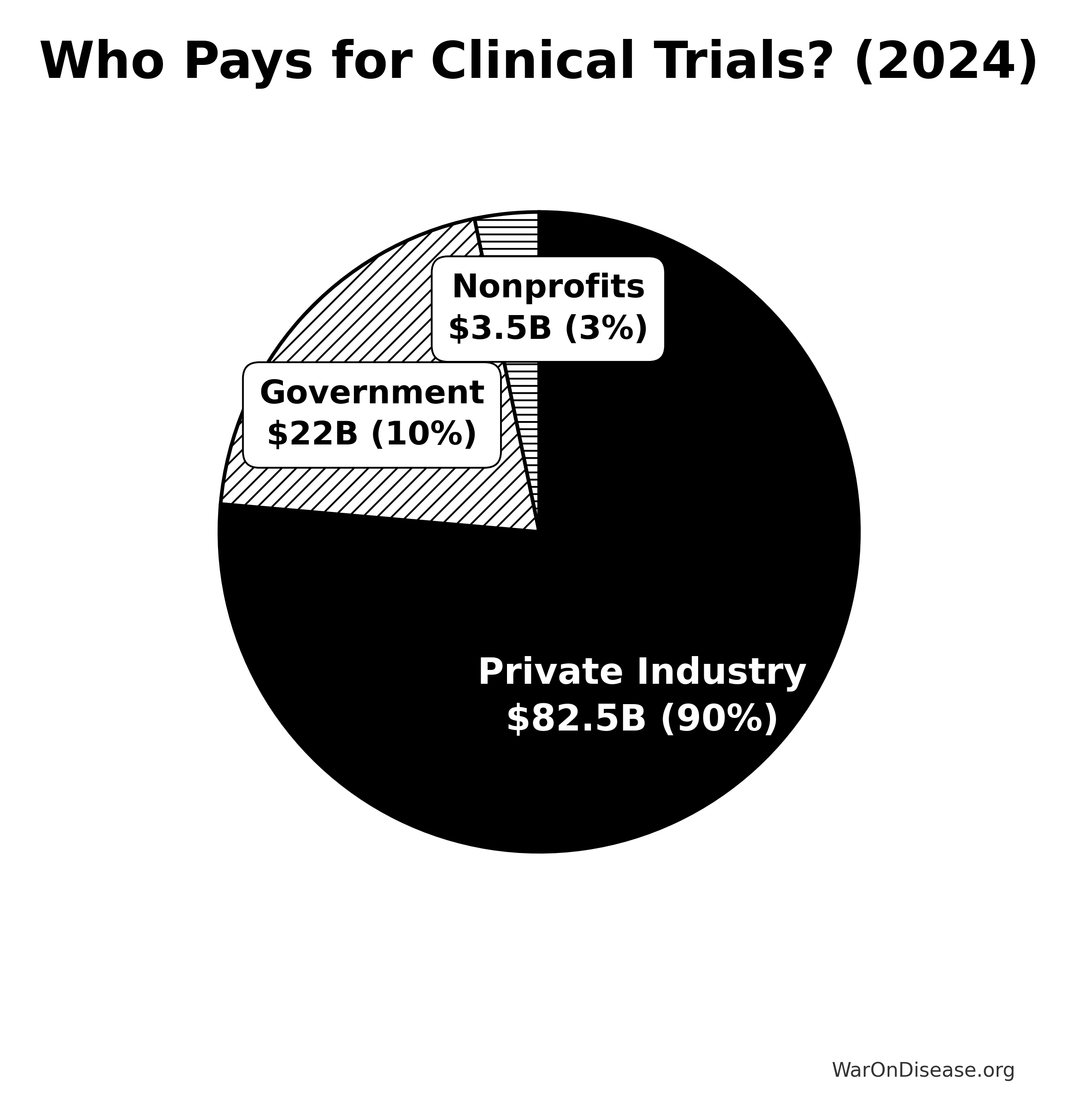

Who’s Paying: Funding Source Breakdown

Private Industry: The Heavy Hitter

Total Annual Spending: $75-90 billion (~90% of global total)

Global pharmaceutical R&D

- Total industry R&D: $300+ billion annually

- Clinical trials portion: ~25-30% of total R&D

- Industry R&D grew 44% (inflation-adjusted) from 2012-2022: $170B → $247B

Top spenders (2024 R&D budgets)

- Pharmaceutical companies dominate funding

- Biotech firms increasingly important (especially in early phases)

- Venture capital: $146 billion invested over 3 years

Regional breakdown

- United States: Largest market for clinical trials

- US clinical trials market: $45 billion in 2024

- ~54% of global market

- China: Rising rapidly

- Europe: Steady player

- Innovative Health Initiative (IHI) under Horizon Europe funds public-private partnerships

Government: The Seed Investor

Total Annual Spending: $19-25 billion on clinical trials (~10-12% of global total)

United States (NIH)

- Total NIH budget: $47.1 billion (FY2024)

- ~80% goes to research, including clinical trials

- NIH clinical research funding: $18.9 billion (FY2023)

- NIH spent $8.1 billion on phased clinical trials (2010-2019) for drugs ultimately approved

- Only ~10% of industry spending over same period

NIH spending by phase (per approved drug, 2010-2019 data):

- Phase 1: $13.9 million average

- Represents 24.6-25.3% of industry Phase 1 costs

- Phase 2: $22.2 million average

- Represents 21.4-23.2% of industry Phase 2 costs

- Phase 3: $12.9 million average

- Represents only 3.7-4.3% of industry Phase 3 costs

- Total NIH per drug: $33.8 million (when ultimately approved)

NIH trial distribution

- 17% Phase 1

- 35% Phase 2 (largest share)

- 11% Phase 3

- 5% Phase 4

- 33% “Other” or unspecified phase

Key insight: NIH focuses on early-stage risk

- NIH covers ~25% of Phase 1 costs

- NIH covers ~22% of Phase 2 costs

- NIH covers only ~4% of Phase 3 costs

- Industry takes over once commercial potential is clearer

European Union

- Horizon Europe total: €95.5 billion (2021-2027)

- Health research portion: Billions allocated

- Horizon Europe Health Budget: €8.2 billion (2021-2027)

- ~€1.17 billion per year (~$1.3 billion)

- EU4Health Programme: €5.3 billion (2021-2027)

China

- Government R&D investment: Part of $15 billion total biopharma R&D

- Rapid growth: $35 million (2015) → $15 billion (2023)

Other major government funders

- UK: ~$3 billion annually on medical research

- Germany: ~$6 billion annually

- Japan: ~$5 billion annually

- Canada: ~$1.5 billion annually

Nonprofit Foundations: The Niche Players

Total Annual Spending: $2-5 billion globally (~2-5% of global total)

Major players (2024)

Gates Foundation + Wellcome Trust + Novo Nordisk:

- New 3-year initiative: $300 million total ($100M each)

- Focus: Climate-health, infectious disease, AMR, nutrition-immunity

- TB vaccine funding: $550 million

- Up to $150M from Wellcome, ~$400M from Gates

Gates Foundation

- Active in global health clinical trials

- Focus: Infectious diseases, vaccines, maternal/child health

- Hundreds of millions to low billions annually

Wellcome Trust

- Major global health research funder

- Clinical trial funding in infectious diseases, mental health

Other major nonprofit funders

- Cancer research charities (American Cancer Society, Cancer Research UK, etc.)

- Disease-specific foundations (Alzheimer’s Association, Michael J. Fox Foundation, etc.)

- Patient advocacy groups funding rare disease trials

Special initiatives

- COVID-19 Therapeutics Accelerator: Gates + Wellcome + Mastercard

The Brutal Economics: Cost Per Approved Drug

/tmp/ipykernel_4829/3000867792.py:44: UserWarning:

set_ticklabels() should only be used with a fixed number of ticks, i.e. after set_ticks() or using a FixedLocator.

Industry average spending on clinical trials per approved drug:

- Total clinical trial costs: $1,065 million per approved drug

- Includes spending on failed drugs (most drugs fail)

Breakdown by phase (industry average)

- Phase 1: $28 million per approved drug

- Phase 2: $65 million per approved drug

- Phase 3: $282 million per approved drug

- Subtotal for completed drugs: $375 million

- Additional $690 million: Spent on contemporaneous drugs that failed

Success rates (the depressing math)

- Only ~12% of drugs entering Phase 1 gain FDA approval

- 100 drugs start Phase 1

- ~60 advance to Phase 2

- ~20 enter Phase 3

- ~12 gain approval

Total drug development cost (preclinical + clinical):

- Estimates range from $1.0 billion to $2.6 billion per approved drug

- Tufts Center 2021 estimate: $2.6 billion

- Nearly 3× increase from $802M in 2003 (inflation-adjusted)

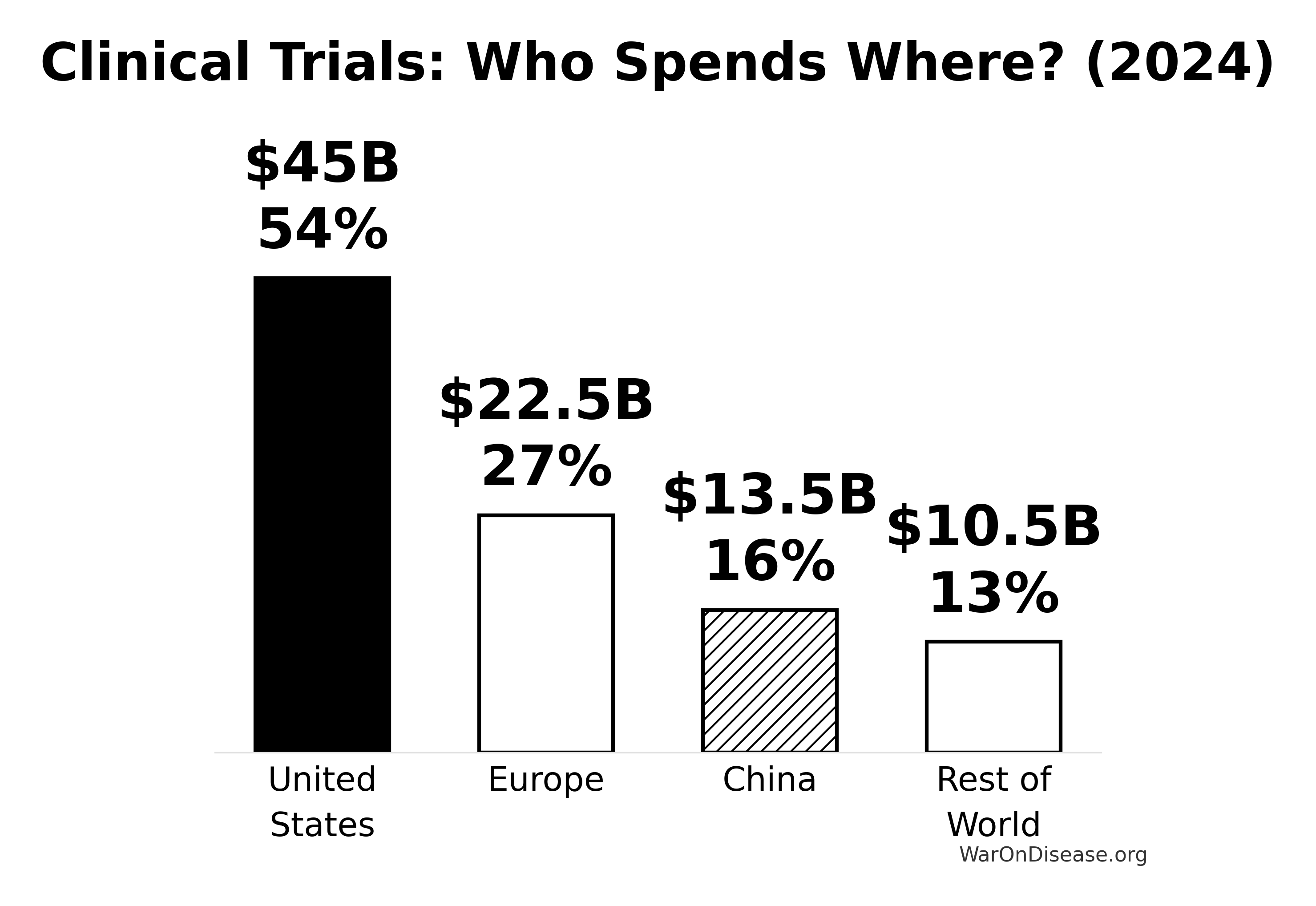

Regional Market Distribution

/tmp/ipykernel_4829/511585387.py:44: UserWarning:

set_ticklabels() should only be used with a fixed number of ticks, i.e. after set_ticks() or using a FixedLocator.

North America: The Dominant Player

Market share: ~50-54% of global clinical trials market

United States

- Clinical trials market size: $45 billion (2024)

- NIH: $18.9 billion in clinical research (2023)

- Industry: Remainder (~$25-30 billion)

Asia-Pacific: The Rising Giant

China

Why China is winning

- Faster and more affordable clinical trials

- Larger patient populations

- Government support for biopharma innovation

- Improved regulatory framework

Other Asia-Pacific

- India, Japan, South Korea, Australia all significant players

- Combined: Substantial portion of global market

Europe: The Steady Player

What This Actually Means

The Good News

- Industry spending grew 44% (2012-2022)

- More trials running globally than ever

- Technology enabling cheaper trials (see: RECOVERY trial at $500/patient)

The Bad News

- $83 billion annually, yet most diseases still have no treatment

- 95% of spending goes to Phase 2-3 trials for molecules that can be patented

- Success rate: 12%

- Average time to develop one drug: 10+ years

- Cost per approved drug: Rising 8.5% annually

The Context

- Global clinical trial spending: $83 billion

- Global military spending: $2.7 trillion

- Global pharmaceutical marketing: $180 billion

- Humans spend 33× more on weapons and 2× more on drug ads than on testing new treatments

The Efficiency Paradox

Current system

- $83 billion spent annually

- ~50 new drugs approved per year globally

- Cost per approved drug: $1.66 billion (using clinical trial spending alone)

- Most are “me-too” drugs (minor variations of existing treatments)

What the same money could buy (with a decentralized framework for drug assessment):

- At $500/patient (RECOVERY model): 166 million patient-participants

- At $2 million per efficient trial: 41,500 trials annually

- Instead of 50 drugs: Hundreds or thousands of treatments tested

- Instead of 10 years: Months to years

The waste

- Traditional Phase 3: $40,000-$120,000 per patient

- RECOVERY achieved: $500 per patient

- That’s an 80-240× markup for bureaucracy

Summary Table

| Category | Annual Spending | % of Total |

|---|---|---|

| Total Global Clinical Trials Market | $83 billion | 100% |

| By Phase: | ||

| Phase 3 | $29-45 billion | 53-55% |

| Phase 2 | $15-25 billion | 20-30% |

| Phase 1 | $8-15 billion | 10-18% |

| Phase 4 | $15-20 billion | ~10-15% |

| By Funding Source: | ||

| Private Industry | $75-90 billion | ~90% |

| Government | $19-25 billion | ~10% |

| Nonprofits | $2-5 billion | ~2-5% |

| Major Regional Markets: | ||

| United States | $45 billion | ~54% |

| Europe | $20-25 billion | ~25-30% |

| China | $12-15 billion | ~15-18% |

| Rest of World | $8-13 billion | ~10-15% |

The Path Forward

Humans spend $83 billion annually to develop ~50 drugs over 10+ years each.

A decentralized framework for drug assessment (dFDA) model could achieve 50-95% cost reduction, enabling:

- 10-20× more treatments tested

- 5-10× faster development

- Access for billions instead of thousands

The money exists. The patients exist. The technology exists.

What we lack is the political will to stop lighting $50 billion per year on fire for the privilege of bureaucracy.

Every phase, every dollar, every delay is a choice. And we’re choosing wrong.